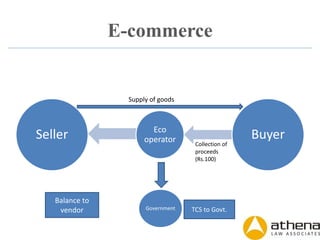

The document outlines the provisions regarding e-commerce under GST, covering definitions, responsibilities of e-commerce operators, and procedures for tax collection at source (TCS). It highlights the lack of clarity on the taxability of transactions involving e-commerce operators and the requirement for operators to collect and report tax from suppliers. Additionally, it details the timelines for payment and reporting obligations, as well as penalties for non-compliance.

![ELECTRONIC COMMERCE: Defined but nowhere used

(Section 43B)

Electronic Commerce means [Section 43B(d)] :

supply or receipt of goods and /or services, or

transmission of funds or data over an electronic network,

by usage of any application of the internet

but shall not be limited to e-mail, instant messaging, shopping carts, web services,

UDDI, FTP, EDI

whether or not payment is conducted online

whether or not the ultimate delivery of goods and services is done by the operator.

Athena Comments:

Even though the term ‘electronic commerce’ is defined in Section 43B (d), yet it is not

used in this Chapter.

However, the term “Electronic Commerce Operator” is being used in Section 43C which

talks about Collection of tax at source.](https://image.slidesharecdn.com/e-commerce-gst-161024123137/85/E-commerce-under-GST-5-320.jpg)

![E-Commerce Operator: (Section 43B)

Electronic Commerce Operator includes: [Section 43B(e)] :

every person who, directly or indirectly,

owns, operates or manages an electronic platform

that is engaged in facilitating the supply of

- any goods and/or services or

in providing any information or

any other services incidental to or

In connection there with

but shall not include persons engaged in supply of such goods and/or

services on their behalf.](https://image.slidesharecdn.com/e-commerce-gst-161024123137/85/E-commerce-under-GST-6-320.jpg)

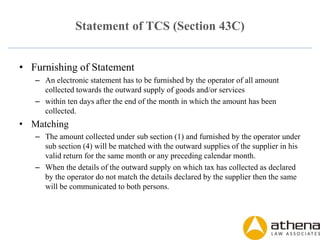

![Collection of tax at source (Section 43C)

• TCS Collection

– Every “electronic commerce operator” [ECO]

– shall collect

– an amount at the rate notified by CG/SG on the recommendation of the Council

– from the supplier

– at the time of credit of any amount to the supplier or at the time of payment made to the

supplier whichever is earlier,

– out of the amount payable or paid to the supplier, representing consideration towards the

supply of good and/or services.

• The amount paid to the Appropriate Govt. shall be considered as tax paid

by the supplier and the supplier shall claim credit in his electronic cash

ledger.

• Payment to Govt.

– The amount has to be paid to the credit of the Appropriate Govt. by the operator within

10 days after the end of the month in which the amount has been collected.](https://image.slidesharecdn.com/e-commerce-gst-161024123137/85/E-commerce-under-GST-7-320.jpg)