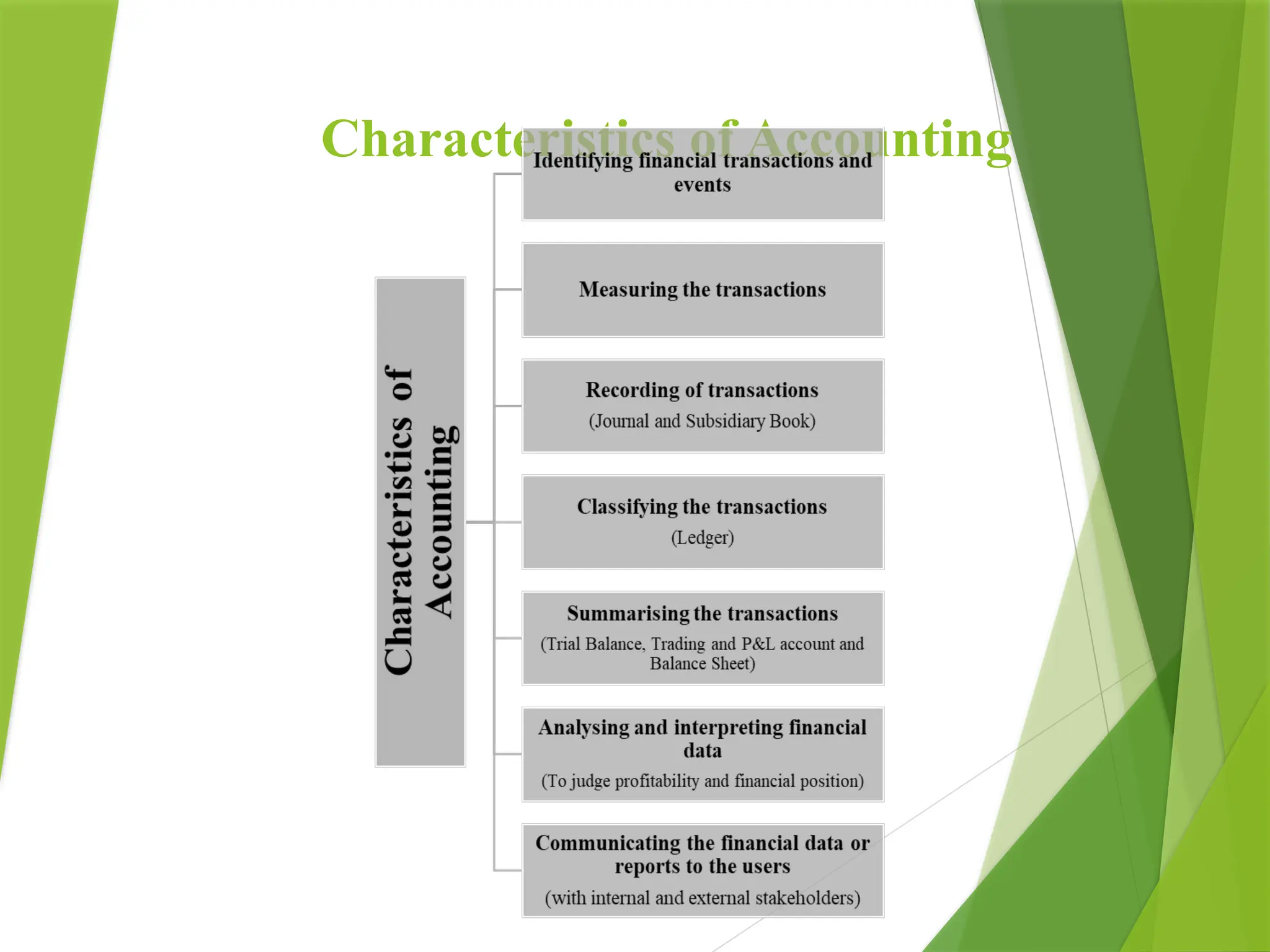

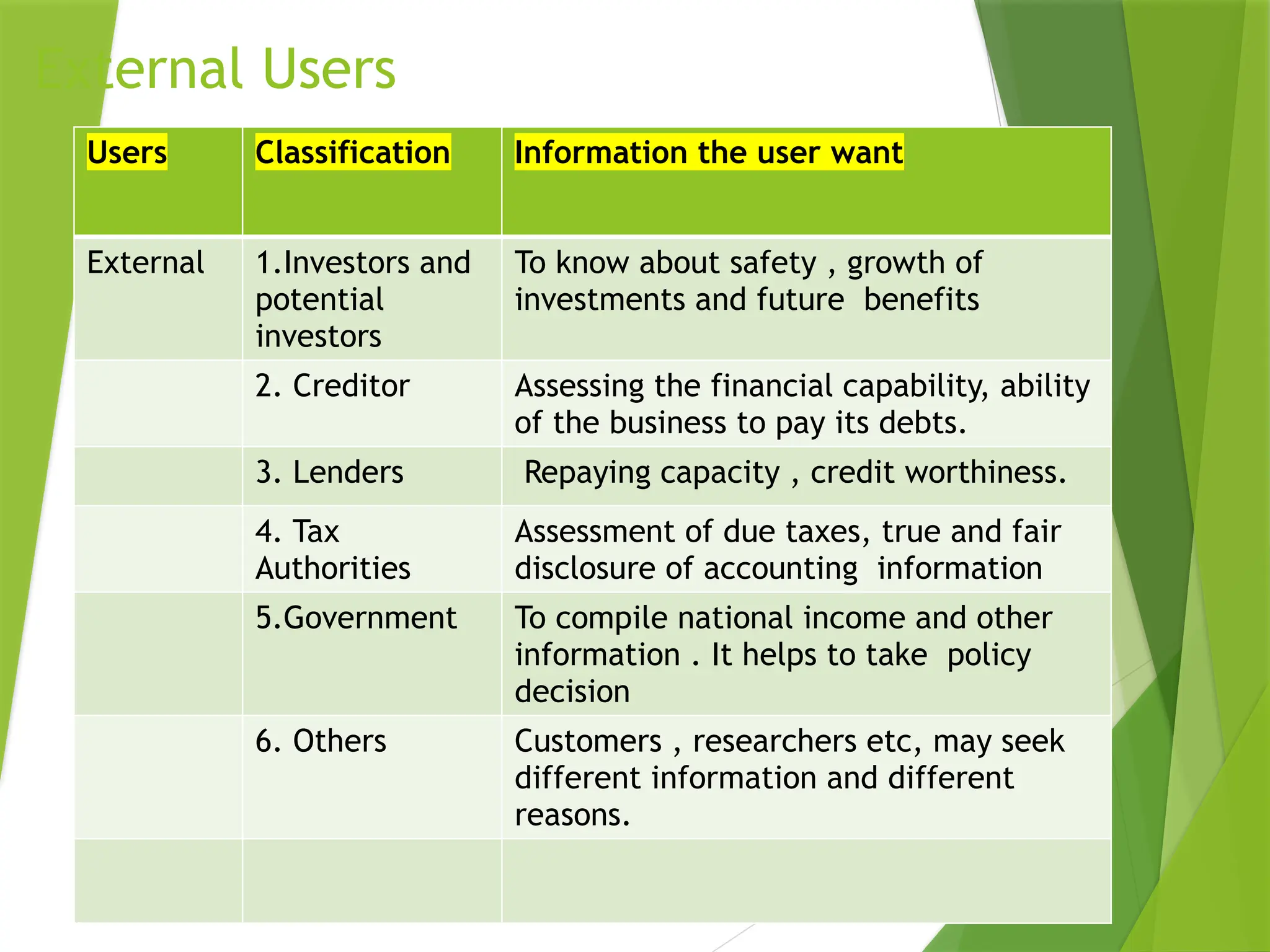

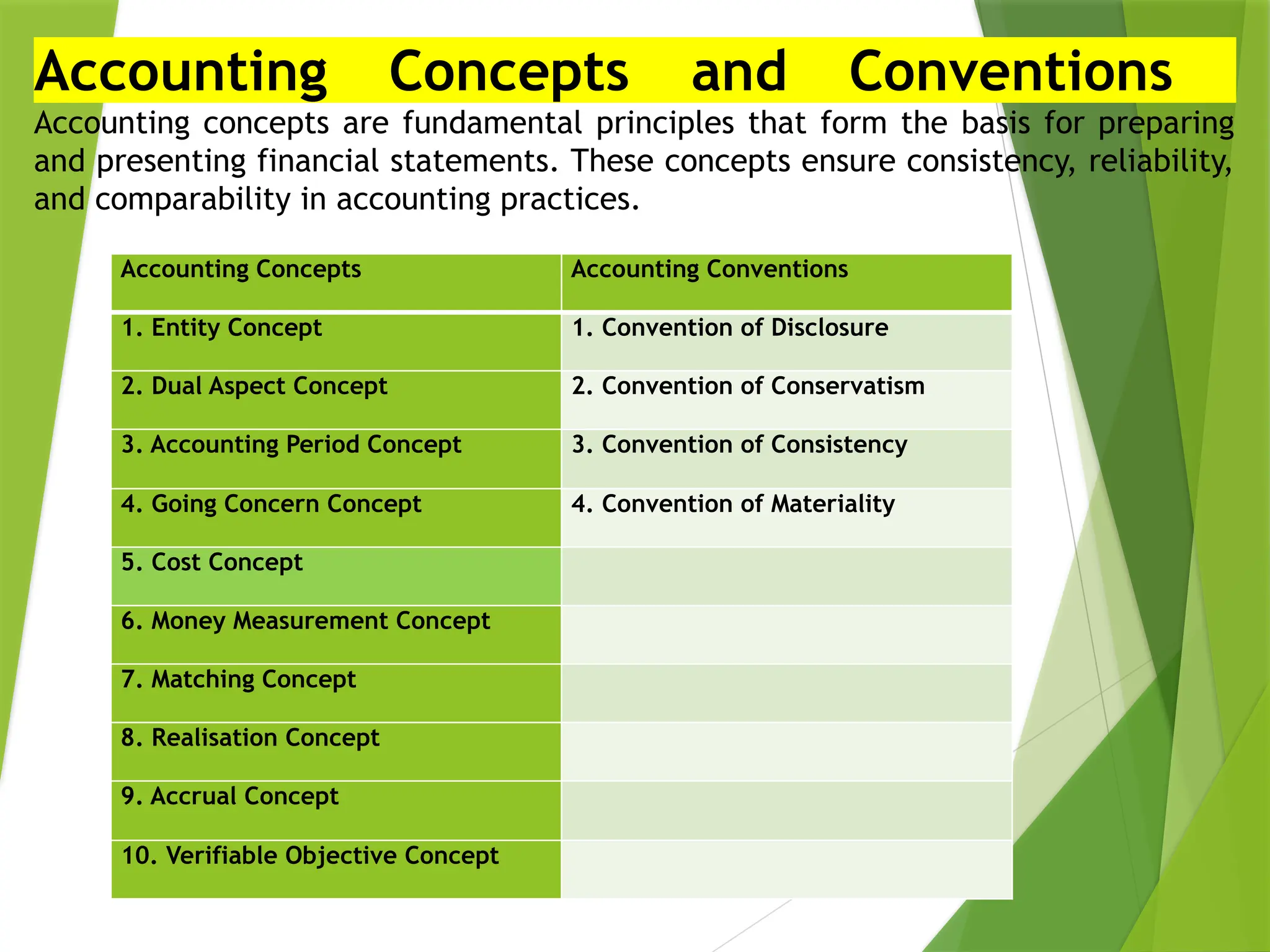

