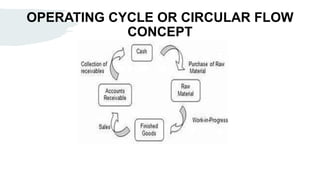

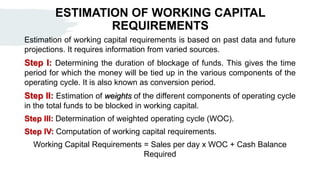

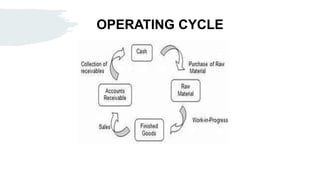

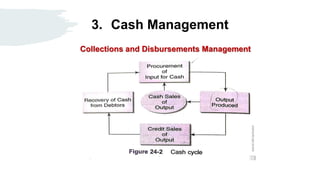

This document discusses working capital management. It defines working capital and net working capital. It explains the operating cycle concept where funds invested in current assets keep revolving and converting into cash. There are three approaches to working capital financing: matching, conservative, and aggressive. Estimating working capital requirements involves determining blockage periods, weights of operating cycle components, and the weighted operating cycle. Key aspects of working capital management are inventory management, receivables management, and cash management. Cash management aims to maximize available cash through efficient collections and disbursements.