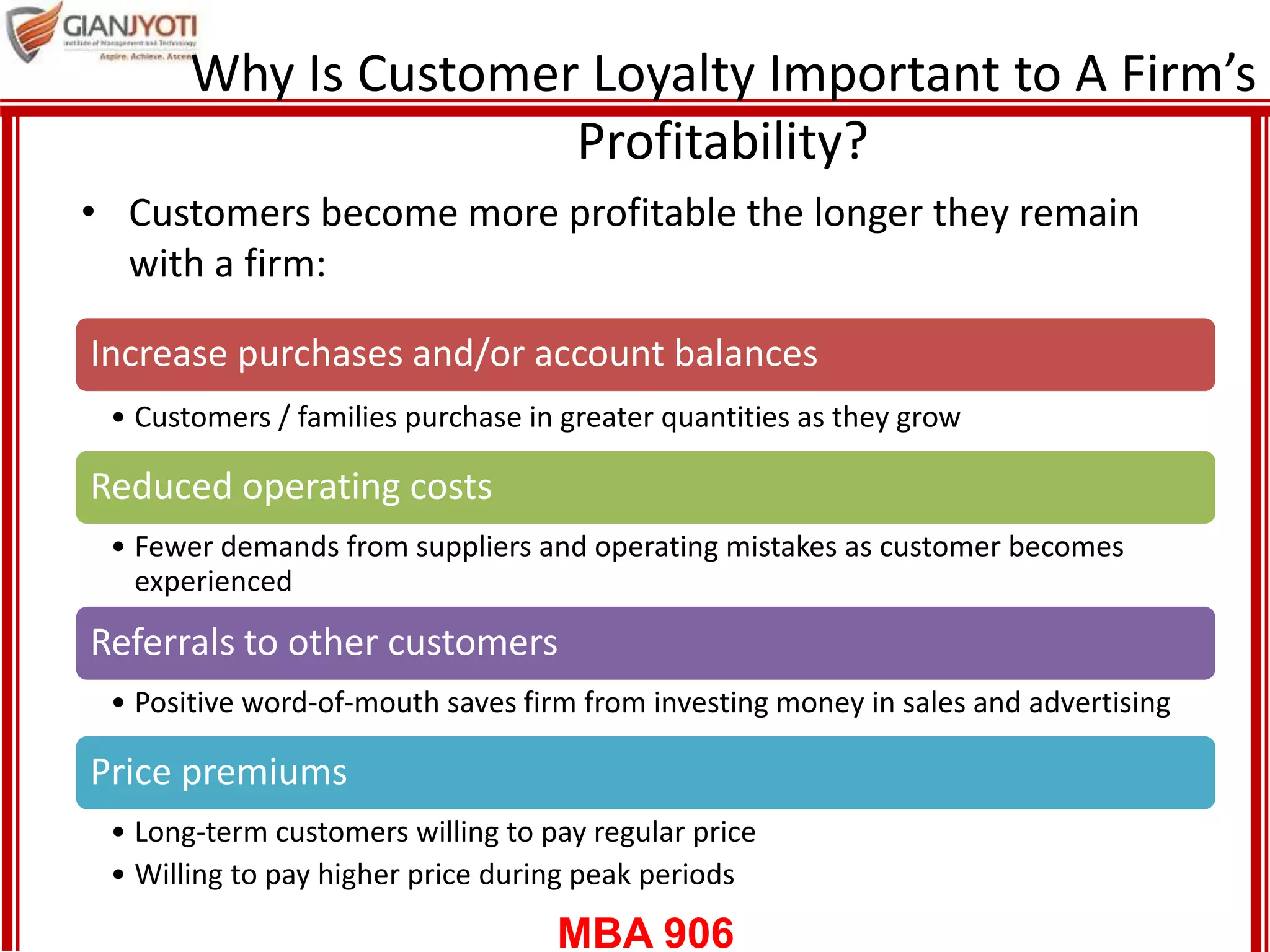

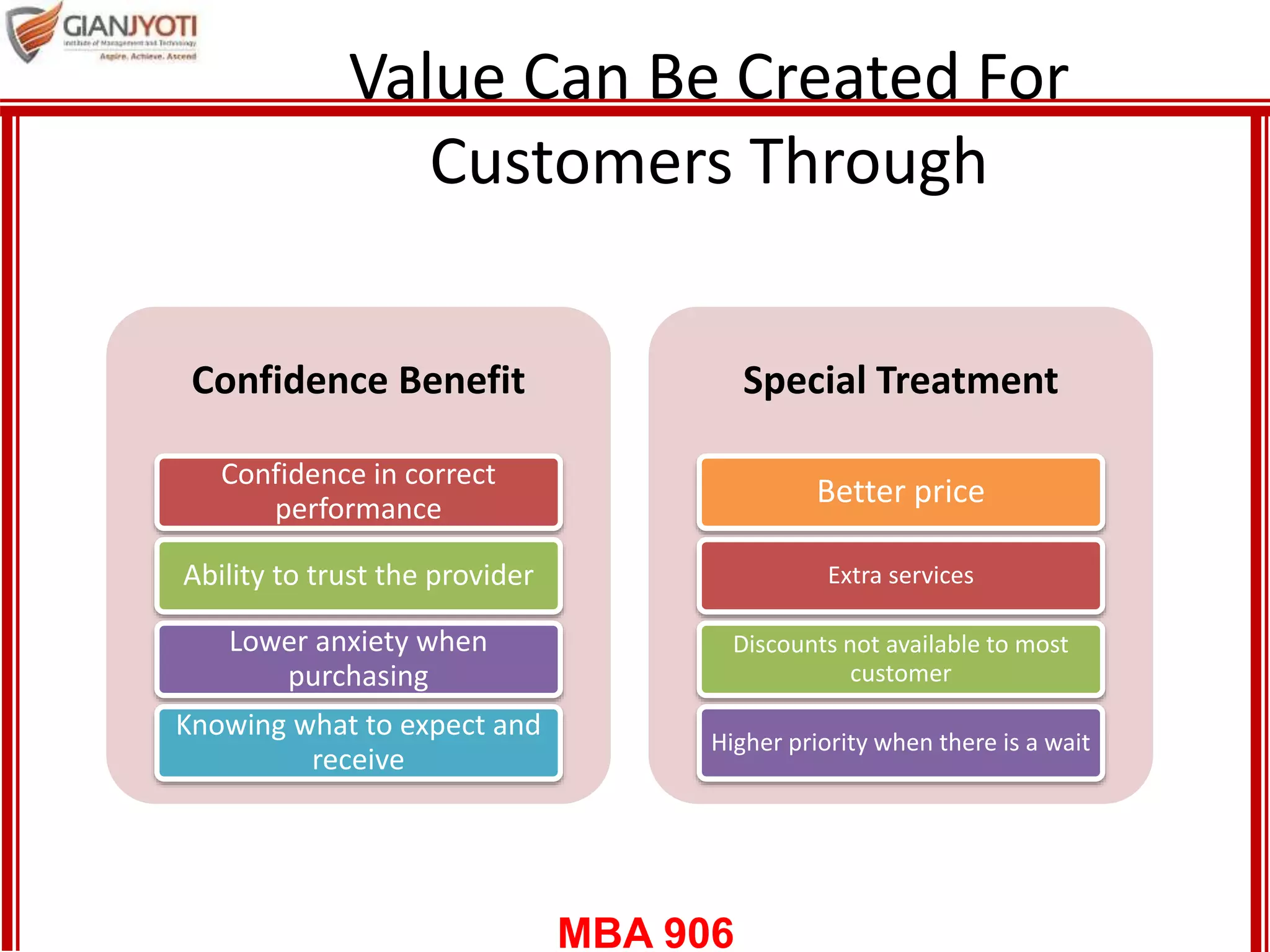

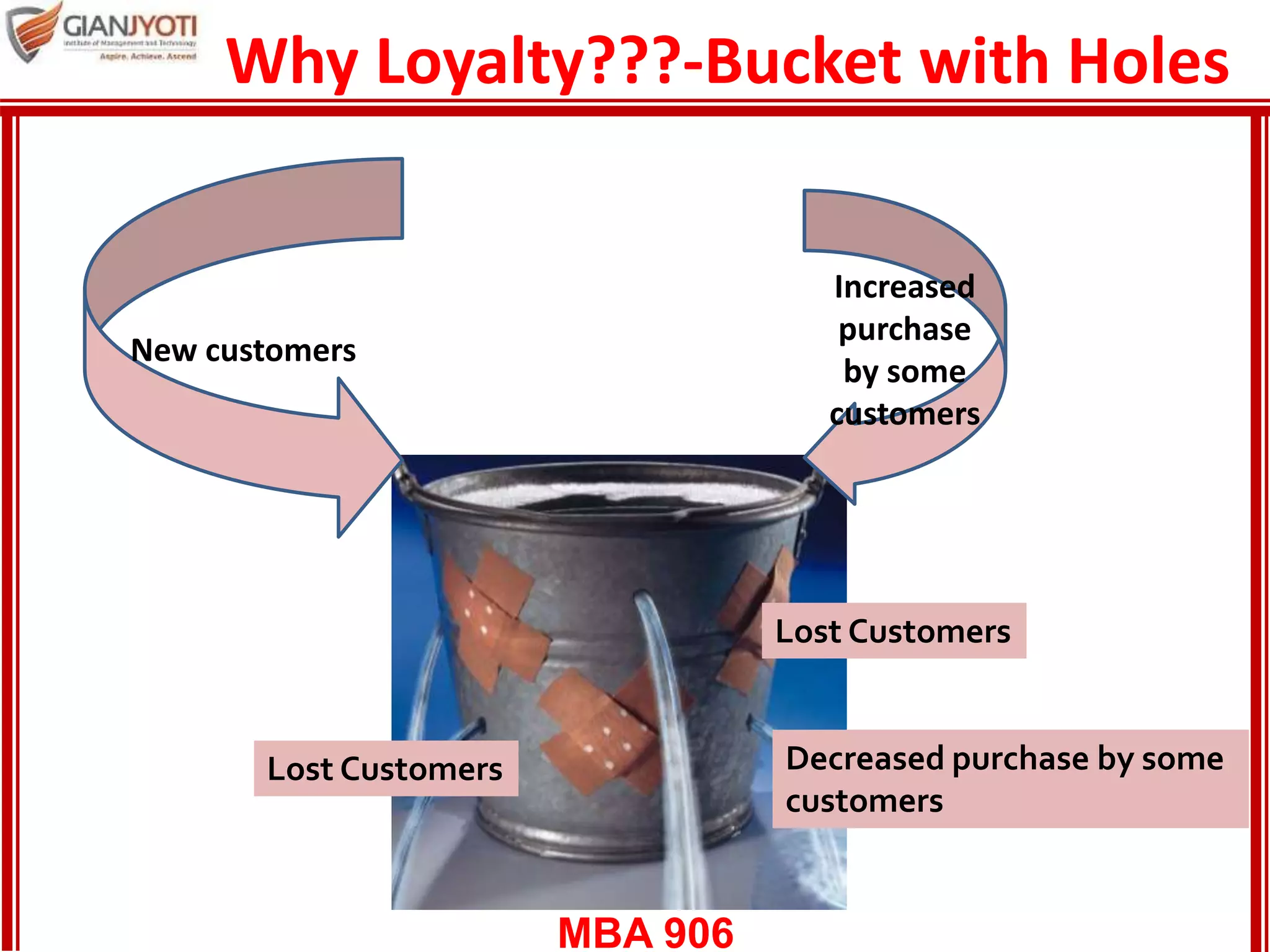

