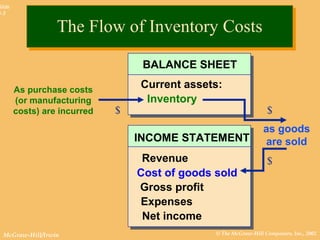

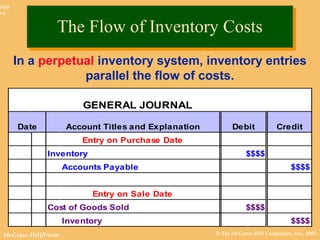

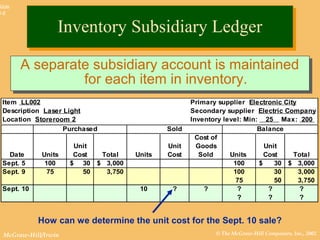

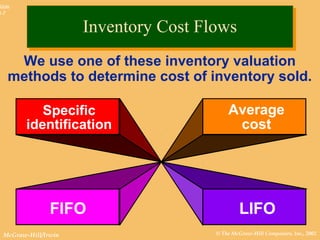

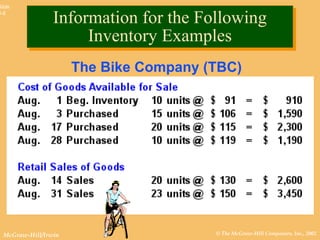

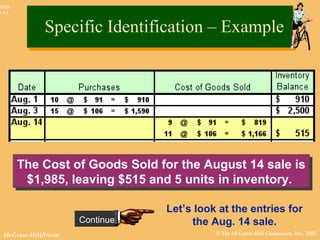

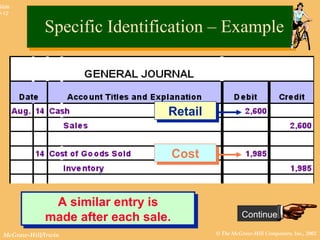

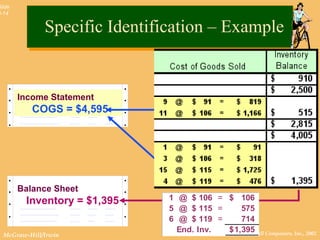

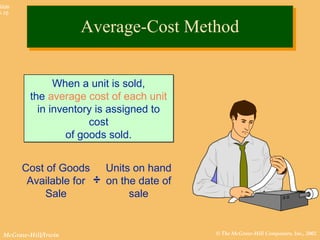

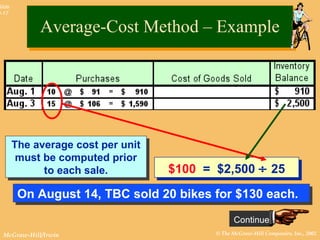

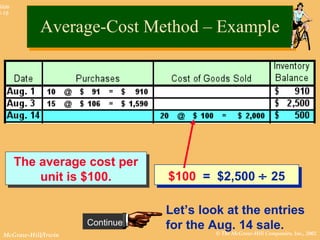

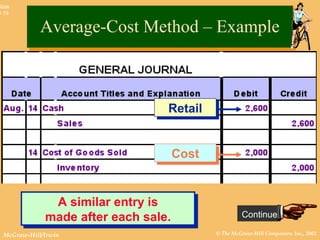

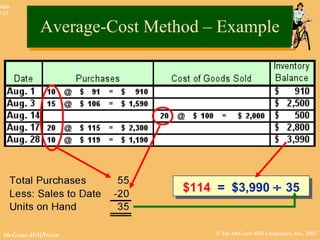

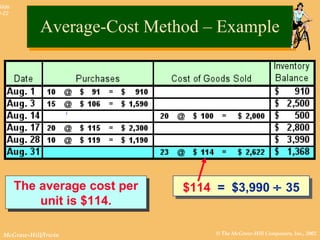

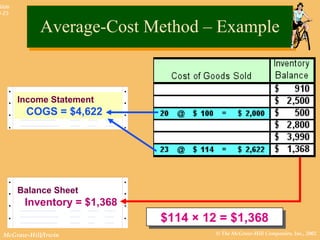

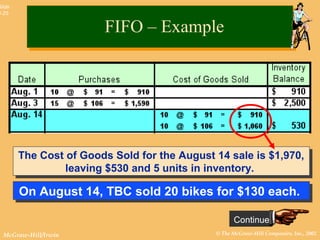

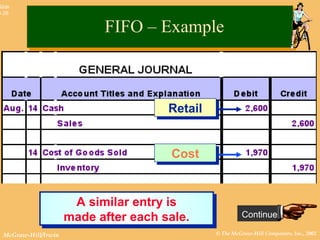

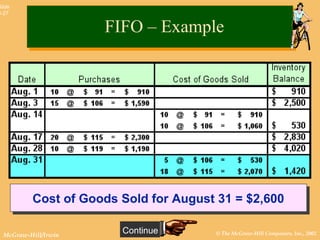

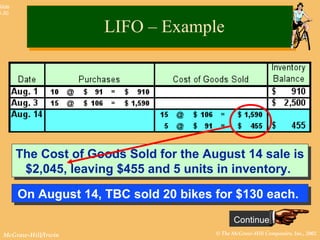

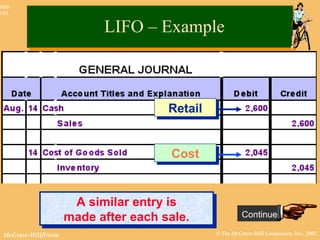

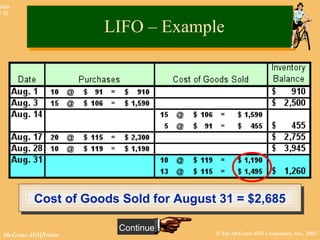

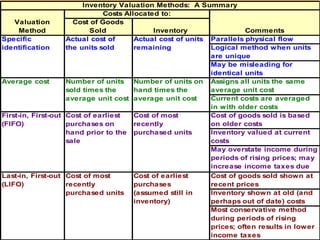

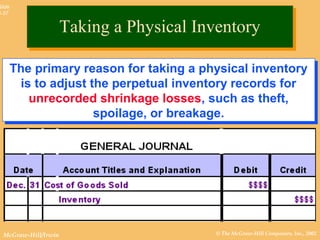

