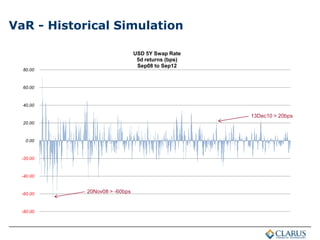

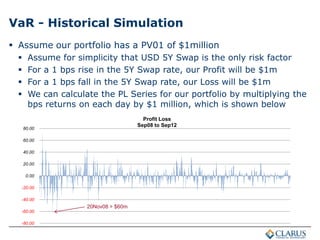

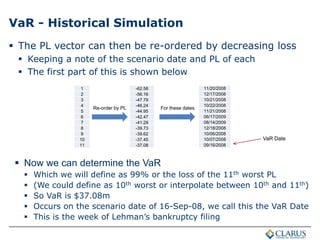

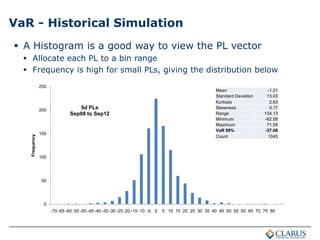

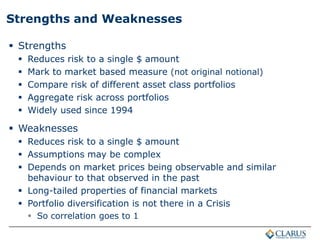

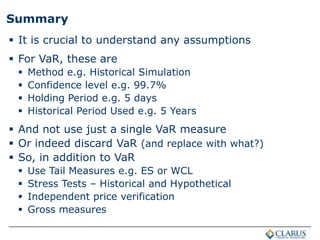

Value at Risk (VaR) is a risk measurement technique used to estimate potential losses that could occur from market risk over a specified time period. The document discusses the need for VaR, how it is defined and calculated using historical simulation, its uses, strengths and weaknesses. It emphasizes that VaR should not be used alone and other risk measures like tail measures and stress testing are also important.