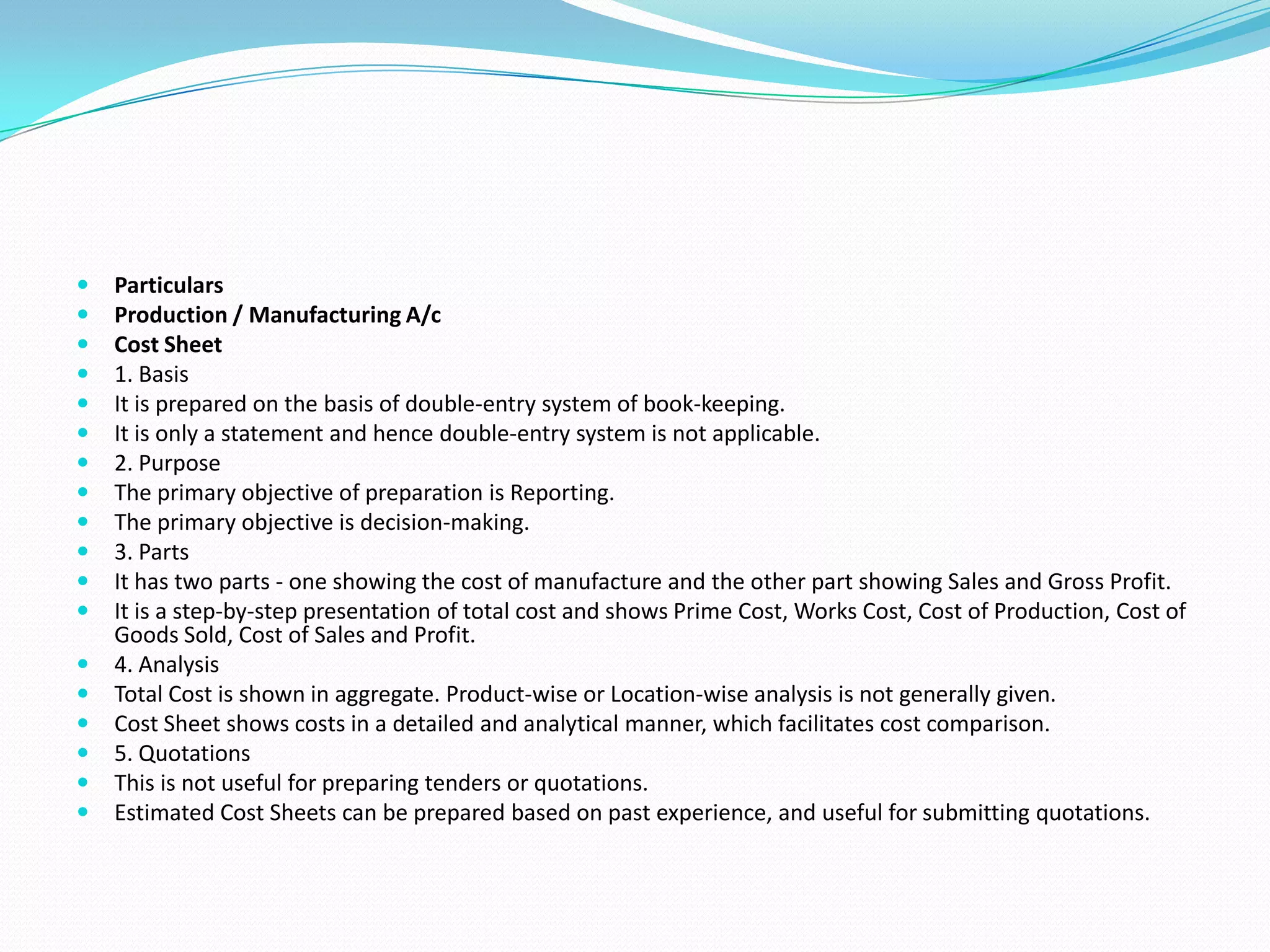

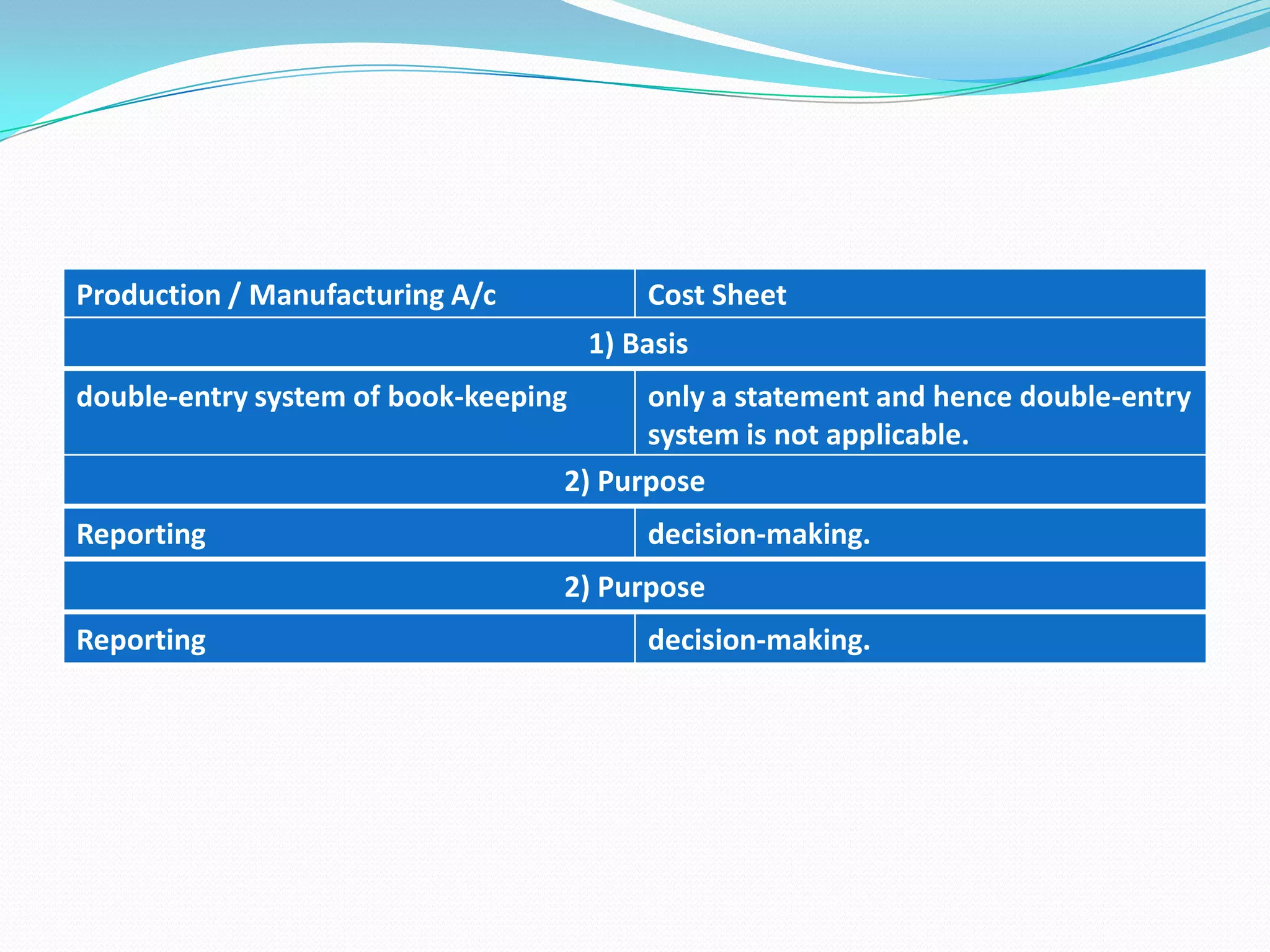

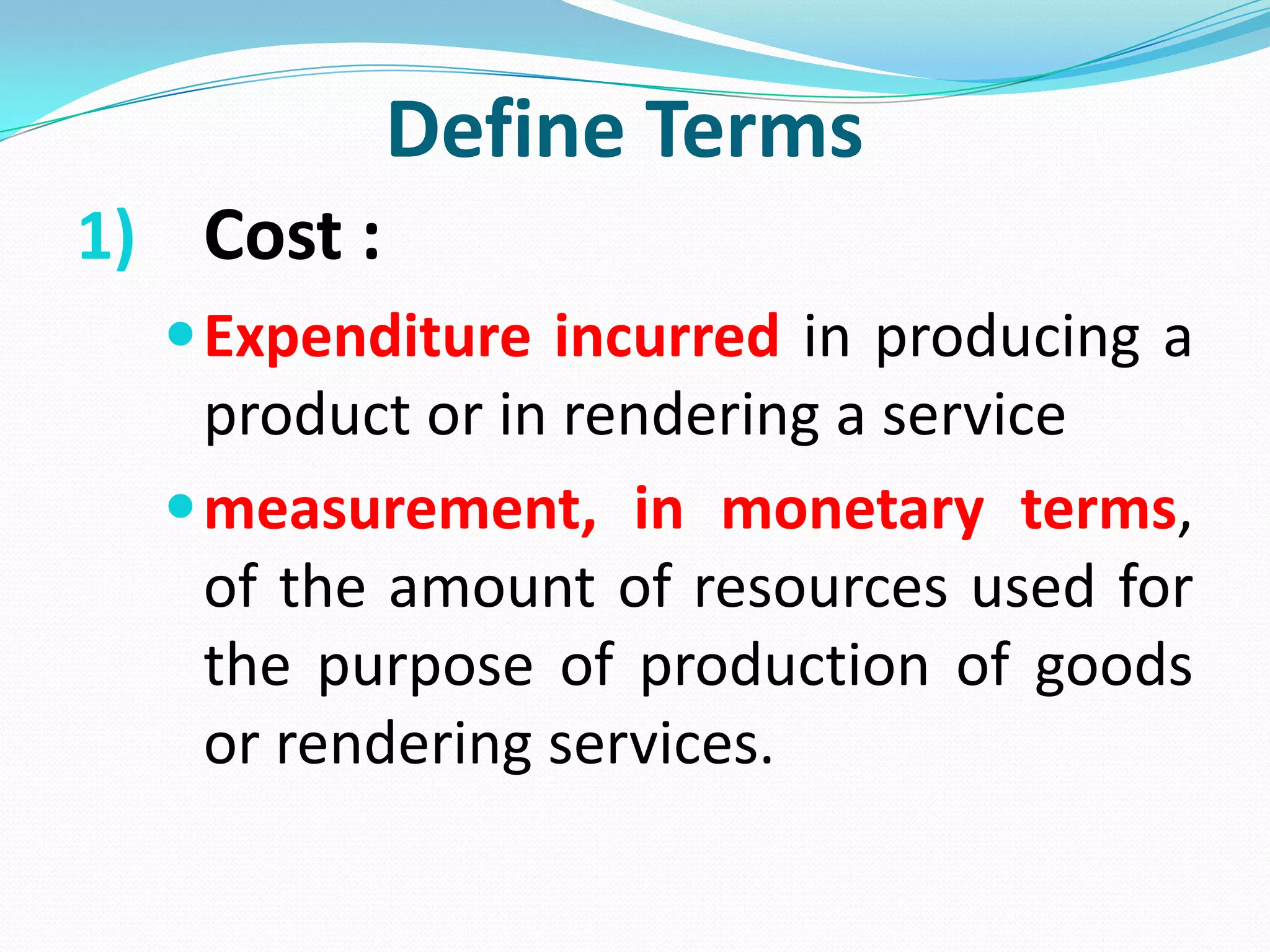

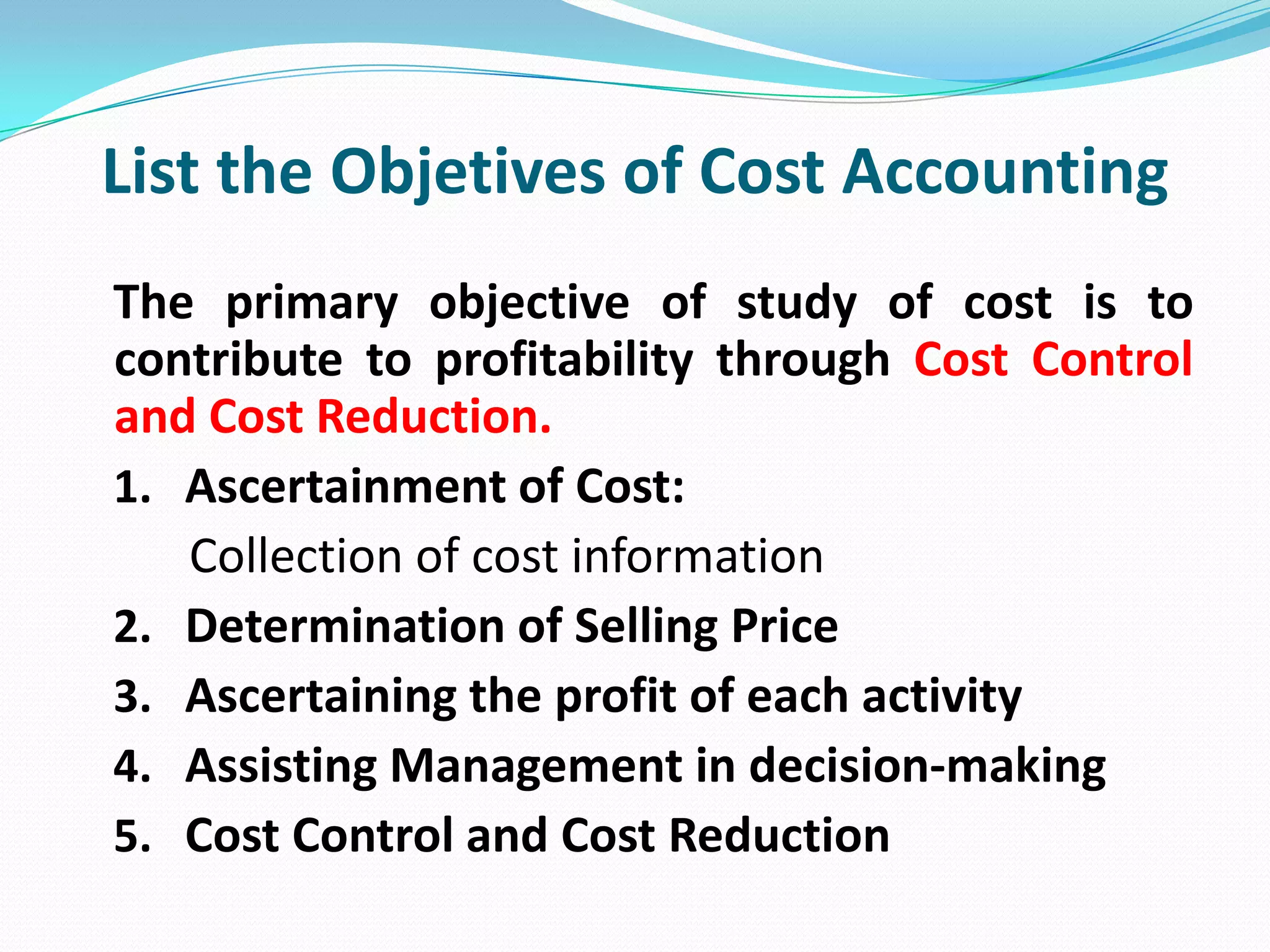

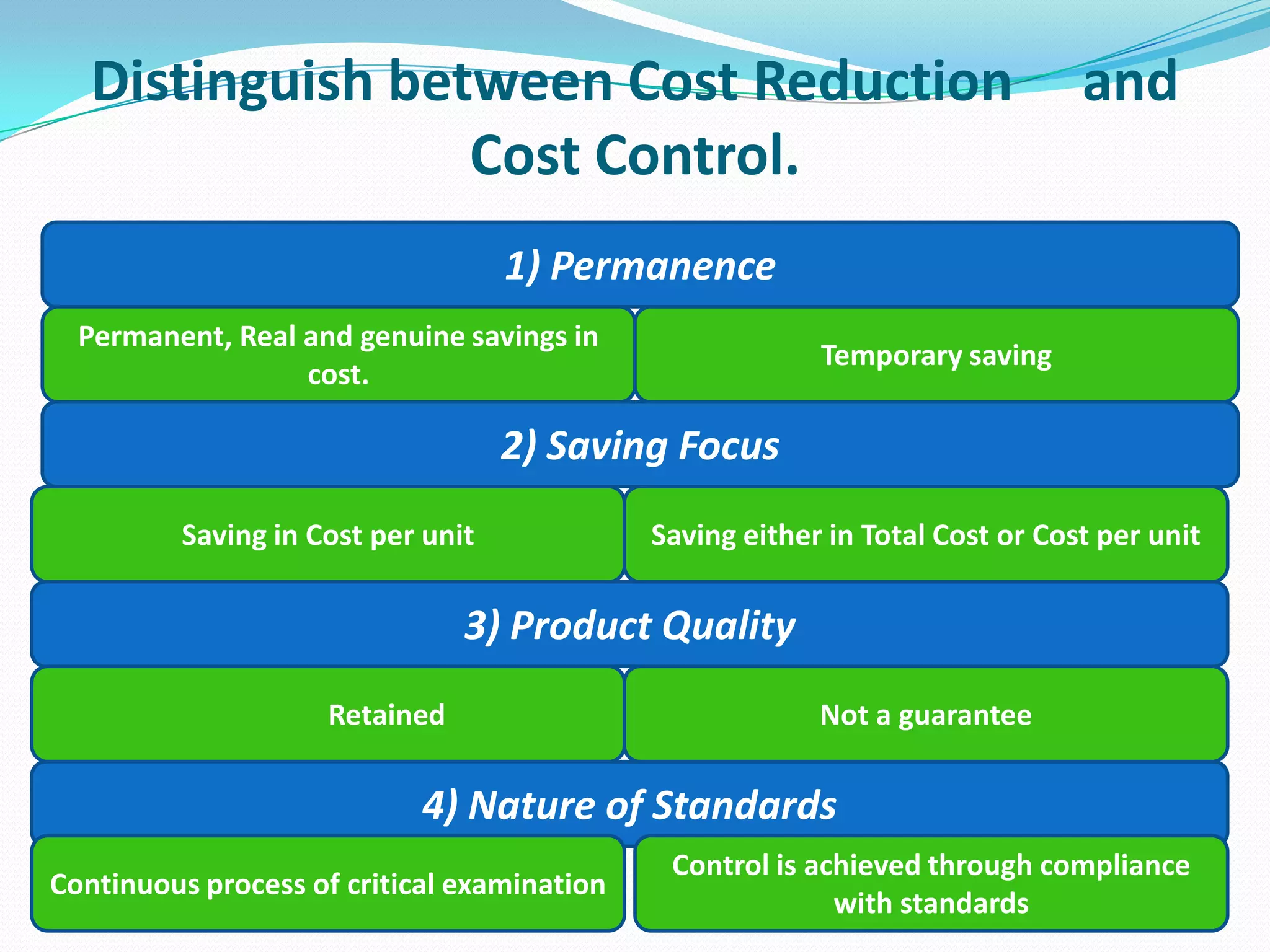

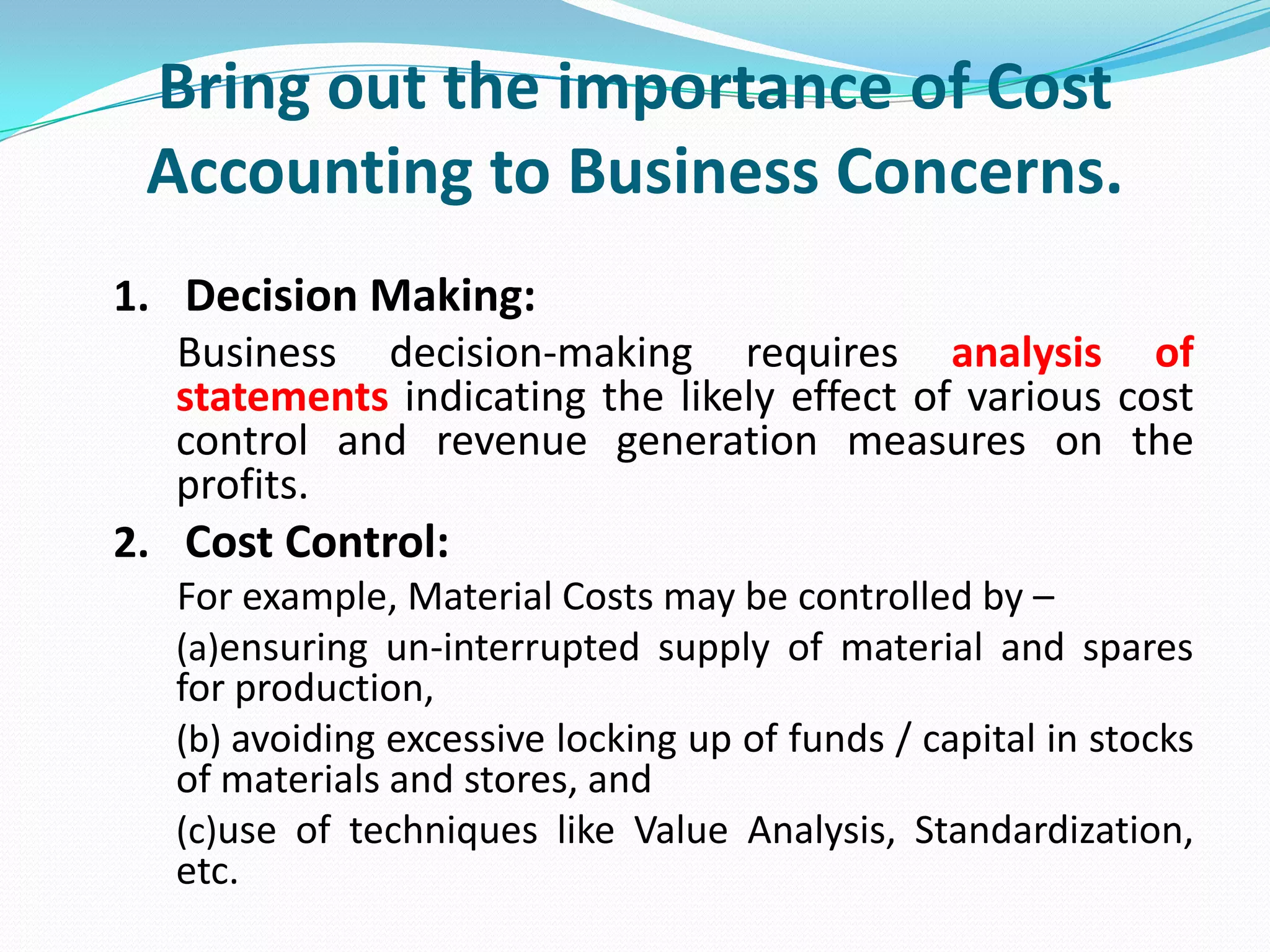

