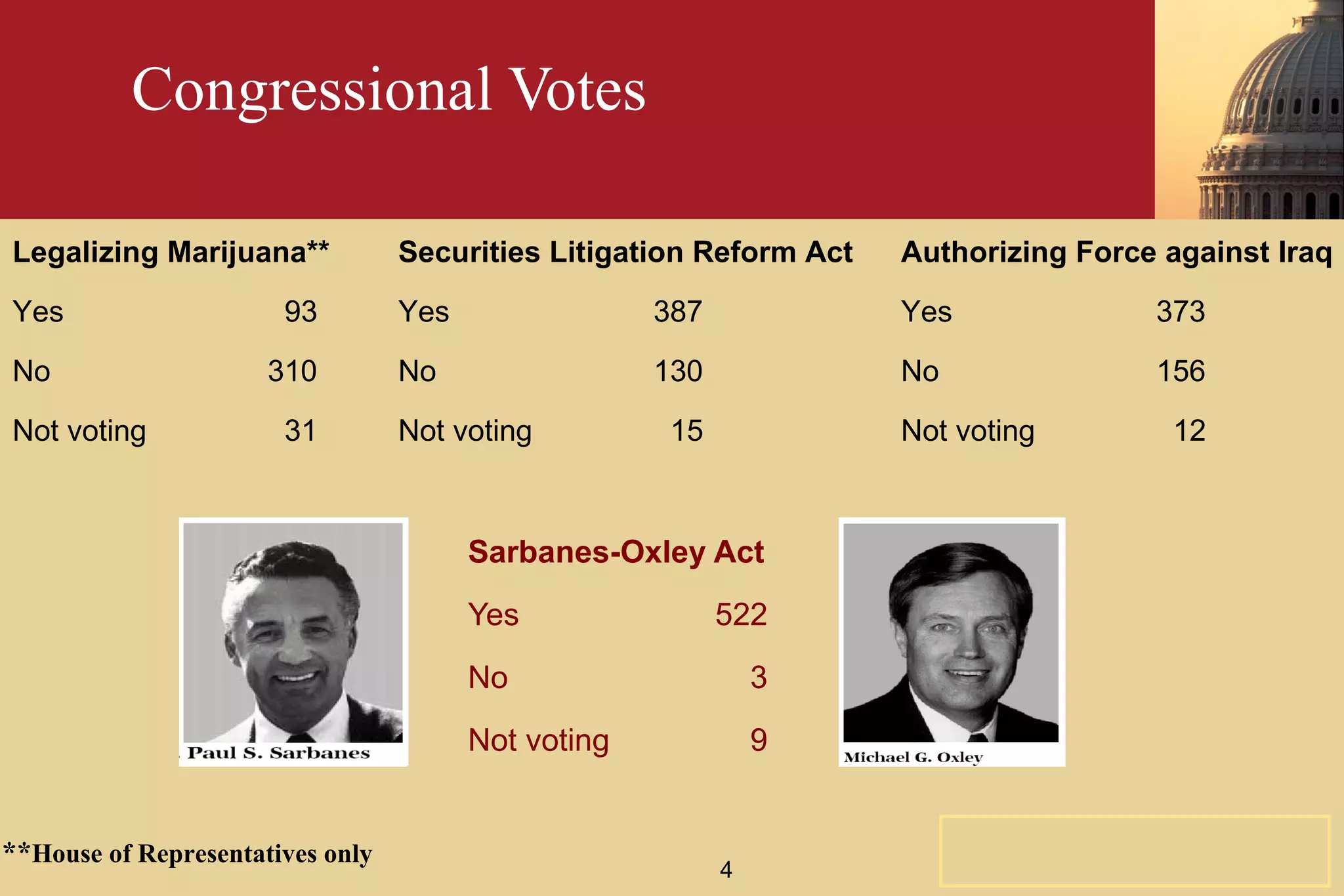

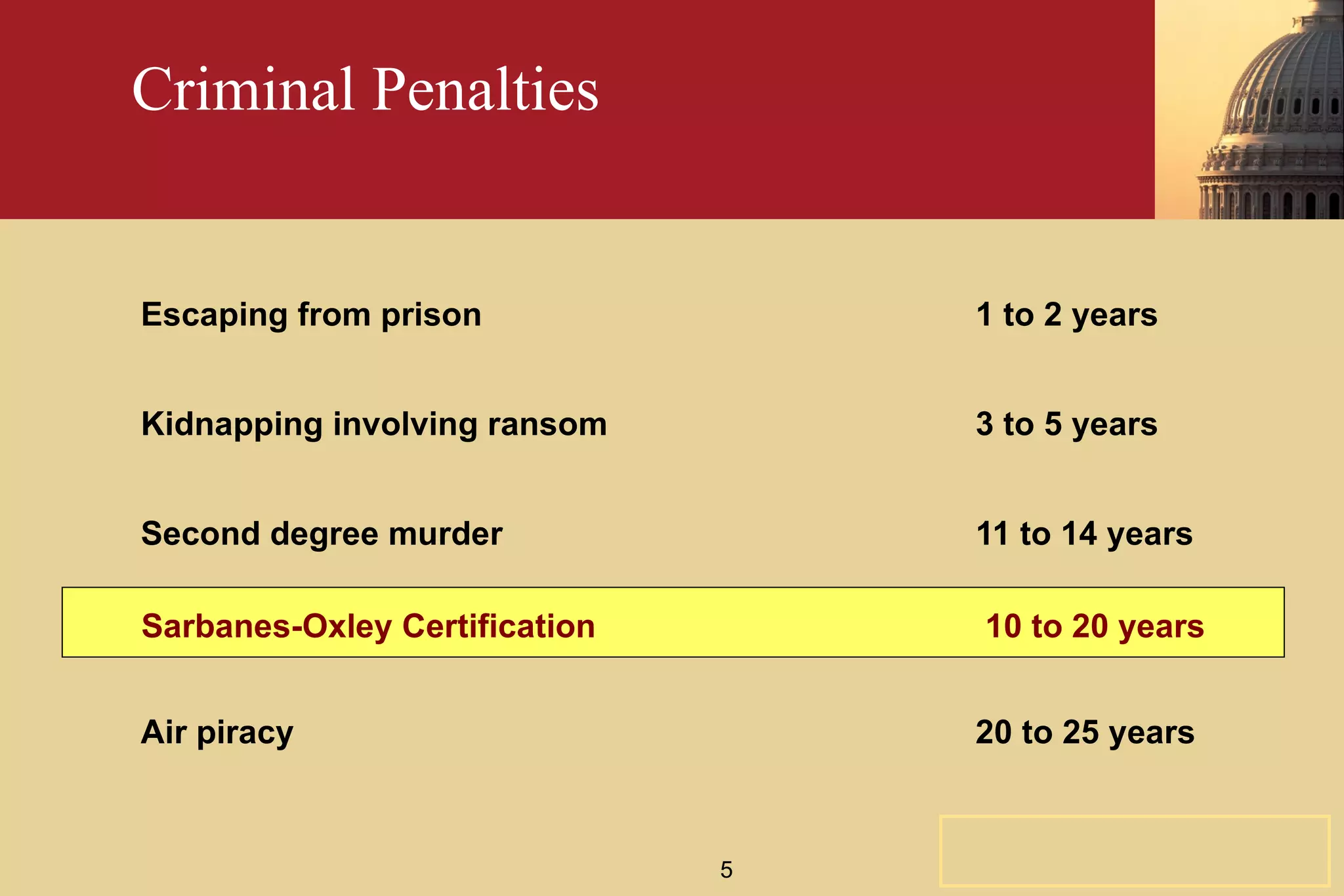

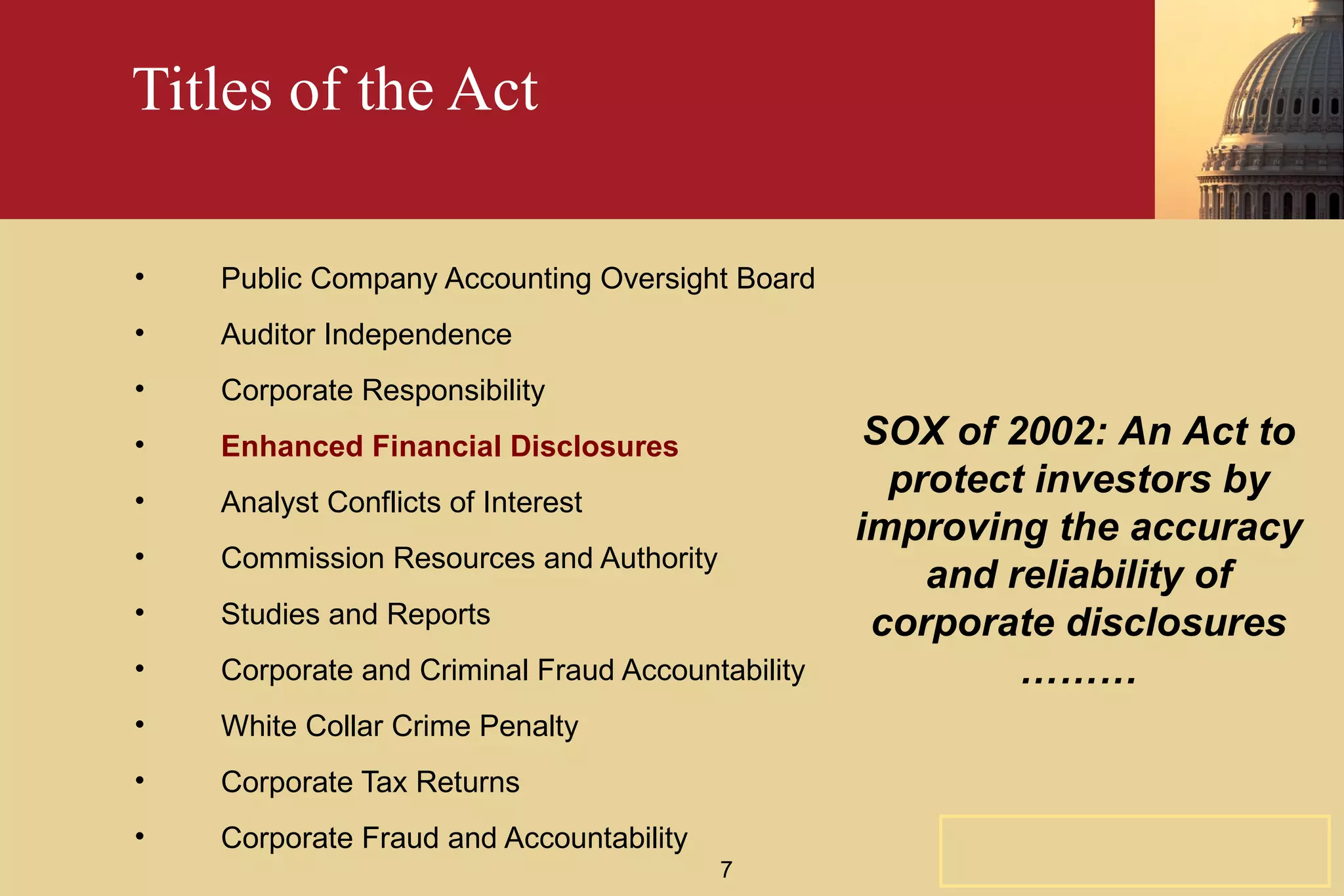