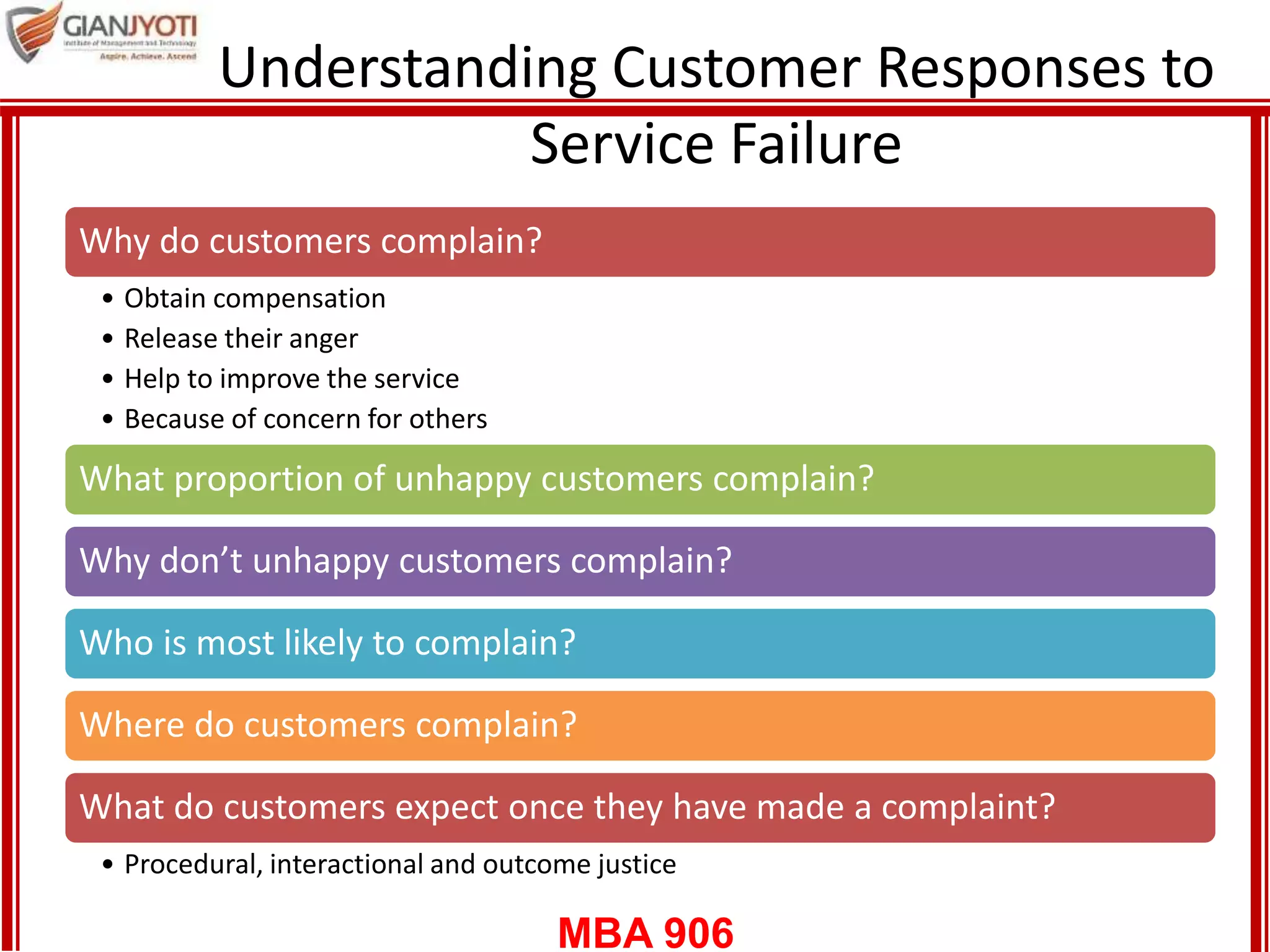

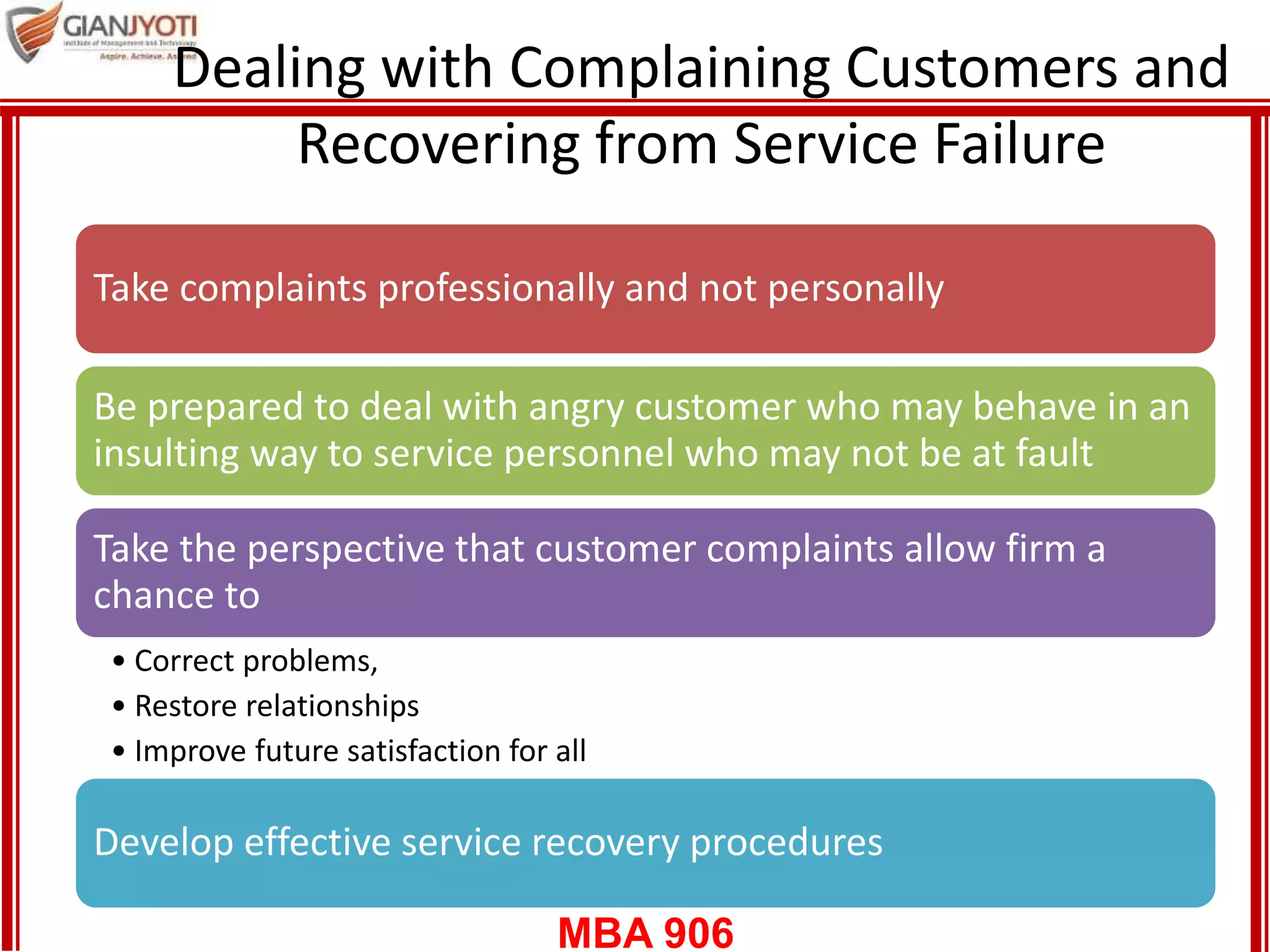

