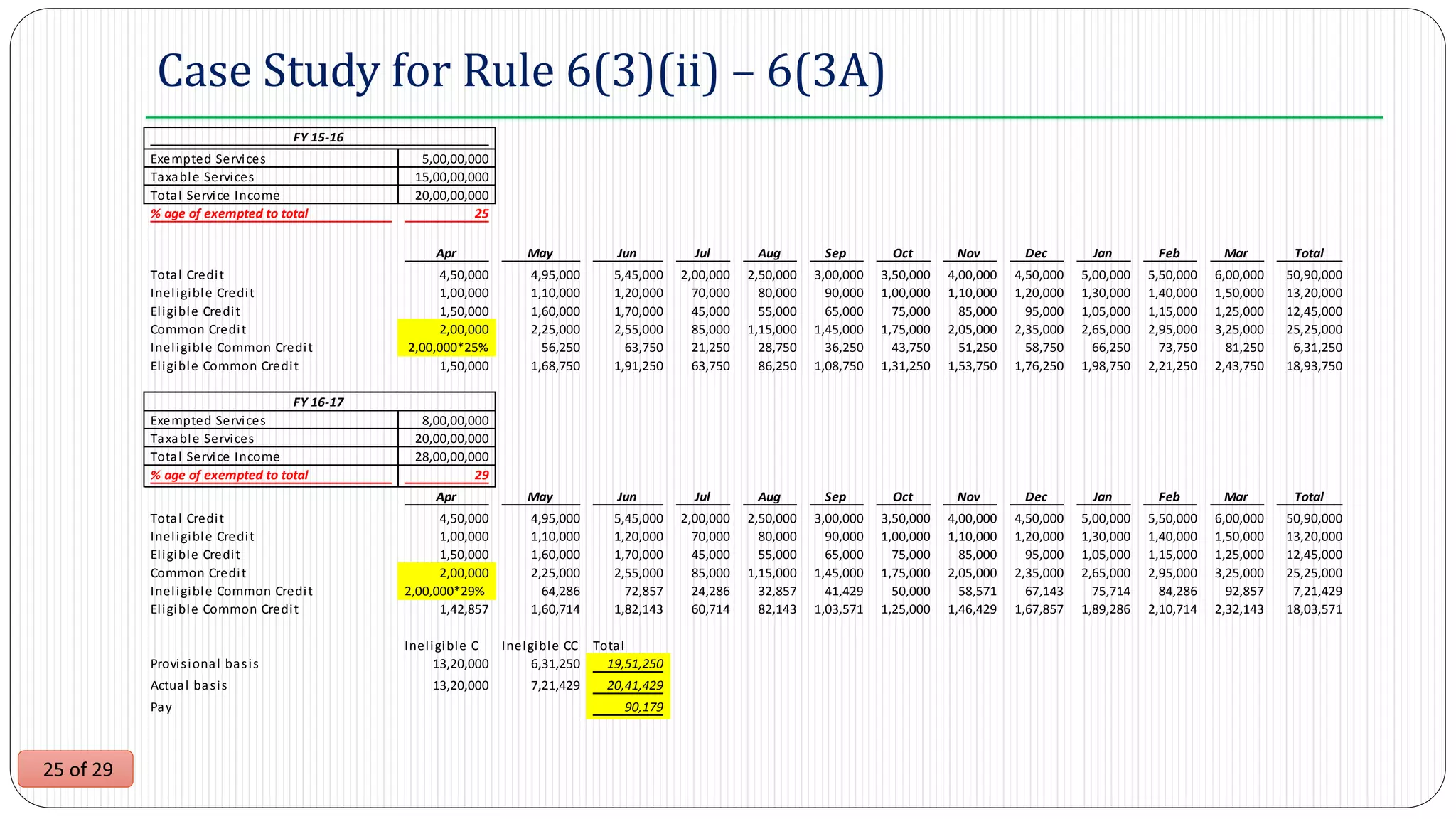

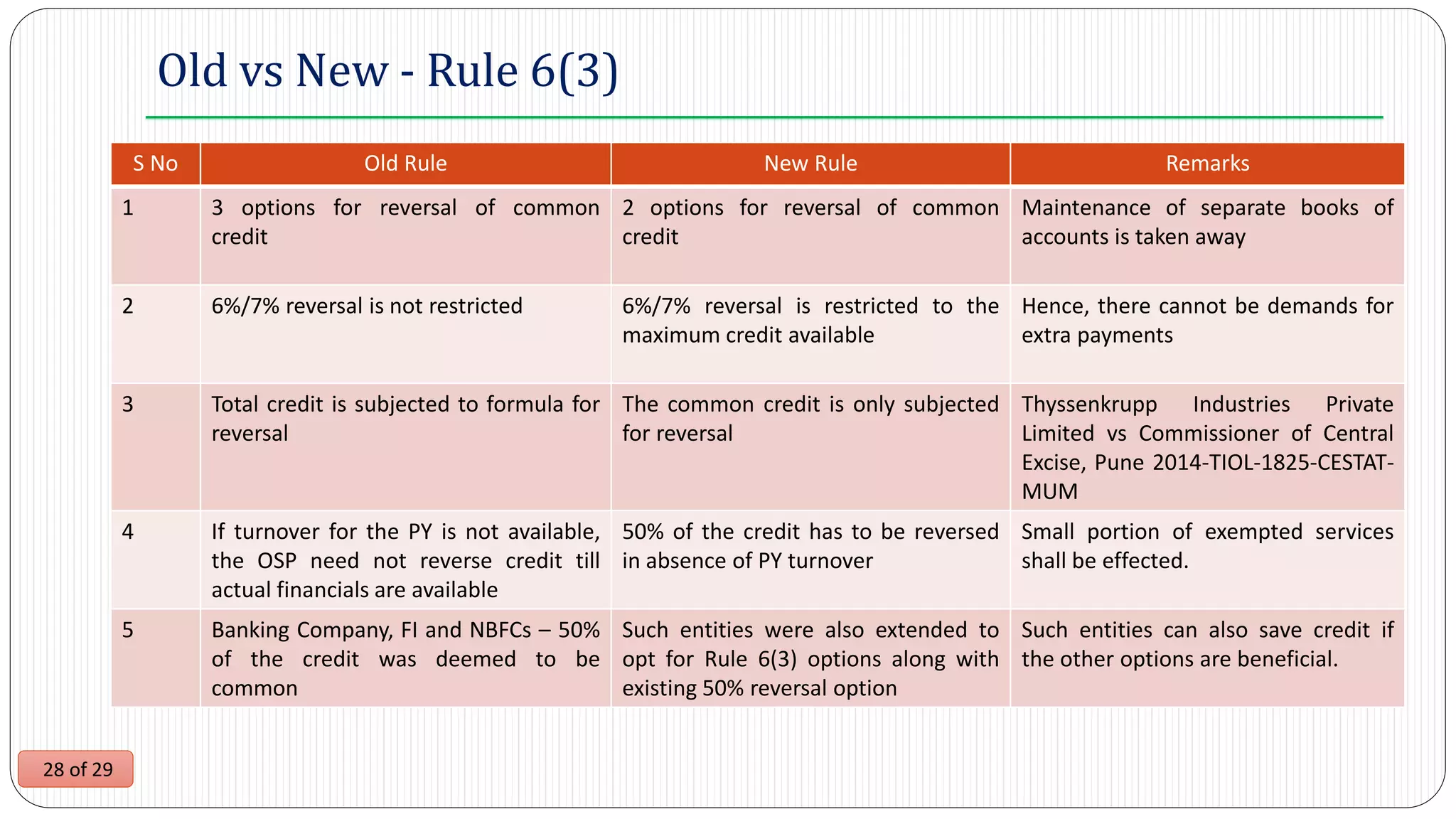

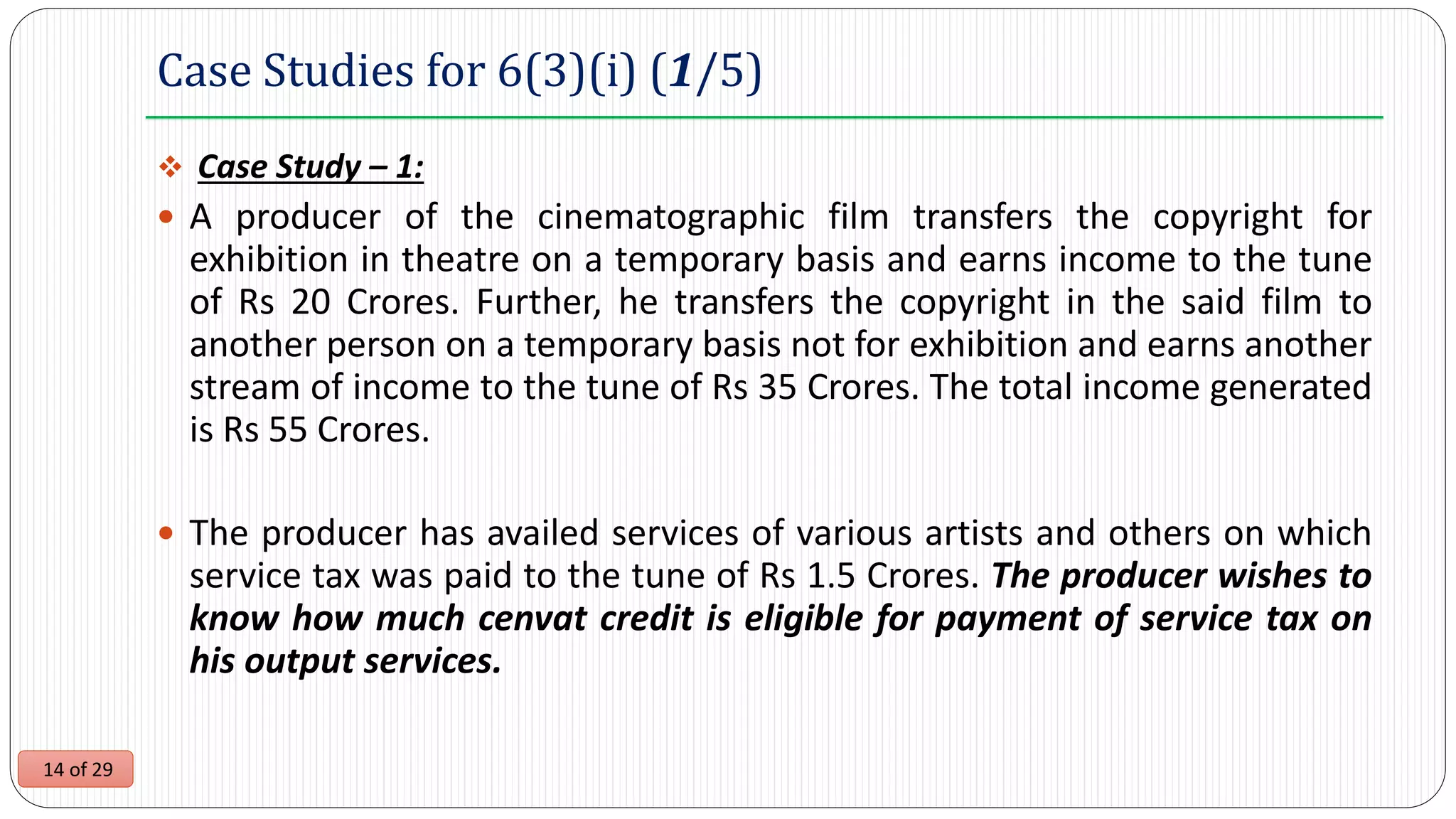

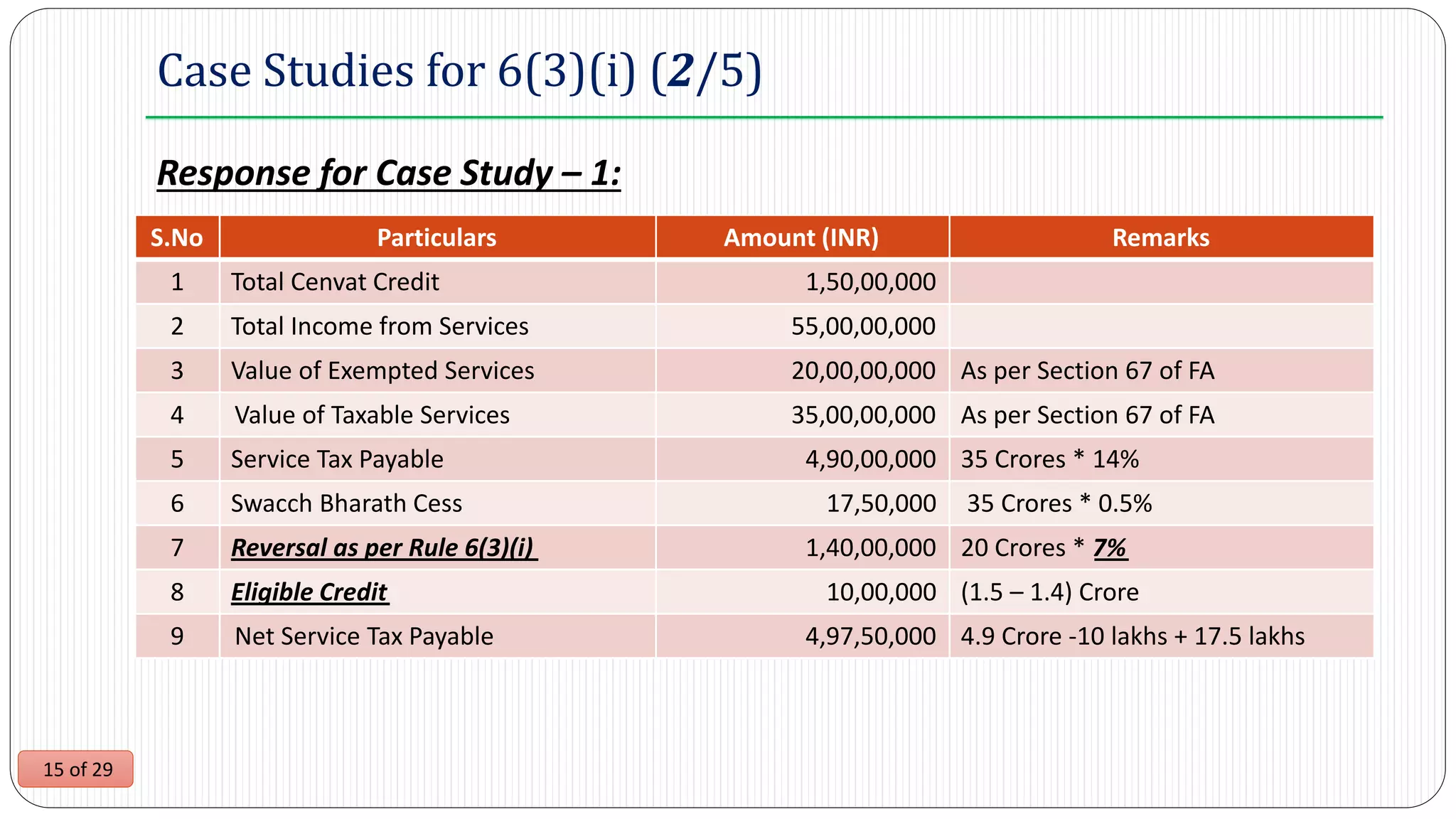

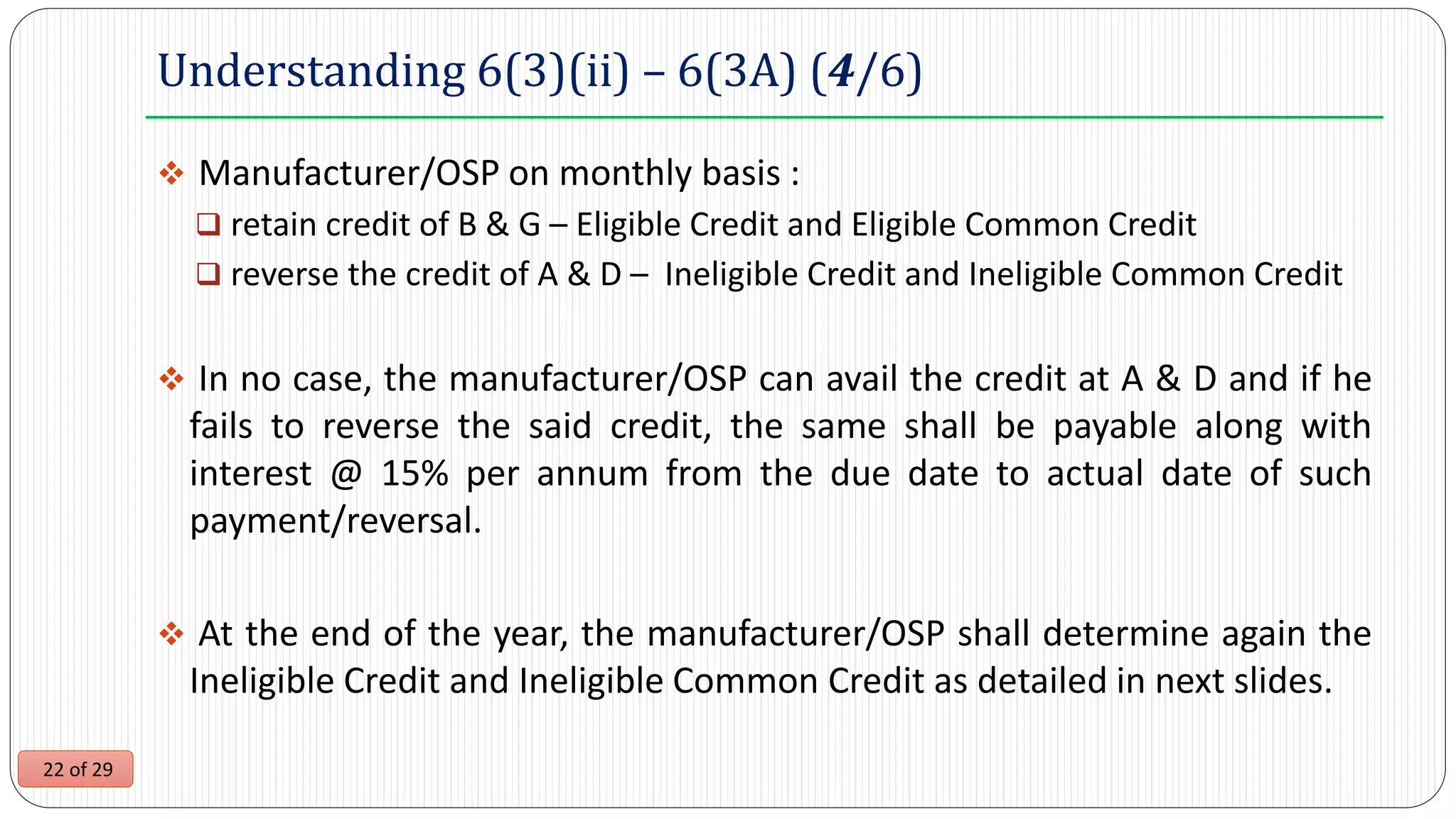

This document provides an analysis of Rule 6 of the Cenvat Credit Rules, 2004 regarding restrictions on cenvat credit for manufacturers and output service providers. It summarizes the key aspects of Rule 6(3) including the two options for reversing common cenvat credit pertaining to exempted goods and services - paying a fixed percentage of value or determining it based on a formula. The document also includes case studies to illustrate the application of Rule 6(3)(i) for different scenarios.

