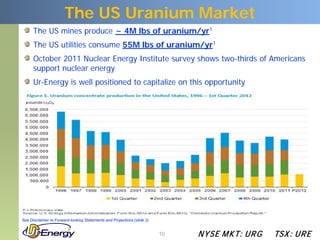

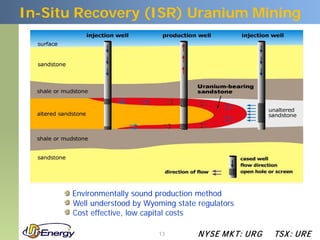

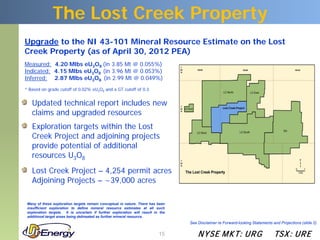

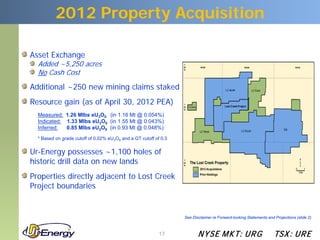

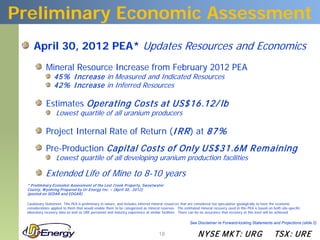

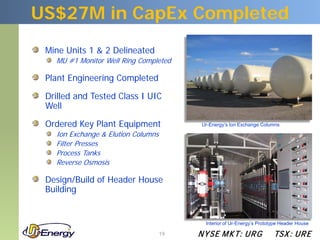

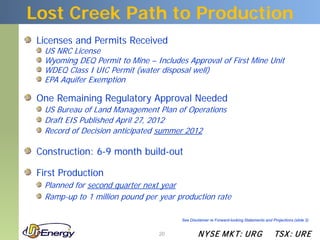

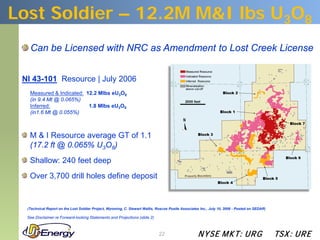

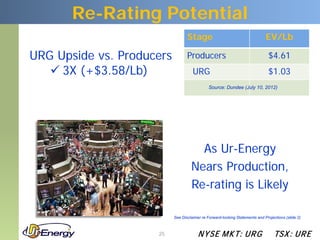

This document provides an overview and corporate presentation for Ur-Energy, an advanced pre-production junior mining company focused on developing low-cost uranium production properties in the United States. Key points include: Ur-Energy's objective is the development of its Lost Creek property in Wyoming, with resource growth and strategic opportunities; it has completed $27 million in capital expenditures towards Lost Creek and needs one remaining regulatory approval; and a preliminary economic assessment estimates an internal rate of return of 87% for Lost Creek with an operating cost of $16.12 per pound and a pre-production capital cost of $31.6 million remaining.