The document discusses several basic valuation models and concepts, including:

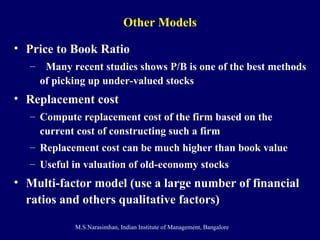

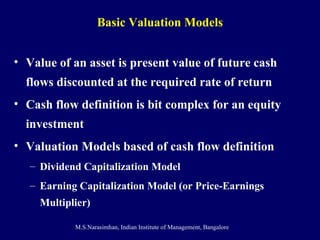

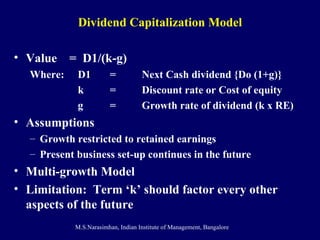

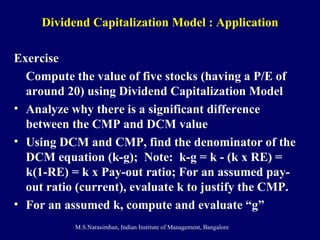

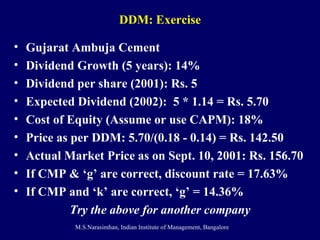

1. The dividend capitalization model values a stock based on its expected future dividends discounted at the cost of equity minus the growth rate.

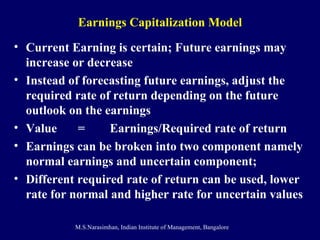

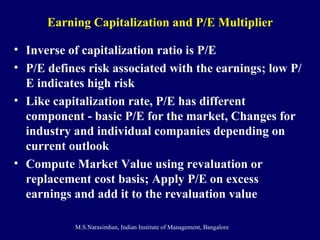

2. The earnings capitalization model values a stock based on its expected future earnings divided by the required rate of return.

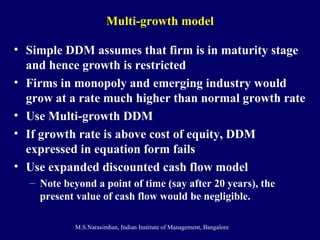

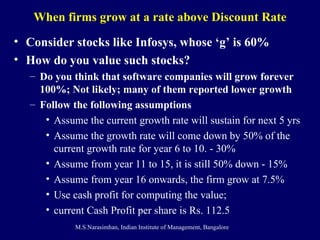

3. For high-growth stocks, a multi-stage dividend discount model may be needed to account for changing growth rates over time.

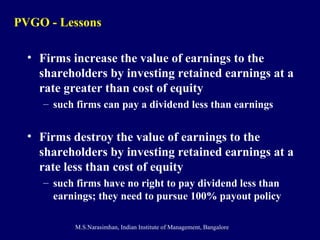

4. The present value of growth opportunities considers how retained earnings are reinvested at rates different than the cost of equity.

![Present Value of Growth Opportunities (PVGO) Suppose EPS & dividend Rs. 10 & Rs. 8 and k=10% If retained earnings invested at a rate equal to 10%, then Value of the firm is equal to D 1 /(k-g) = 8/(.10-.02) = 100 E 1 /k = 10/.10 = 100 If retained earnings are invested suboptimally or higher rate of return Value = (EPS 1 / r) + PV of return arising out of RE = (EPS 1 / r) + [NPV 1 /(r-g)] - Example follows….](https://image.slidesharecdn.com/valuationofequitysession10-100524072847-phpapp01/85/Valuation-of-equity-session-10-8-320.jpg)

![PVGO - Example If retained earnings are invested at higher rate of return say 20% against cost of equity of 10% Value = (EPS 1 / r) + NPV 1 /(r-g) = (10/.10) + [2/(.10-.04)] = 100+33.33 = 133.33 where NPV 1 = -2 + [(.2*2)/.10] = 2; g = 20%*20% If retained earnings are invested at lower rate of return say 5% against cost of equity of 10% Value = (EPS 1 / r) + NPV 1 /(r-g) = (10/.10) + [-1/(.10-.01)]=100-11.11 = 88.89 where NPV 1 = -2 + [(.05*2)/.10] = -12.50; g = 5%*20%](https://image.slidesharecdn.com/valuationofequitysession10-100524072847-phpapp01/85/Valuation-of-equity-session-10-9-320.jpg)

![PVGO - Example If retained earnings are invested at higher rate of return say 20% against cost of equity of 10% Value = (EPS 1 / r) + NPV 1 /(r-g) = (10/.10) + [2/(.10-.04)] = 100+33.33 = 133.33 where NPV 1 = -2 + [(.2*2)/.10] = 2; g = 20%*20% If retained earnings are invested at lower rate of return say 5% against cost of equity of 10% Value = (EPS 1 / r) + NPV 1 /(r-g) = (10/.10) + [-1/(.10-.01)]=100-11.11 = 88.89 where NPV 1 = -2 + [(.05*2)/.10] = -12.50; g = 5%*20%](https://image.slidesharecdn.com/valuationofequitysession10-100524072847-phpapp01/85/Valuation-of-equity-session-10-10-320.jpg)