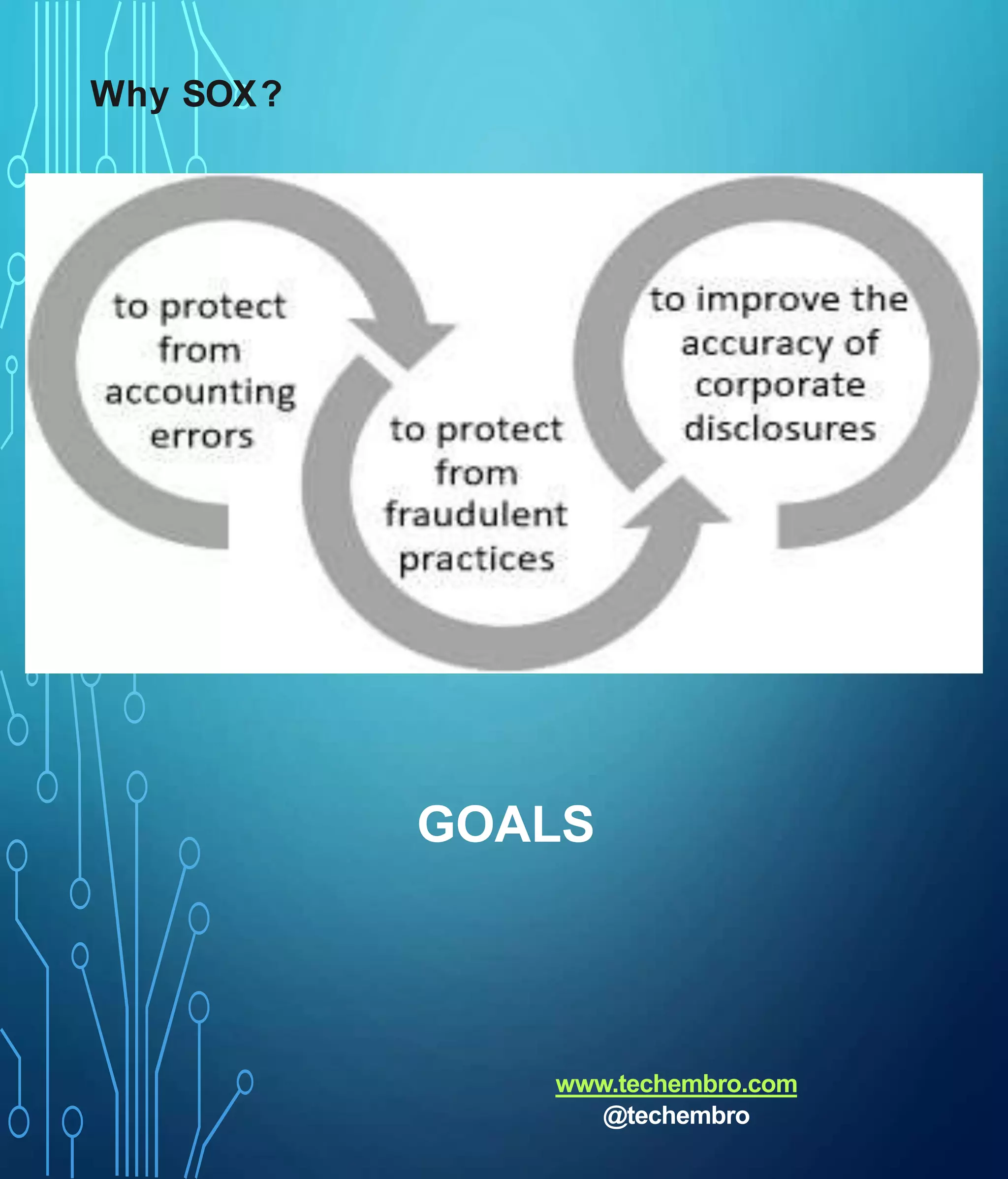

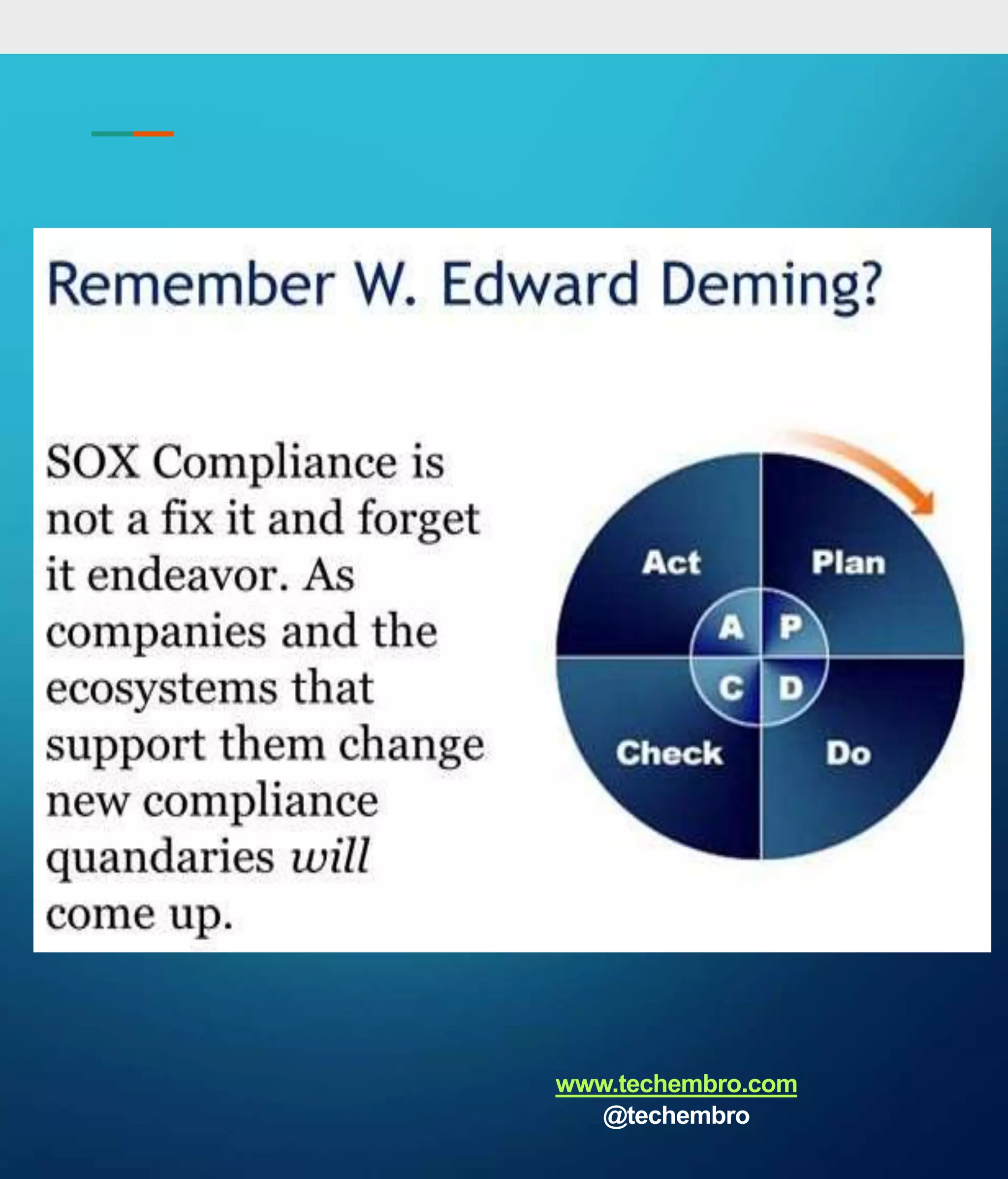

The document discusses SOX compliance, detailing its legal requirements, compliance methods, and frameworks like COSO and COBIT. It emphasizes the importance of security controls, data protection, and audit processes in ensuring accurate financial reporting and operational efficiency. The conclusion highlights that despite the costs of compliance, SOX application has led to improved performance and internal processes for companies.