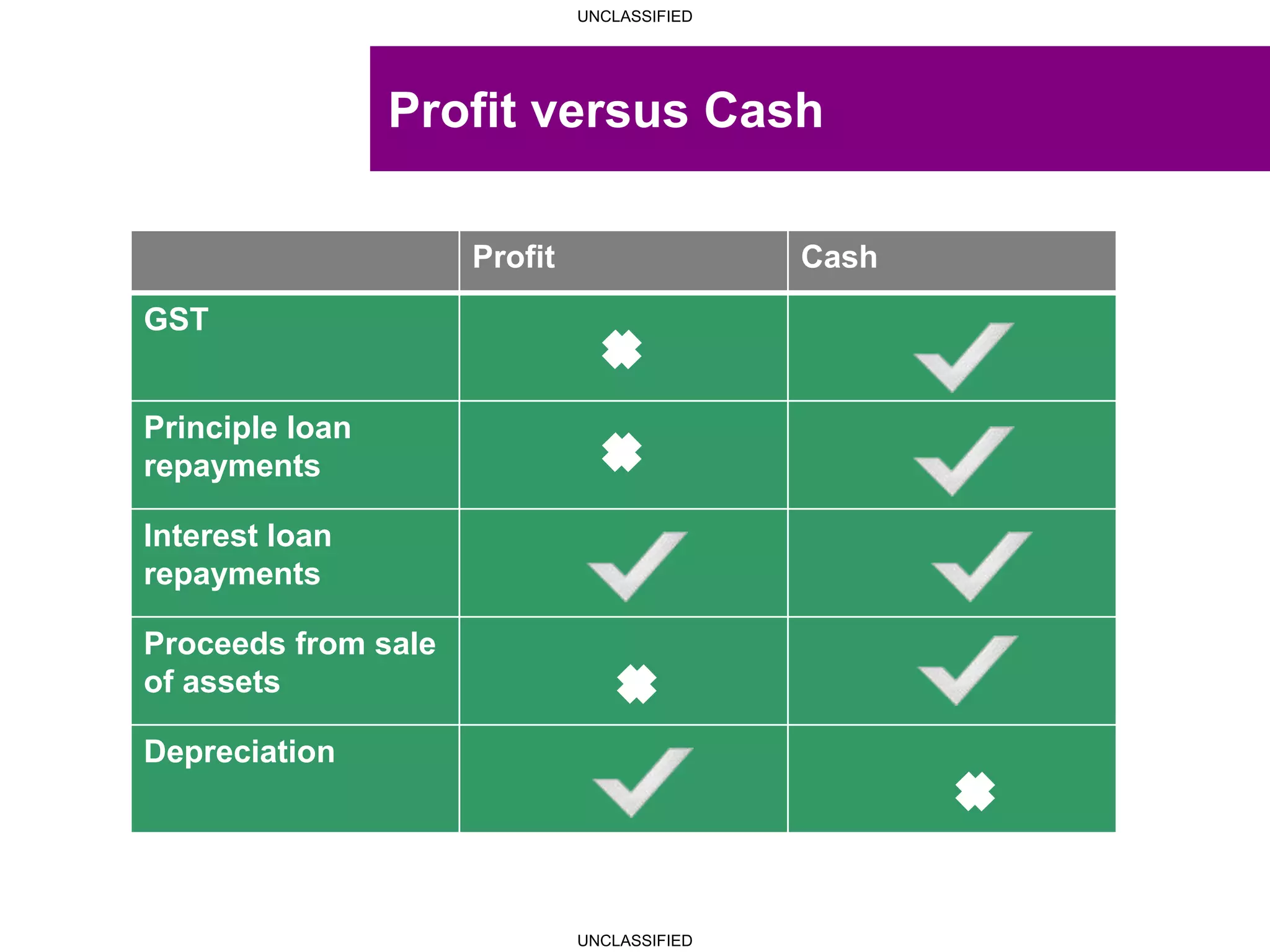

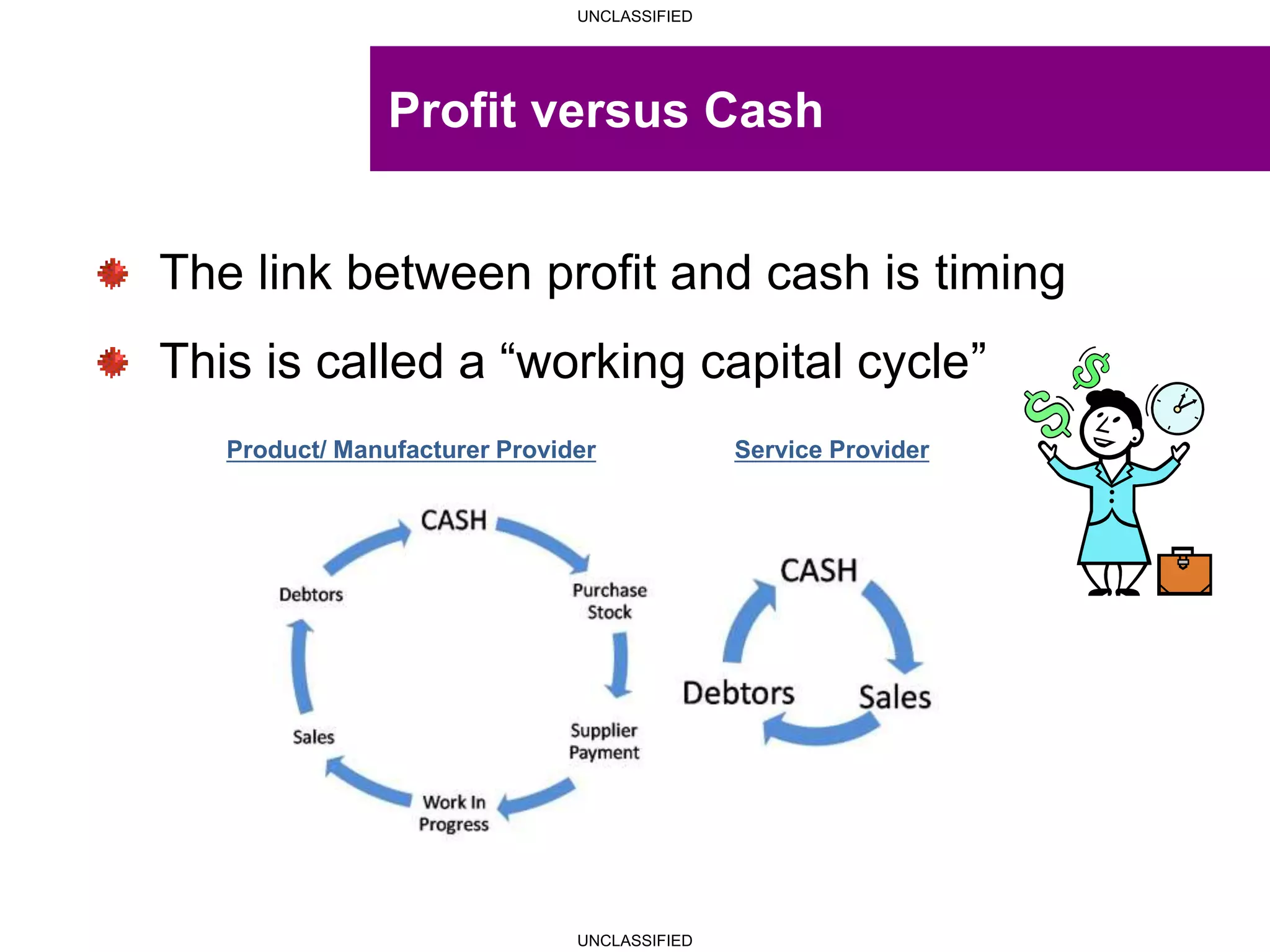

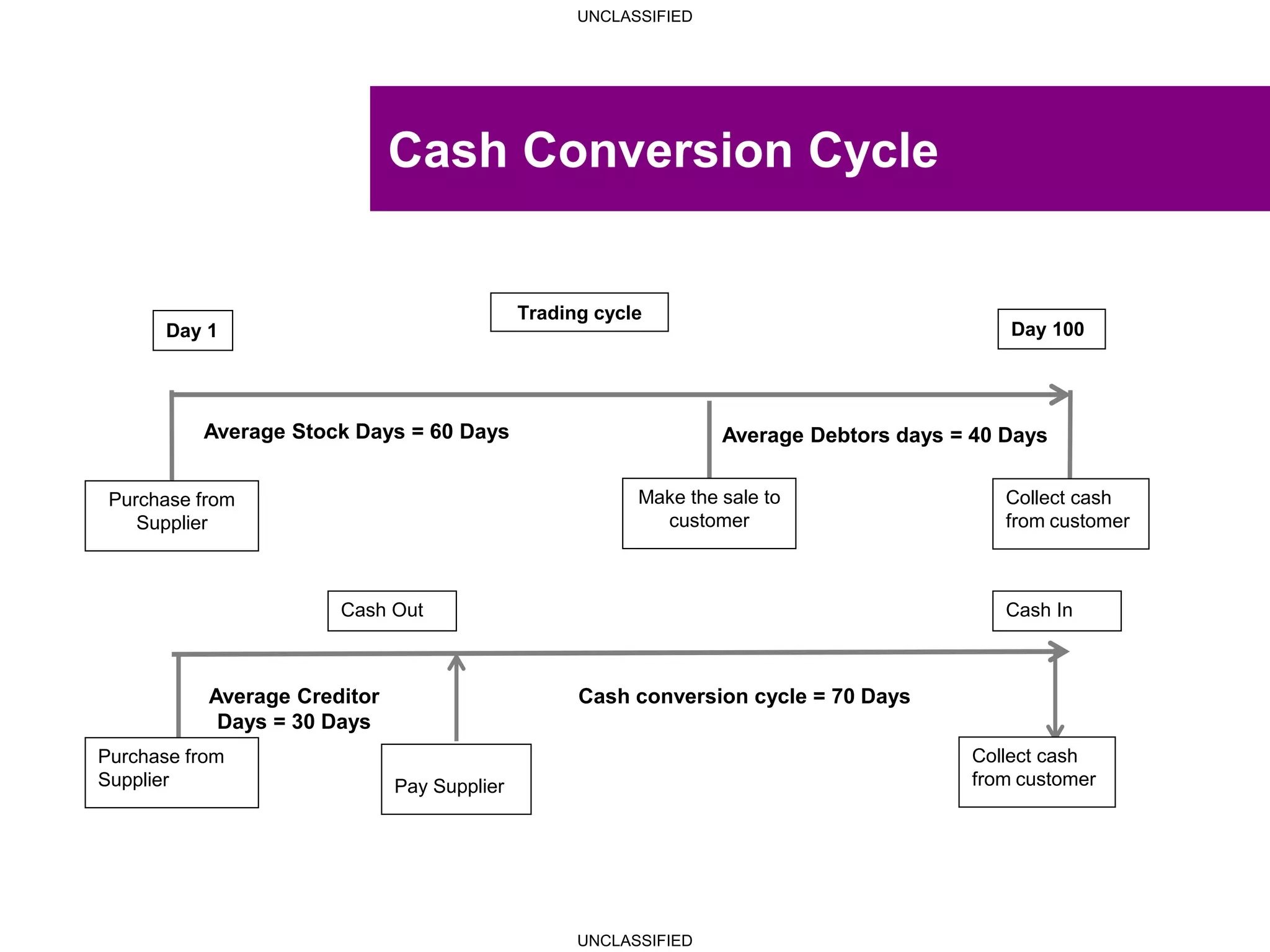