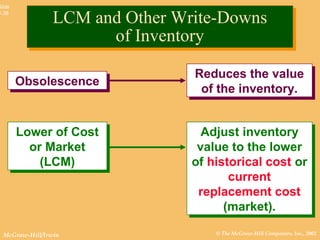

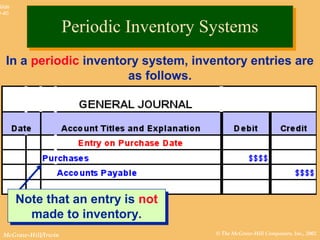

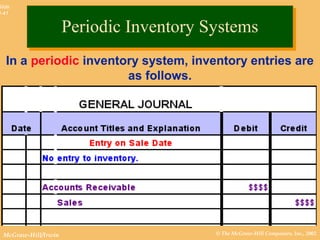

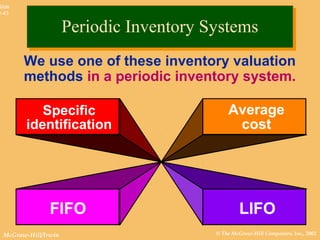

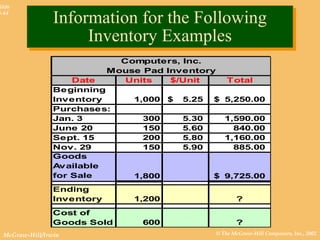

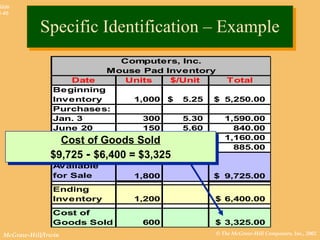

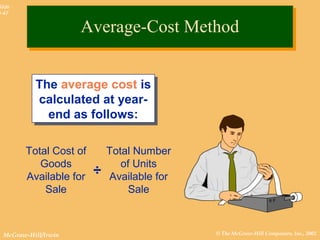

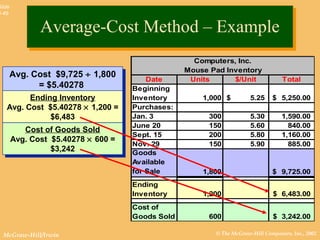

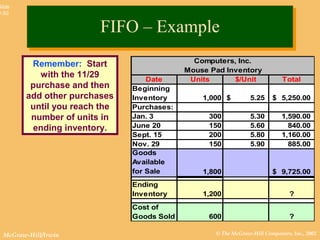

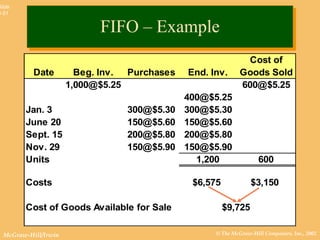

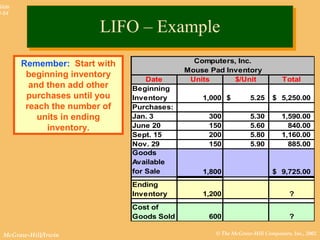

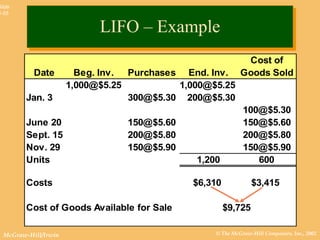

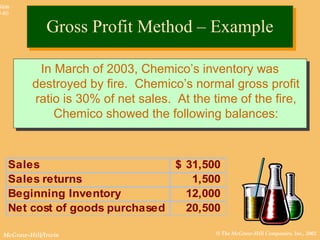

This document discusses inventory valuation methods including specific identification, average cost, FIFO, and LIFO. Examples are provided to illustrate how inventory and cost of goods sold transactions are recorded under each method. The key inventory accounting principles of consistency, physical inventory counts, obsolescence, and lower of cost or market are also overviewed.