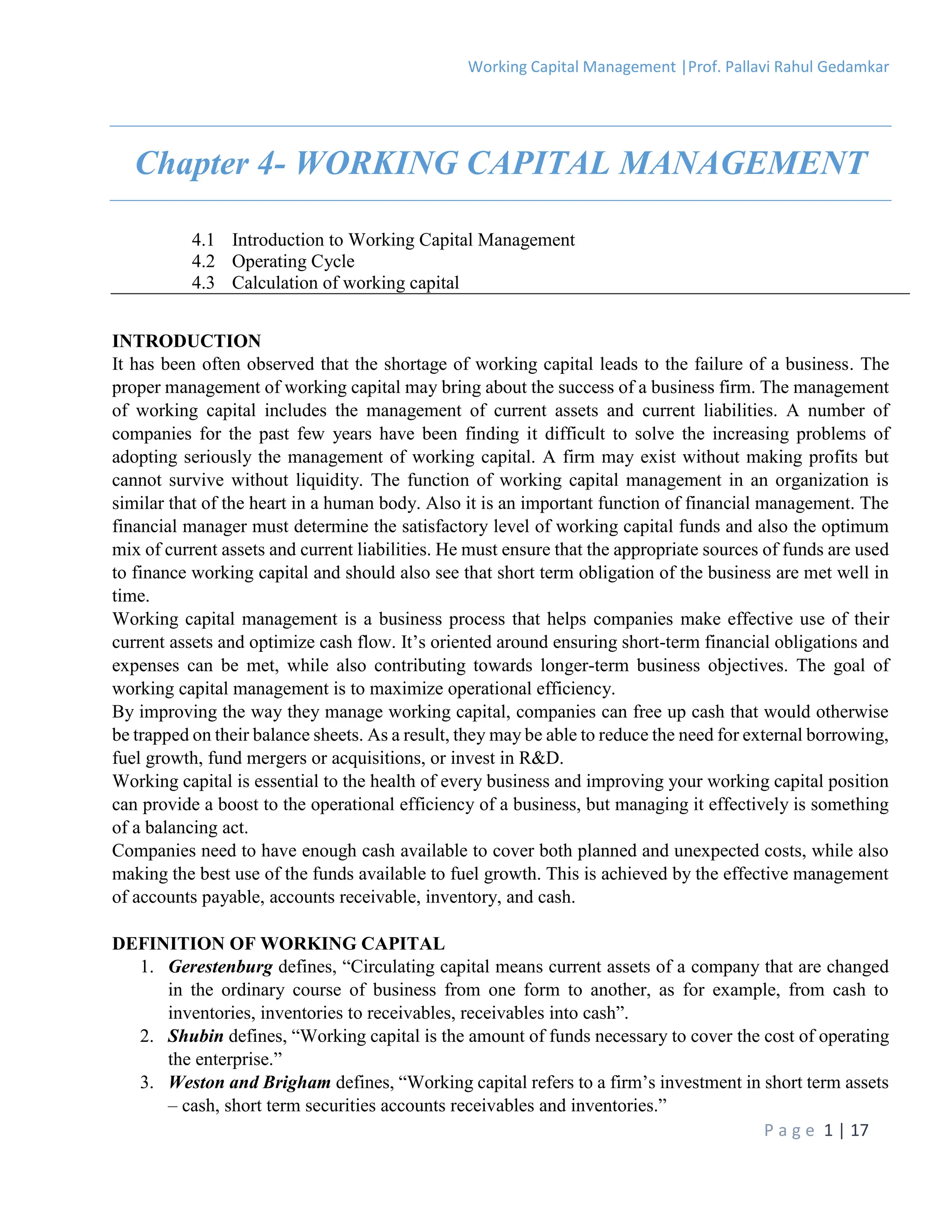

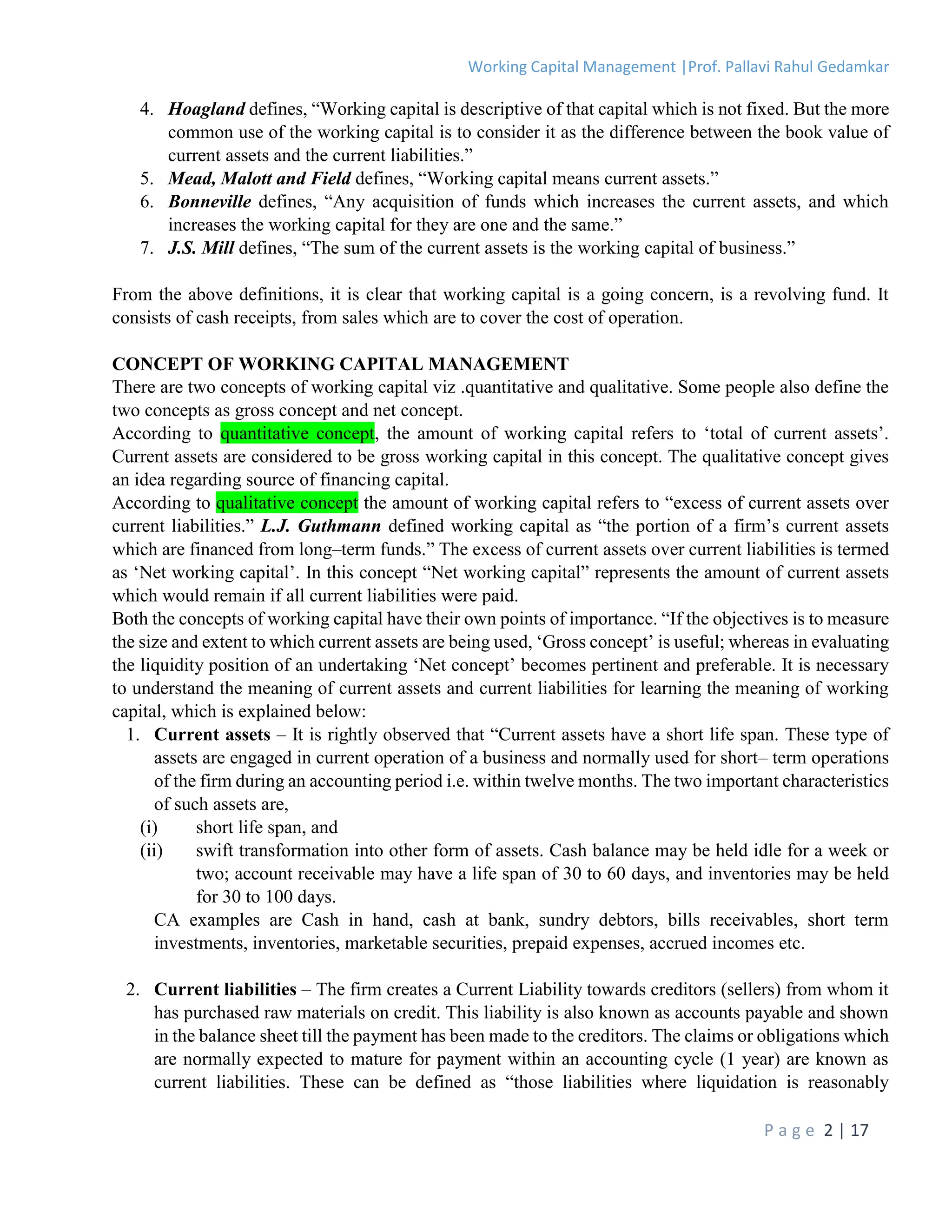

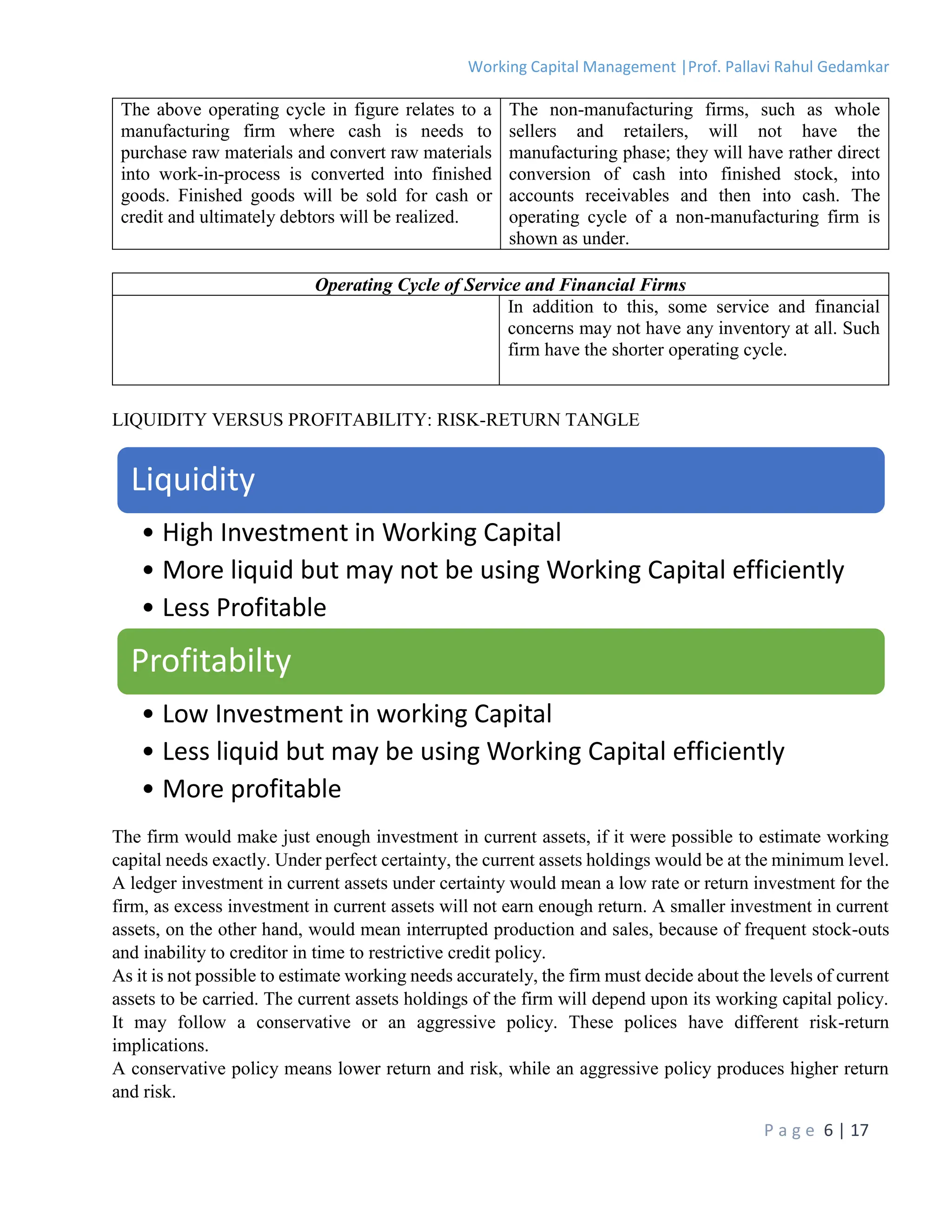

