1. Value at Risk (VaR) is a measure of the maximum likely loss over a target period at a given confidence level. It provides a common measure to assess and aggregate market risk across different products in a portfolio.

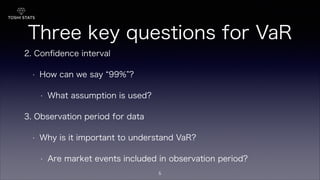

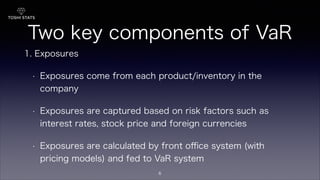

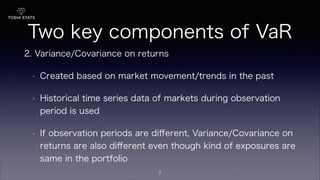

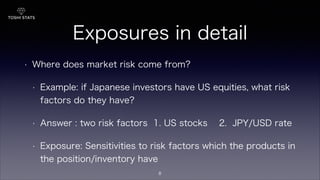

2. Calculating VaR involves determining exposures to various risk factors from positions, as well as the historical variance and covariance of returns for those risk factors. Common methods to calculate VaR include historical simulation, variance-covariance, and Monte Carlo simulation.

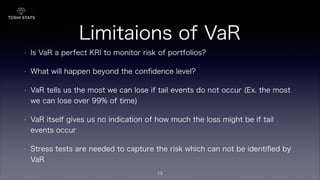

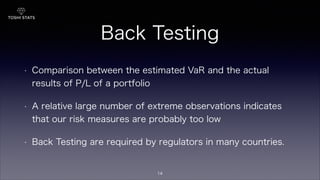

3. While VaR provides a useful measure of risk, it has limitations as it only provides information about losses up to the confidence level and does not indicate how large losses could be in extreme events. Therefore, stress testing is also needed to