![11 of 29

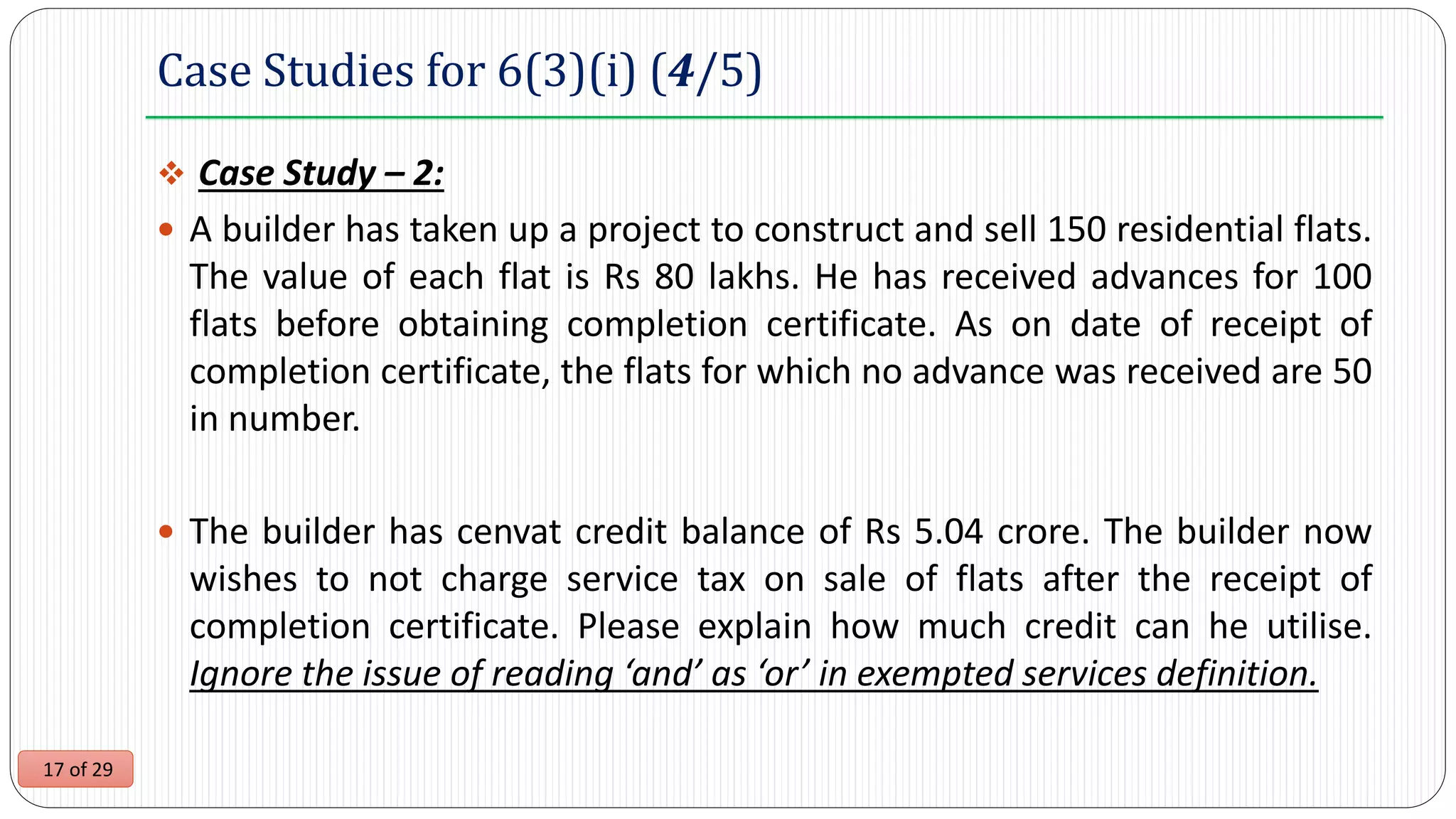

Understanding Rule 6(3)(i) (1/3)

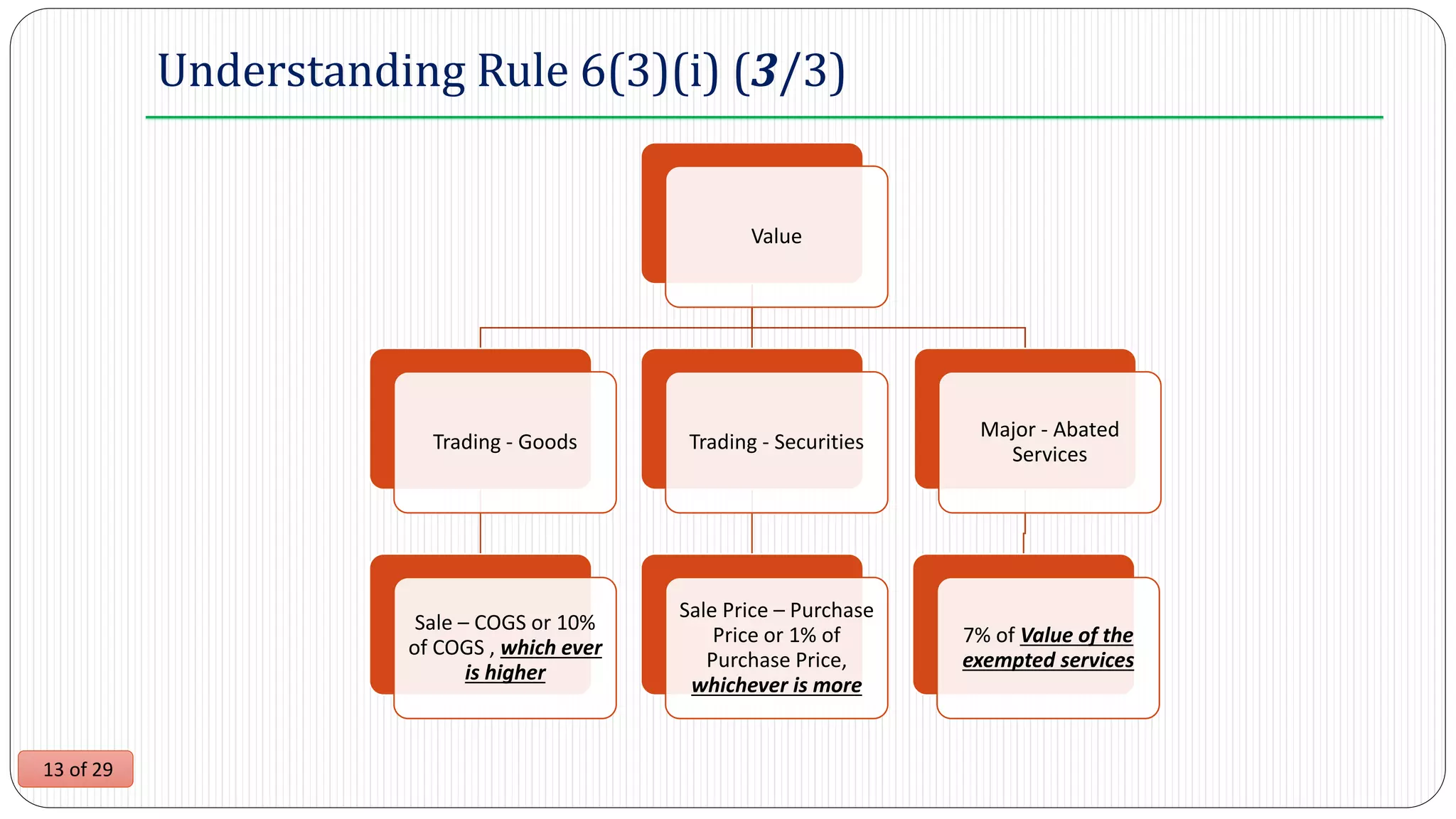

Under this method, the manufacturer/OSP can avail the total cenvat

credit subject to reversal of the following amounts:

6% * [value of exempted goods ] and

7% * [value of exempted services]

Such reversal has to be made every month/quarter, as the case may be

and if failed, the same shall be recovered in terms of Rule 14 of CCR, 2004

The option shall be applicable for all exempted services and exempted

goods and cannot be changed during the year.](https://image.slidesharecdn.com/rule6-ofcenvatcreditrules2004-160526132320/75/Rule-6-of-cenvat-credit-rules-2004-11-2048.jpg)