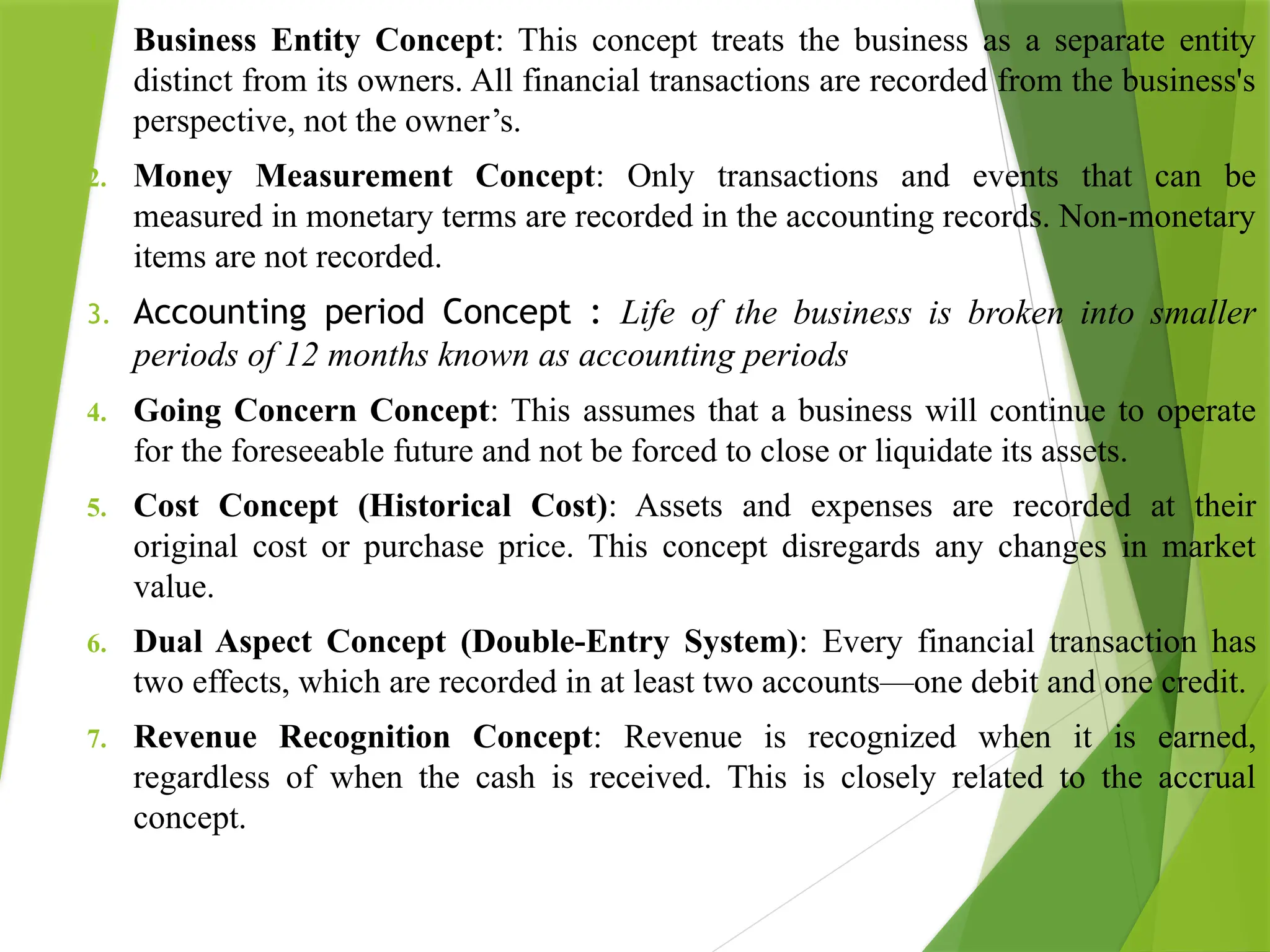

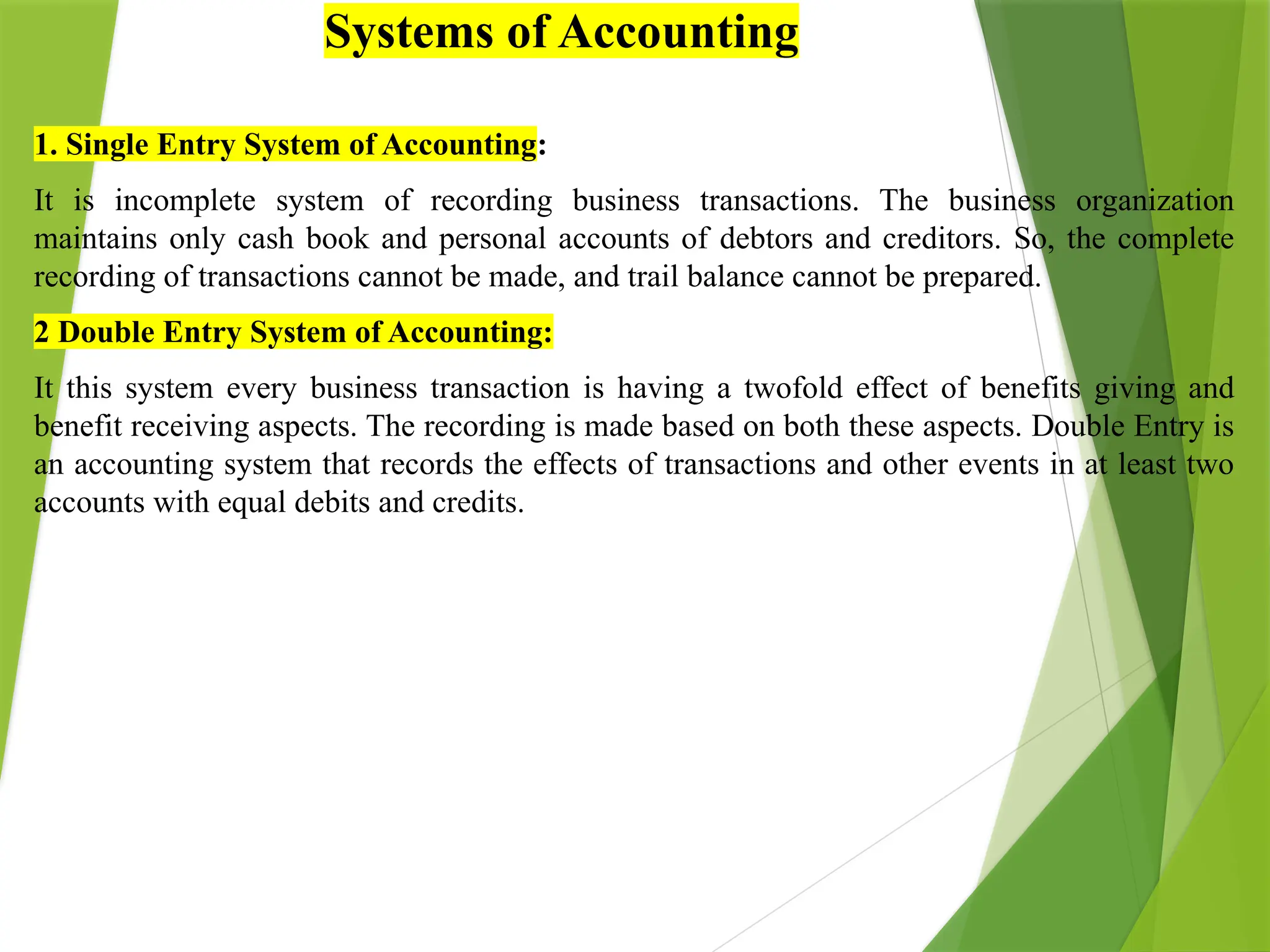

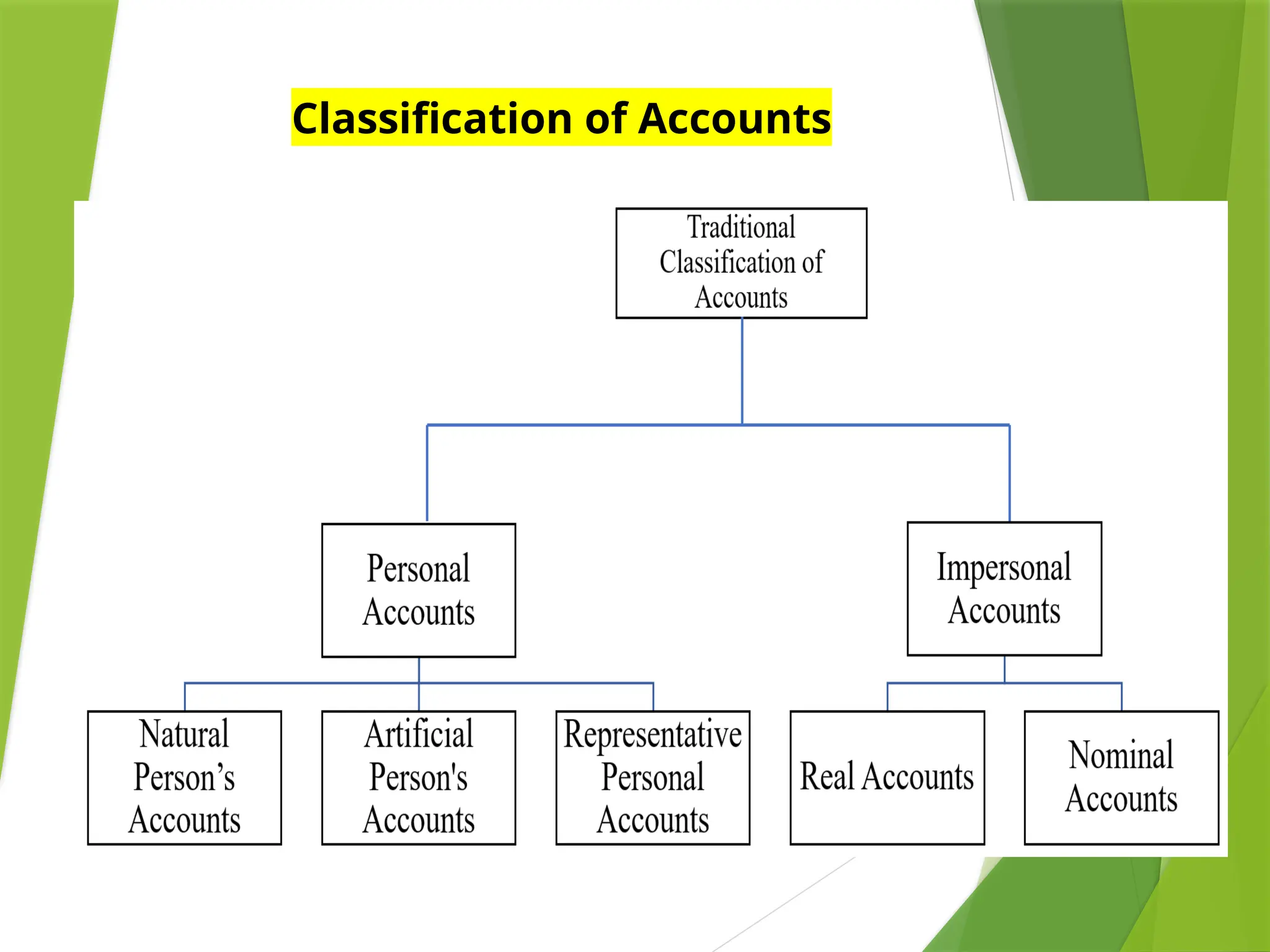

