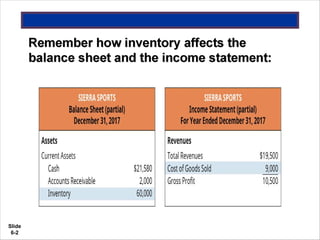

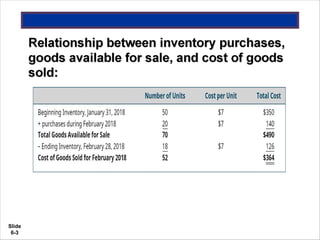

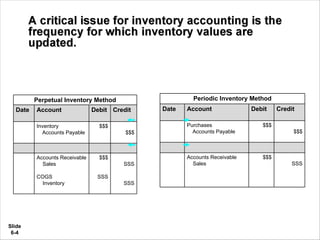

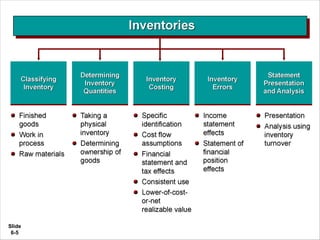

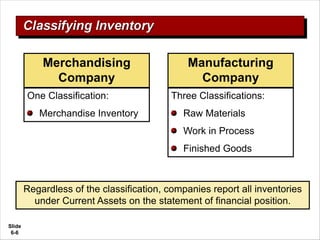

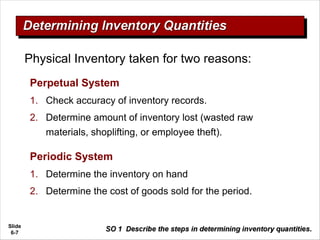

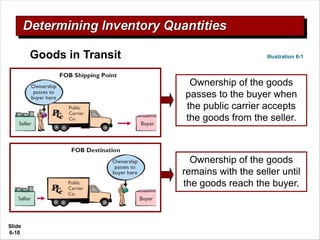

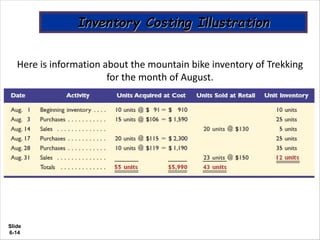

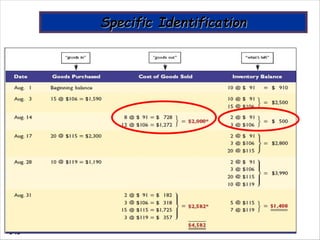

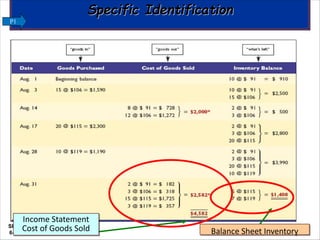

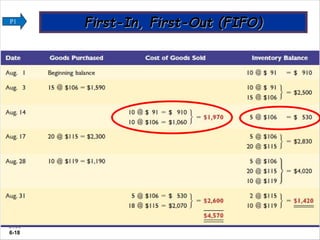

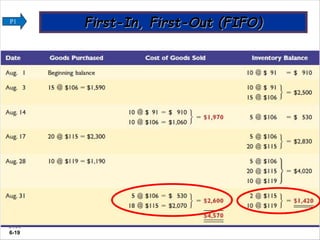

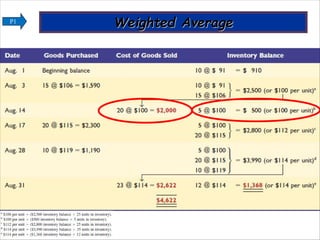

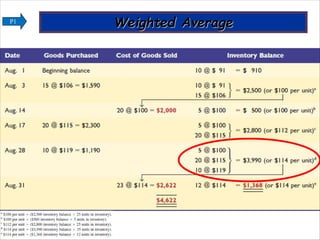

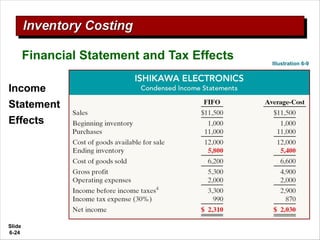

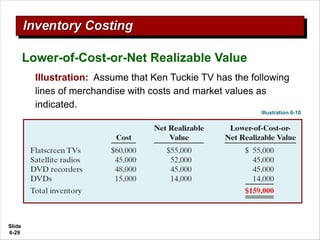

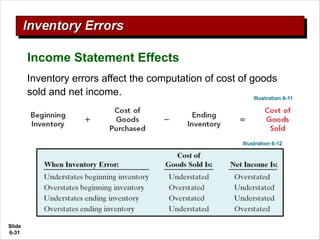

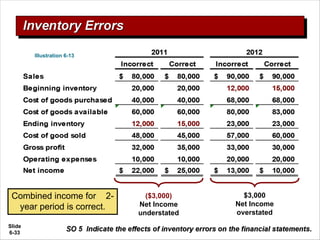

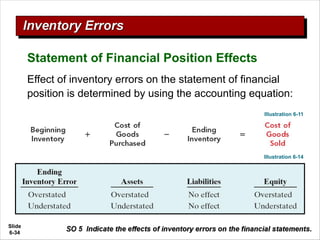

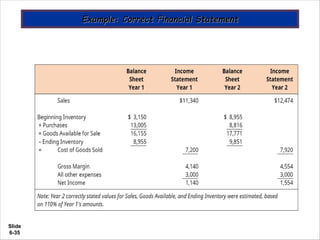