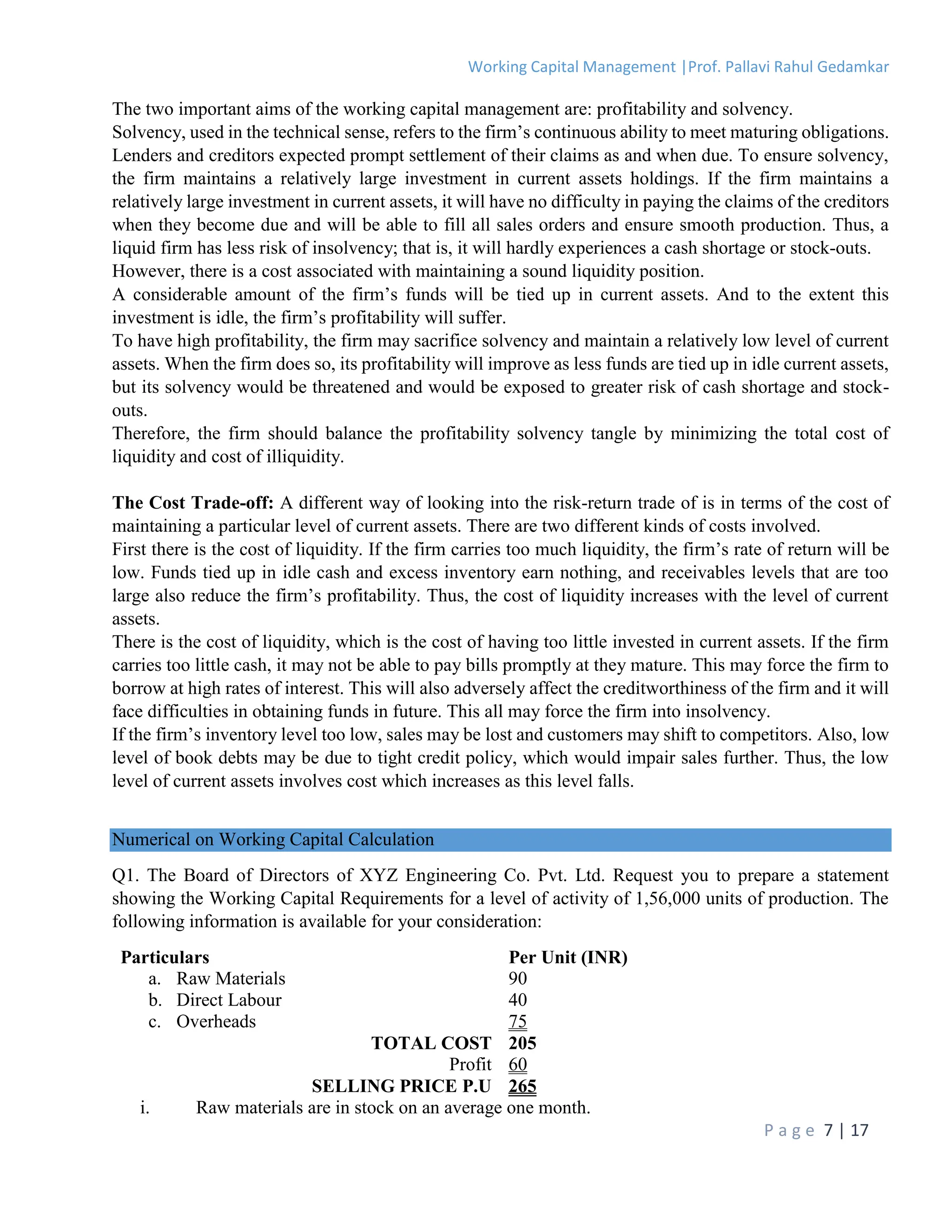

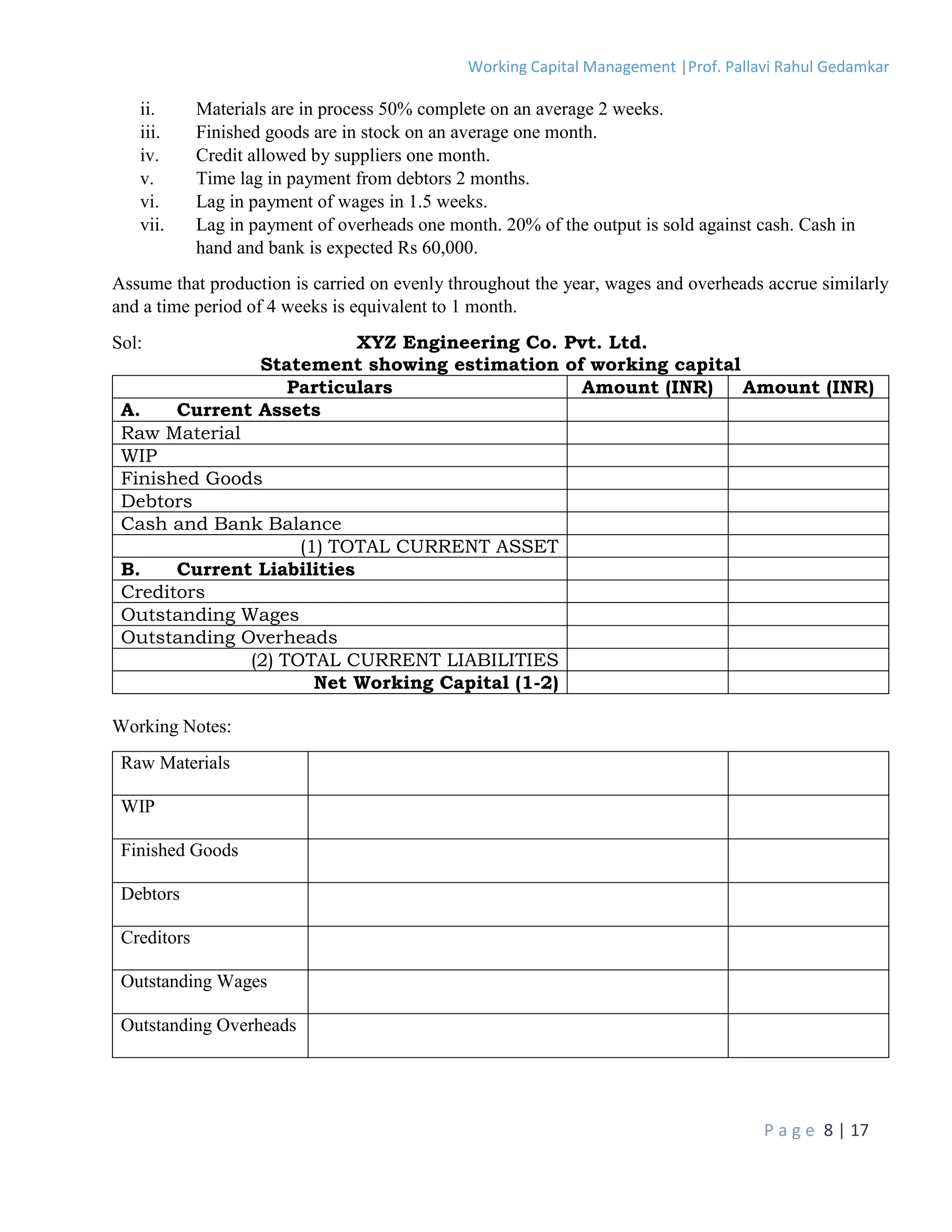

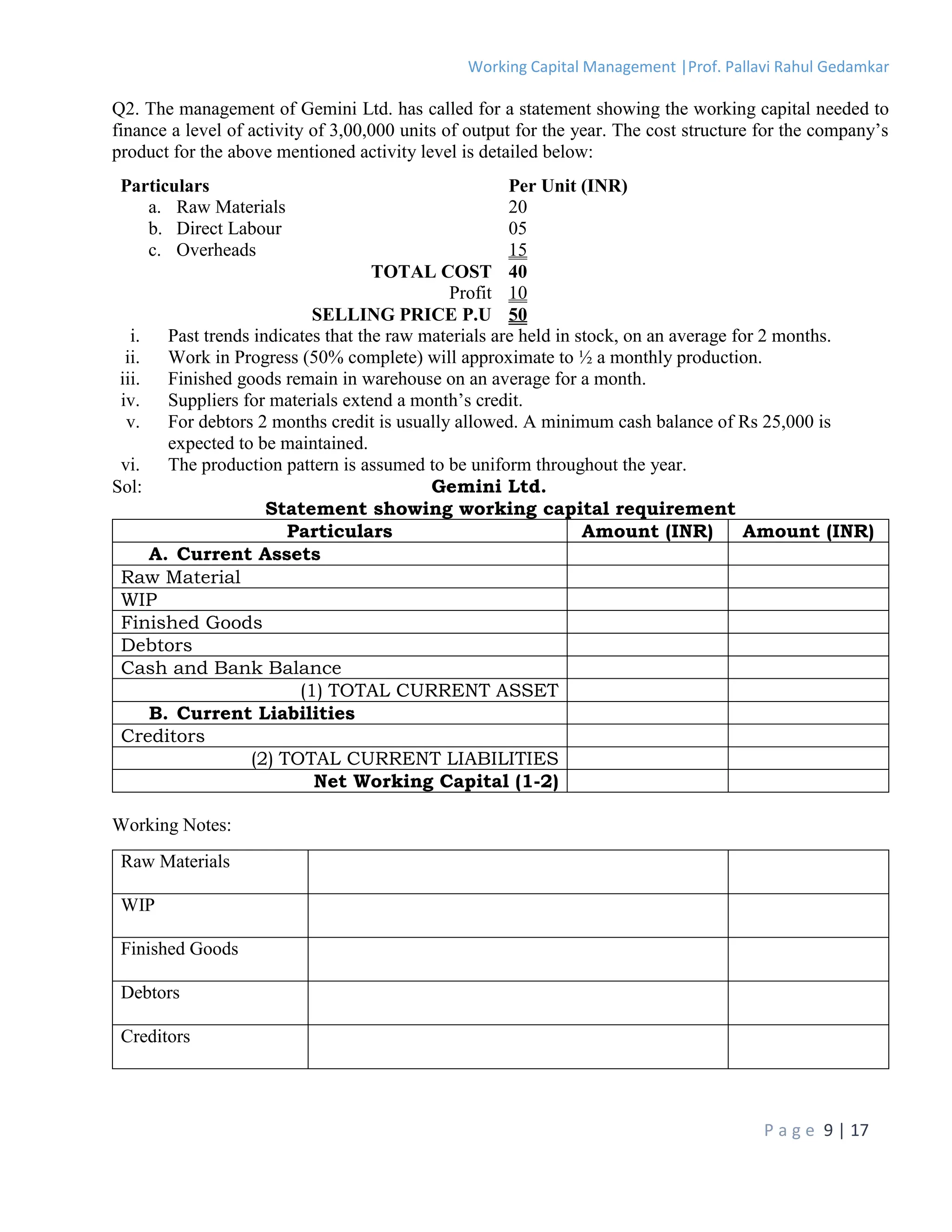

