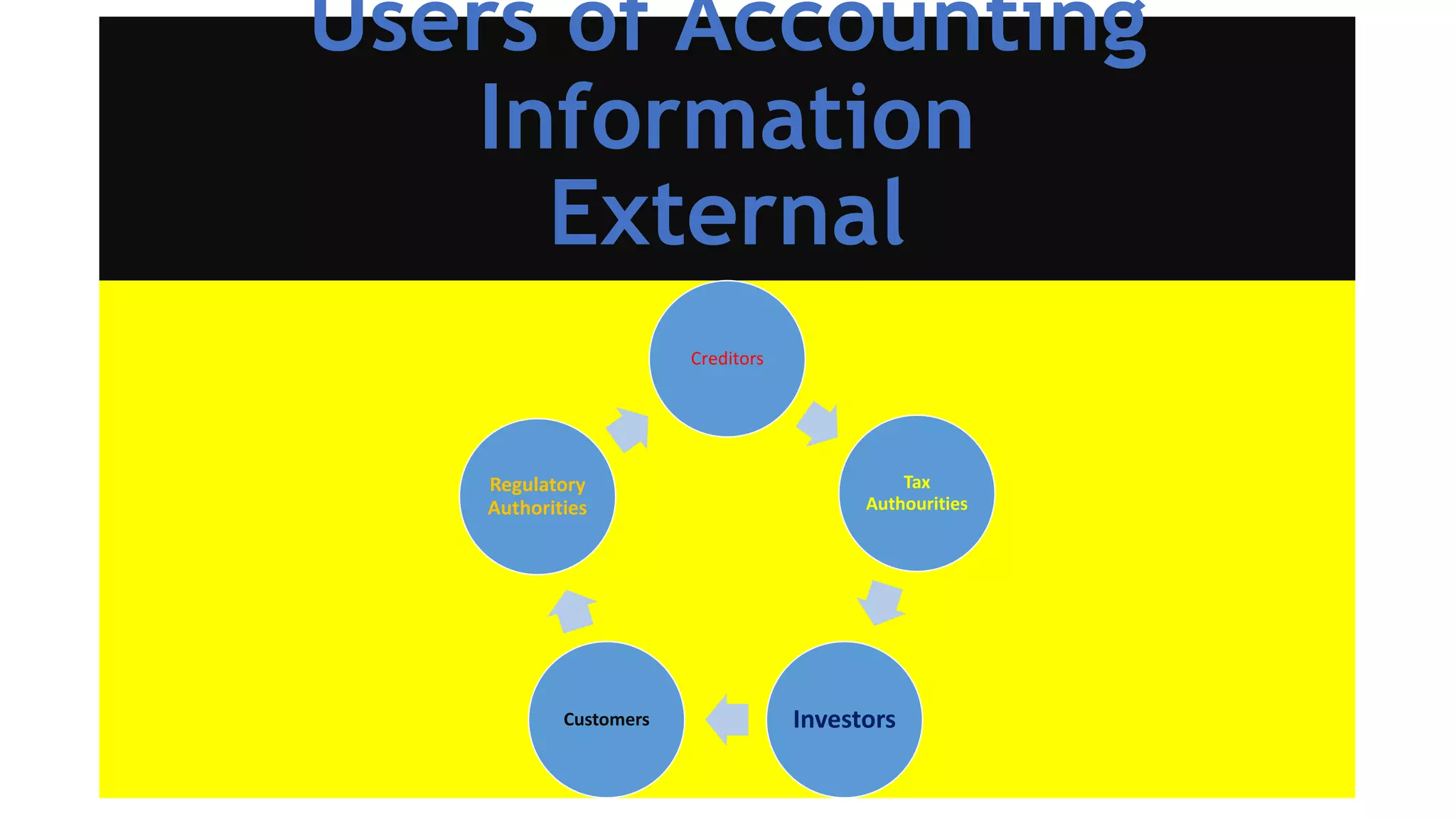

This document discusses the users of accounting information, both internal and external to an organization. Internal users include management, employees, and owners, who use accounting data to analyze performance, assess profitability and viability, and determine compensation and job security. External users consist of creditors, tax authorities, investors, customers, and regulatory bodies. Creditors examine creditworthiness and risk. Tax authorities review tax filings. Investors analyze investment feasibility and returns. Customers ensure stable supply. Regulators ensure compliance with disclosure rules. Overall, accounting information helps both internal and external users make better financial decisions.