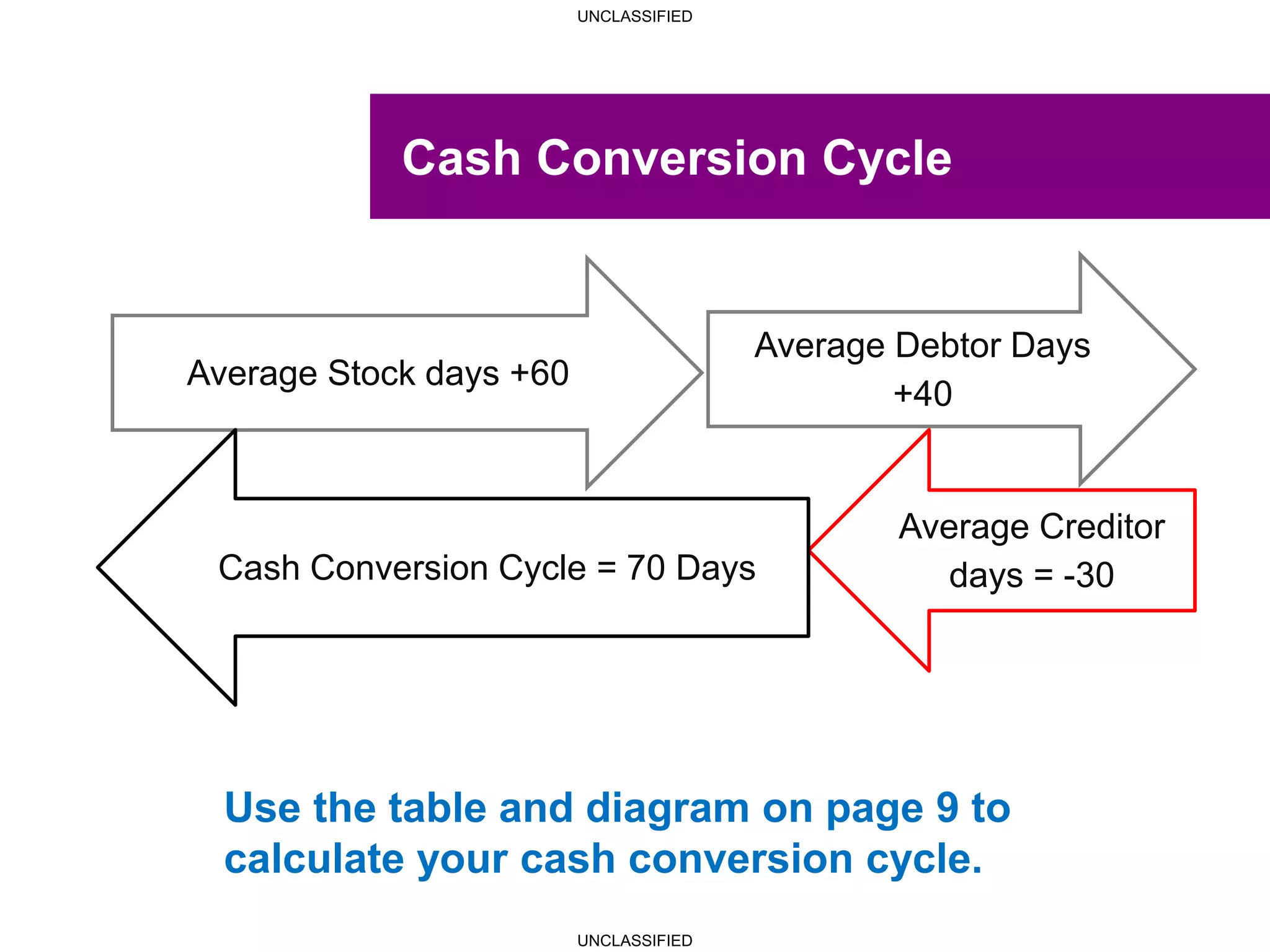

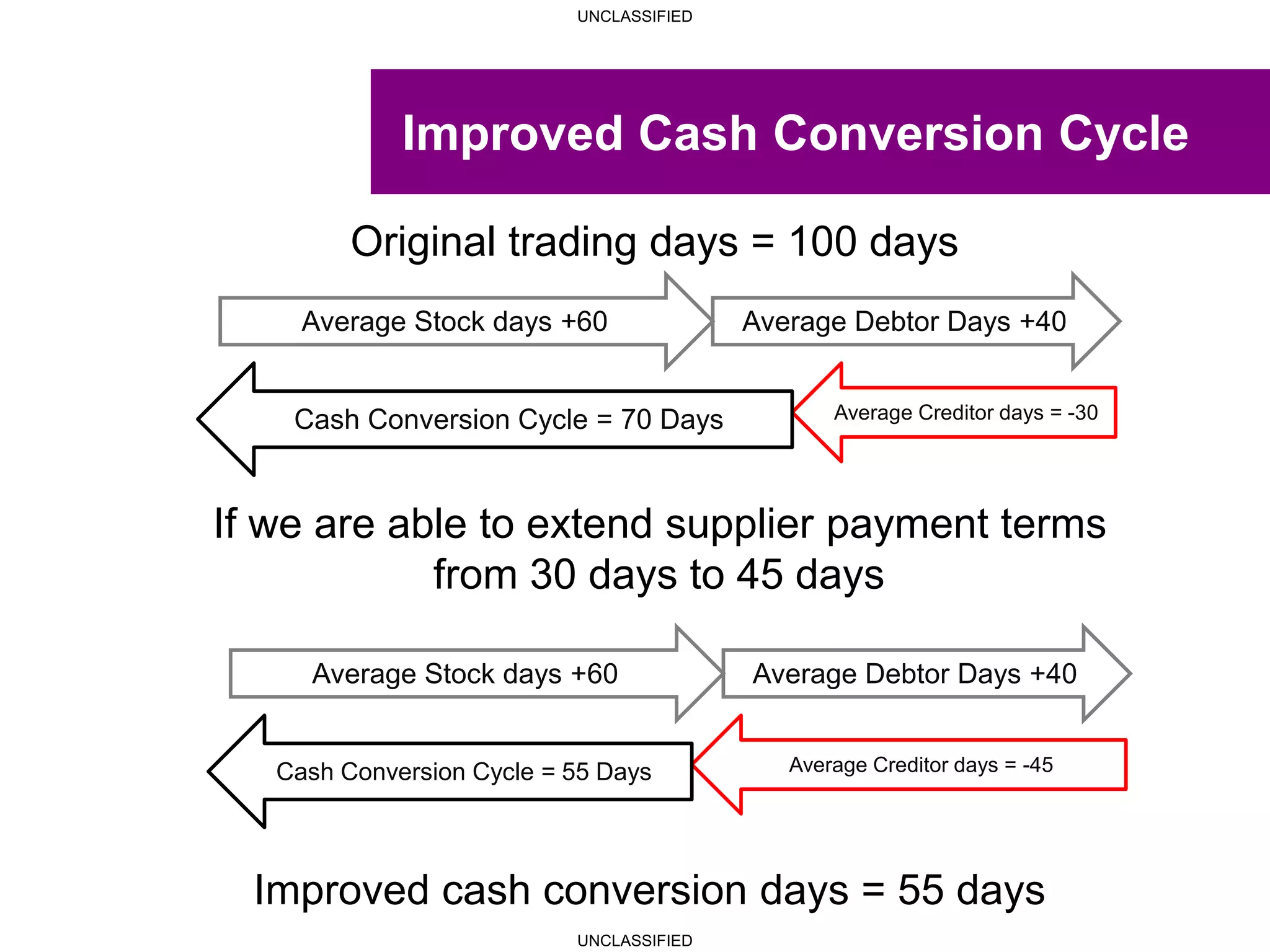

