This document discusses time series analysis and forecasting using exponential smoothing methods. It provides textbooks and learning resources on time series analysis. It then describes the different types of exponential smoothing models - simple/single, double/Holt's trend, and triple/Holt-Winters. Examples are given showing how to implement these methods in Python using real-world airline passenger data and evaluate forecasts. Frequently asked questions are also included to summarize the key exponential smoothing techniques.

![8

20 October 2023

Dr. Tej Bahadur Chandra

Example 1: Simple Exponential Smoothing

#Second Instance

modal3 = SimpleExpSmoothing(df.Passengers).fit()

forecast3 = modal3.forecast(n).rename('alpha=%s'%modal3.model.params['smoothing_level

'])

#After creating model we will visualize the plot

ax = df.plot(marker='o', color='black', figsize=(12,8), legend=True)

#Plot for alpha =0.2

forecast1.plot(marker='+', ax=ax, color='blue', legend=True)

modal1.fittedvalues.plot(marker='+', ax=ax, color='blue')

#Plot for alpha=Optimized by statsmodel

forecast3.plot(marker='*', ax=ax, color='green', legend=True)

modal3.fittedvalues.plot(marker='*', ax=ax, color='green')

plt.show()](https://image.slidesharecdn.com/m2l6tsfexponentialsmoothingholtwinter-231020101237-1e8b44db/85/M2_L6-TSF-Exponential-Smoothing-Holt-Winter-pptx-8-320.jpg)

![11

20 October 2023

Dr. Tej Bahadur Chandra

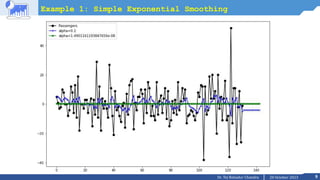

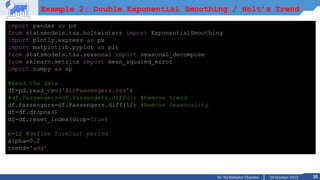

Example 2: Double Exponential Smoothing / Holt’s Trend

#First Instance

modal1 = ExponentialSmoothing(df.Passengers, trend).fit(smoothing_level=alpha)

forecast1 = modal1.forecast(n).rename('alpha='+str(alpha))

#Third Instance

modal3 = ExponentialSmoothing(df.Passengers, trend).fit()

forecast3 = modal3.forecast(n).rename('alpha=%s'%modal3.model.params['smoothing_level

'])

#After creating model we will visualize the plot

ax = df.plot(marker='o', color='black', figsize=(12,8), legend=True)

#Plot for alpha =0.2

forecast1.plot(marker='+', ax=ax, color='blue', legend=True)

modal1.fittedvalues.plot(marker='+', ax=ax, color='blue')

#Plot for alpha=Optimized by statsmodel

forecast3.plot(marker='*', ax=ax, color='green', legend=True)

modal3.fittedvalues.plot(marker='*', ax=ax, color='green')

plt.show()](https://image.slidesharecdn.com/m2l6tsfexponentialsmoothingholtwinter-231020101237-1e8b44db/85/M2_L6-TSF-Exponential-Smoothing-Holt-Winter-pptx-11-320.jpg)

![14

20 October 2023

Dr. Tej Bahadur Chandra

Example 3: Triple Exponential Smoothing

#First Instance

modal1 = ExponentialSmoothing(df.Passengers, trend, seasonal='add', seasonal_periods=sPer

iod).fit(smoothing_level=alpha)

forecast1 = modal1.forecast(n).rename('alpha='+str(alpha))

#Third Instance

modal3 = ExponentialSmoothing(df.Passengers, trend, seasonal='add', seasonal_periods=sPer

iod).fit()

forecast3 = modal3.forecast(n).rename('alpha=%s'%modal3.model.params['smoothing_level'])

#After creating model we will visualize the plot

ax = df.plot(marker='o', color='black', figsize=(12,8), legend=True)

#Plot for alpha =0.2

forecast1.plot(marker='+', ax=ax, color='blue', legend=True)

modal1.fittedvalues.plot(marker='+', ax=ax, color='blue')

#Plot for alpha=Optimized by statsmodel

forecast3.plot(marker='*', ax=ax, color='green', legend=True)

modal3.fittedvalues.plot(marker='*', ax=ax, color='green')

plt.show()](https://image.slidesharecdn.com/m2l6tsfexponentialsmoothingholtwinter-231020101237-1e8b44db/85/M2_L6-TSF-Exponential-Smoothing-Holt-Winter-pptx-14-320.jpg)

![16

20 October 2023

Dr. Tej Bahadur Chandra

Example 4: Triple Exponential Smoothing on Training Testing Data

import pandas as pd

from statsmodels.tsa.holtwinters import ExponentialSmoothing

import plotly.express as px

import matplotlib.pyplot as plt

from statsmodels.tsa.seasonal import seasonal_decompose

from sklearn.metrics import mean_squared_error

import numpy as np

alpha=0.8

sPeriod=12

#Read the data

df=pd.read_csv('AirPassengers.csv')

df_train = df[:-24]

df_test = df[-24:]

# Additive model

model_add = ExponentialSmoothing(df_train['Passengers'], trend='add', seasonal='add',

seasonal_periods=sPeriod)

results_add = model_add.fit()

predictions_add = results_add.forecast(steps=24)](https://image.slidesharecdn.com/m2l6tsfexponentialsmoothingholtwinter-231020101237-1e8b44db/85/M2_L6-TSF-Exponential-Smoothing-Holt-Winter-pptx-16-320.jpg)

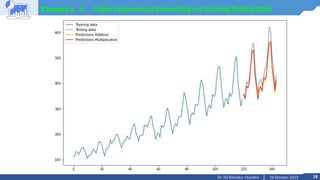

![17

20 October 2023

Dr. Tej Bahadur Chandra

Example 4: Triple Exponential Smoothing on Training Testing Data

# Multiplicative model

model_mul = ExponentialSmoothing(df_train['Passengers'], trend='mul', seasonal='add',

seasonal_periods=sPeriod)

results_mul = model_mul.fit()

predictions_mul = results_mul.forecast(steps=24)

# Evaluate

rmse_add = mean_squared_error(df_test['Passengers'], predictions_add, squared=False)

rmse_mul = mean_squared_error(df_test['Passengers'], predictions_mul, squared=False)

print('rmse_add = ', rmse_add)

print('rmse_mul = ', rmse_mul)

# Plot

plt.figure(figsize=(12,8))

plt.plot(df_train['Passengers'], label='Training data')

plt.plot(df_test['Passengers'], color='gray', label='Testing data')

plt.plot(predictions_add, color='orange', label='Predictions Additive')

plt.plot(predictions_mul, color='red', label='Predictions Multiplicative')

plt.legend();](https://image.slidesharecdn.com/m2l6tsfexponentialsmoothingholtwinter-231020101237-1e8b44db/85/M2_L6-TSF-Exponential-Smoothing-Holt-Winter-pptx-17-320.jpg)

![21

20 October 2023

Dr. Tej Bahadur Chandra

Further Readings:

• https://machinelearningmastery.com/exponential-smoothing-for-time-series-forecasting-in-python/

• How to Select a Model For Your Time Series Prediction Task [Guide], https://neptune.ai/blog/select-model-for-time-series-

prediction-task](https://image.slidesharecdn.com/m2l6tsfexponentialsmoothingholtwinter-231020101237-1e8b44db/85/M2_L6-TSF-Exponential-Smoothing-Holt-Winter-pptx-21-320.jpg)