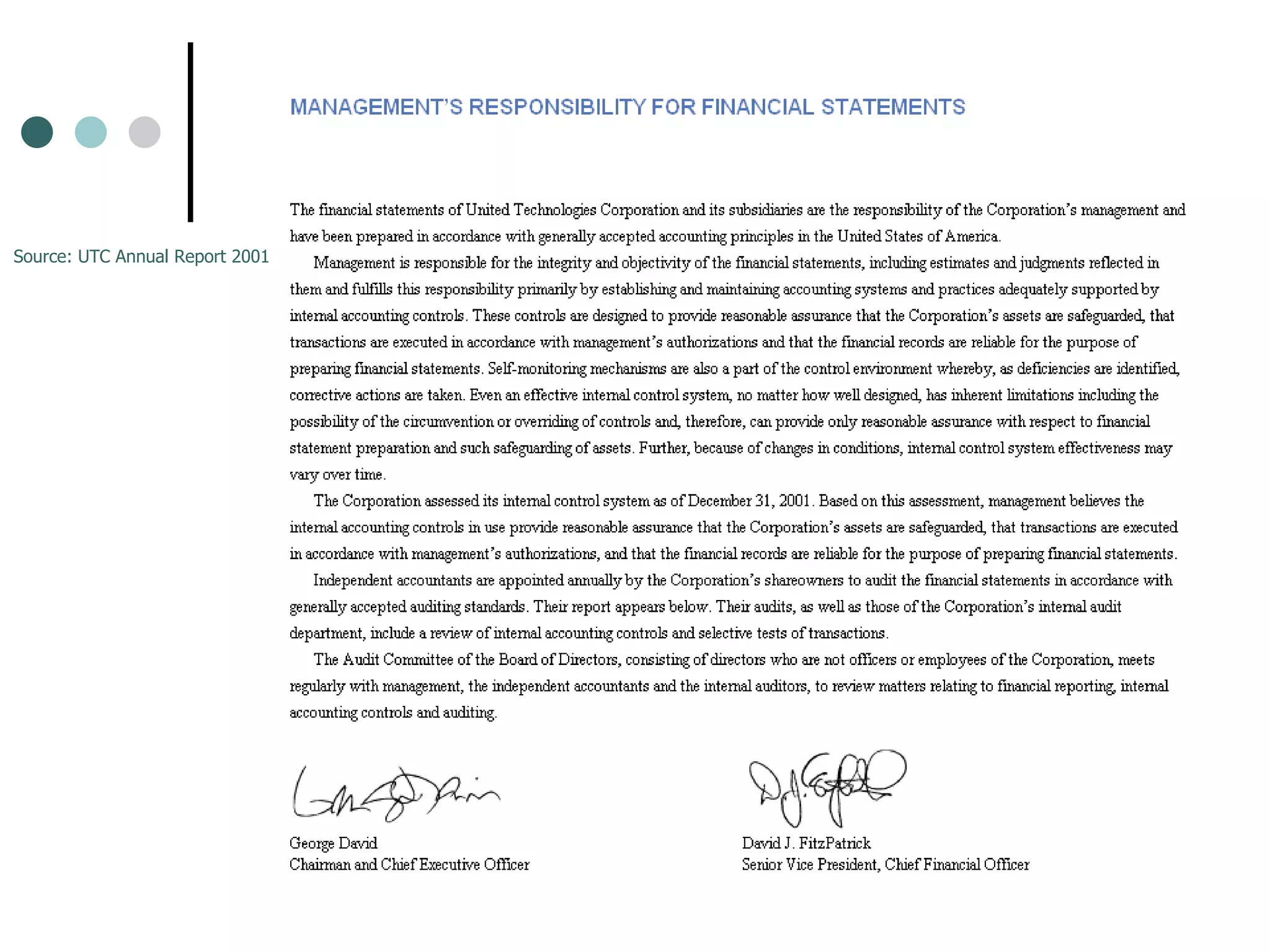

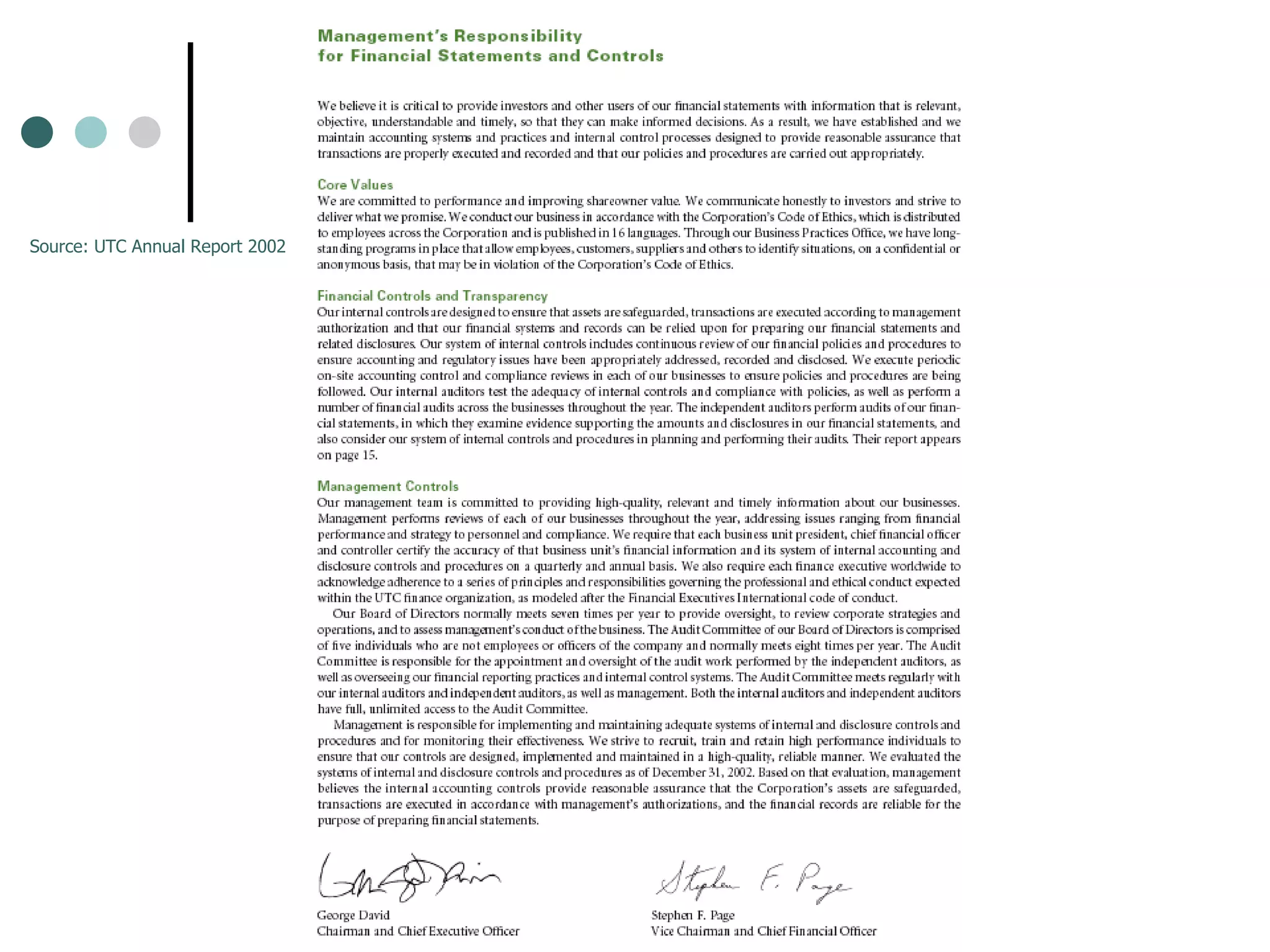

The document discusses the Sarbanes-Oxley Act (SOX) passed in 2002 in response to several major corporate accounting scandals. SOX aimed to restore confidence by requiring stricter financial disclosures, independent audits of internal controls, corporate fraud accountability, and protections for whistleblowers. Key aspects of SOX include CEO/CFO certification of financial reports, management assessment of internal controls, auditor oversight, and analysis of potential conflicts of interest for securities analysts.