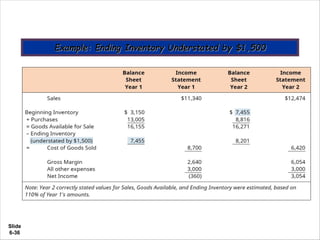

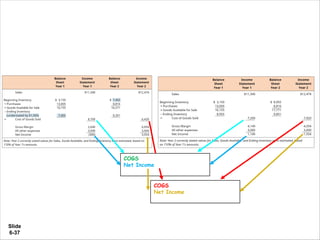

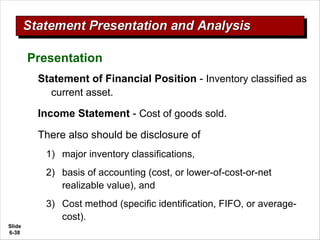

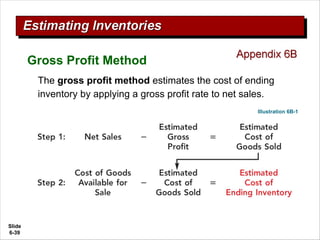

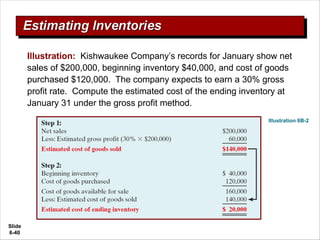

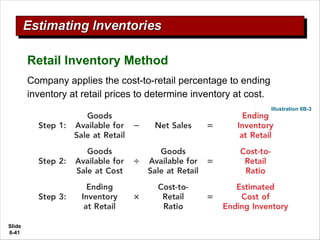

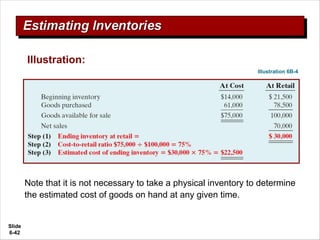

This document discusses inventory valuation methods. It covers perpetual and periodic inventory systems, as well as classifications like raw materials, work in process, and finished goods. Cost flow methods like FIFO, average cost, and specific identification are explained. The document also discusses lower of cost or market, inventory errors, and presentation of inventory balances. Alternative methods for estimating inventory balances like the gross profit method and retail inventory method are presented through examples.