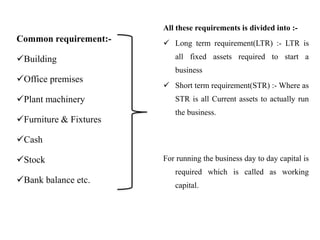

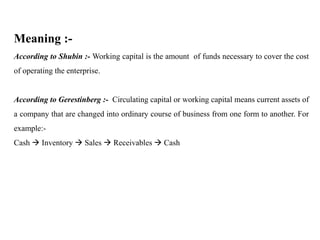

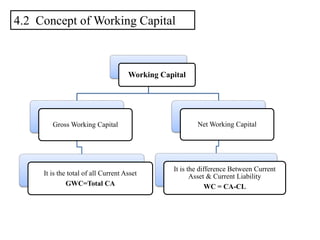

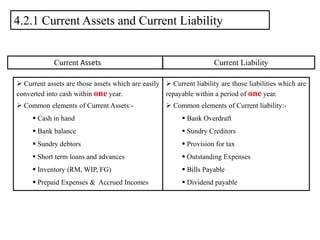

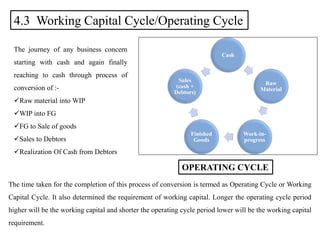

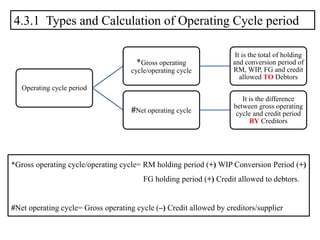

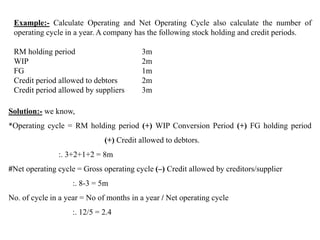

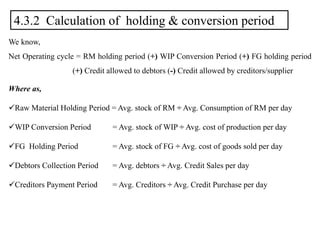

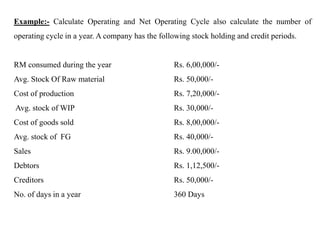

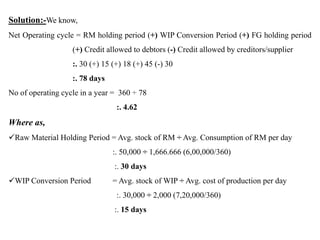

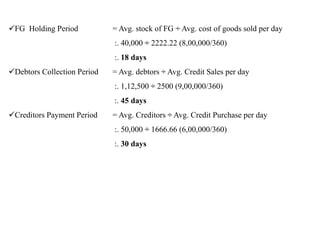

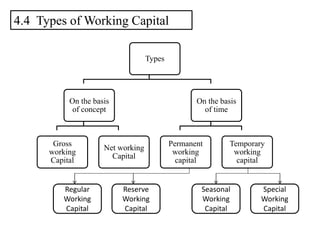

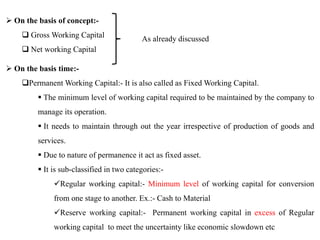

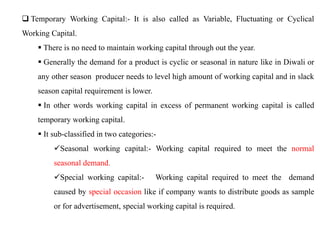

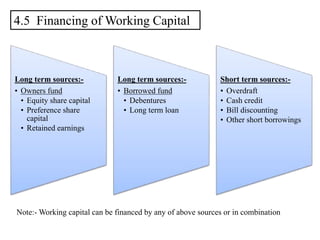

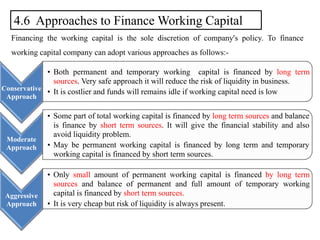

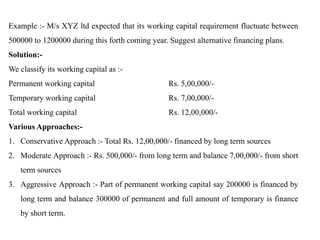

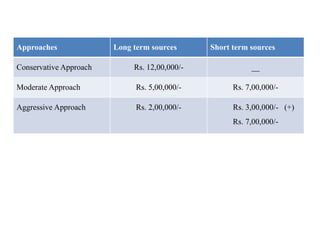

The document outlines the key concepts of working capital management, including its definition, components, and various types such as gross and net working capital. It discusses the working capital cycle and how to calculate it, along with different financing approaches like conservative, moderate, and aggressive strategies. Additionally, it covers the types of working capital required for business operations and methods of financing them.