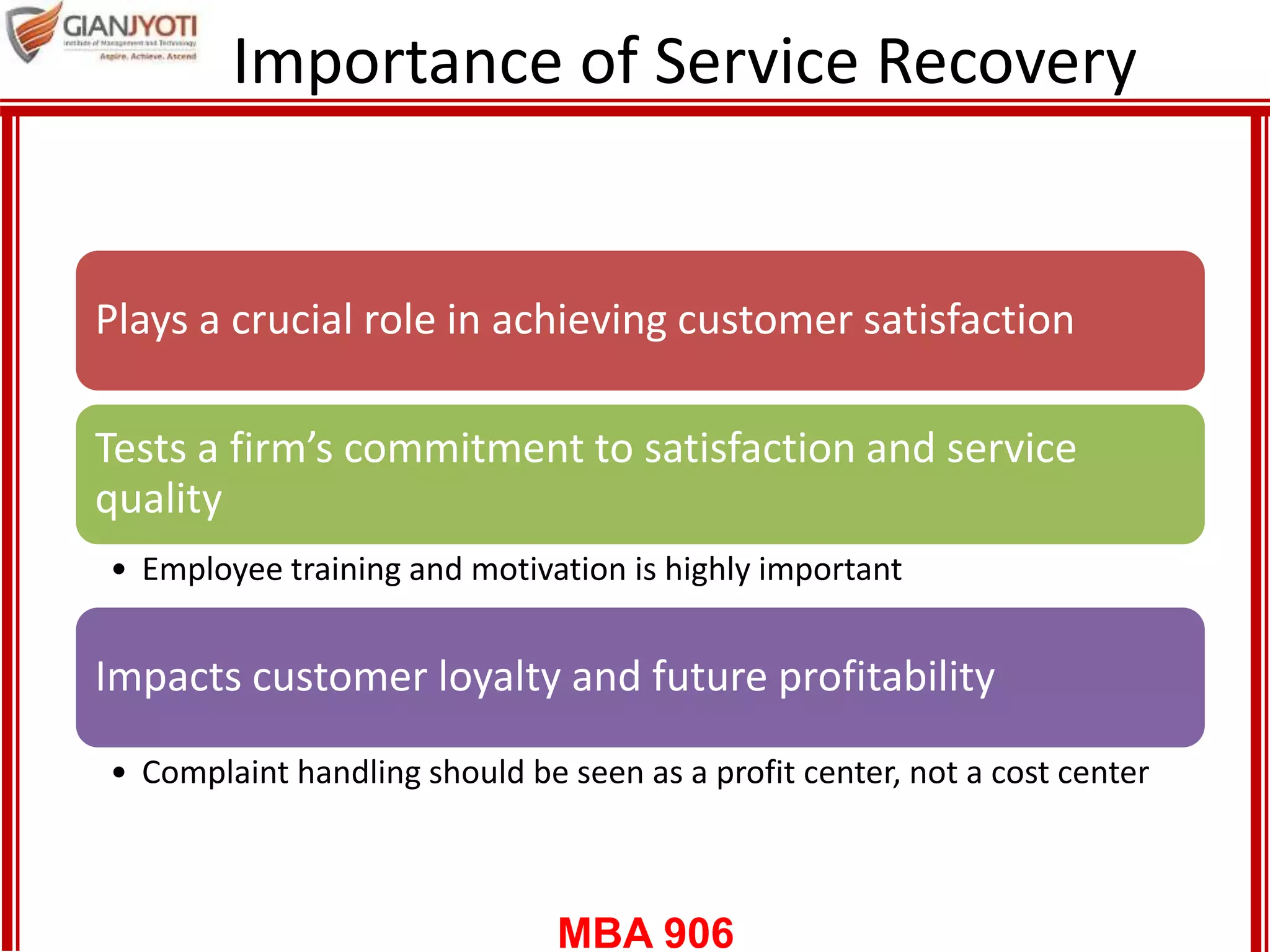

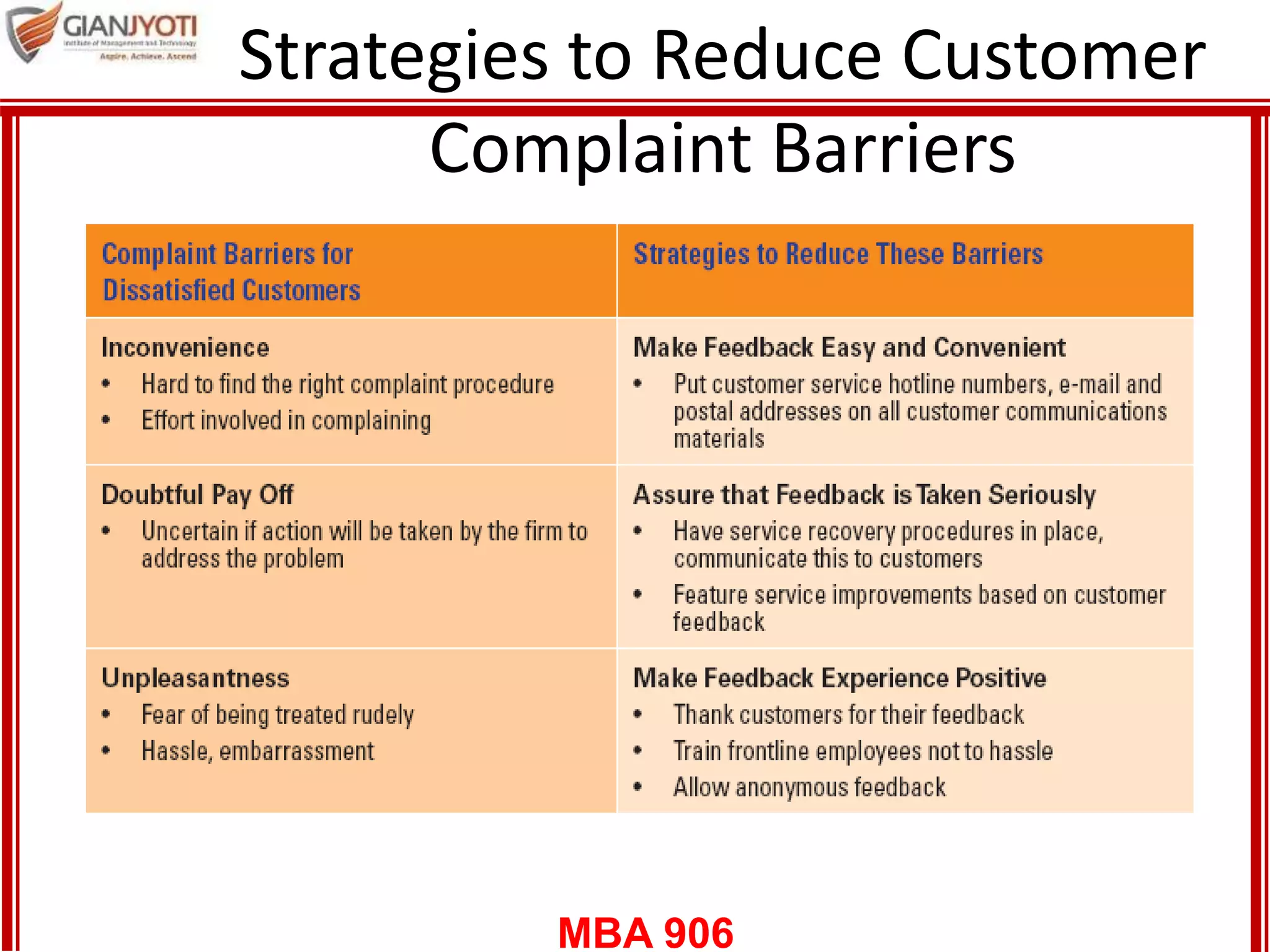

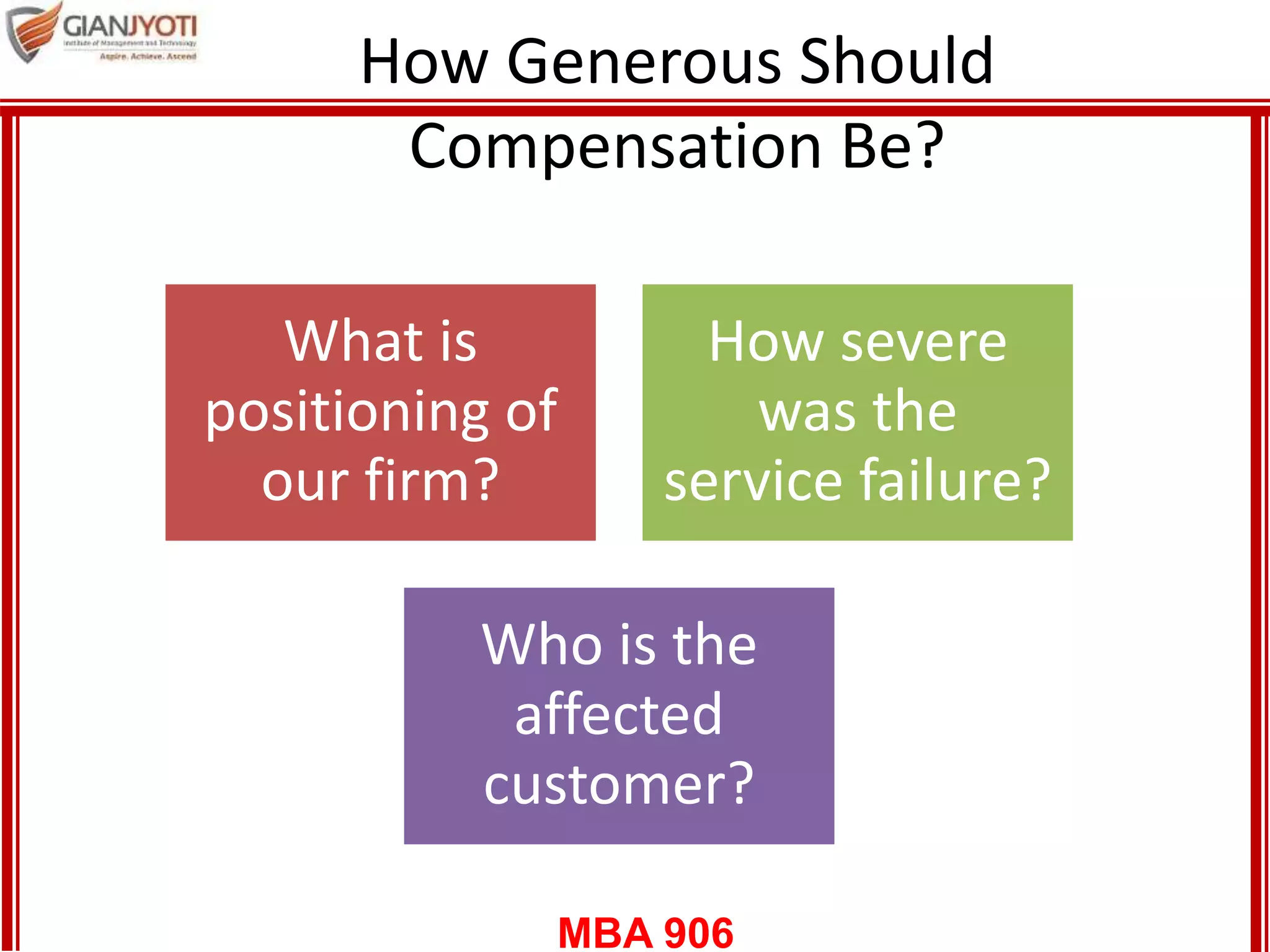