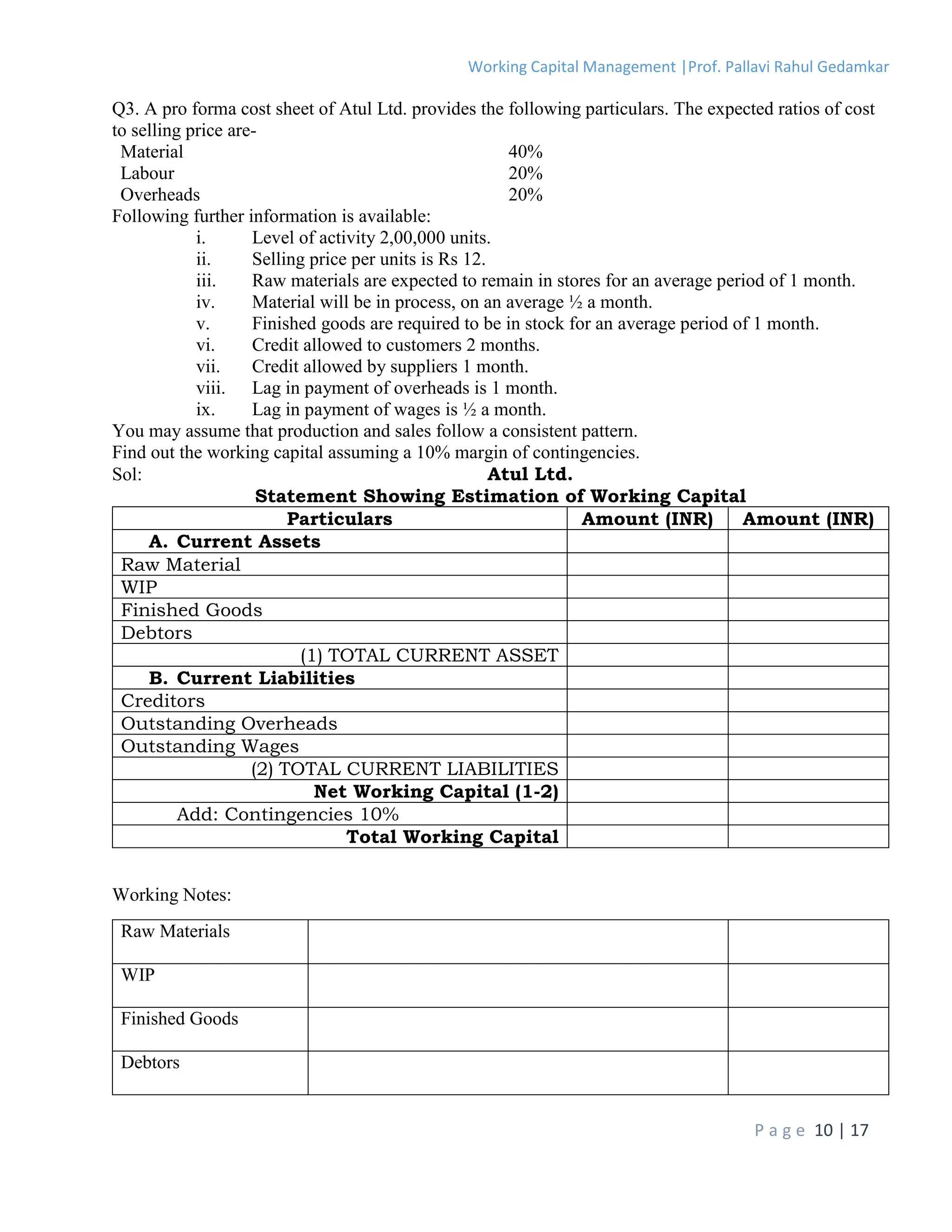

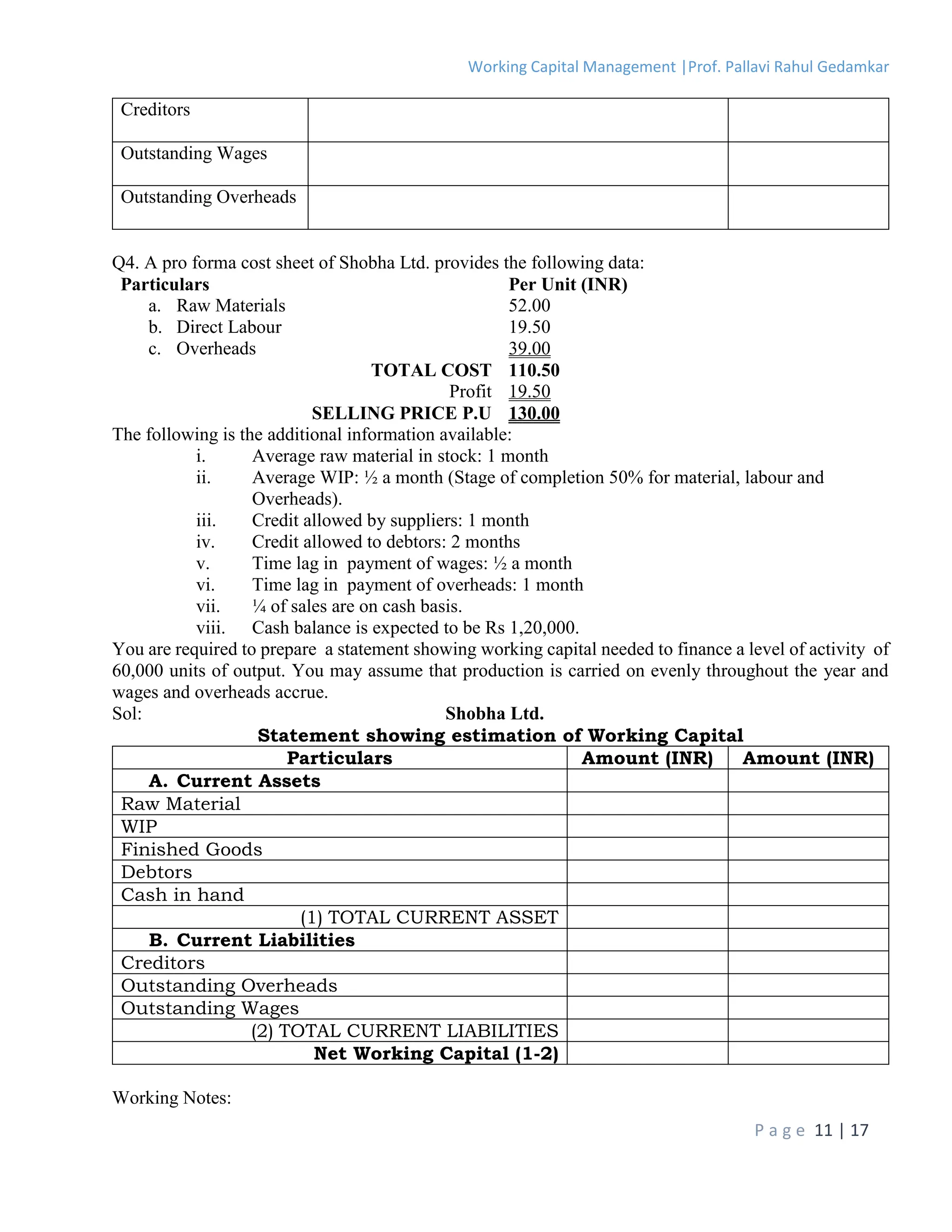

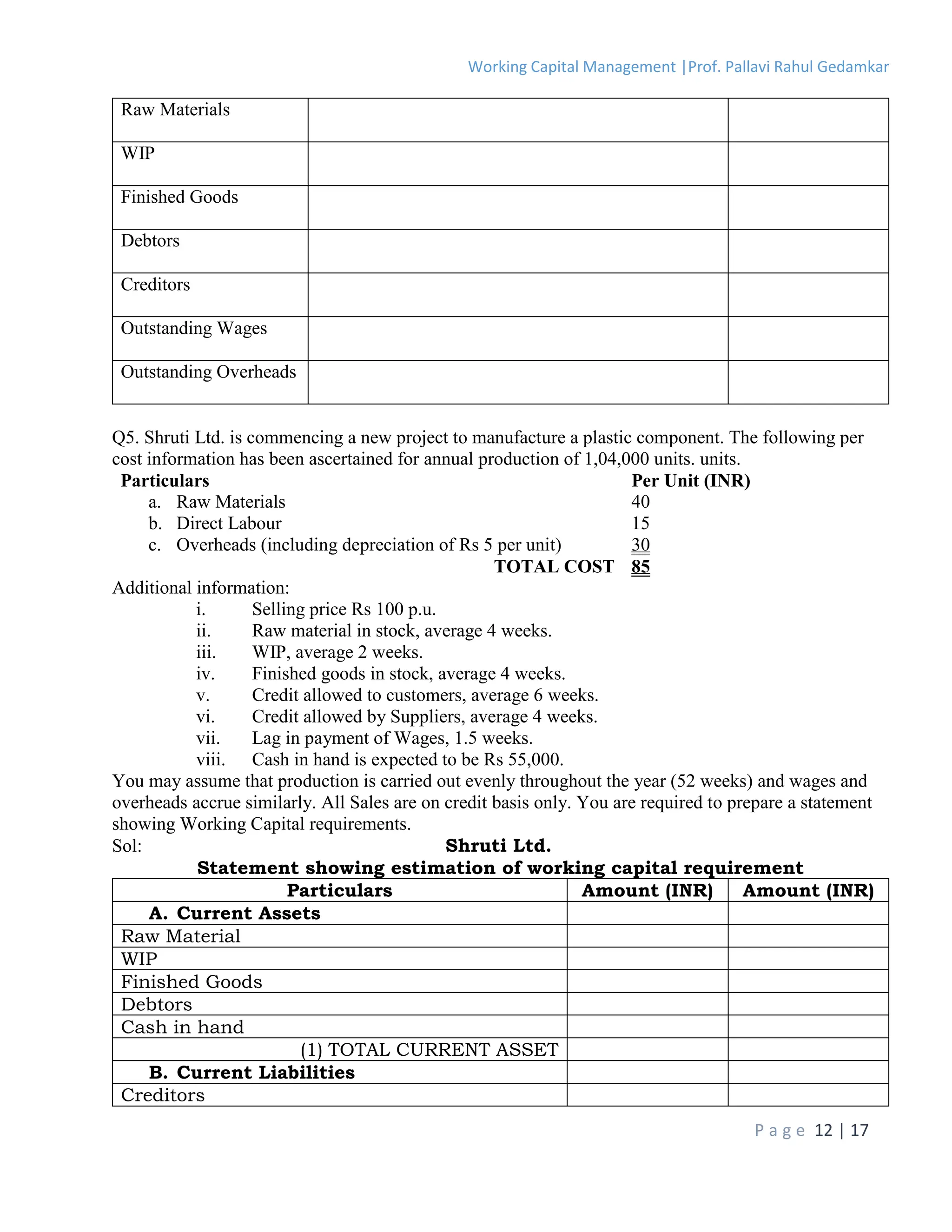

