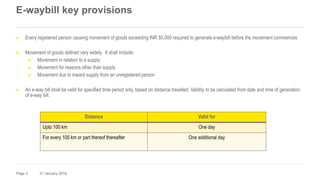

- E-way bills are required for the movement of goods exceeding 50,000 INR and must be generated before movement commences. They are valid for a specified time period based on distance travelled.

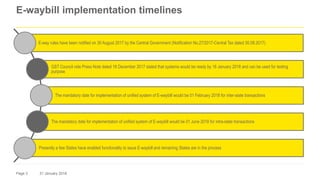

- Mandatory implementation dates are February 1, 2018 for inter-state movement and June 1, 2018 for intra-state movement.

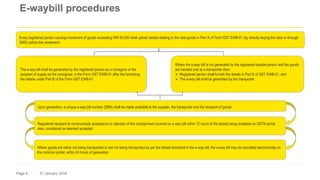

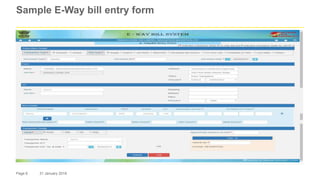

- The e-way bill procedures involve the registered consignor or consignee uploading details in Part A of the e-way bill form before movement, and an e-way bill number being generated upon submission. The transporter is responsible for generating the e-way bill if not provided by the consignor.