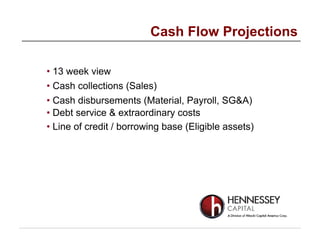

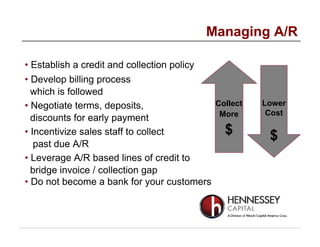

The document outlines essential strategies for effective cash flow management and working capital optimization to support business growth. Key points include avoiding poor cash management practices, leveraging partnerships, and focusing on operational efficiency. It emphasizes the importance of understanding cash cycles and implementing proactive measures to enhance cash inflows and manage inventories.