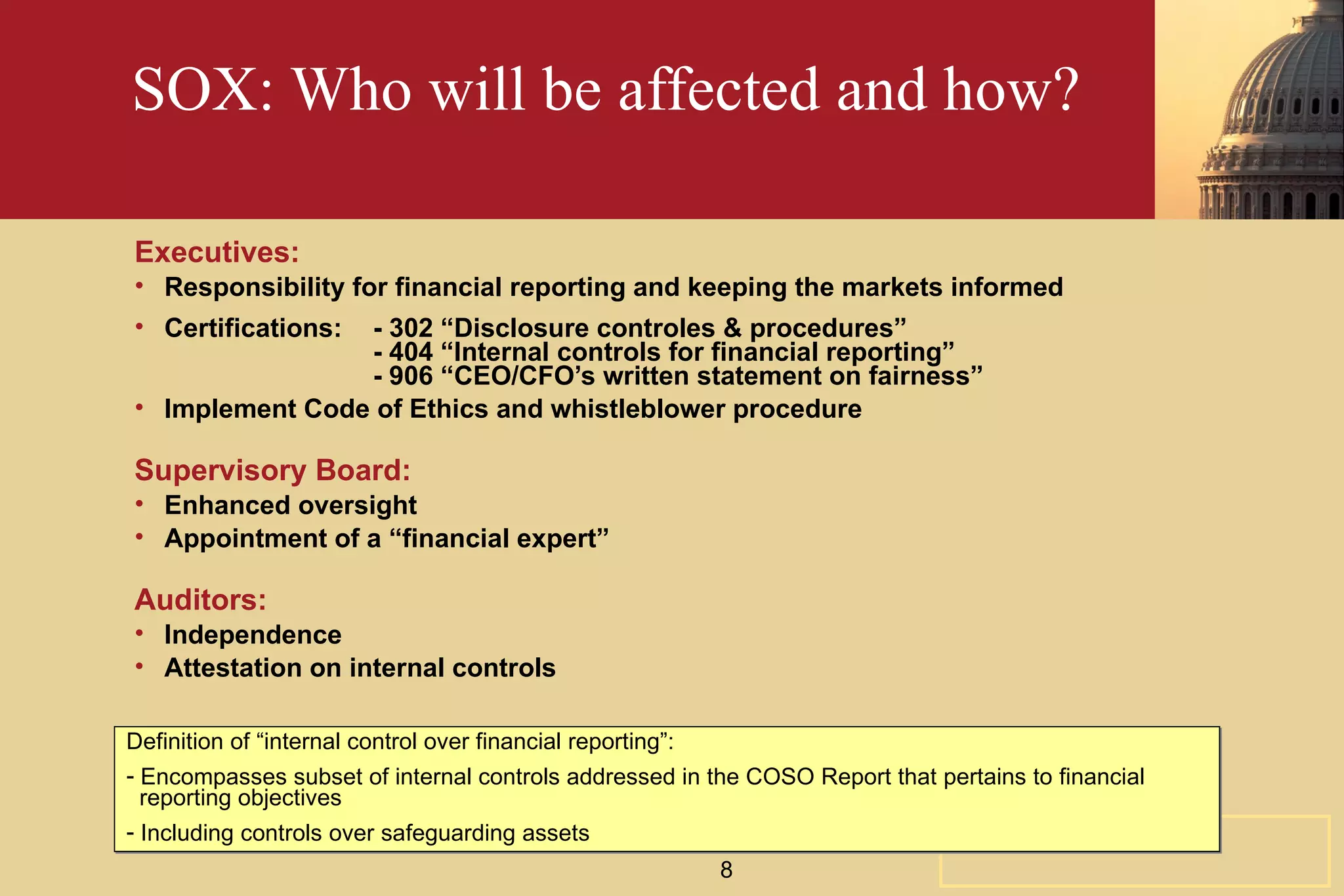

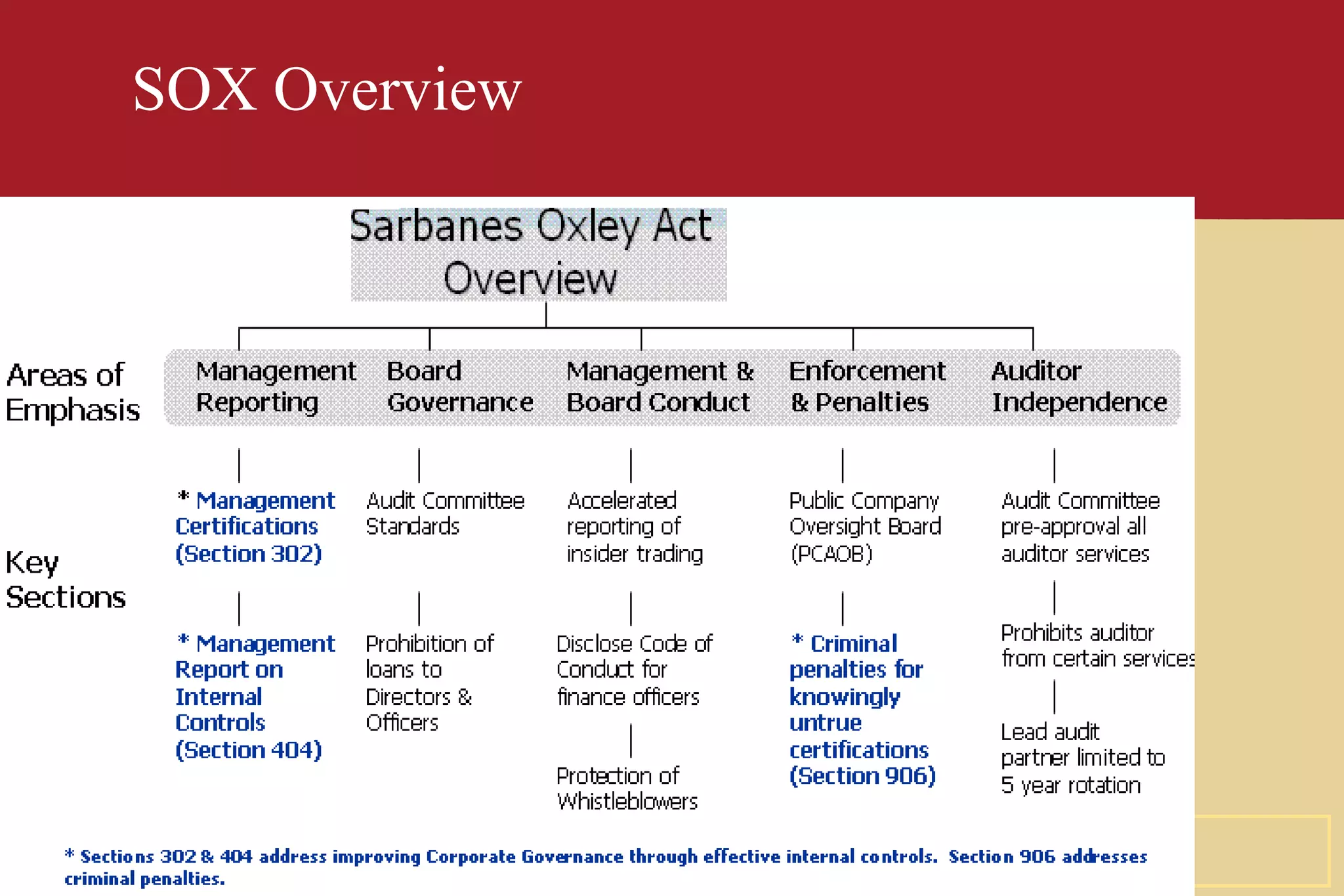

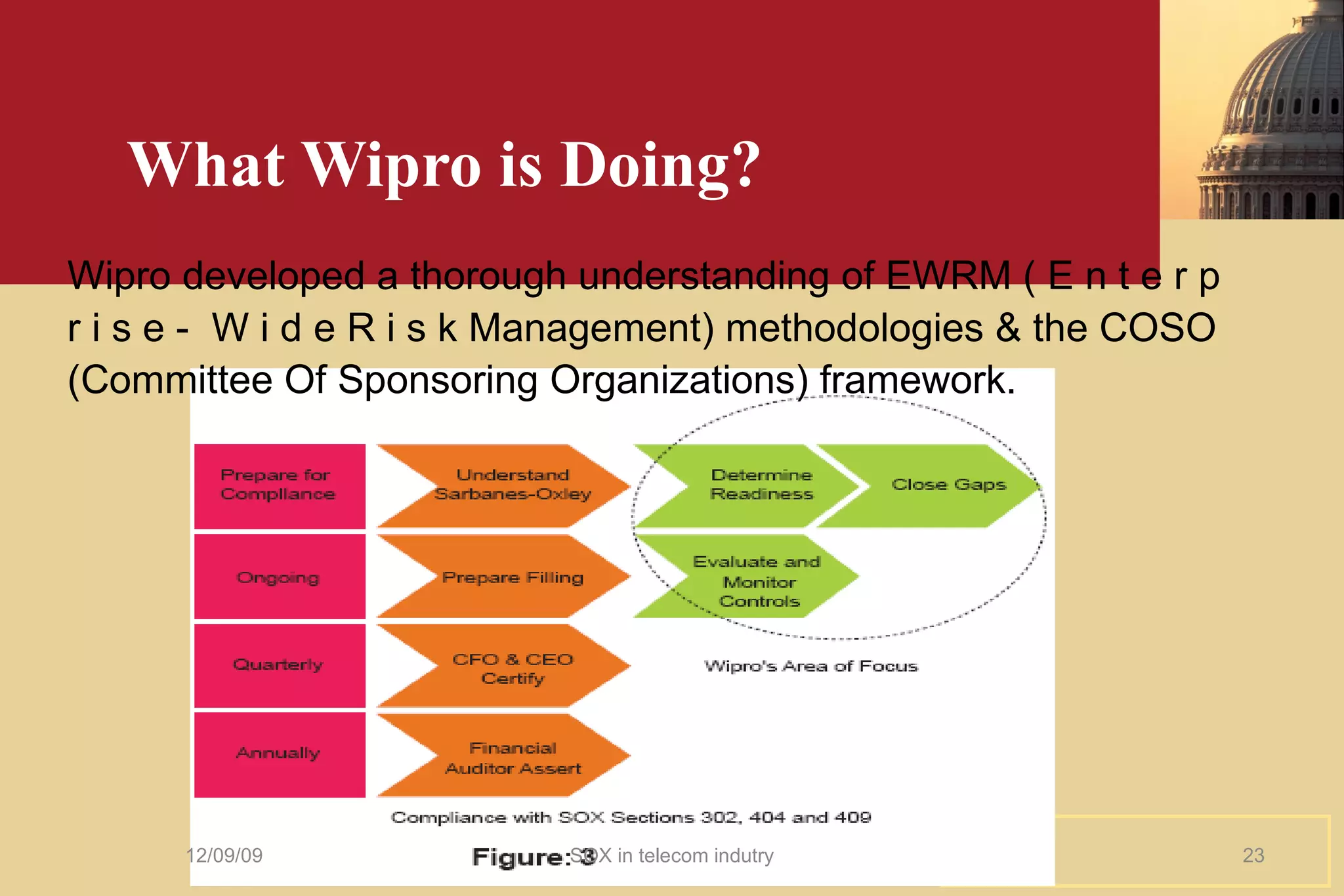

