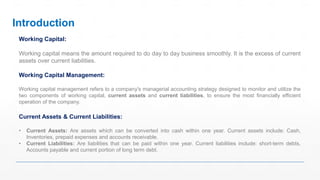

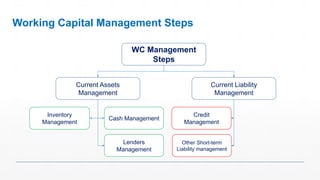

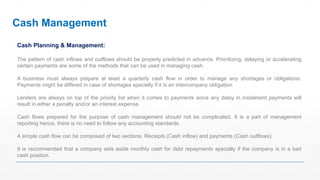

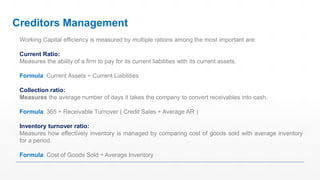

The document outlines the concept and importance of working capital management, emphasizing the management of current assets and liabilities to ensure liquidity, profitability, and business continuity. Key components discussed include cash management, collection management, inventory management, and creditors management, along with steps for efficient working capital management. Ultimately, effective management of working capital is vital for a firm's short-term solvency and ability to handle business emergencies.