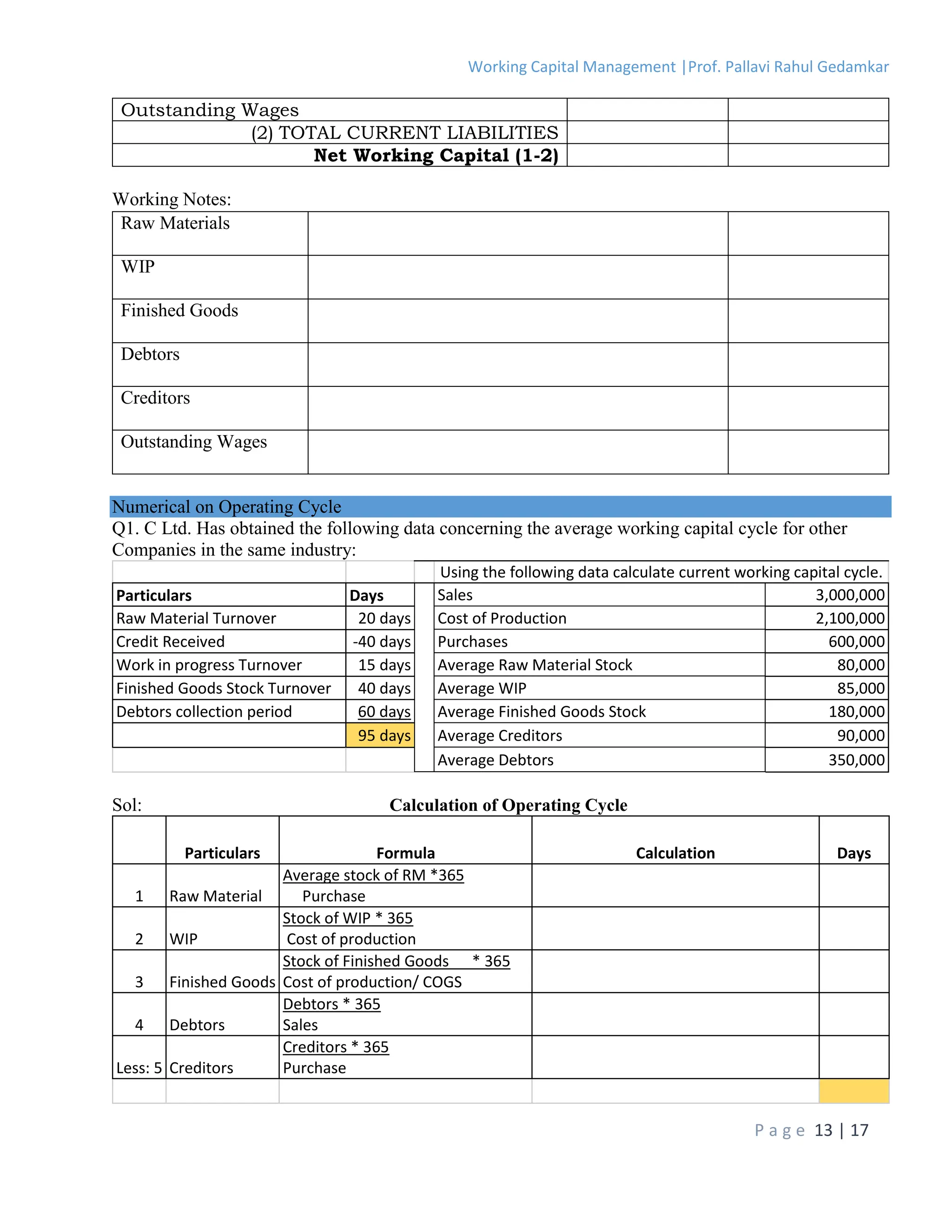

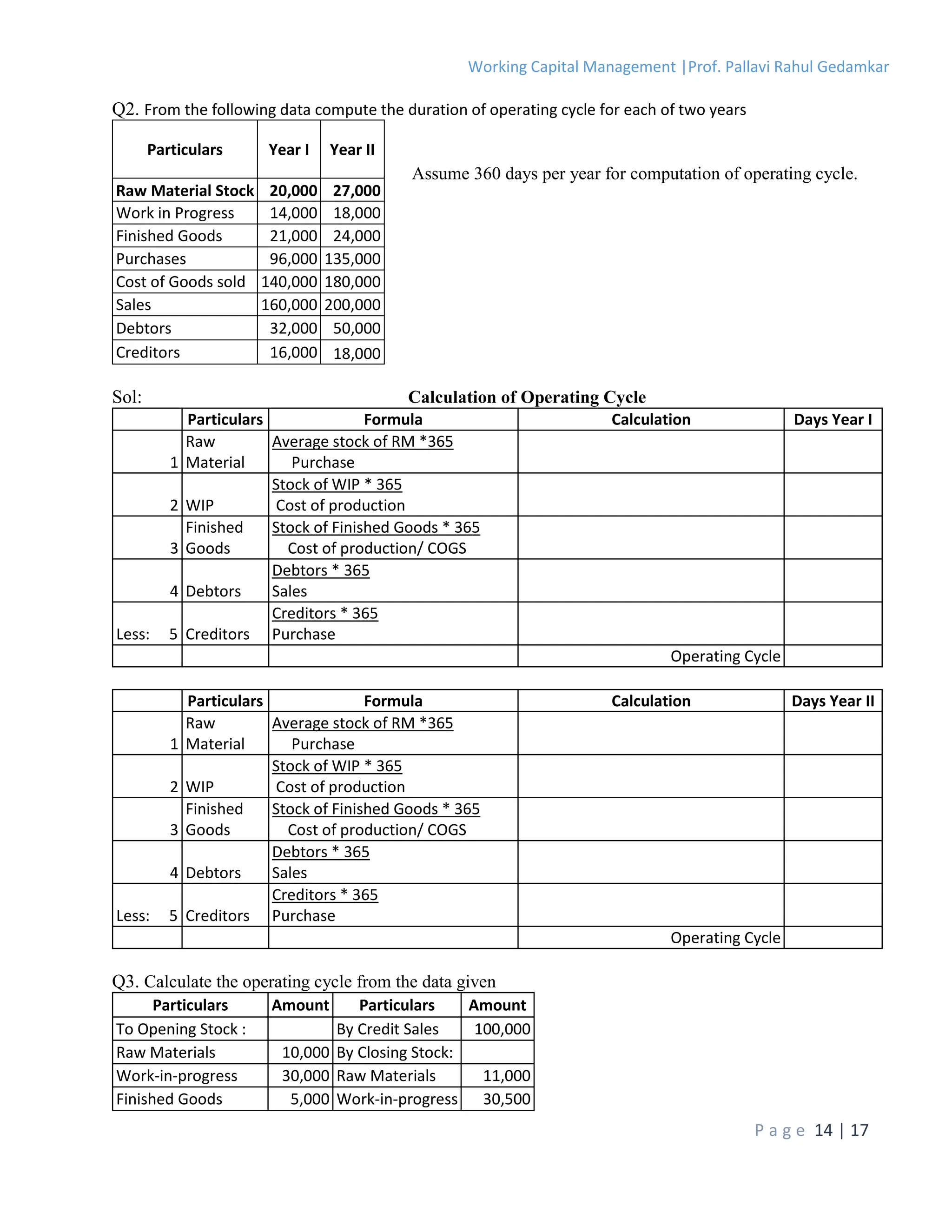

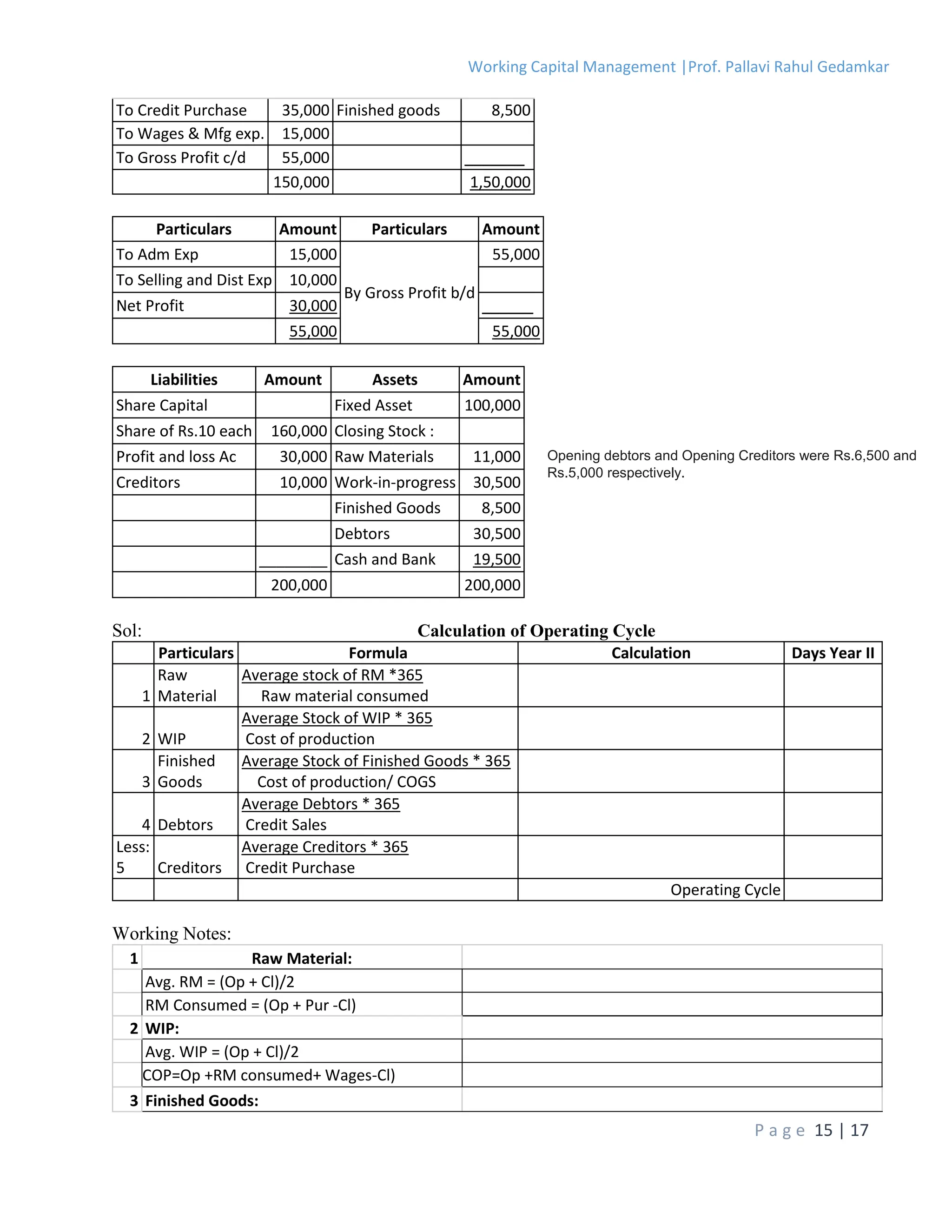

