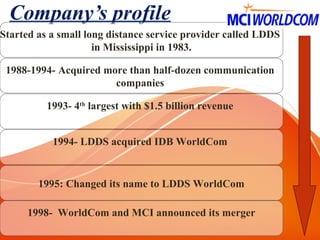

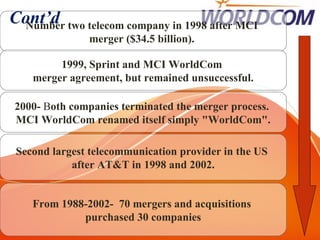

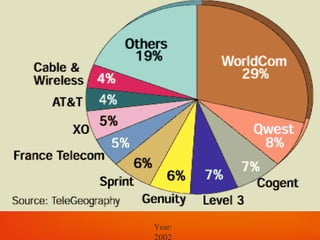

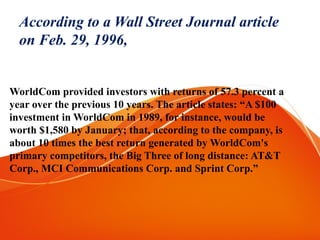

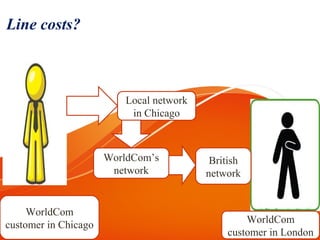

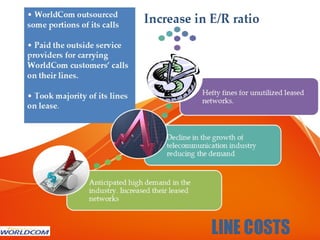

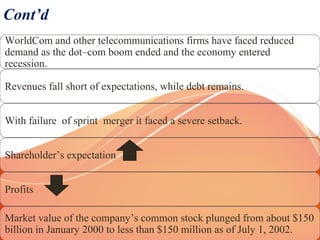

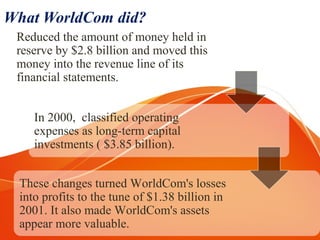

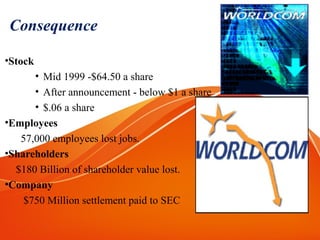

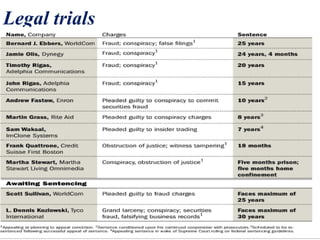

WorldCom started as a small long distance provider in 1983 and grew through many acquisitions to become the second largest telecom company in the US by 1998. However, the dot-com bust led to revenue shortfalls and high debt. To hide losses and meet Wall Street expectations, WorldCom fraudulently classified $3.8 billion in operating expenses as capital expenditures. An internal audit uncovered the fraud in 2002, and WorldCom filed for bankruptcy, resulting in 57,000 job losses and $180 billion in lost shareholder value. CEO Bernie Ebbers and CFO Scott Sullivan were later convicted for their role in the massive accounting scandal.