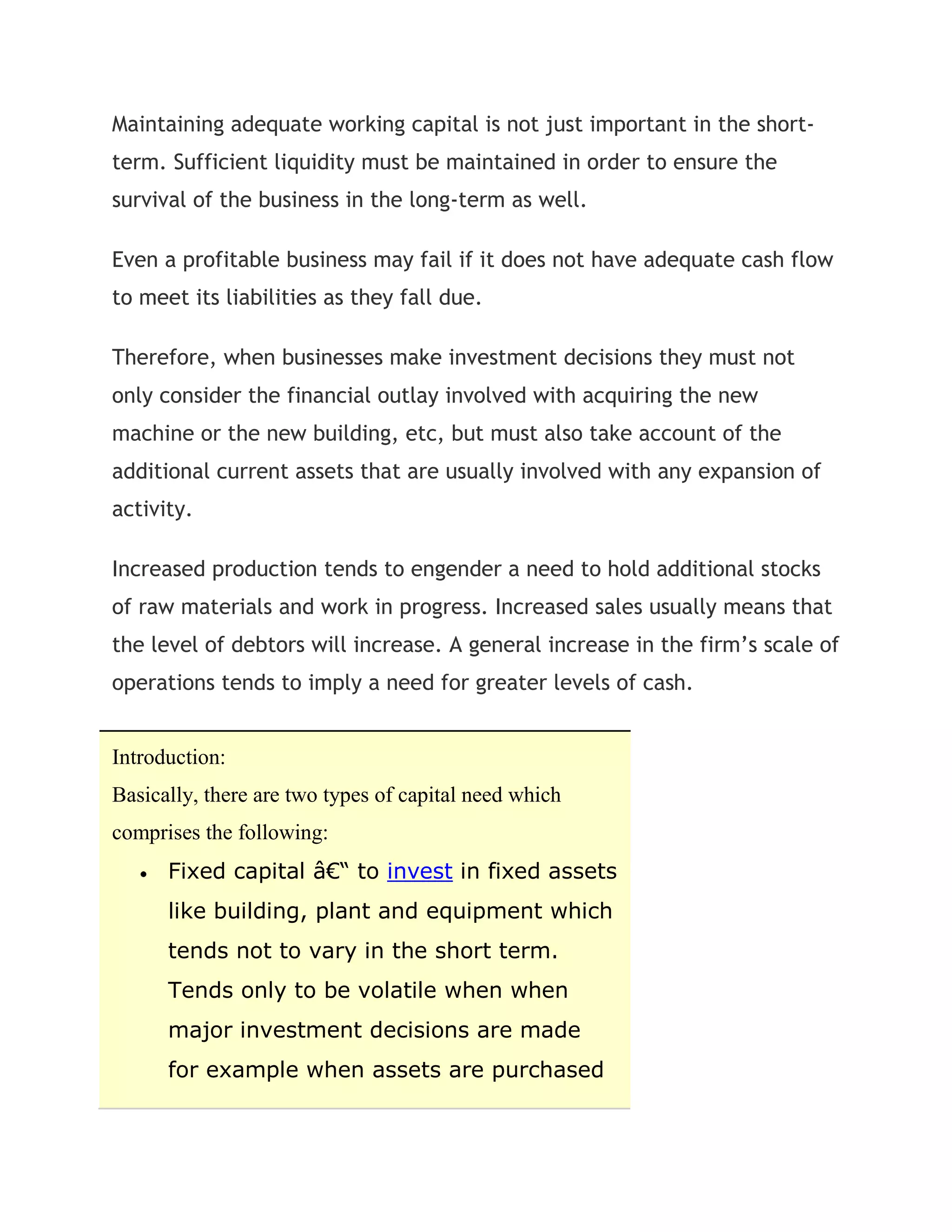

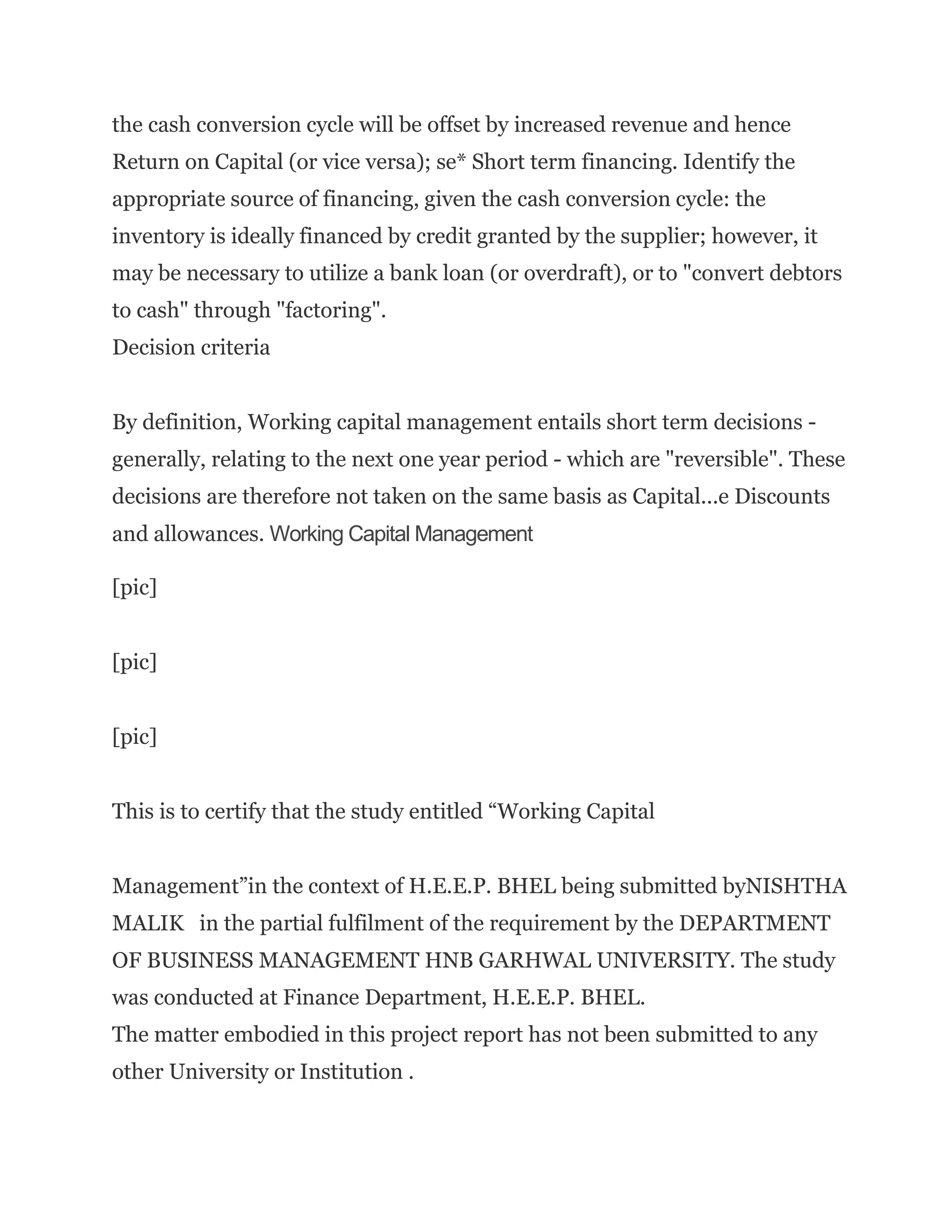

This document discusses the importance of working capital management for businesses. It defines working capital as current assets minus current liabilities. This includes items like inventory, accounts receivable, cash balances, accounts payable, accrued expenses, taxes payable and short term loans. Maintaining adequate working capital is important for businesses to ensure they have enough cash flow for daily operations and to pay upcoming bills. Poor working capital management can lead to overcapitalization or overtrading, which can threaten a business' survival. The document emphasizes the need to balance current assets and liabilities to minimize risk and maximize returns.