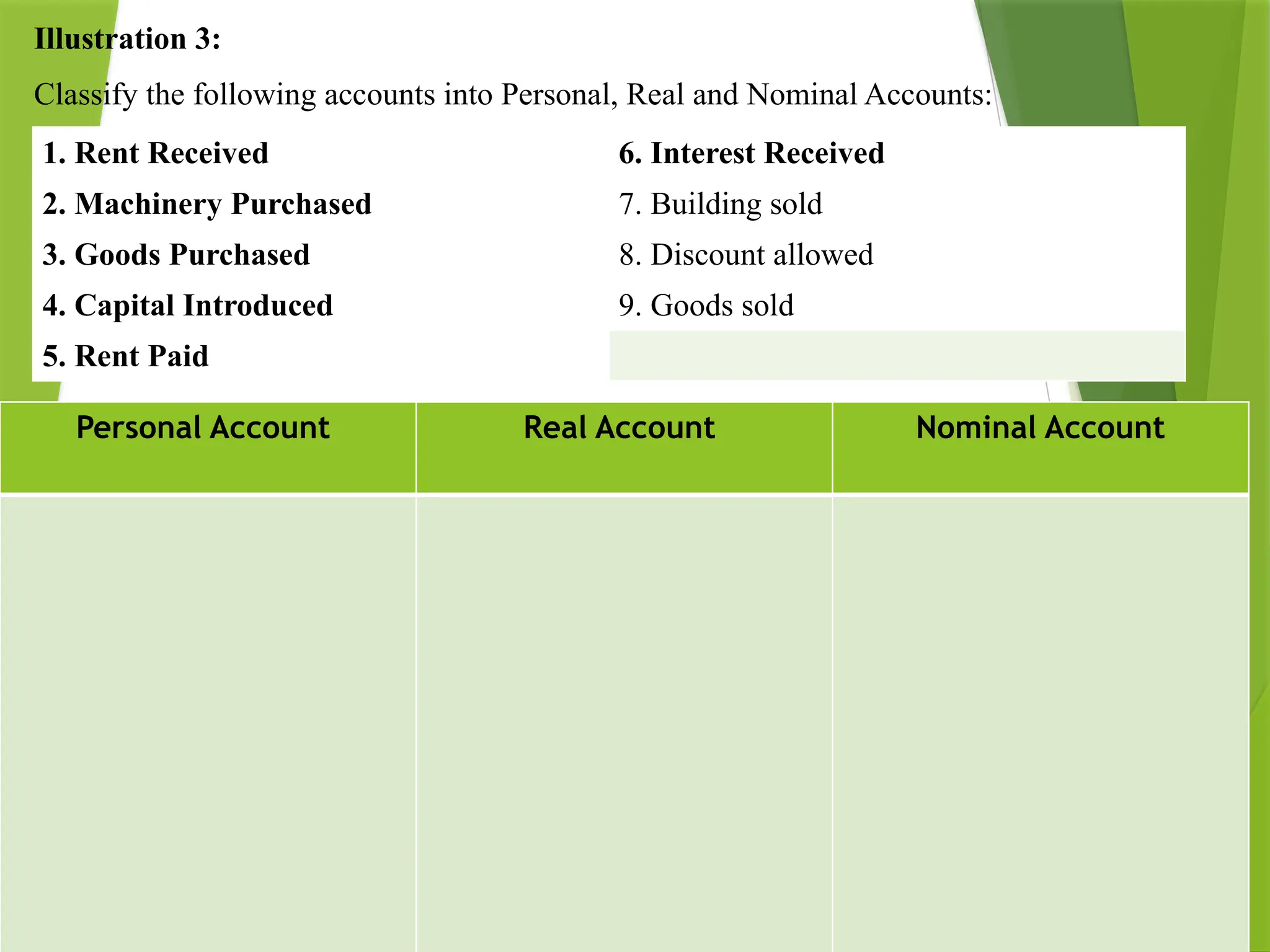

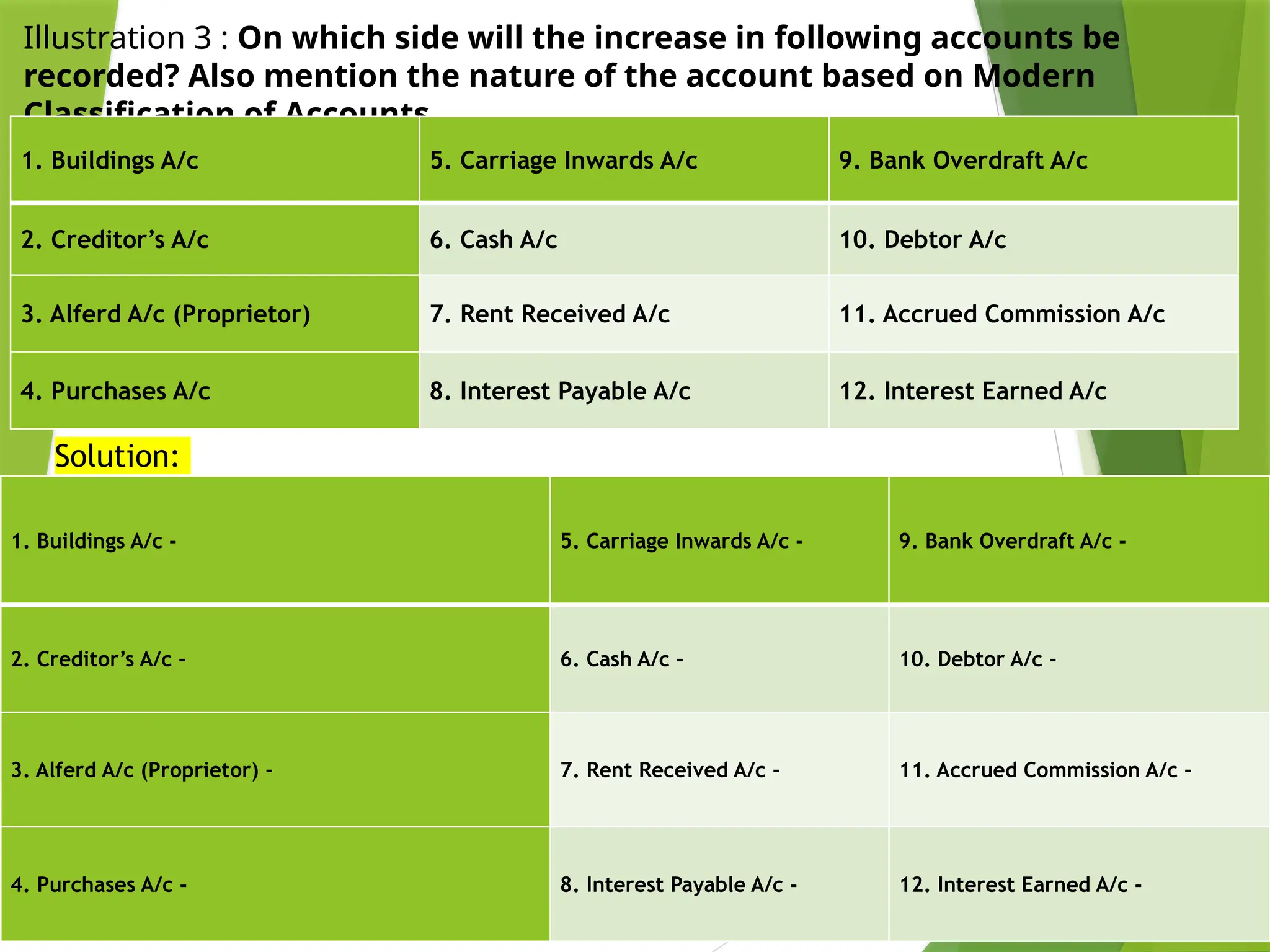

