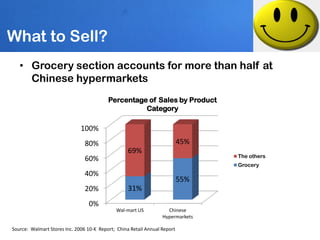

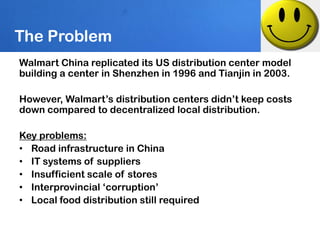

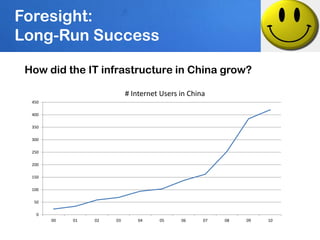

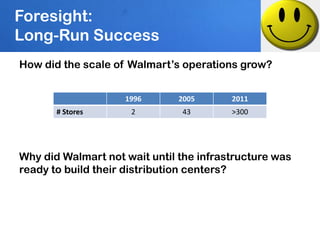

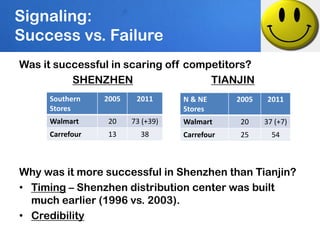

Walmart entered the Chinese market in 1996 and has since expanded to over 189 stores across China. While Walmart has had success replicating aspects of its US model in China, it has faced key issues in distribution and targeting the right customers. Walmart built early distribution centers in China despite infrastructure challenges to signal long-term commitment and scare off competitors, though this approach was more successful in Shenzhen than Tianjin due to timing and credibility differences. Overall, Walmart has had to adapt its model to the Chinese market by selling more local products, focusing on quality over low prices, and utilizing a multi-tier store strategy to target different income levels.