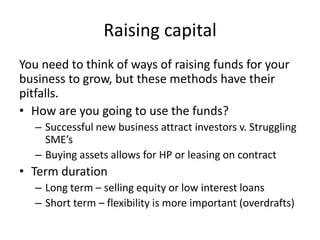

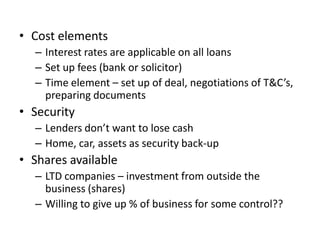

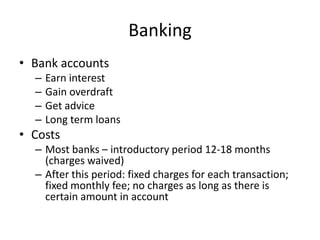

The document discusses various methods for raising capital for a business including equity financing through selling shares, loans, and lines of credit. It notes the costs, security requirements, and time involved in setting up different financing options. The document also discusses establishing bank accounts for businesses and provides tips for forecasting sales, budgets, profits, and cash flow to help with financial planning and management.