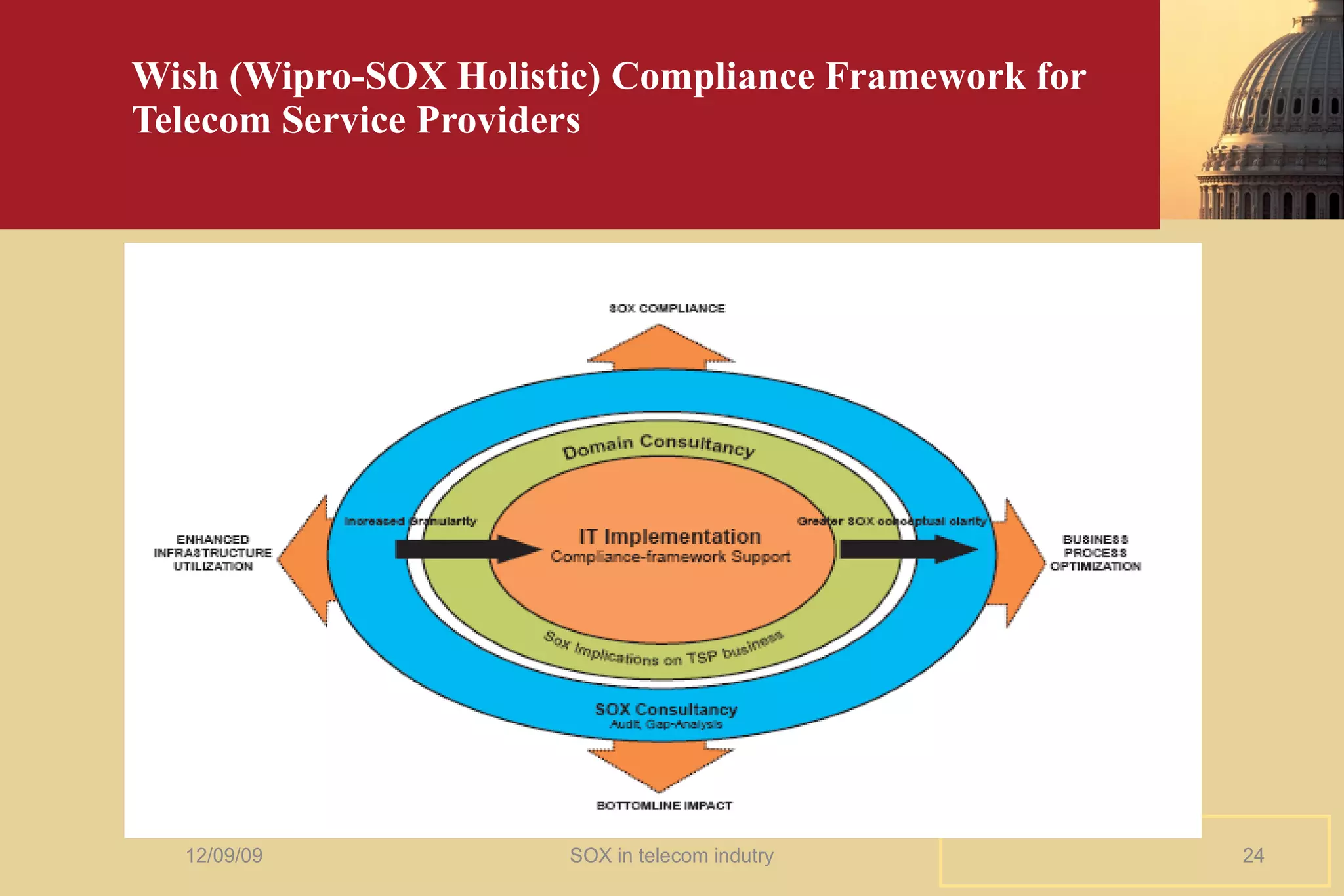

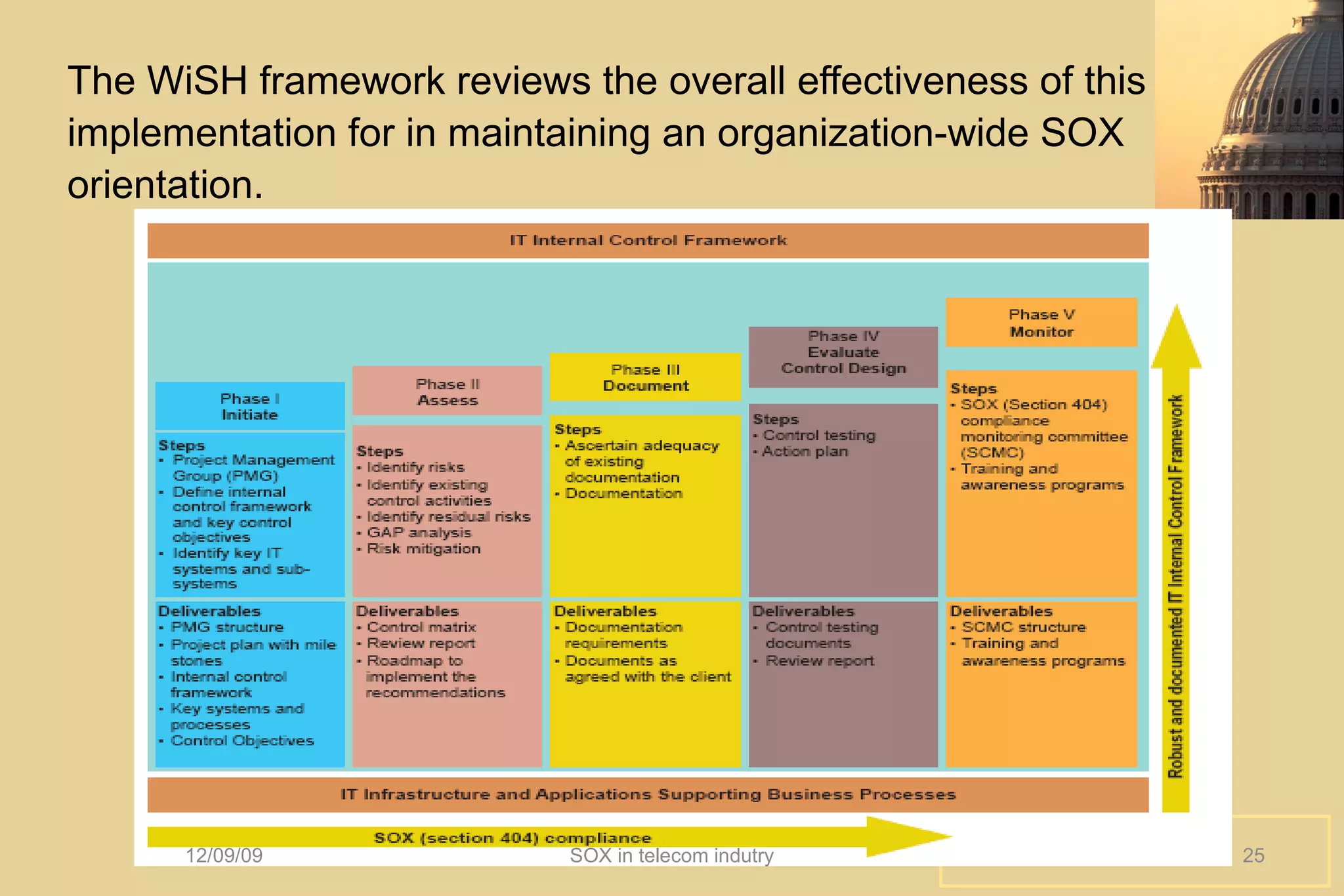