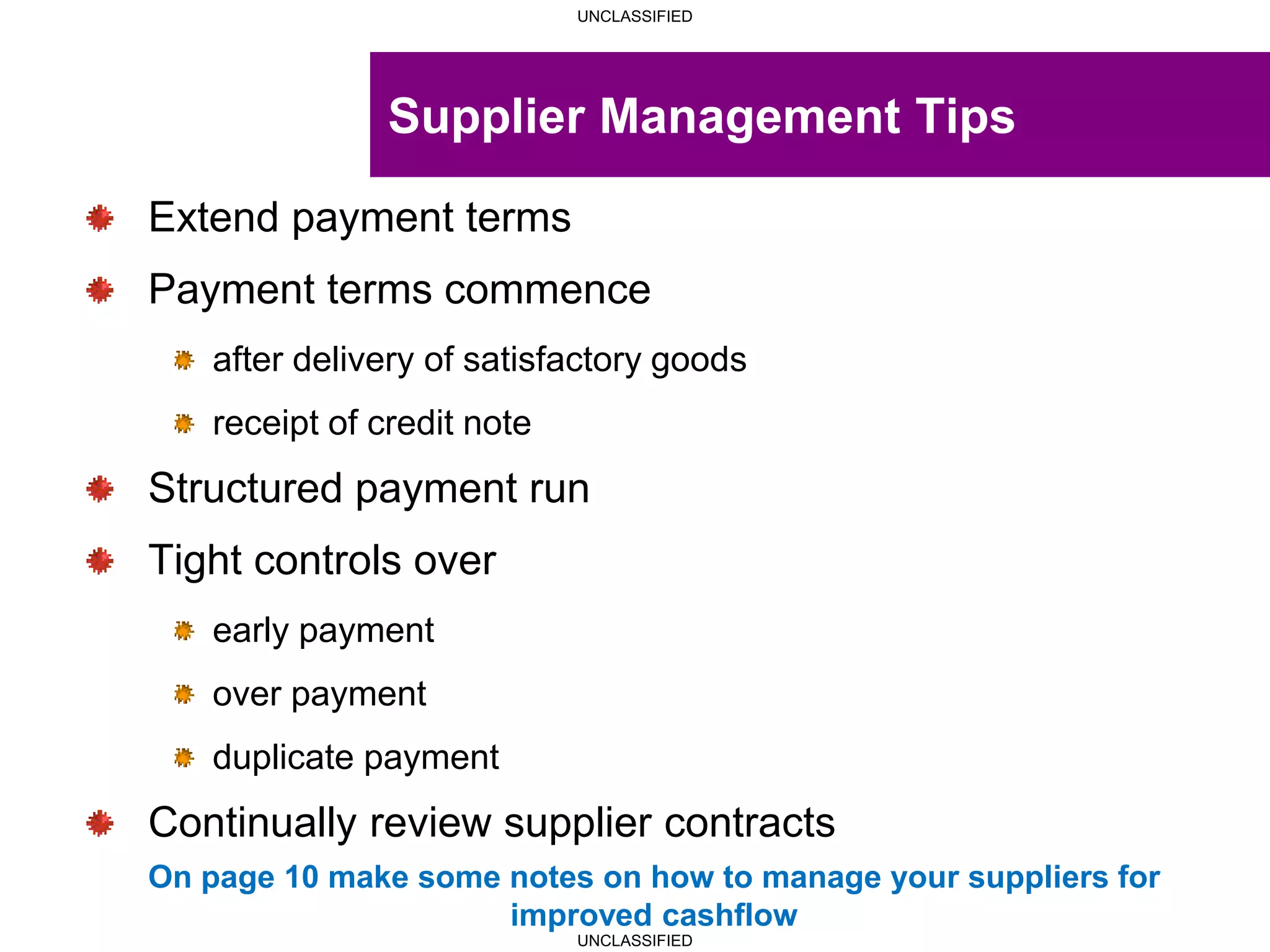

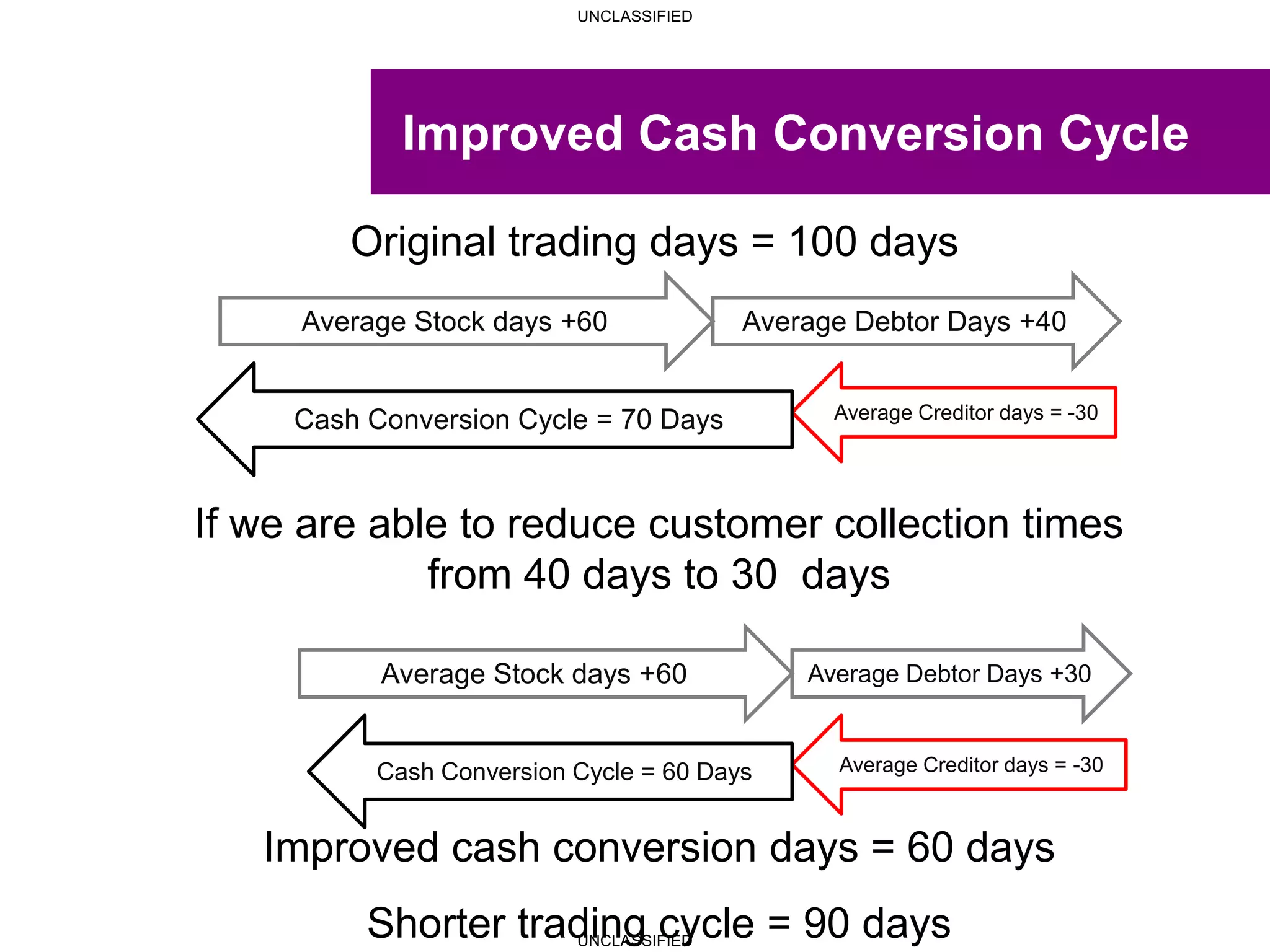

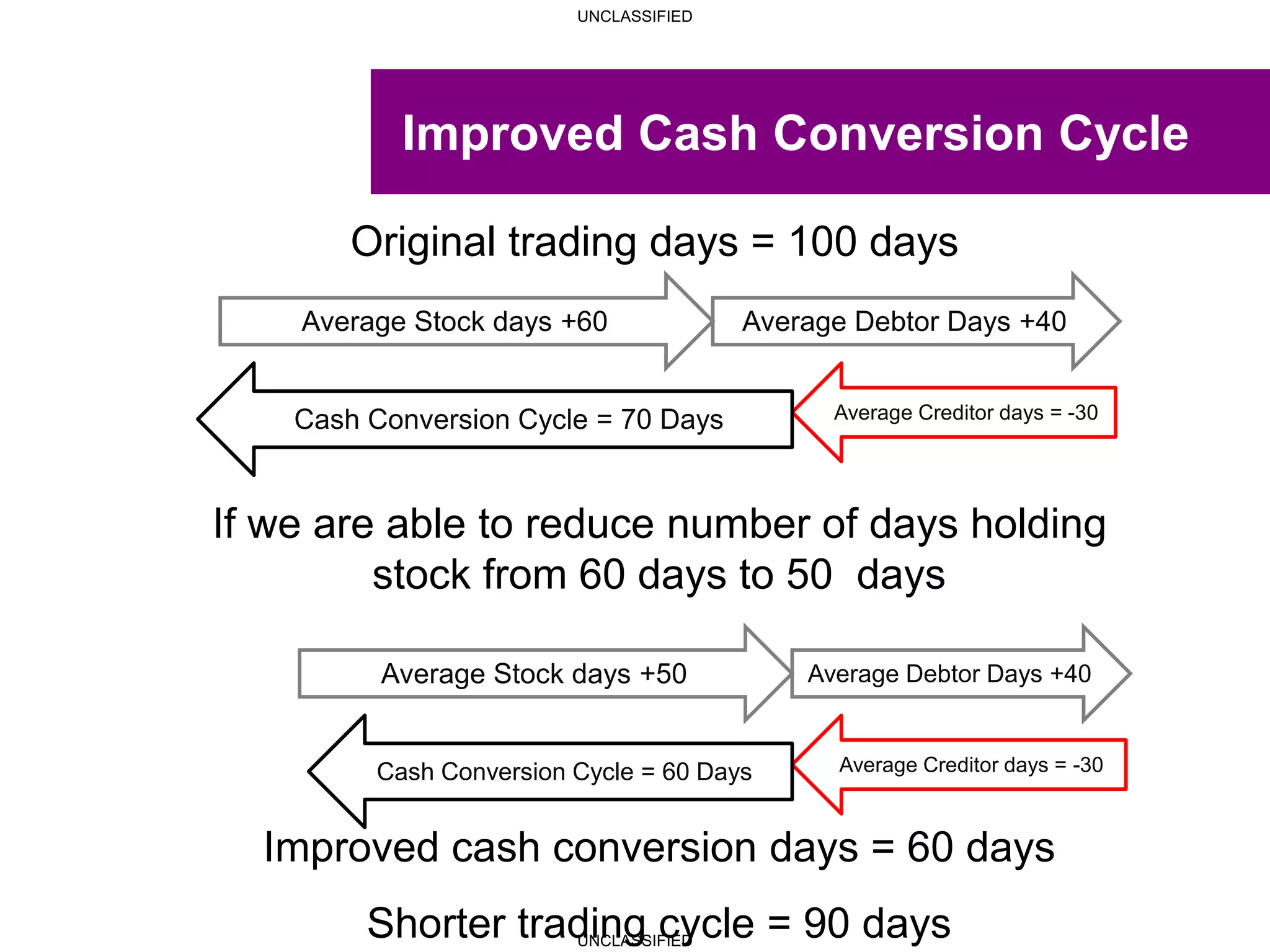

