Embed presentation

Download to read offline

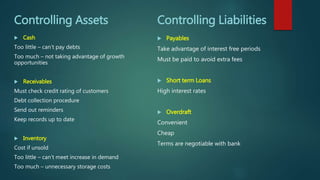

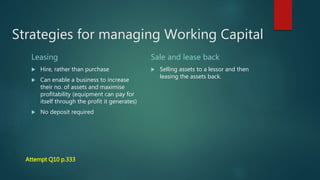

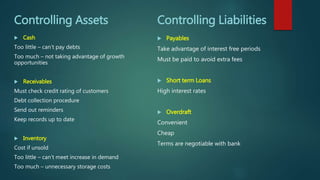

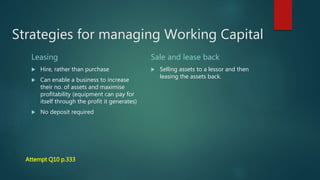

Working capital management involves maintaining liquidity by properly managing current assets and current liabilities. It requires determining the optimal mix of these items based on a typical target ratio of 2:1 for current assets to current liabilities. Effective working capital management strategies include controlling cash, receivables, and inventory levels; taking advantage of payment terms for payables and loans; and using leasing or sale-and-leaseback arrangements to acquire assets in a cost-effective manner.