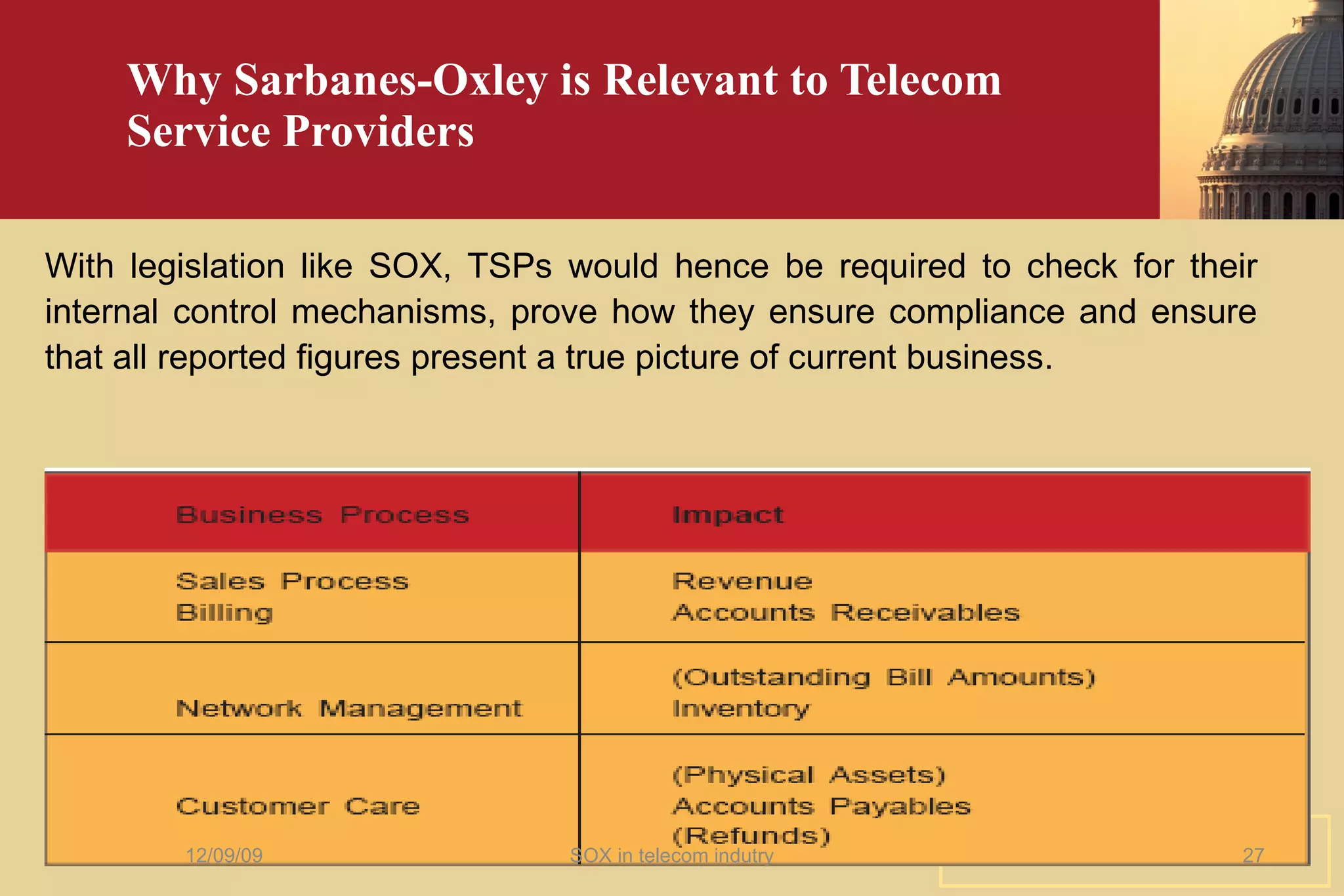

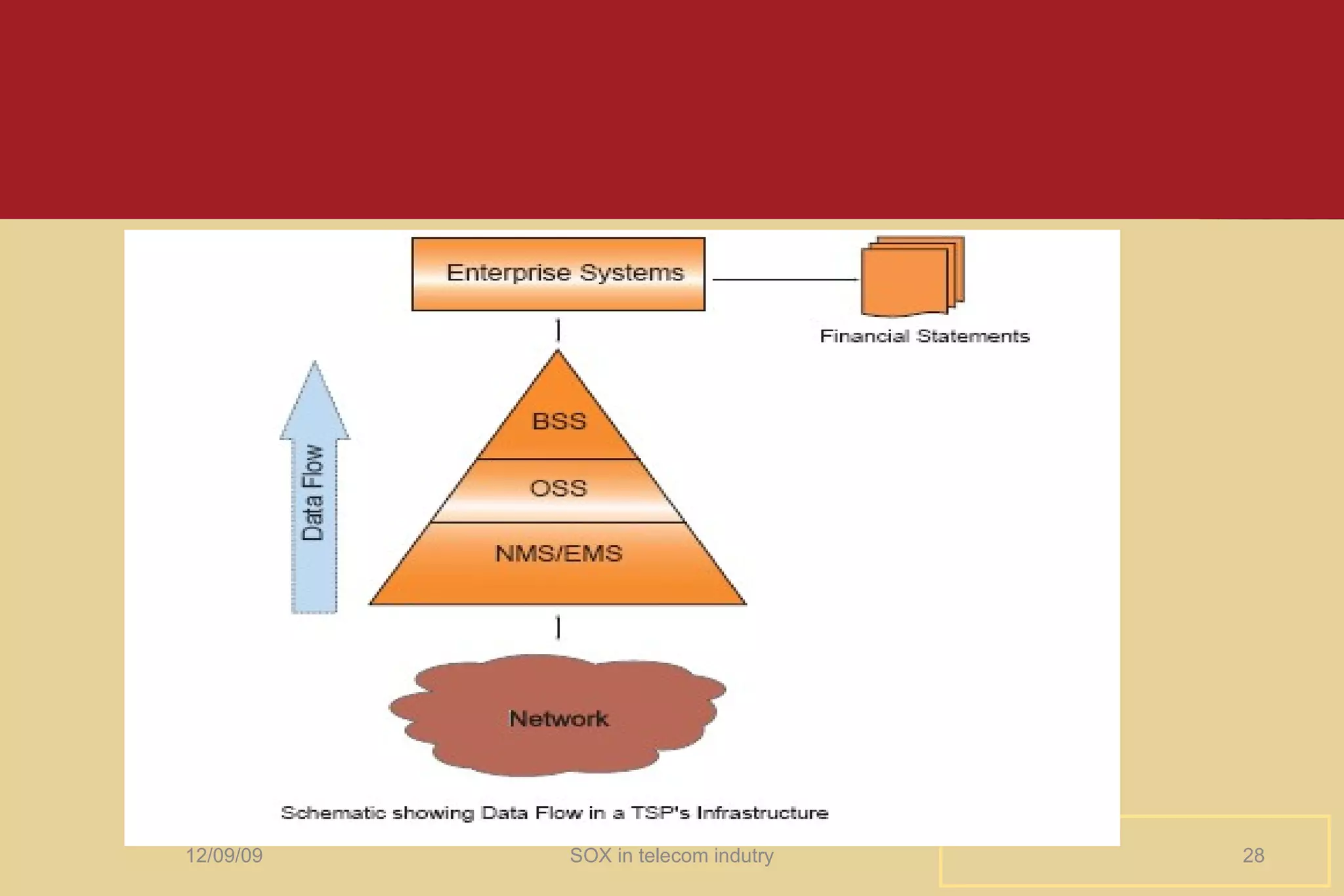

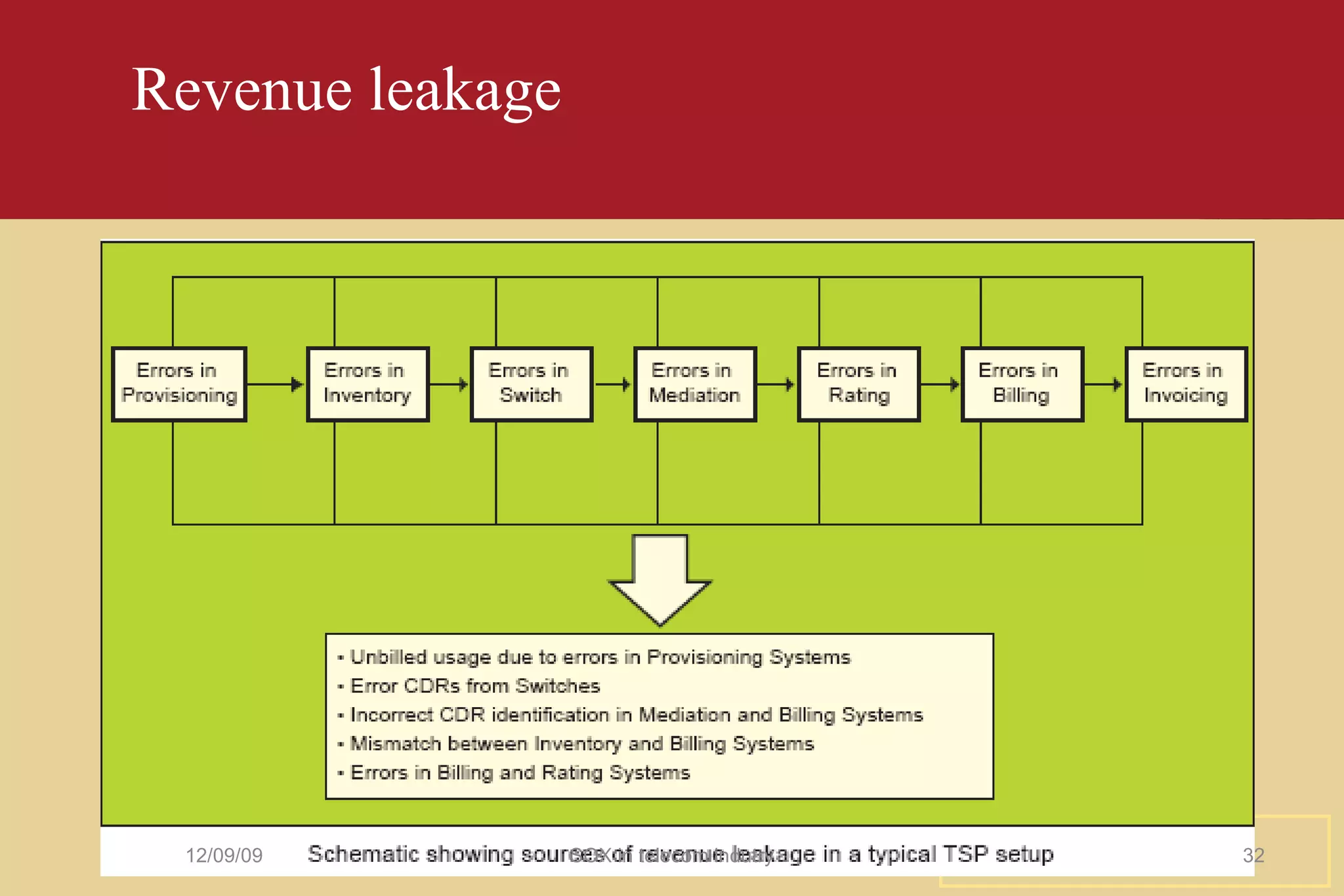

