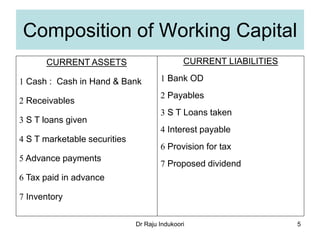

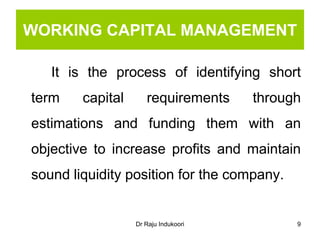

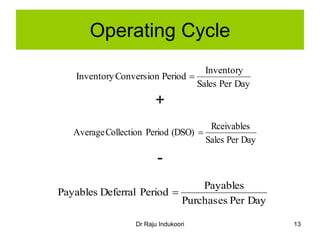

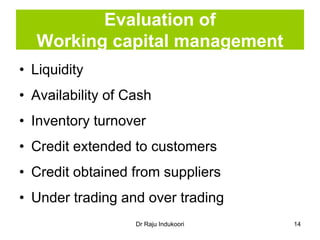

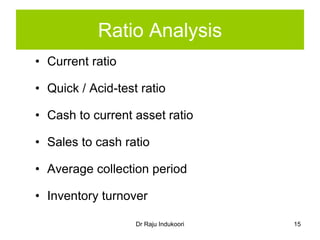

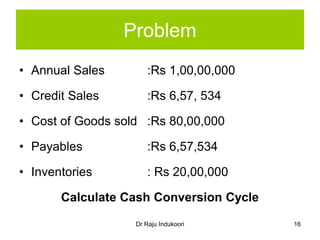

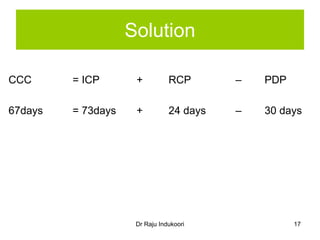

This document discusses working capital management. It defines working capital as the capital needed for day-to-day business operations, including current assets like inventory and cash. It notes that working capital management involves identifying short-term capital needs and funding sources to increase profits while maintaining liquidity. The document outlines various aspects of working capital management like inventory management, receivables management, and cash management. It also provides an example to calculate the cash conversion cycle using information about annual sales, credit sales, cost of goods sold, payables, and inventories.