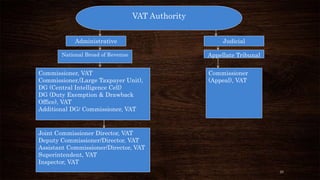

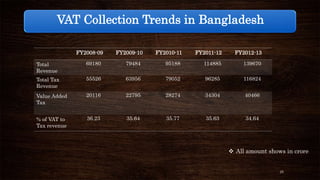

This document contains the presentation materials for a talk on taxation in Bangladesh. It discusses the history and implementation of Value Added Tax (VAT) in Bangladesh. The presentation is made up of several speakers who cover topics like the definition of VAT, the VAT mechanism, VAT rates and exemptions in Bangladesh, trends in VAT collection, and the authority that administers VAT. It provides an overview of how VAT works and its role in the Bangladeshi tax system.