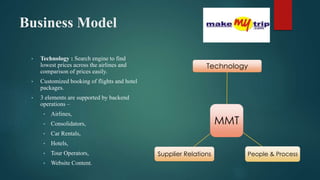

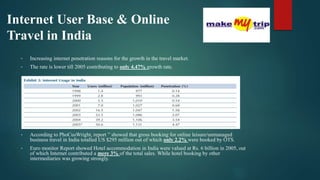

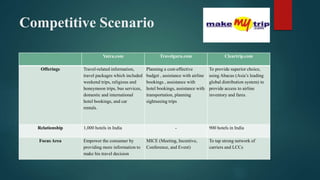

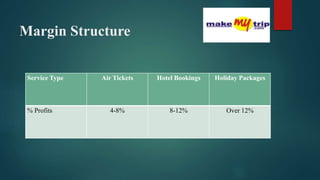

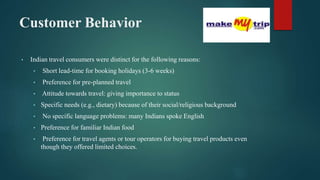

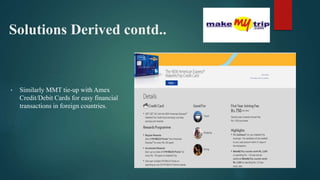

This document summarizes the services marketing and management strategies of MakeMyTrip. It discusses how MMT was launched in 2000 in the US to cater to the niche market of travel between US and India. MMT expanded to India in 2005. It highlights MMT's business model, suppliers, customers segmentation, competitive analysis, challenges faced such as low internet penetration and suppliers selling directly online. Solutions proposed include increasing customization options, sponsoring TV shows, providing international SIM cards and credit card partnerships to address challenges and leverage opportunities in the growing Indian online travel market.