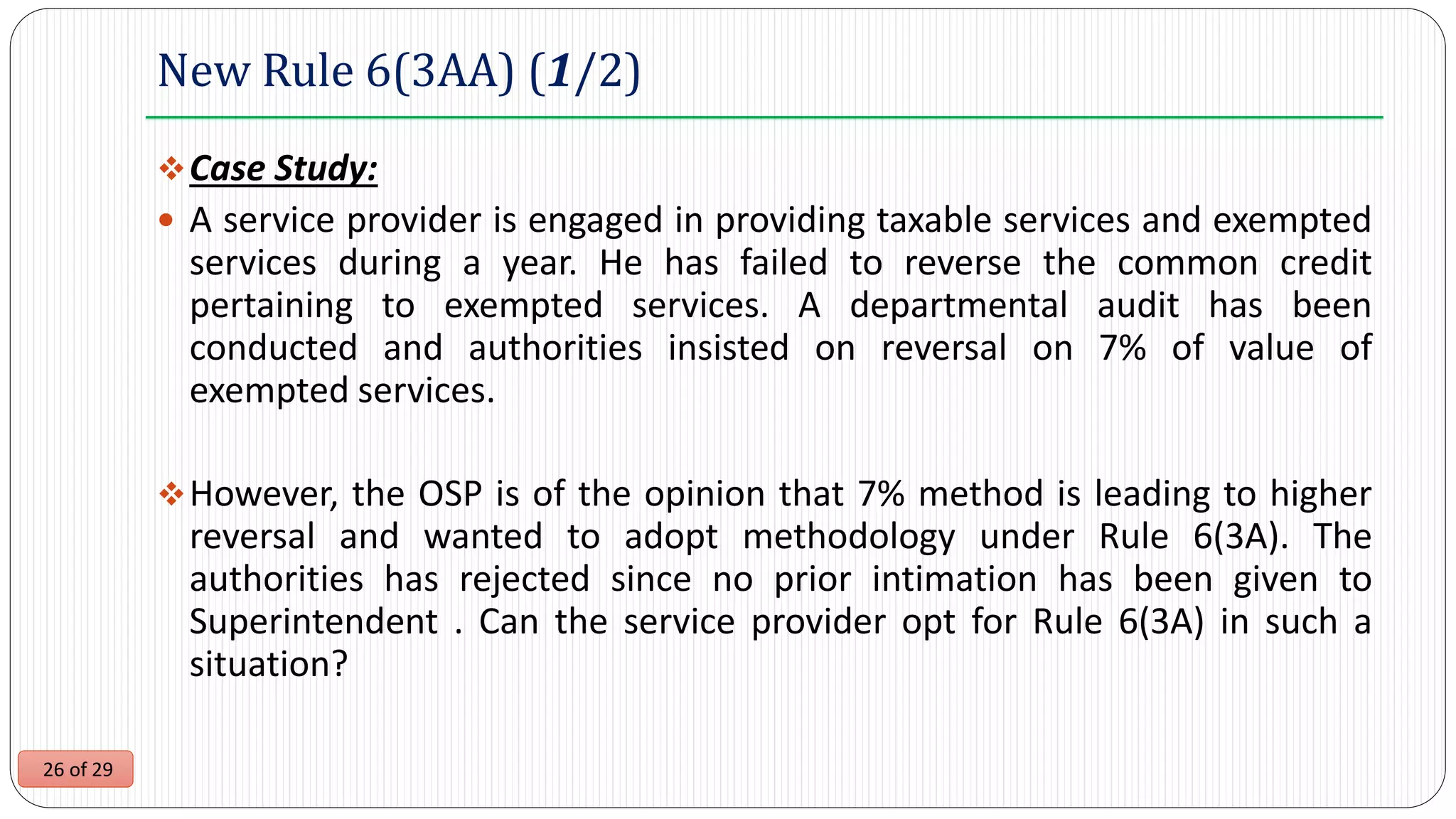

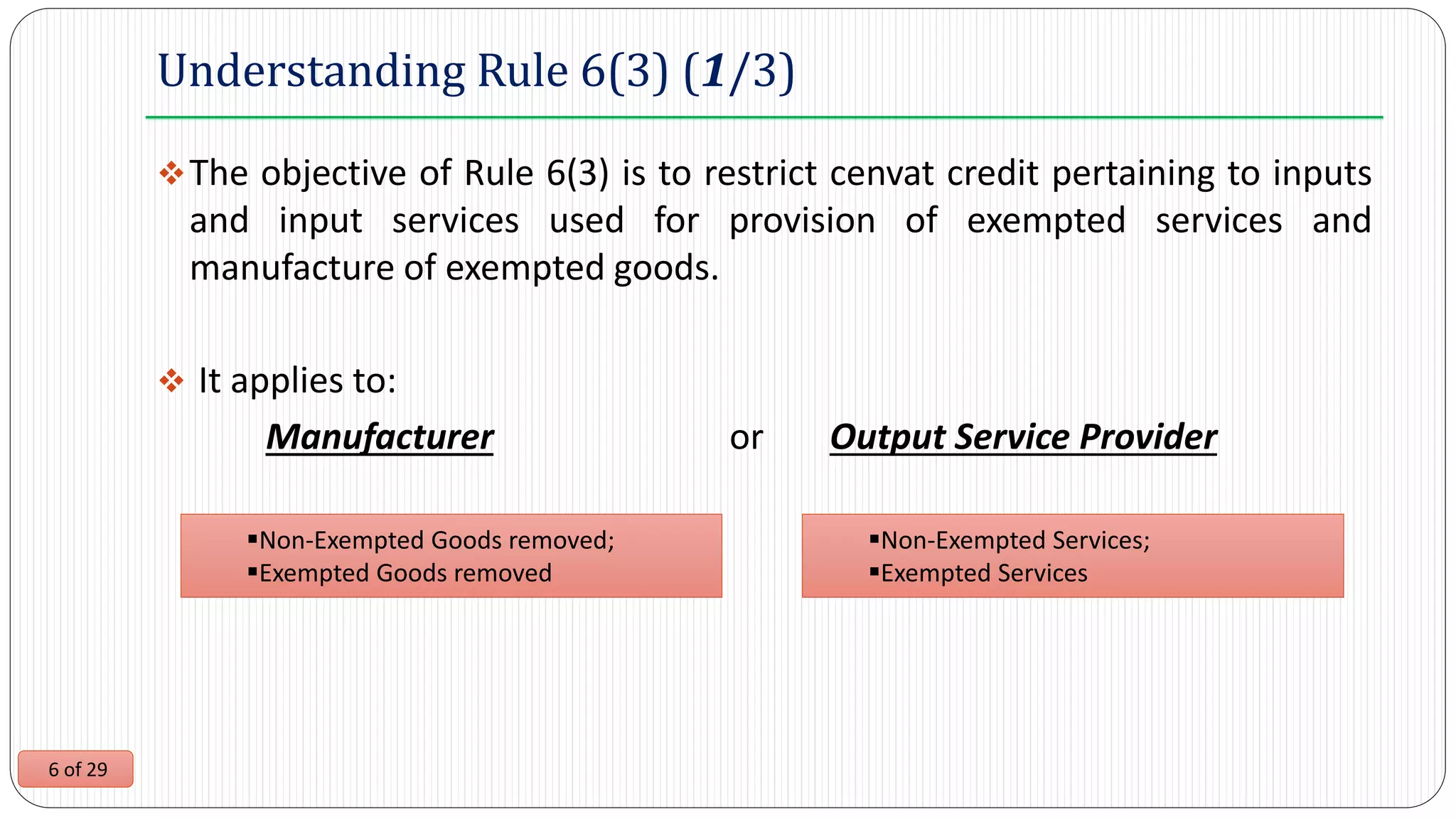

![23 of 29

Understanding 6(3)(ii) – 6(3A) (5/6)