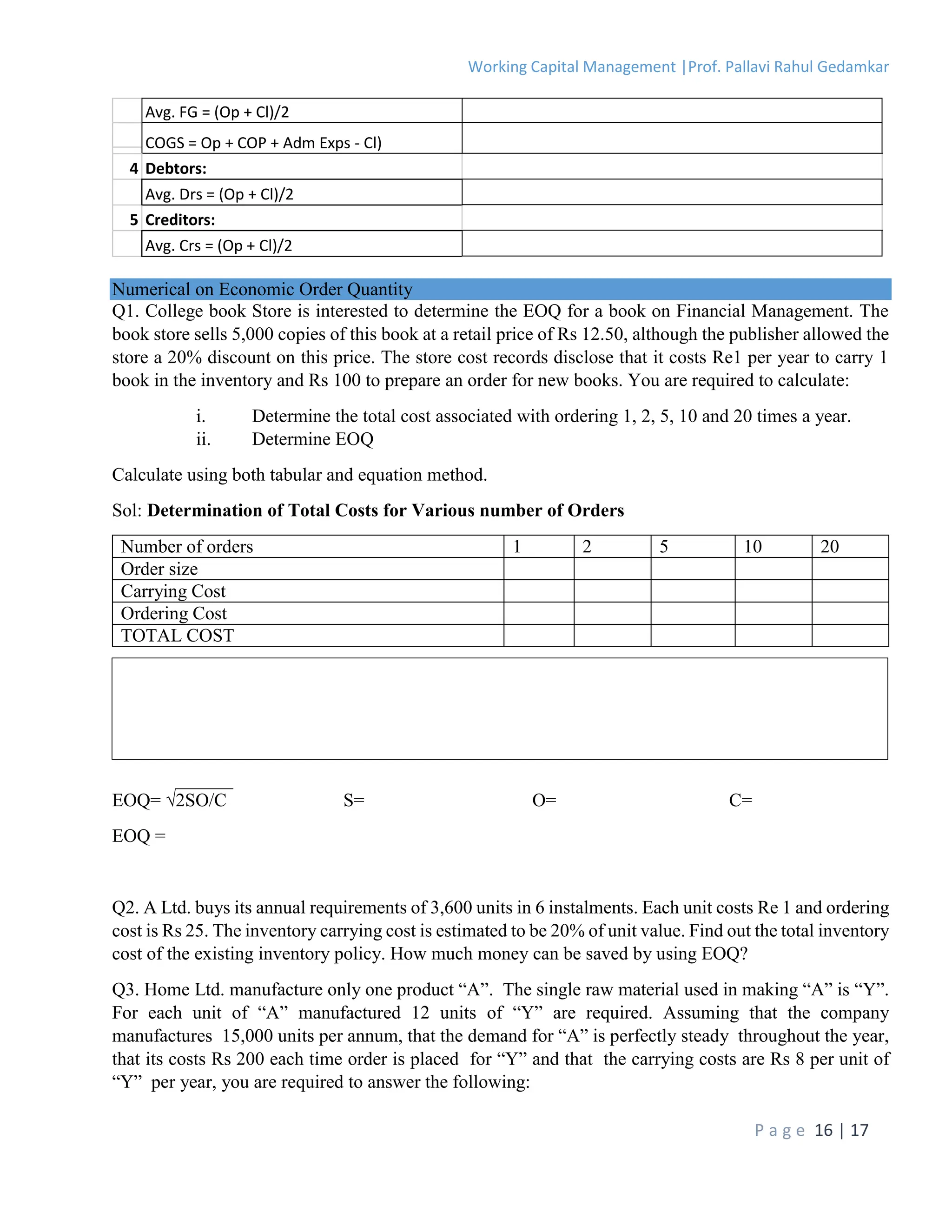

The document outlines the critical aspects of working capital management, emphasizing its role in ensuring liquidity and operational efficiency for businesses. It defines working capital and discusses its significance, types, and the importance of balancing profitability and solvency while managing current assets and liabilities. Key factors influencing working capital requirements, such as the operating cycle, nature of business, and financial management policies, are also examined.