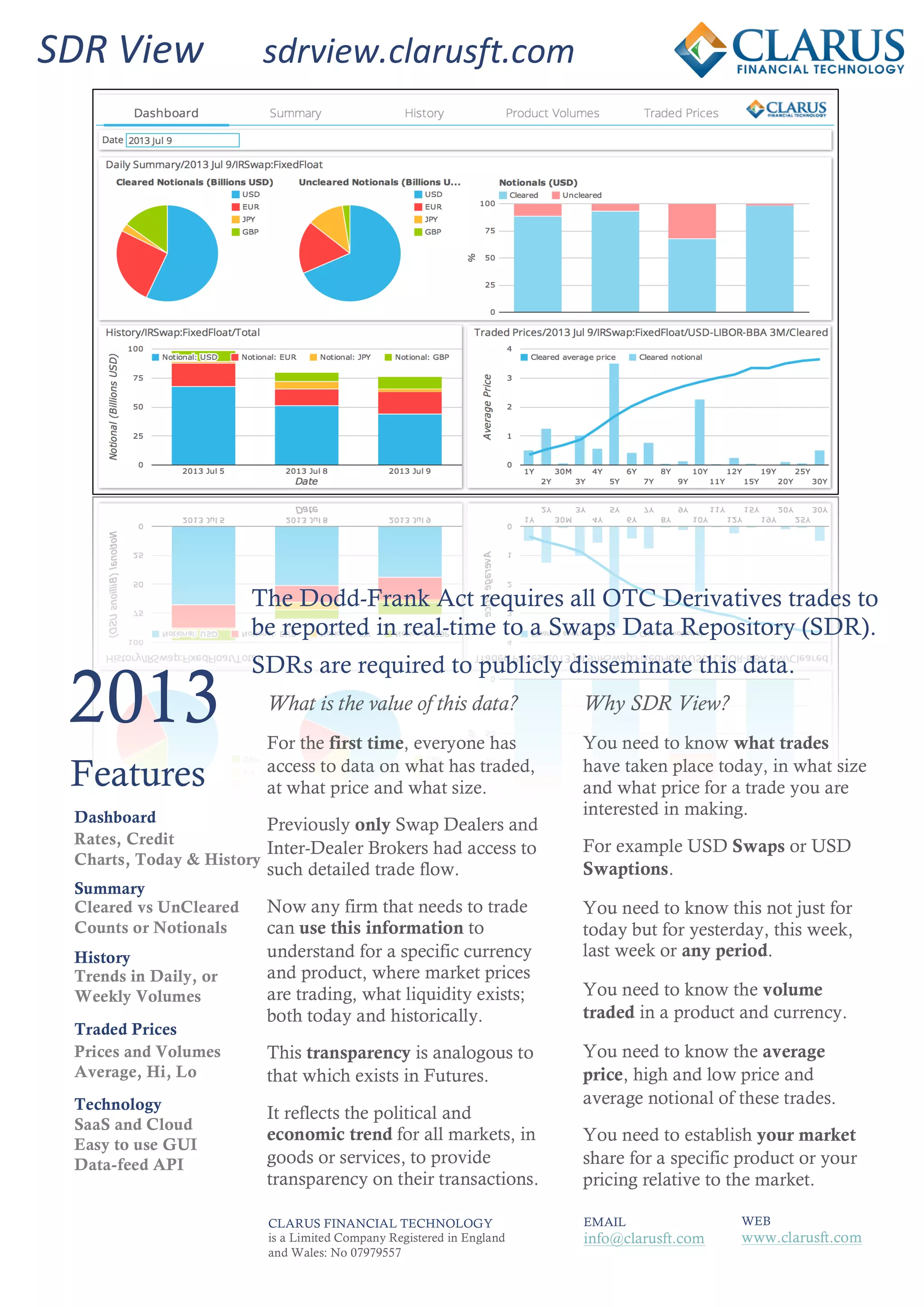

The document discusses the value of swap data reported to Swap Data Repositories (SDRs) under Dodd-Frank regulations. It notes that for the first time, all market participants have access to data on swap transaction prices, sizes, and volumes. This transparency allows firms to understand market pricing and liquidity to inform their own trading activities. The document then describes the features of the SDR View software which aggregates and visualizes SDR swap data to provide users insights into recent and historical swap market prices, volumes, and their own market share.