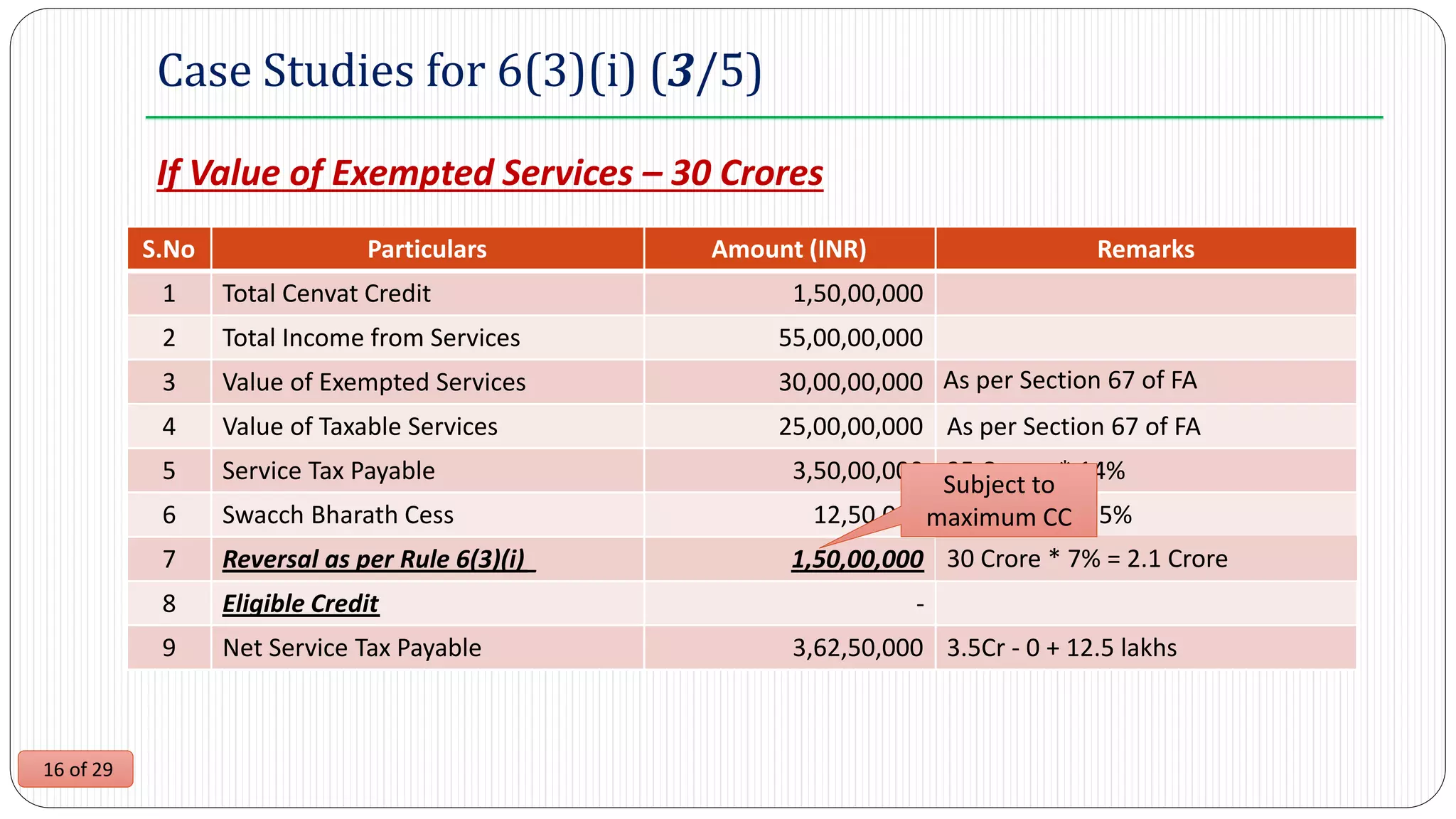

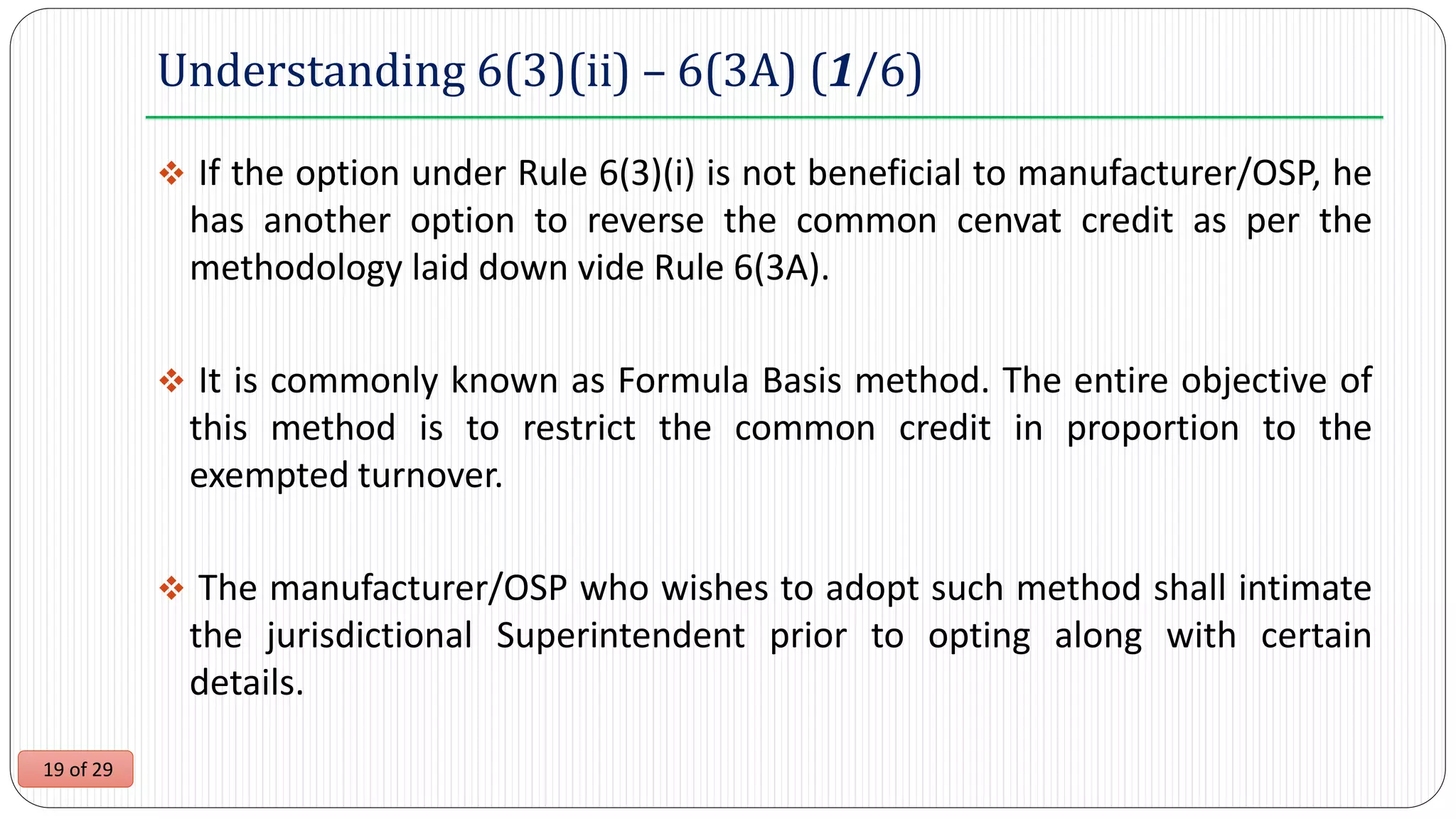

Year end – Actual Basis:

The turnover for the year under consideration shall be taken. The difference between the monthly

calculations and year end calculations would only differ because of the turnovers.

Re Short Description Formula Remarks

T(A) Total Cenvat Credit - I & IS availed during the year

A(A) Ineligible Credit - I & IS used exclusively for exempted goods & services

B(A) Eligible Credit - I & IS used exclusively for non – exempted goods & services

C(A) Total Common Credit T(A) - [A(A)+B(A)] Total Common Credit shall be arrived

D(A) Ineligible Common Credit C(A) * H/I Common credit pertaining to exempted goods & services

H Exempted Turnover - Turnover of [Exempted Goods + Exempted Services]

I Total Turnover - Turnover of Exempted & Non – Exempted goods & services](https://image.slidesharecdn.com/rule6-ofcenvatcreditrules2004-160526132320/75/Rule-6-of-cenvat-credit-rules-2004-23-2048.jpg)

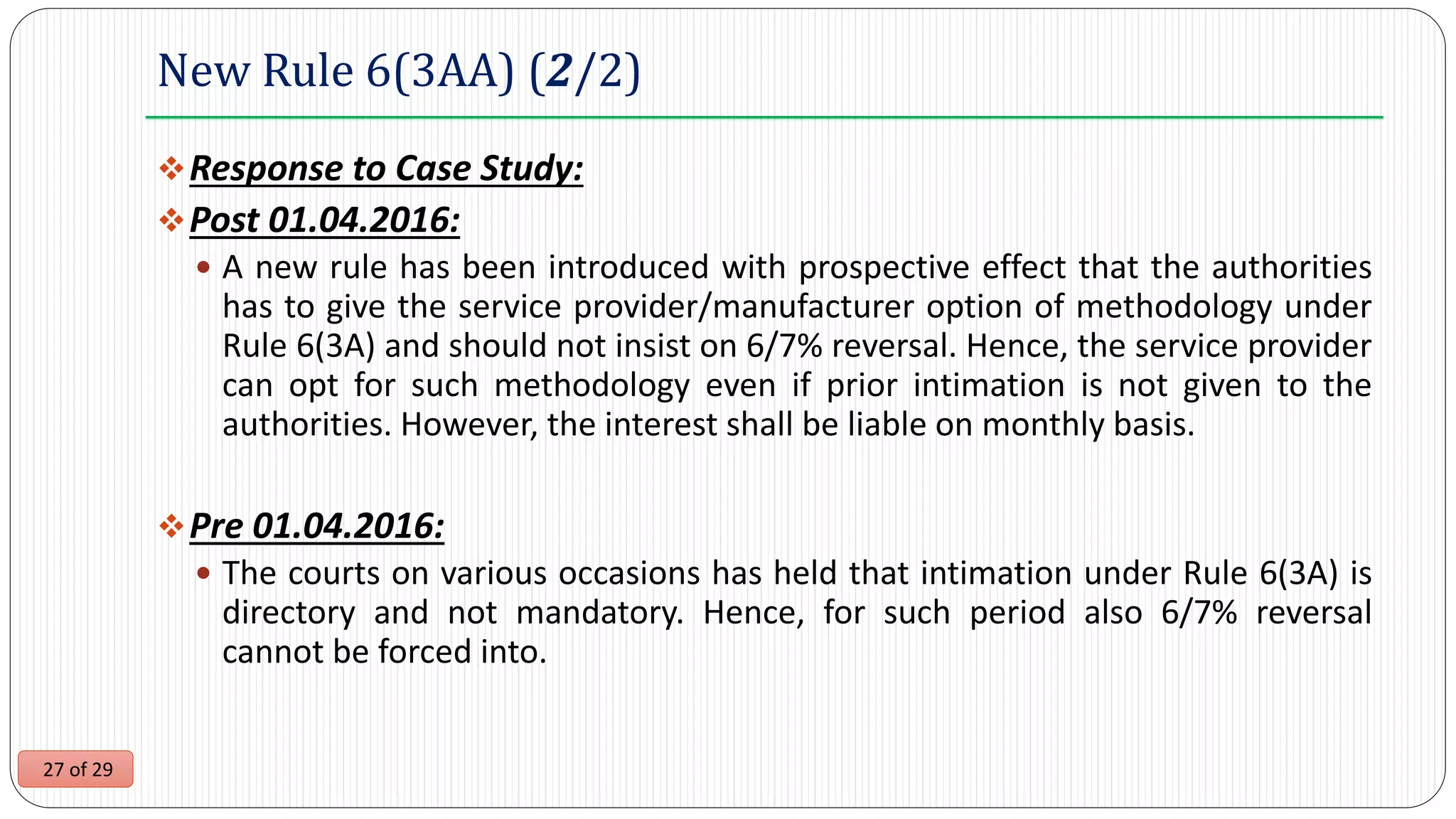

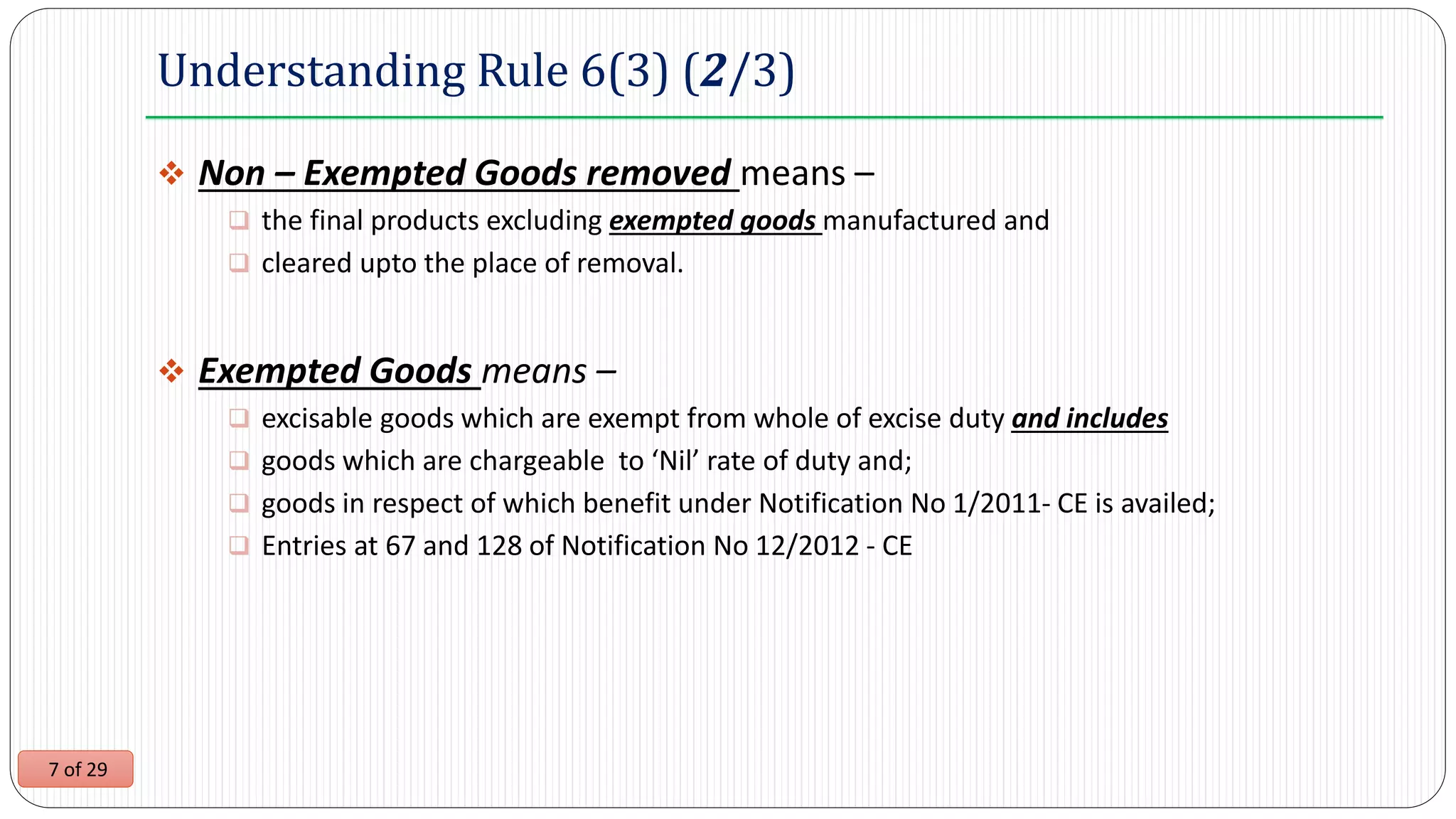

![24 of 29

Understanding 6(3)(ii) – 6(3A) (6/6)

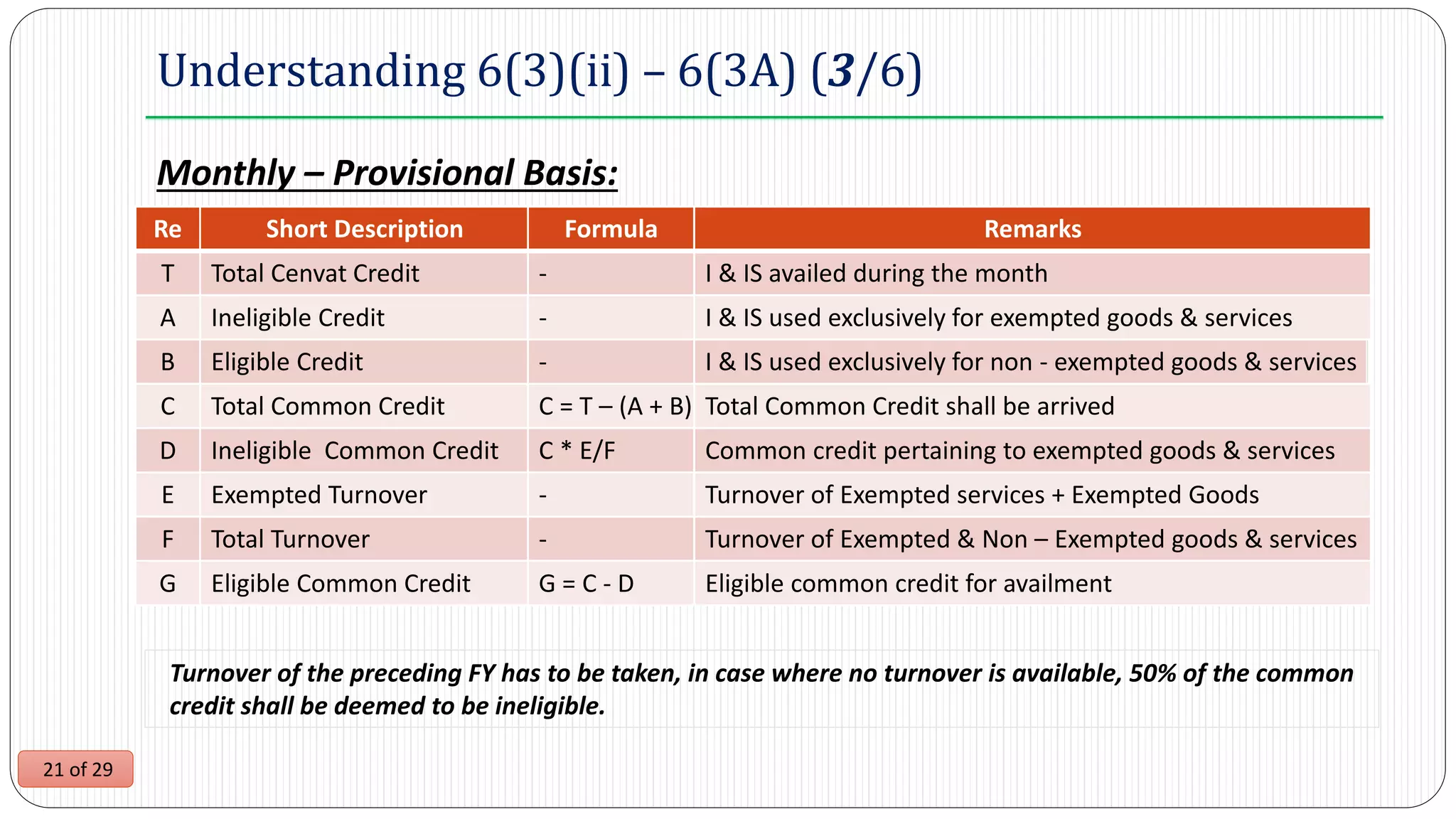

Manufacturer/OSP before 30th June:

Pay, If {A(A) + D(A)} > {A+D [aggregated for whole year]}

Avail, If {A(A) + D(A)} < {A+D [aggregated for whole year]}

If manufacturer/OSP fails to pay the difference, he shall be liable to pay

the interest @ 15% per annum from 30th June to the actual date of

payment.

Manufacturer/OSP shall intimate within 15 days from the date of

payment/adjustment to the jurisdictional superintendent along with

other details.](https://image.slidesharecdn.com/rule6-ofcenvatcreditrules2004-160526132320/75/Rule-6-of-cenvat-credit-rules-2004-24-2048.jpg)