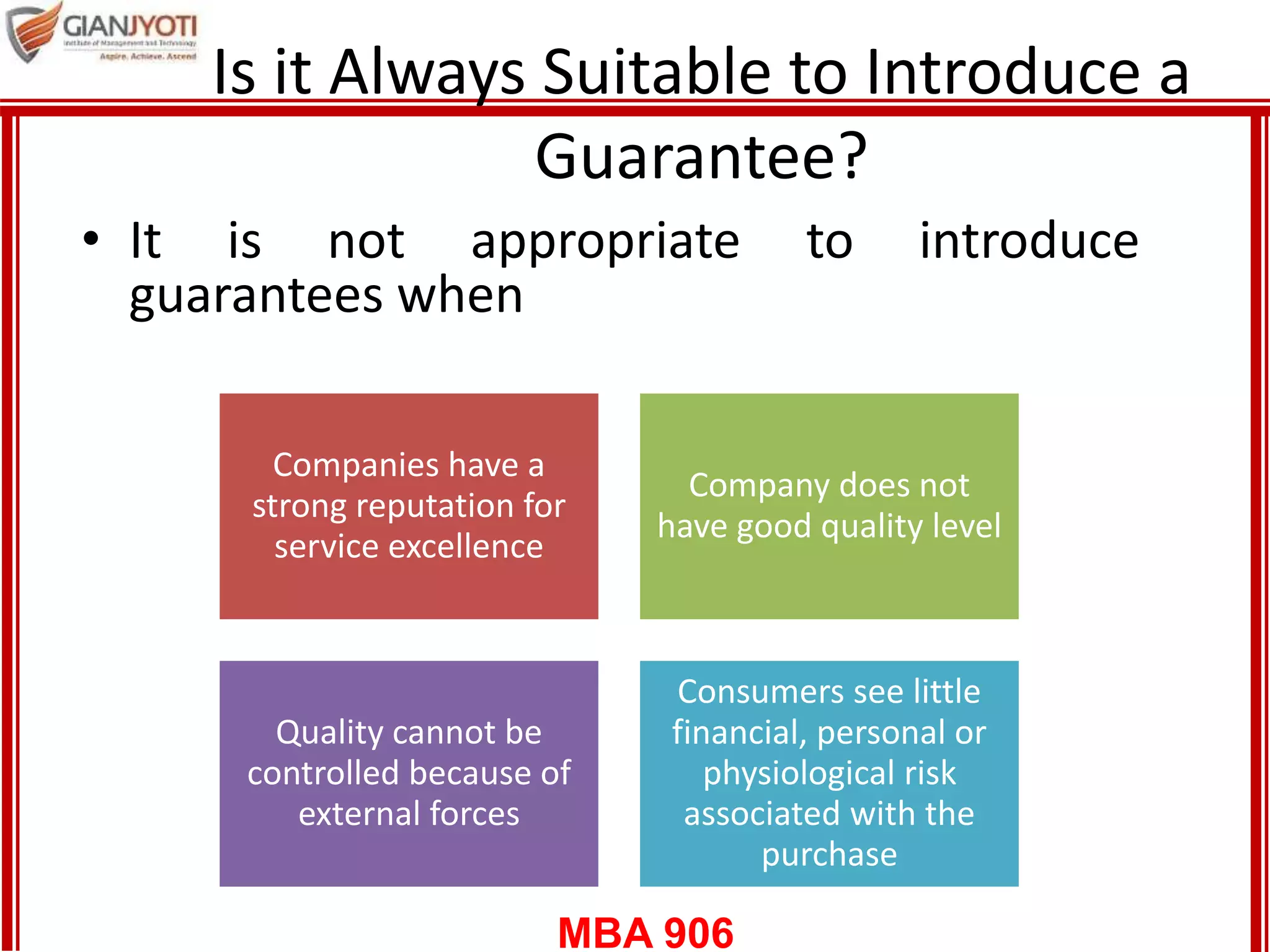

The document discusses strategies for managing customer relationships and building loyalty. It covers four stages of brand loyalty, why loyalty is important for profitability, assessing the value of loyal customers, and reasons why customers become loyal. It also discusses strategies for developing loyalty bonds such as rewarding customers, reducing customer defections, handling complaints and recovering from service failures. The importance of service guarantees and how to design effective guarantees is also covered.