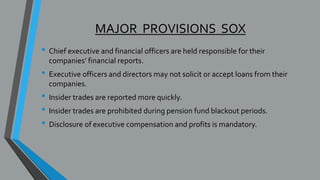

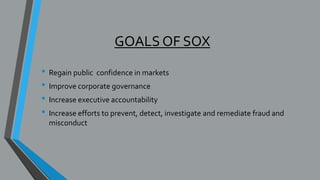

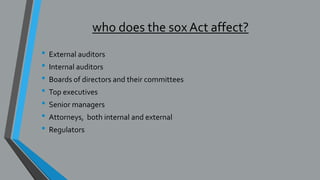

The Sarbanes-Oxley Act of 2002 (SOX) was enacted to protect shareholders and the public from accounting errors and fraudulent financial practices by corporations. Key provisions of SOX include establishing the Public Company Accounting Oversight Board to oversee audits of public companies, requiring CEOs and CFOs to certify the accuracy of financial reports, prohibiting companies from making loans to executives, and increasing penalties for fraudulent behavior. The overall goals of SOX are to regain public confidence in financial markets, improve corporate governance and accountability, and strengthen efforts to prevent and detect financial misconduct.