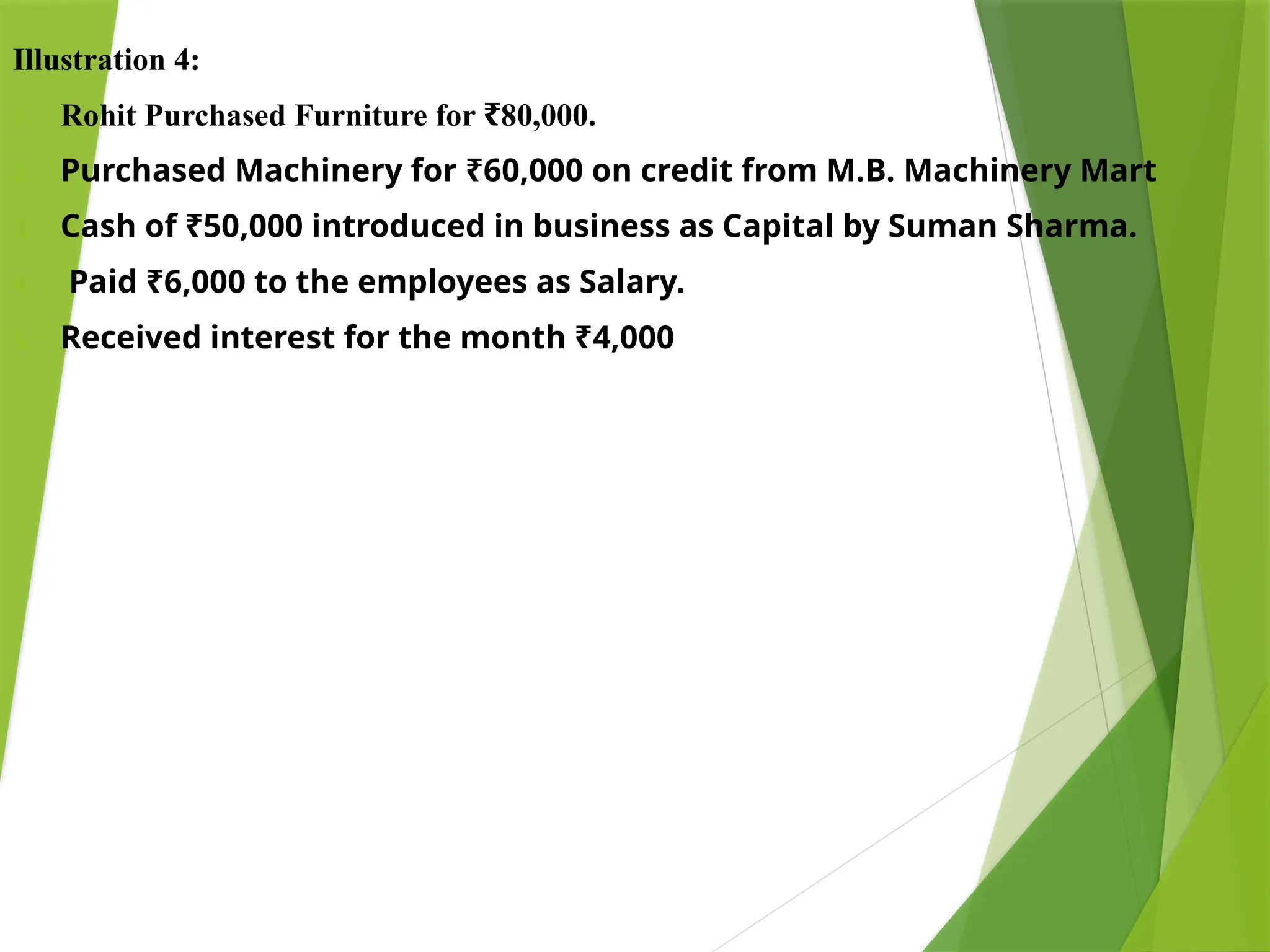

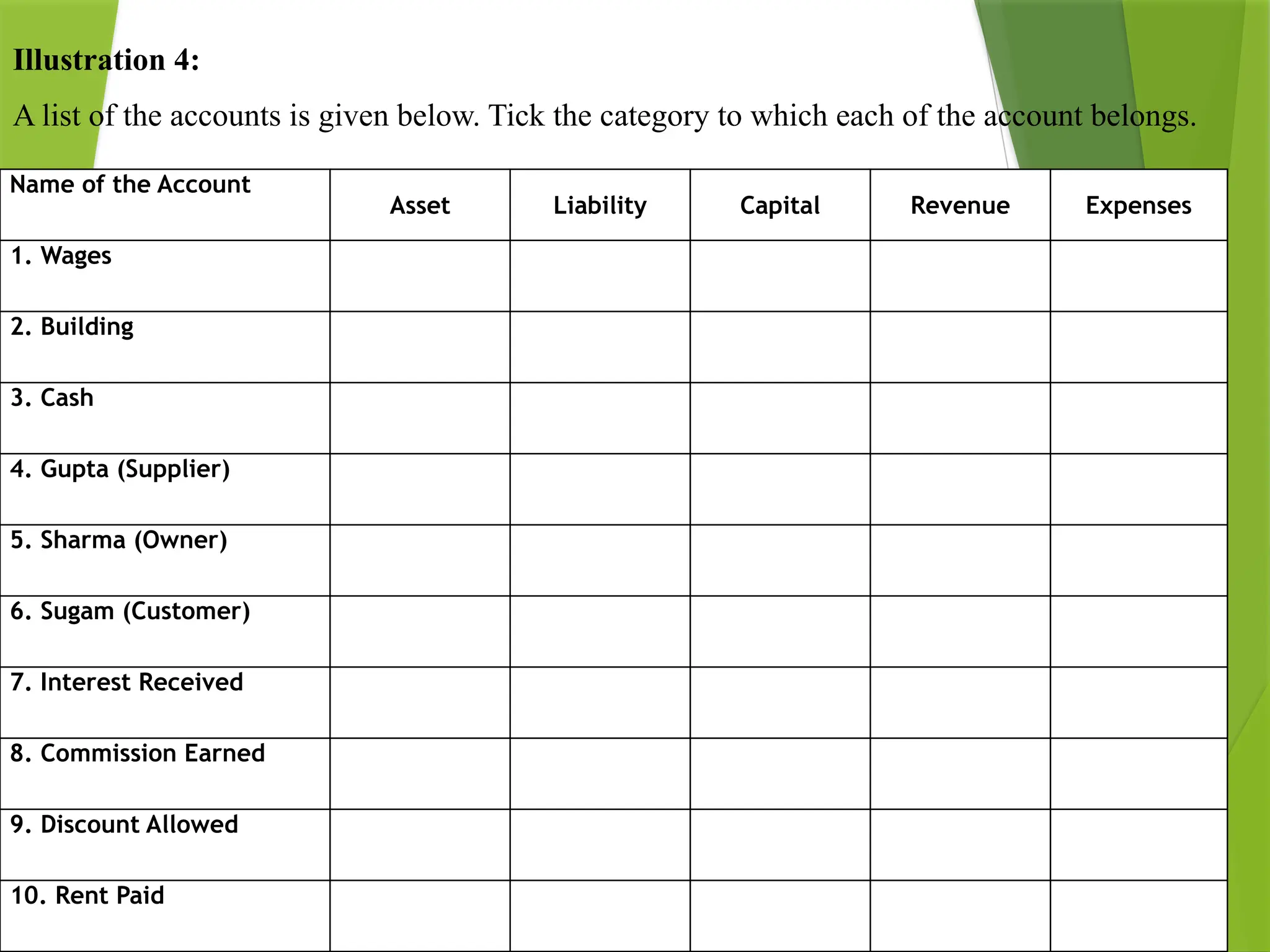

The document covers business accounting principles and practices across six units, introducing concepts such as accounting systems, bookkeeping, final accounts, IFRS, and emerging trends in accounting. It elaborates on the classification of business firms, the objectives and functions of accounting, and the roles of accountants and accounting information. Additionally, it discusses different branches of accounting, fundamental concepts, conventions, and rules for maintaining systematic financial records.