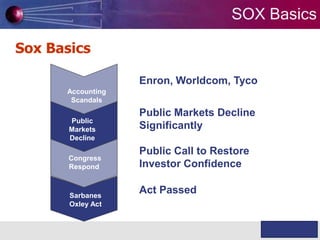

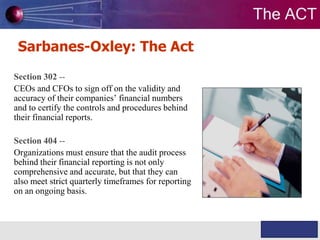

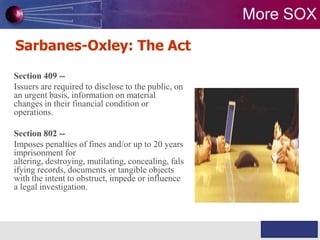

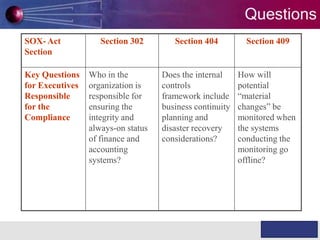

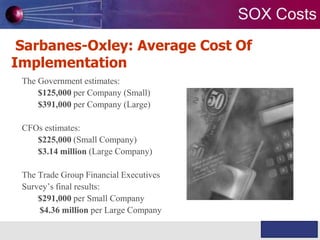

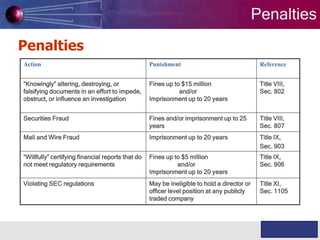

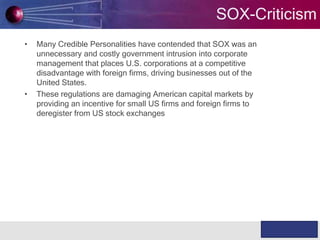

The Sarbanes-Oxley Act (SOX) was passed in 2002 in response to major corporate accounting scandals to improve financial disclosure and transparency for public companies. Major sections of SOX include requirements for CEOs and CFOs to certify financial reports, for companies to establish internal controls on financial reporting, and to promptly disclose material changes. While SOX increased compliance costs for companies, it also aimed to restore investor confidence by improving accuracy of financial reporting and imposing penalties for violations. However, some critics argue that SOX places unnecessary regulatory burdens on companies.