This document discusses arbitrage, nominal effective exchange rates (NEER), and real effective exchange rates (REER). It provides the following key points:

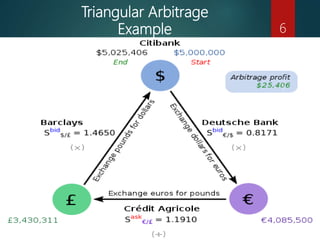

1) Arbitrage involves buying the same asset in different markets simultaneously to profit from price discrepancies. Triangular arbitrage exploits exchange rate discrepancies across currency pairs.

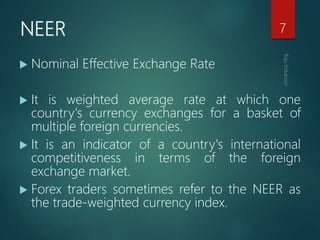

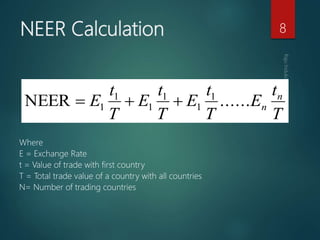

2) NEER is a weighted average exchange rate that indicates a country's international competitiveness. It incorporates exchange rates against a basket of currencies weighted by trade volumes.

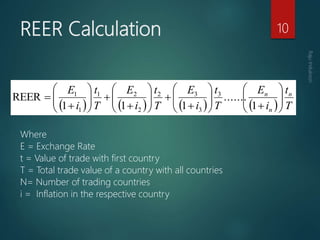

3) REER adjusts the NEER for inflation differences between countries to reflect exchange rate changes in real terms. When exchange rates are fixed, there is no difference between NEER and REER since other economic factors