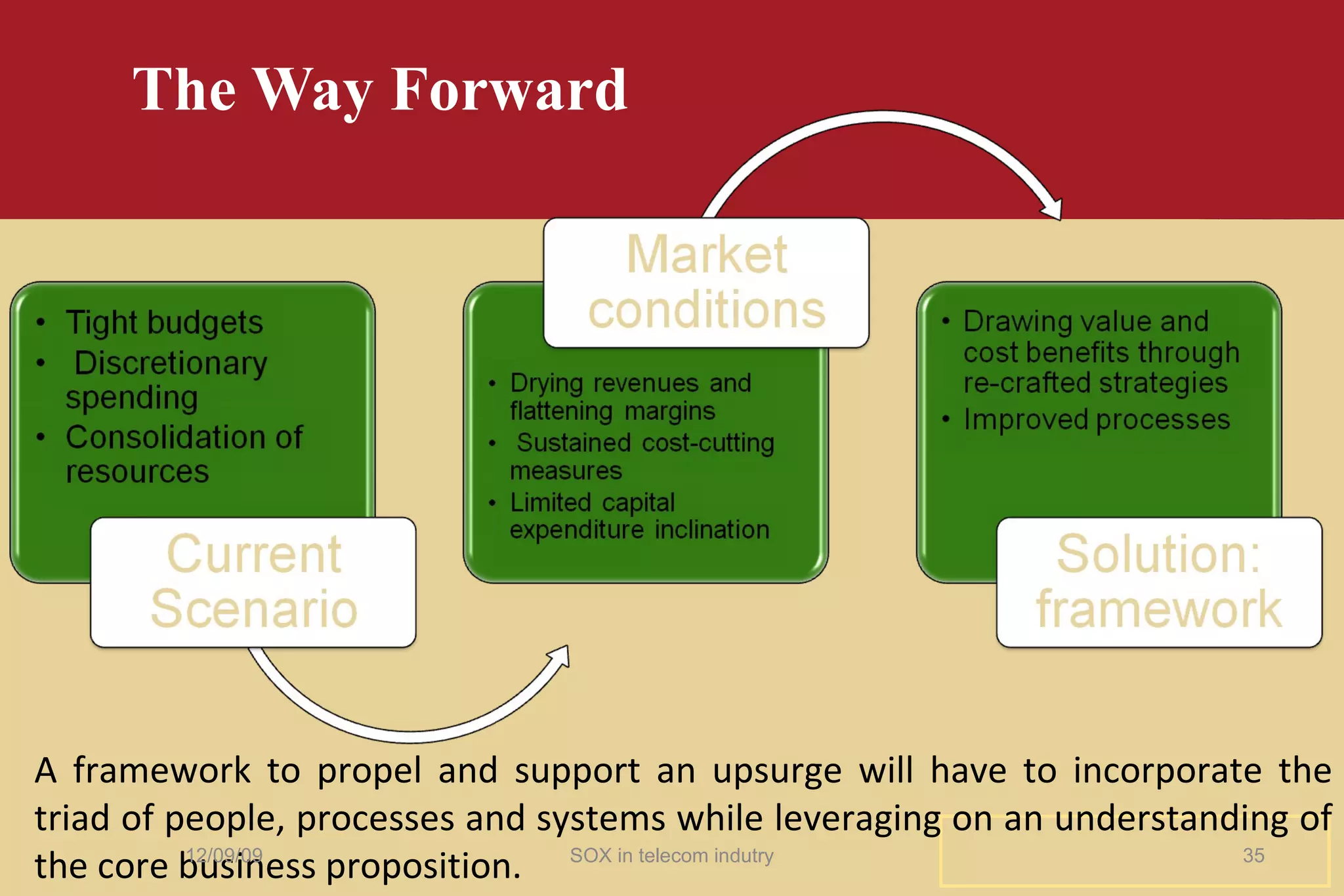

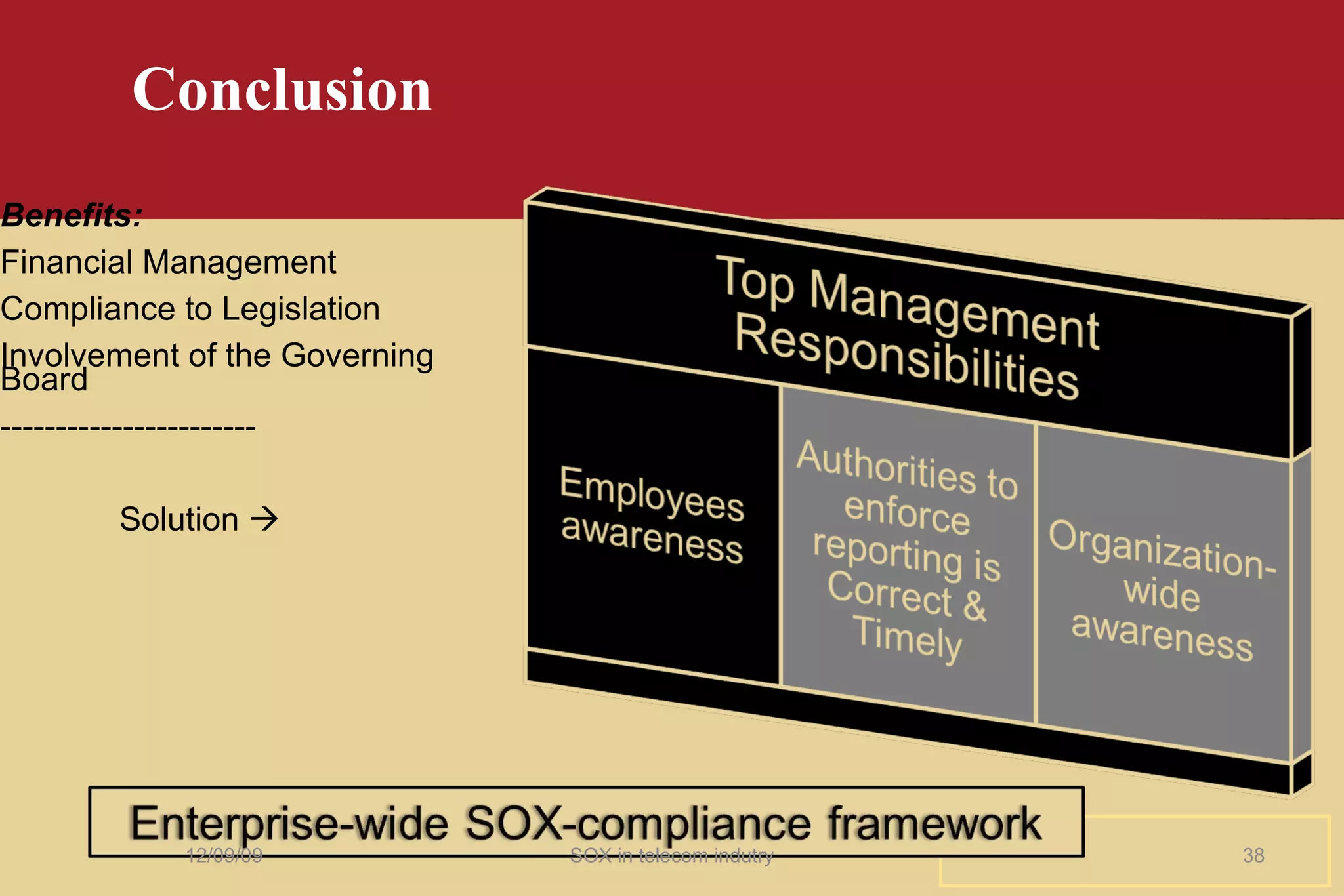

The document discusses the Sarbanes-Oxley Act and its implications for telecom companies. It requires executives to certify financial reports, establishes oversight of auditors, and aims to increase accuracy and reliability of corporate disclosures. For telecom companies, complying with SOX can help reduce revenue leakages, align data flows, and accelerate initiatives to plug leakage points.