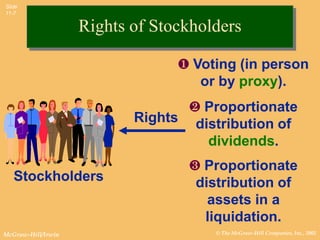

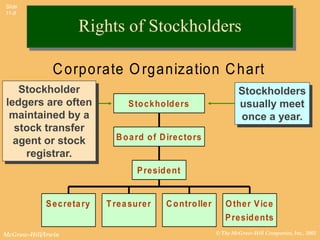

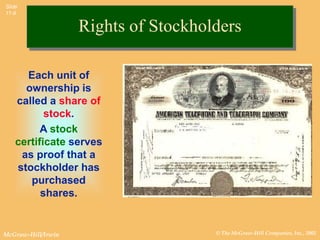

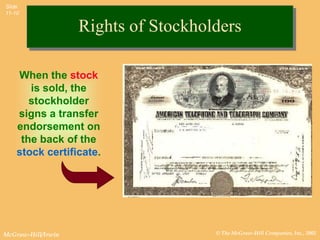

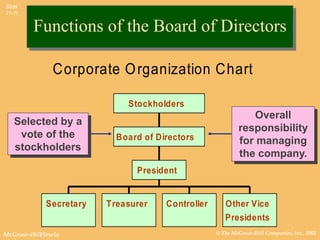

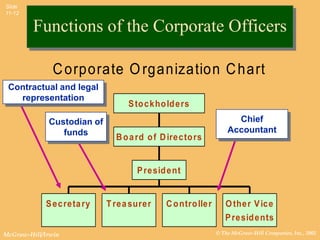

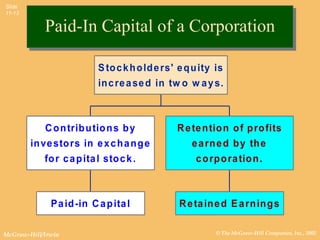

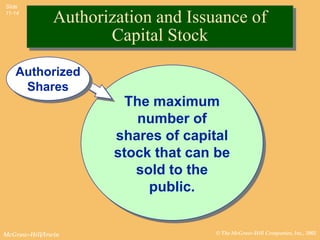

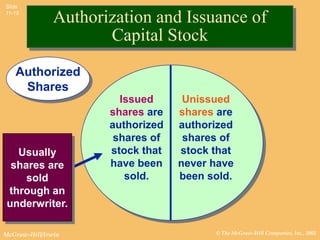

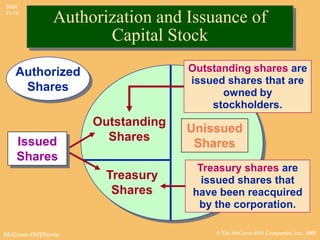

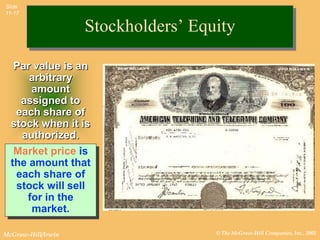

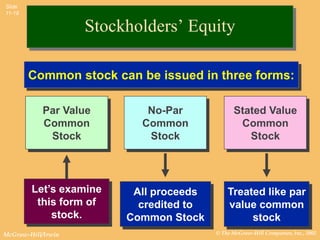

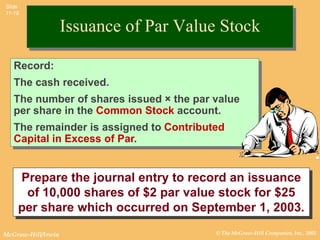

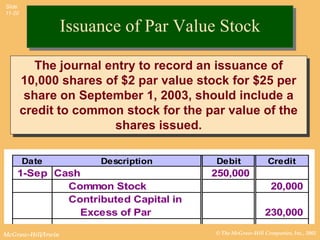

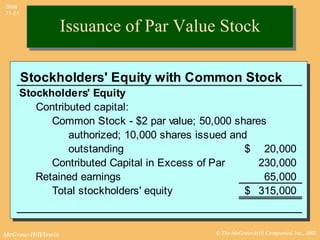

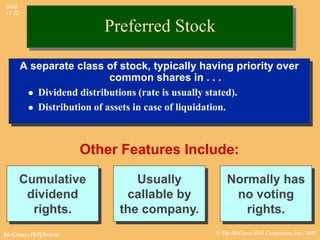

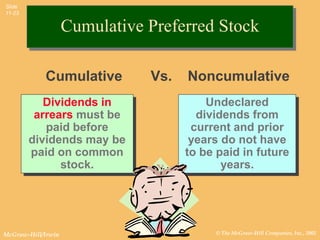

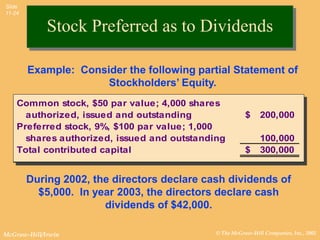

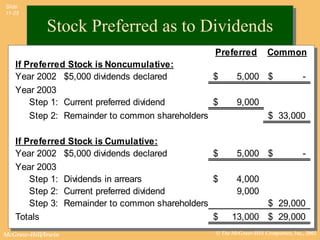