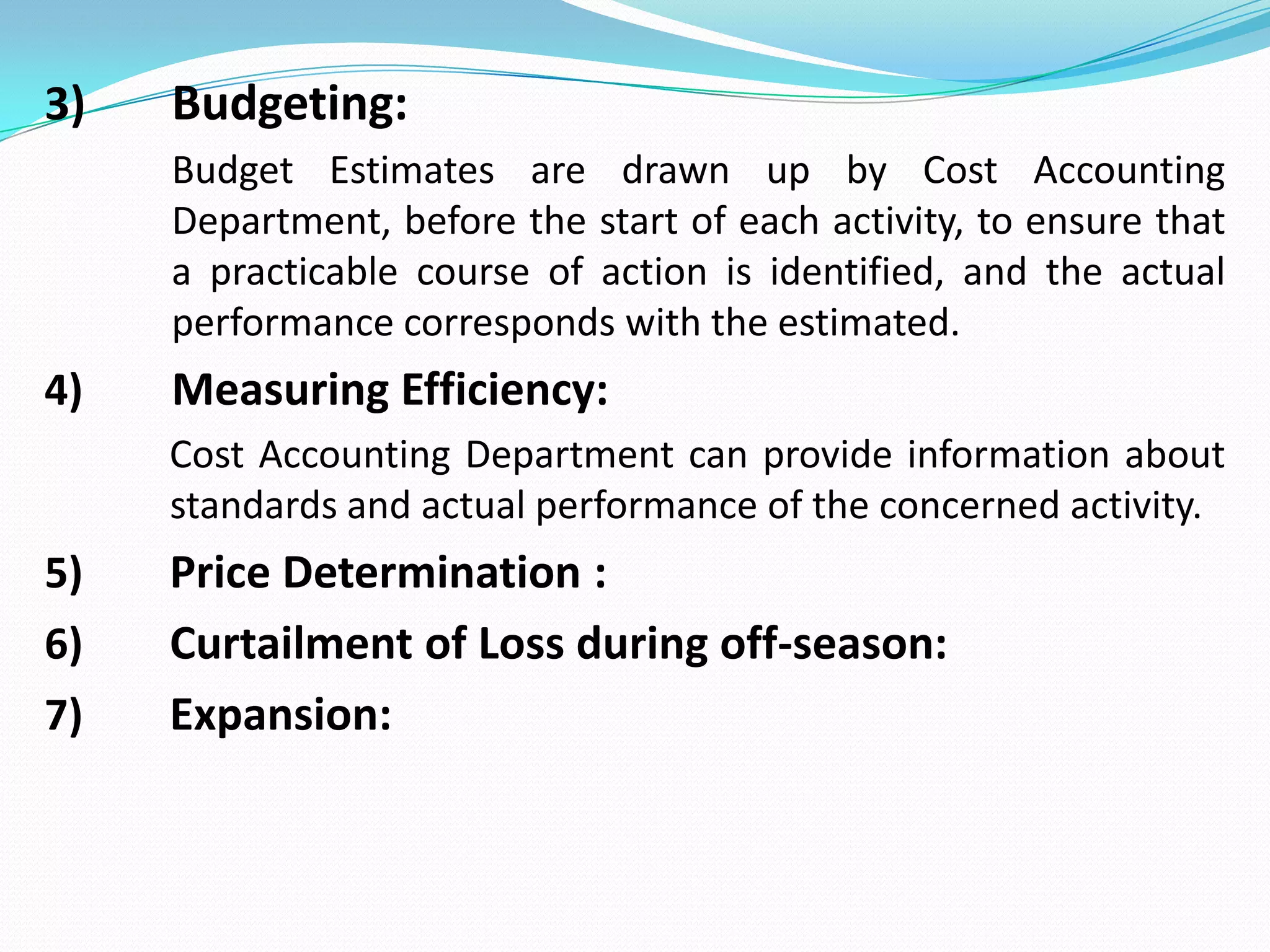

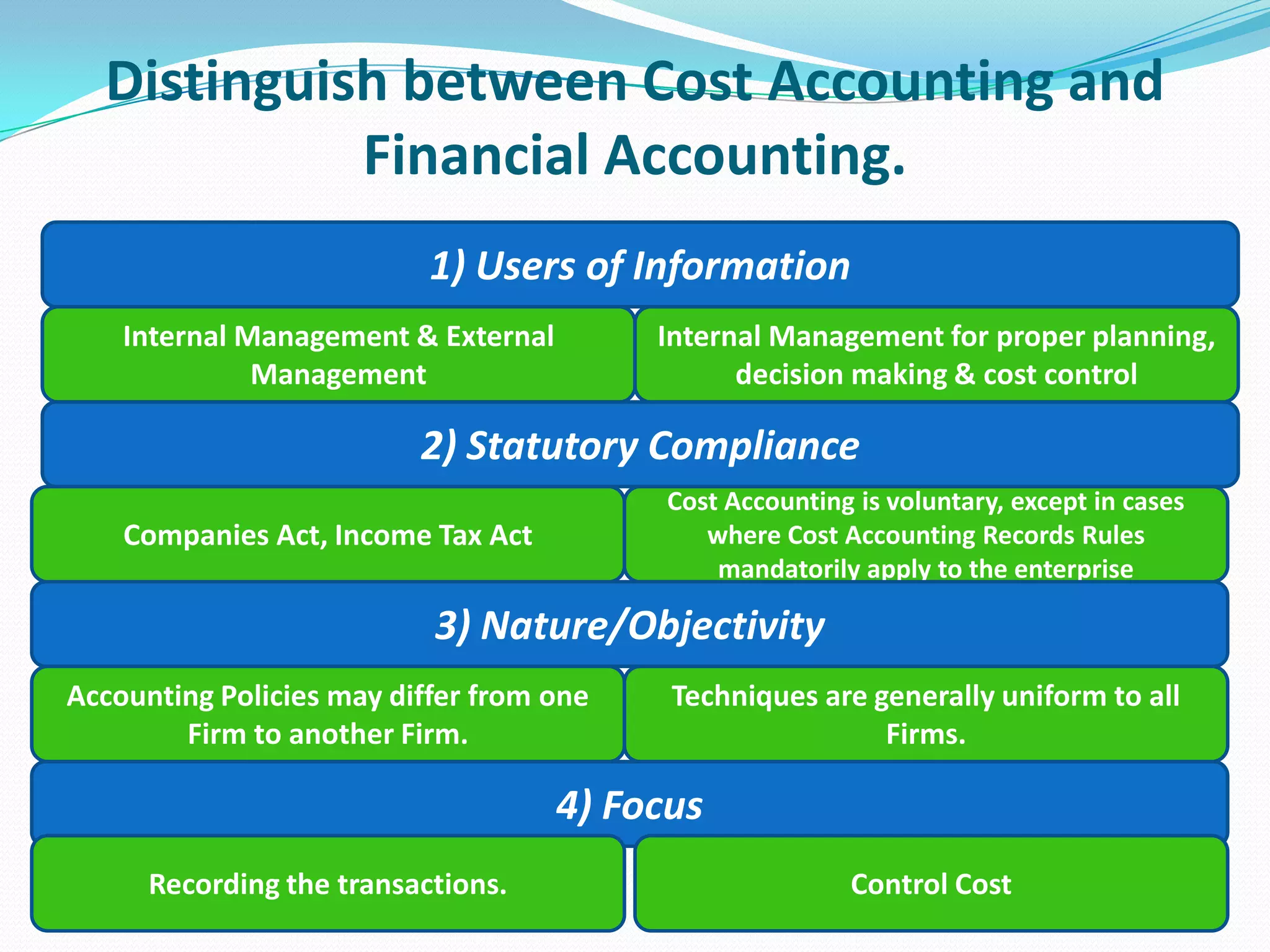

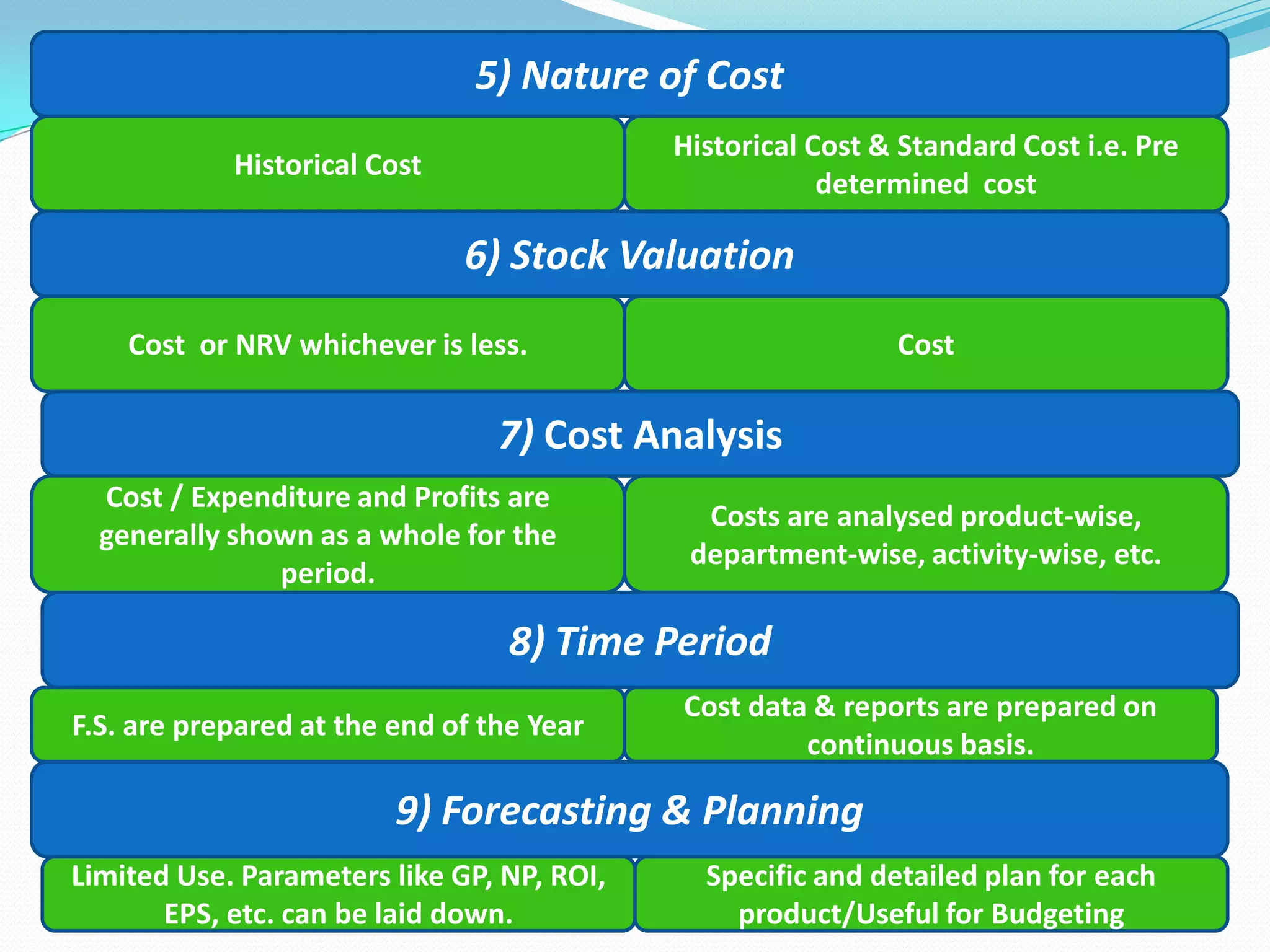

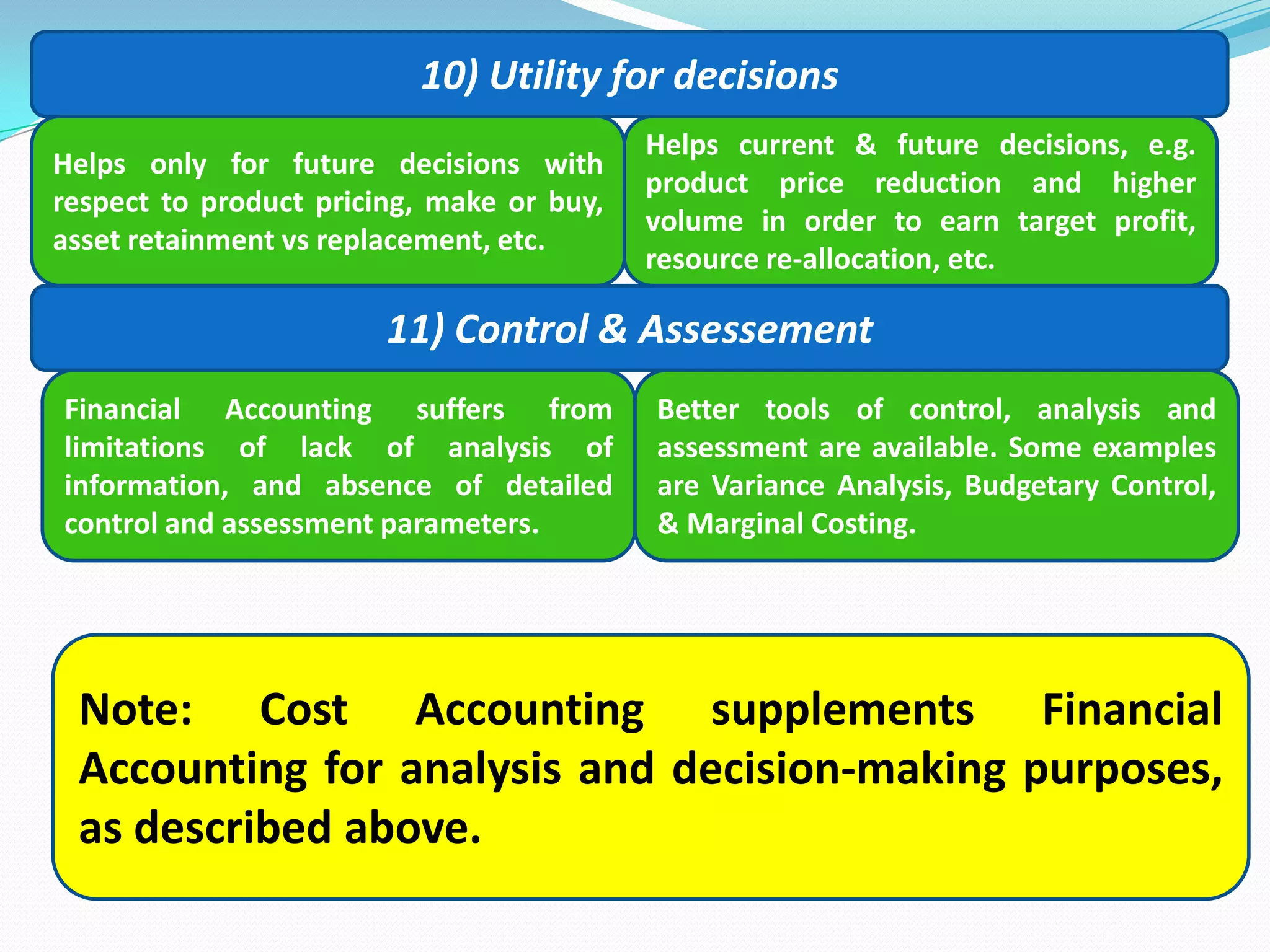

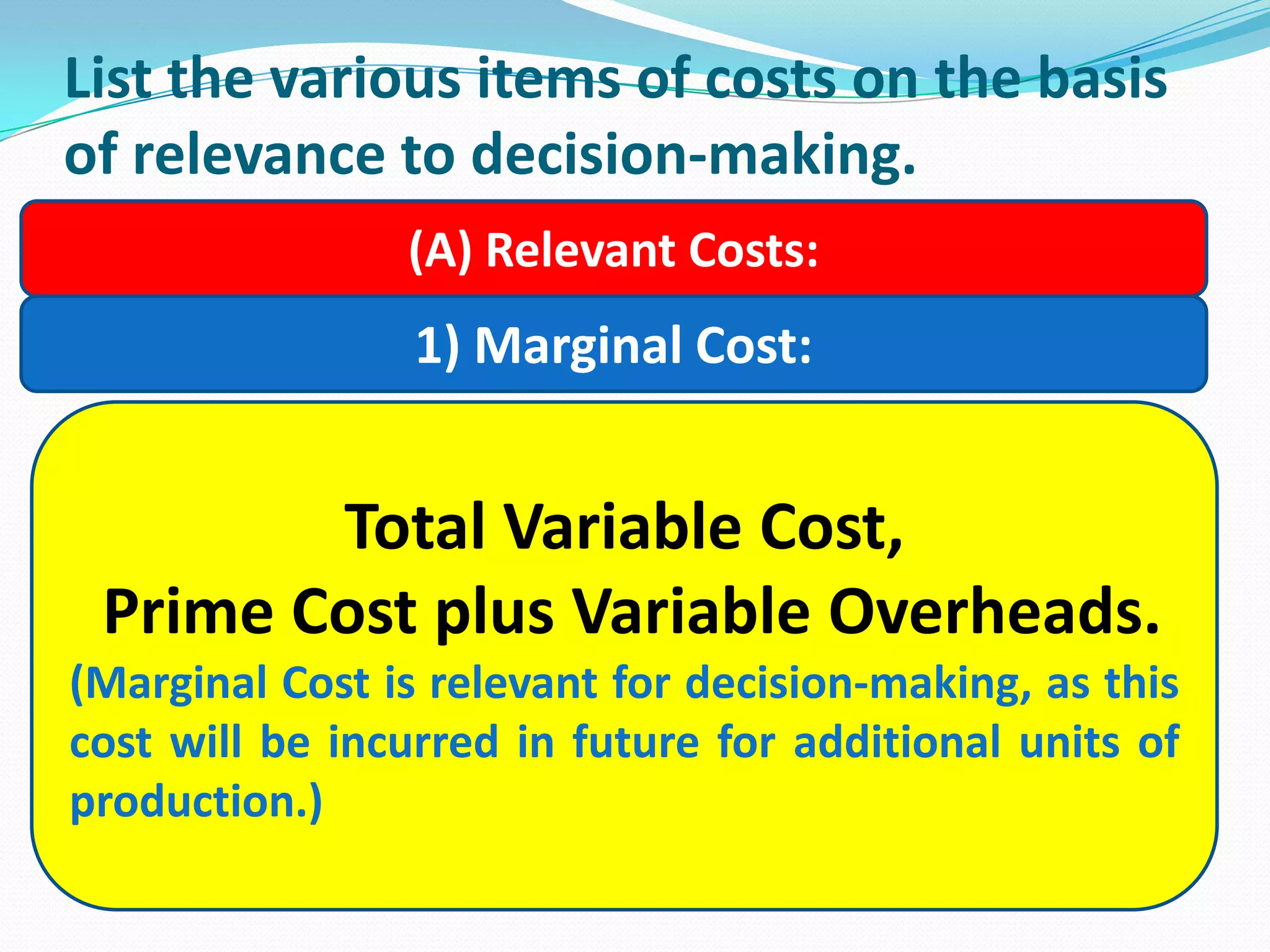

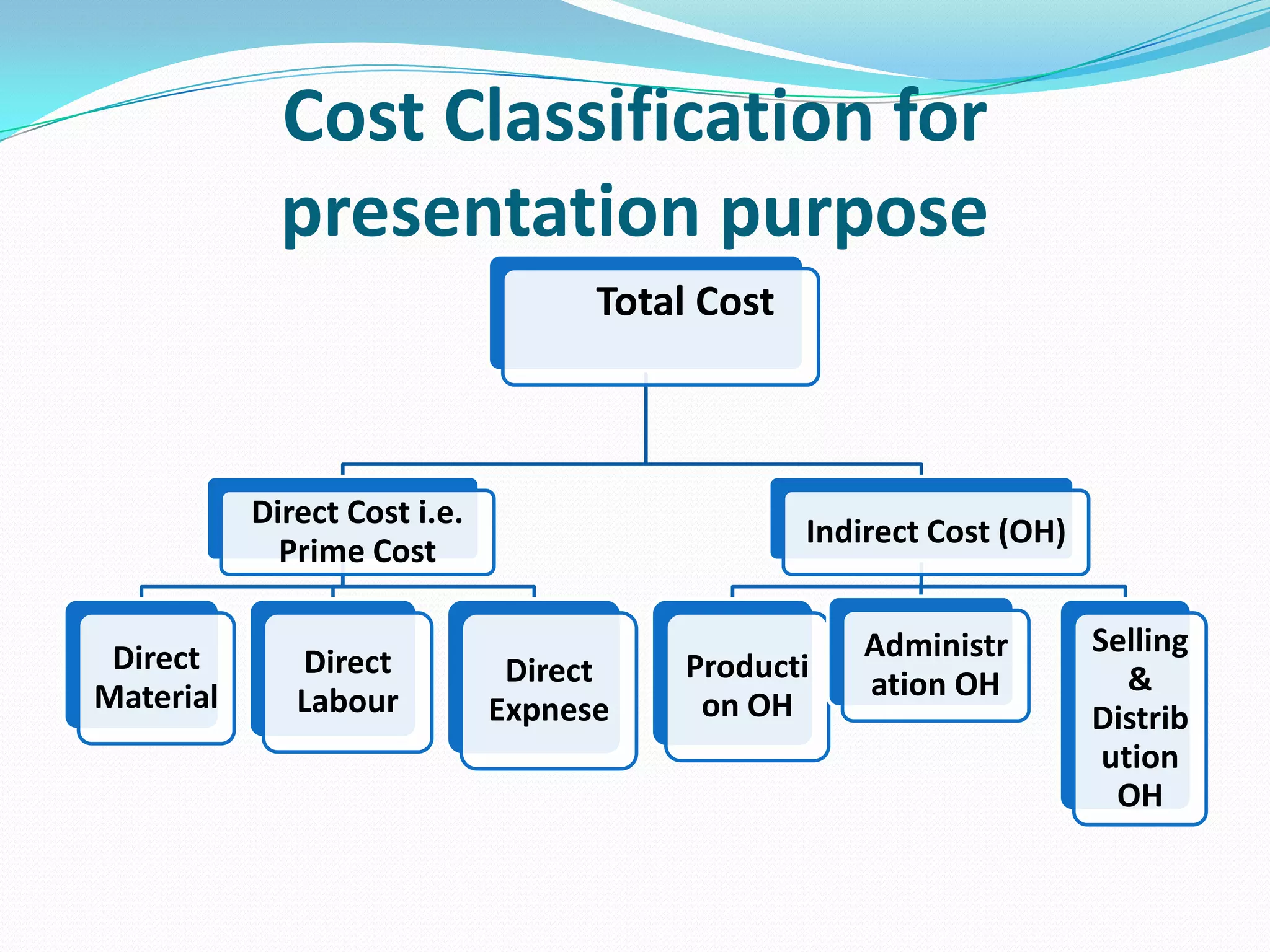

