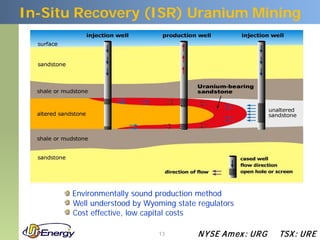

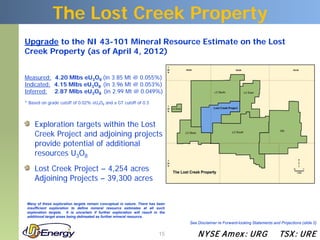

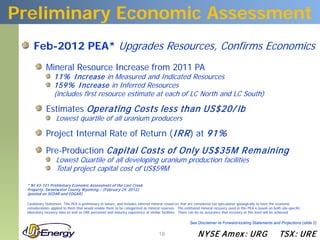

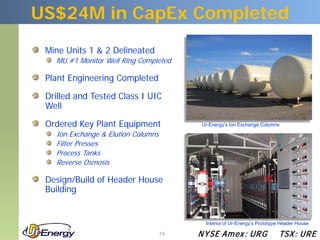

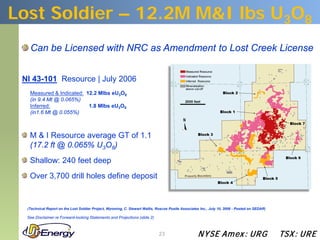

Ur-Energy is an advanced pre-production junior mining company focused on developing low-cost uranium production properties in the United States. The company owns the Lost Creek property in Wyoming, which has received several key licenses and permits and needs only one remaining regulatory approval. Construction is expected to begin this summer and production is planned to start in the second quarter of next year, ramping up to 1 million pounds per year. The property has increased uranium resources and preliminary economic assessments confirm its low operating costs and high projected returns.