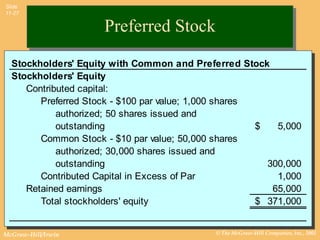

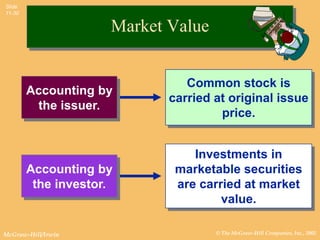

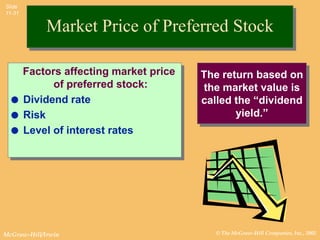

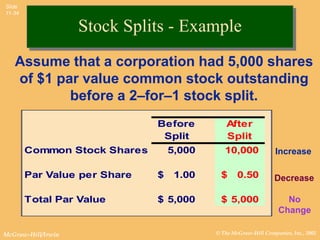

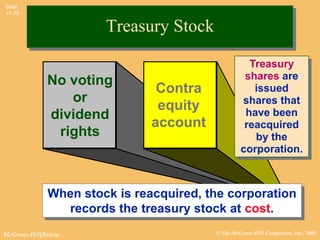

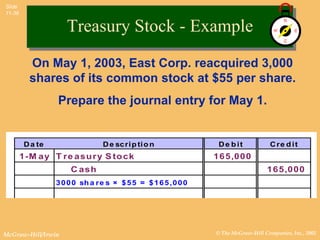

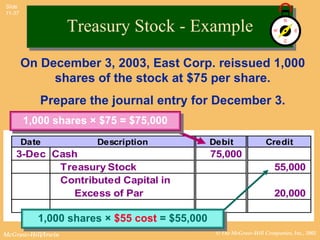

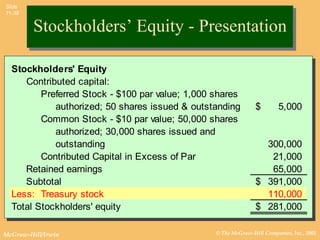

This document provides an overview of stockholders' equity, including paid-in capital and different types of stock issued by corporations. It discusses the formation of corporations and advantages/disadvantages of incorporation. It also covers key aspects of common stock, preferred stock, treasury stock, and stock splits. The slides define important terms, provide examples of accounting entries, and illustrate how different transactions affect stockholders' equity.