![working capital introduction<br />The importance of working capital<br />Definition of working capital<br />The net working capital of a business is its current assets less its current liabilities<br />Current Assets include:<br />- Stocks of raw materials- Work-in-progress- Finished goods- Trade debtors- Prepayments- Cash balances<br />Current Liabilities include:- Trade creditors- Accruals- Taxation payable- Dividends payable- Short term loans<br />Every business needs adequate liquid resources in order to maintain day-to-day cash flow. It needs enough cash to pay wages and salaries as they fall due and to pay creditors if it is to keep its workforce and ensure its supplies.<br />Maintaining adequate working capital is not just important in the short-term. Sufficient liquidity must be maintained in order to ensure the survival of the business in the long-term as well.<br />Even a profitable business may fail if it does not have adequate cash flow to meet its liabilities as they fall due.<br />Therefore, when businesses make investment decisions they must not only consider the financial outlay involved with acquiring the new machine or the new building, etc, but must also take account of the additional current assets that are usually involved with any expansion of activity.<br />Increased production tends to engender a need to hold additional stocks of raw materials and work in progress. Increased sales usually means that the level of debtors will increase. A general increase in the firm’s scale of operations tends to imply a need for greater levels of cash.<br />Introduction:Basically, there are two types of capital need which comprises the following:Fixed capital – to invest in fixed assets like building, plant and equipment which tends not to vary in the short term. Tends only to be volatile when when major investment decisions are made for example when assets are purchased or sold andWorking capital, on the other hand, is much more fluid and fluctuates with the level of business. The working capital cycle links directly with the cash operating cycle. Comprises short term net assets: stock, debtors, and cash, less creditors.Working Capital Management:Is the management of all aspects of both current assets and current liabilities, so as to minimize the risk of insolvency while maximizing return on assets.The primary objective of working capital management is to ensure that sufficient cash is available to:meet day-to-day cash flow needs;pay wages and salaries when they fall due;pay creditors to ensure continued supplies of goods and services;pay government taxation and providers of capital – dividends; andensure the long term survival of the business entity.It is critical to understand that Profit is not Cash. A company can be very profitable but it can collapse simply because it has insufficient cash/liquidity to pay its relevant bill (as stated above).Always remember that any company’s liabilities are settledwith cash and not by profit.Importance in Optimizing Working Capital Management:Poor working capital management can lead to:over-capitalisation; andovertradingCharacteristics of over-capitalisation are excessive stocks, debtors, and cash, low return on investment with long term funds tied up in non-earning short term assets.Overtrading leads to escalating debtors and creditors, and if unchecked, ultimately to cash starvation.<br />Project On Working Capital Management \ Working capital management :It involves managing the relationship between a firm's short-term assets and its short-term liabilities. The goal of Working capital management is to ensure that the firm is able to continue its operations and that it has sufficient cash flow to satisfy both maturing short-term debt and upcoming operational expenses.Management of working capitalGuided by the above criteria, management will use a combination of policies and techniques for the management of working capital. These policies aim at managing the current assets (generally cash and cash equivalents, inventories and debtors) and the short term financing, such that cash flows and returns are acceptable.* Cash management. Identify the cash balance which allows for the business to meet day to day expenses, but reduces cash holding costs.* Inventory management. Identify the level of inventory which allows for uninterrupted production but reduces the investment in raw materials - and minimizes reordering costs - and hence increases cash flow; see Supply chain management; Just In Time (JIT); Economic order quantity (EOQ); Economic production quantity (EPQ).* Debtors management. Identify the appropriate credit policy, i.e. credit terms which will attract customers, such that any impact on cash flows and the cash conversion cycle will be offset by increased revenue and hence Return on Capital (or vice versa); se* Short term financing. Identify the appropriate source of financing, given the cash conversion cycle: the inventory is ideally financed by credit granted by the supplier; however, it may be necessary to utilize a bank loan (or overdraft), or to \"

convert debtors to cash\"

through \"

factoring\"

.Decision criteriaBy definition, Working capital management entails short term decisions - generally, relating to the next one year period - which are \"

reversible\"

. These decisions are therefore not taken on the same basis as Capital...e Discounts and allowances. Working Capital Management<br />[pic][pic][pic]This is to certify that the study entitled “Working CapitalManagement”in the context of H.E.E.P. BHEL being submitted byNISHTHA MALIK in the partial fulfilment of the requirement by the DEPARTMENT OF BUSINESS MANAGEMENT HNB GARHWAL UNIVERSITY. The study was conducted at Finance Department, H.E.E.P. BHEL.The matter embodied in this project report has not been submitted to any other University or Institution .Mr. SUSHIL ARYA SR.ACCOUNTS OFFICPAYROLL SECTION (FINANCE)ACKNOWLEDGEMENT I express my sincere thanks to the Management of ‘HEEP(Heavy Electrical Equipment Plant) of BHEL, Ranipur, Haridwar Unit for giving me an opportunity togain exposure on matter related to Project under the esteem guidance of Mr. SUSHIL ARYA(Sr.Accounts Payroll section) I hereby take this opportunity to put on records my sincere thanks to Shri SUSHIL ARYA under the light of whose able guidance I could complete this project in an effective and successful manner. I am also indebted to MR.VIVEK GOYAL(Sr.Accounts officer Books&budget), Mr.INDER KUMAR(Sr.A/O),Mr.SUJIT KUMAR(Sr.A/O) ,Smt Usha Verma (Accounts officer) for their valuable information’s and inputs, which added dimensions and meaning to my project. I am also thankful to the rest of the staff of the SALES section for their valuable suggestion and coperation to achive the task.With sincere thanksSAKSHI MEHROTRAH.N.B GARHWAL UNIVERSITYSRINAGAR[pic] ➢ BHEL AN OVERVIEW ➢ WORKING CAPITAL MANAGEMENT 1. MEANING 2. NEED 3. OBJECTIVE 4. WORKING CAPITAL MANAGEMENT IN BHEL ➢ MANAGEMENT OF DIFFERENT COMPONENTS OF WORKING CAPITAL 1. DEBTOR MANAGEMENT 2. INVENTORY MANAGEMENT 3. CASH MANAGEMENT<br />](https://image.slidesharecdn.com/workingcapitalintroduction-100310102521-phpapp01/75/Working-Capital-Introduction-1-2048.jpg)