This document defines key cost accounting terms and concepts. It discusses the objectives of cost accounting like ascertaining costs, determining selling prices, and assisting management decision making. It distinguishes between cost reduction and cost control and highlights their differences. The importance of cost accounting to businesses is outlined for decision making, cost control, budgeting, efficiency measurement, and price determination. Financial accounting is distinguished from cost accounting. Finally, it describes different bases for classifying costs like functions, controllability, normality, and relevance for decision making.

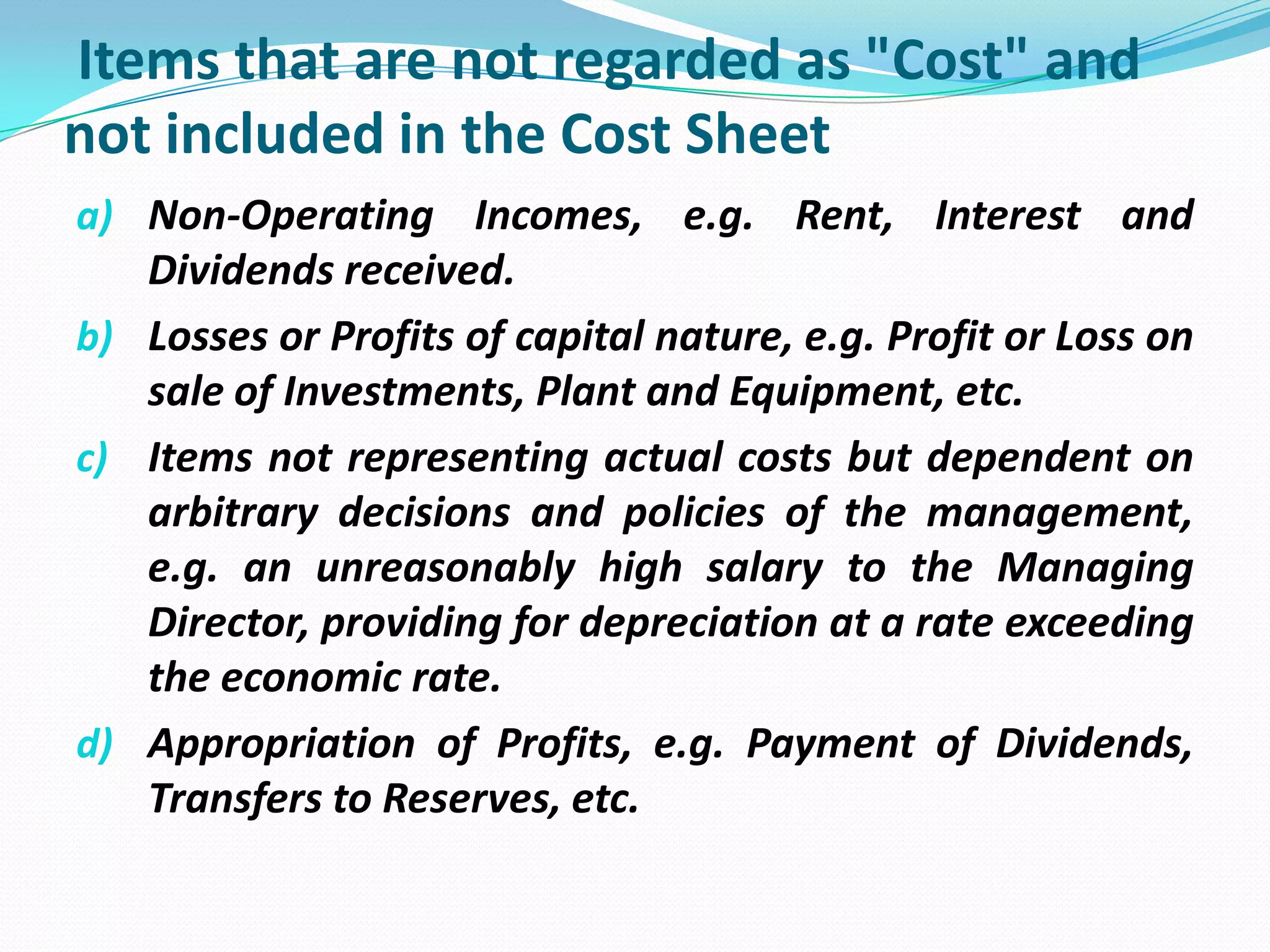

![e) Profit based Outflows, i.e. Income-Tax. [Note: Bonus

paid to workers is treated as Cost].

f) Amounts representing loss on account of inefficiency

of a particular activity, e.g. Bad Debts as a result of

inefficient credit management, Penalties & Fines due

to non-compliance with law, abnormal wastages and

losses, etc.

g) Items which may distort comparison, e.g. financial

items like interest, discount, etc. and other similar

items.

h) Imputed items that are not actually incurred by the

firm but constitute arbitrary charges against profit,

e.g. interest on own capital at an arbitrary rate.

i) Write-offs of Goodwill, Preliminary Expenses, etc.](https://image.slidesharecdn.com/basiccostconcepts-131007000608-phpapp01/75/Basic-cost-concepts-28-2048.jpg)