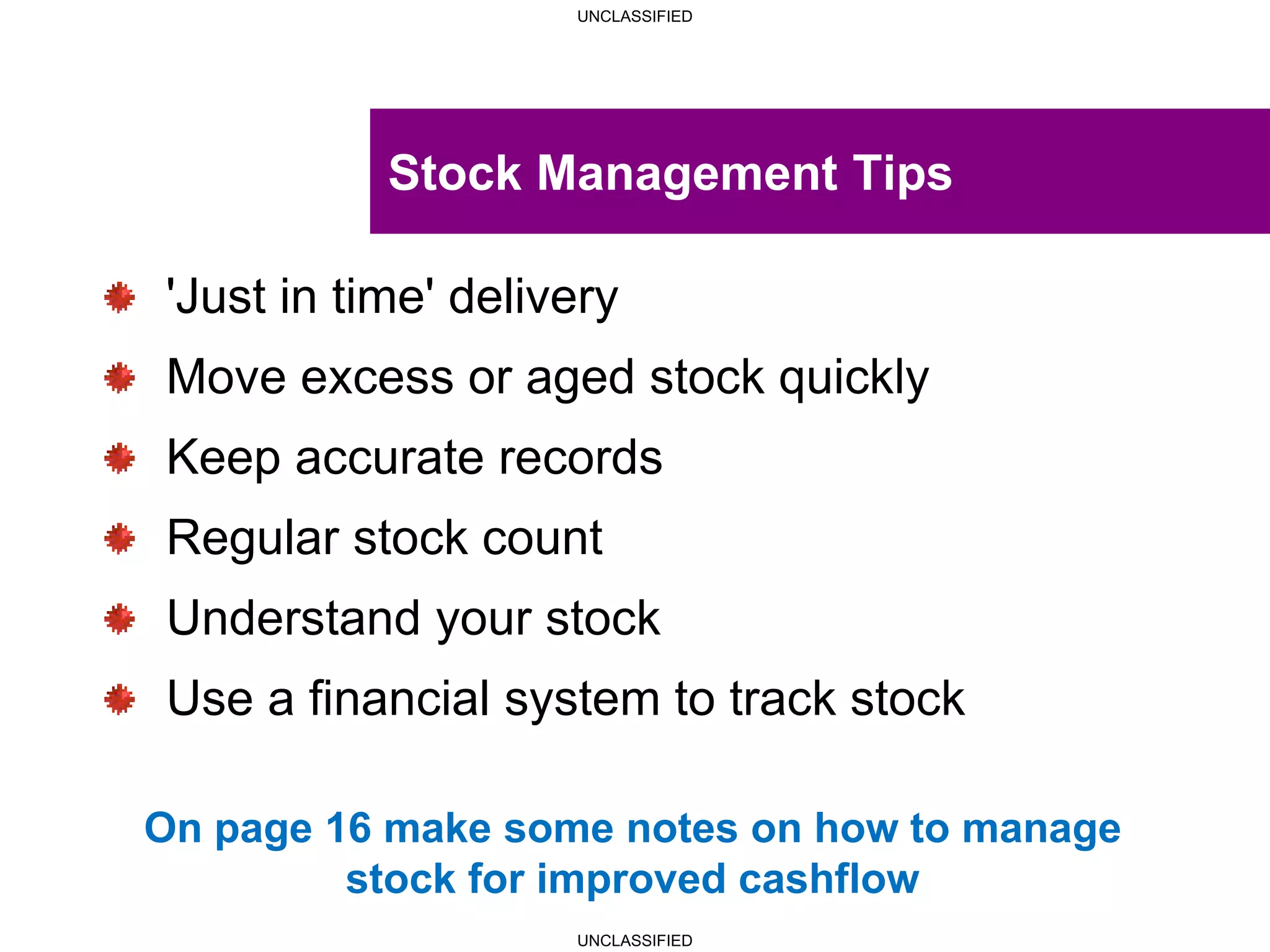

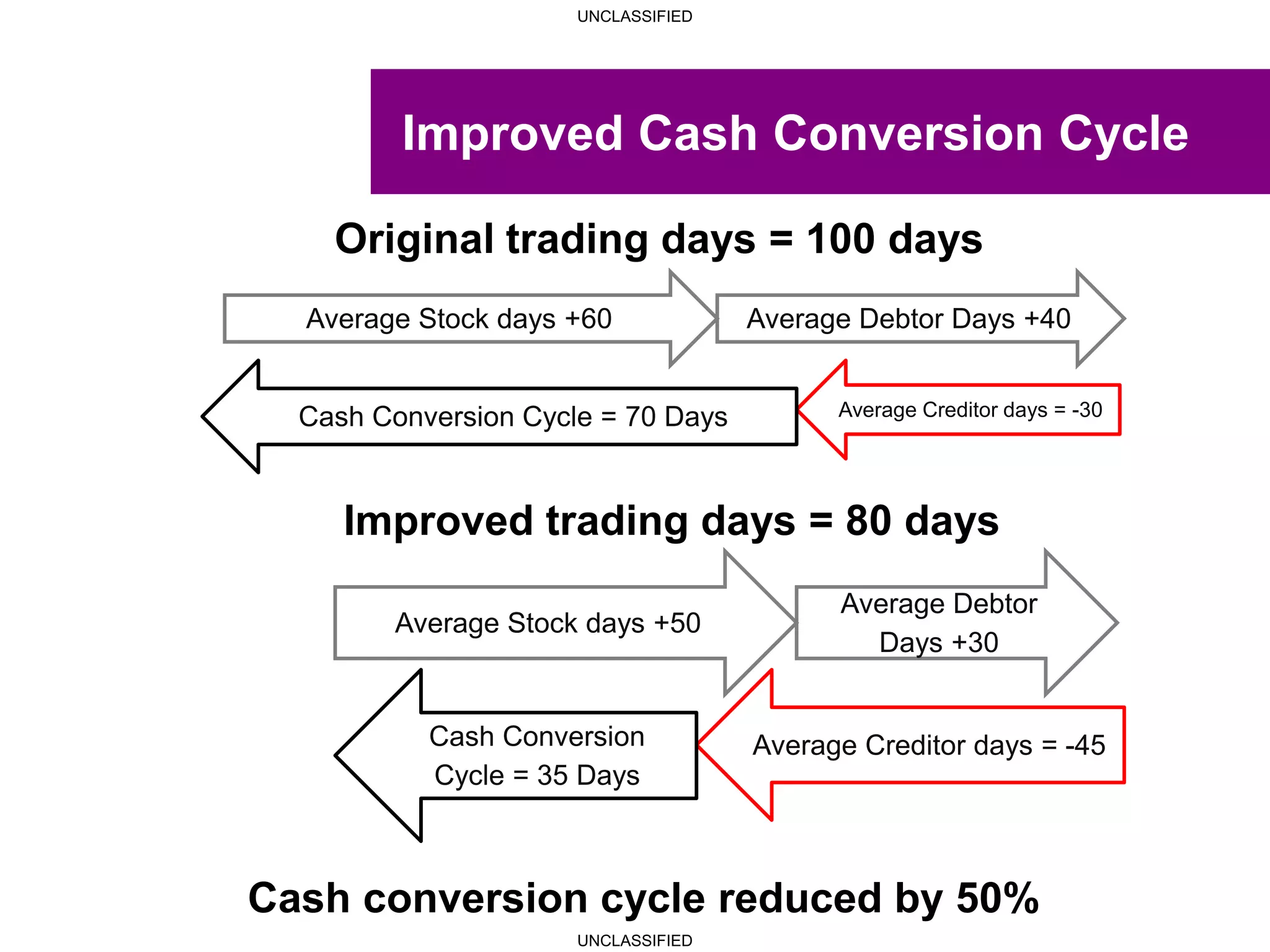

The seminar focuses on improving cash flow management for businesses, emphasizing the distinction between profit and cash, and the significance of the cash conversion cycle. Participants will learn about effective supplier and debtor management, stock control, and marketing strategies to enhance cash flow. Key takeaways include actionable tips for optimizing cash flow and the importance of regular audits and mentoring.