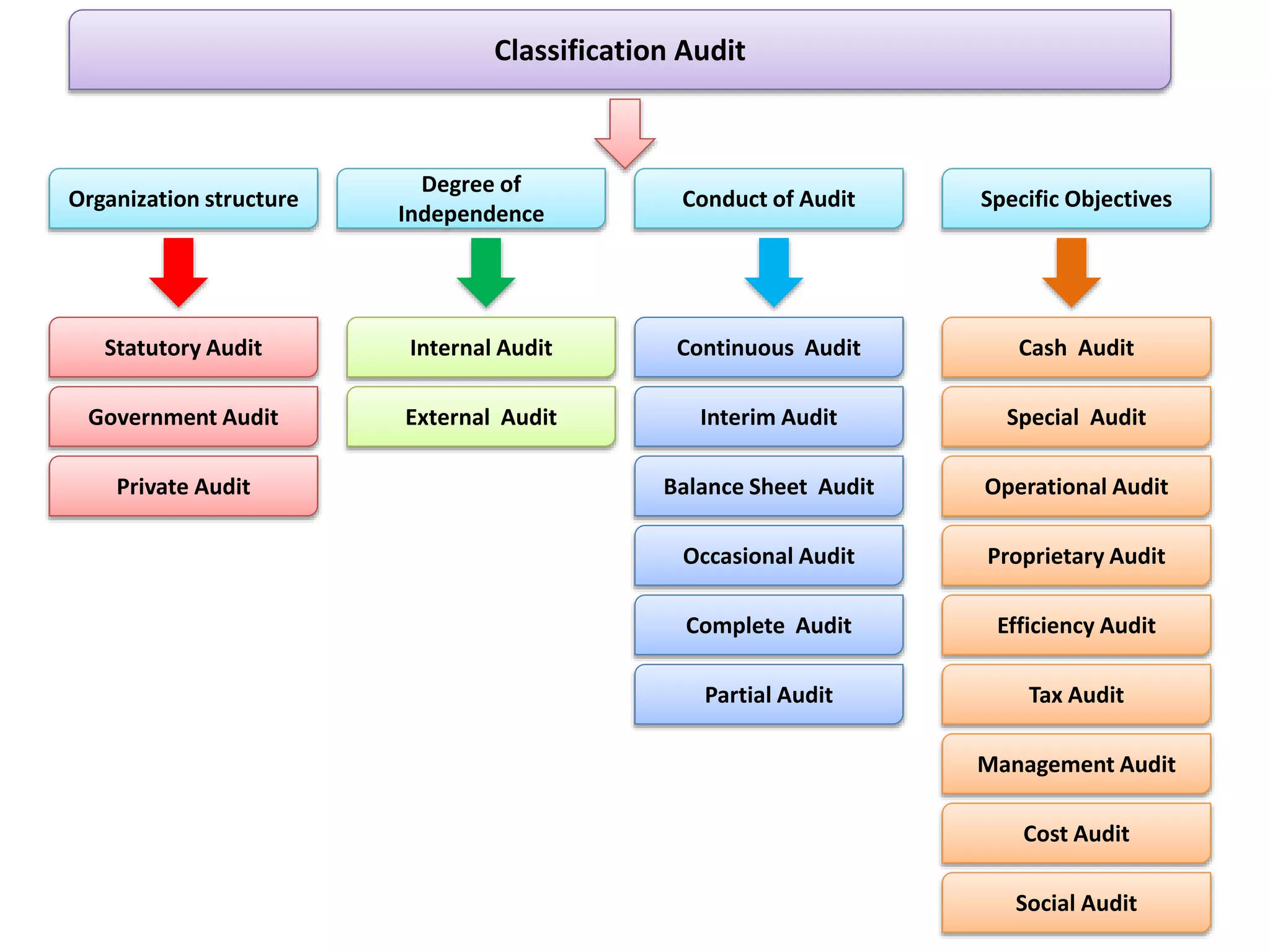

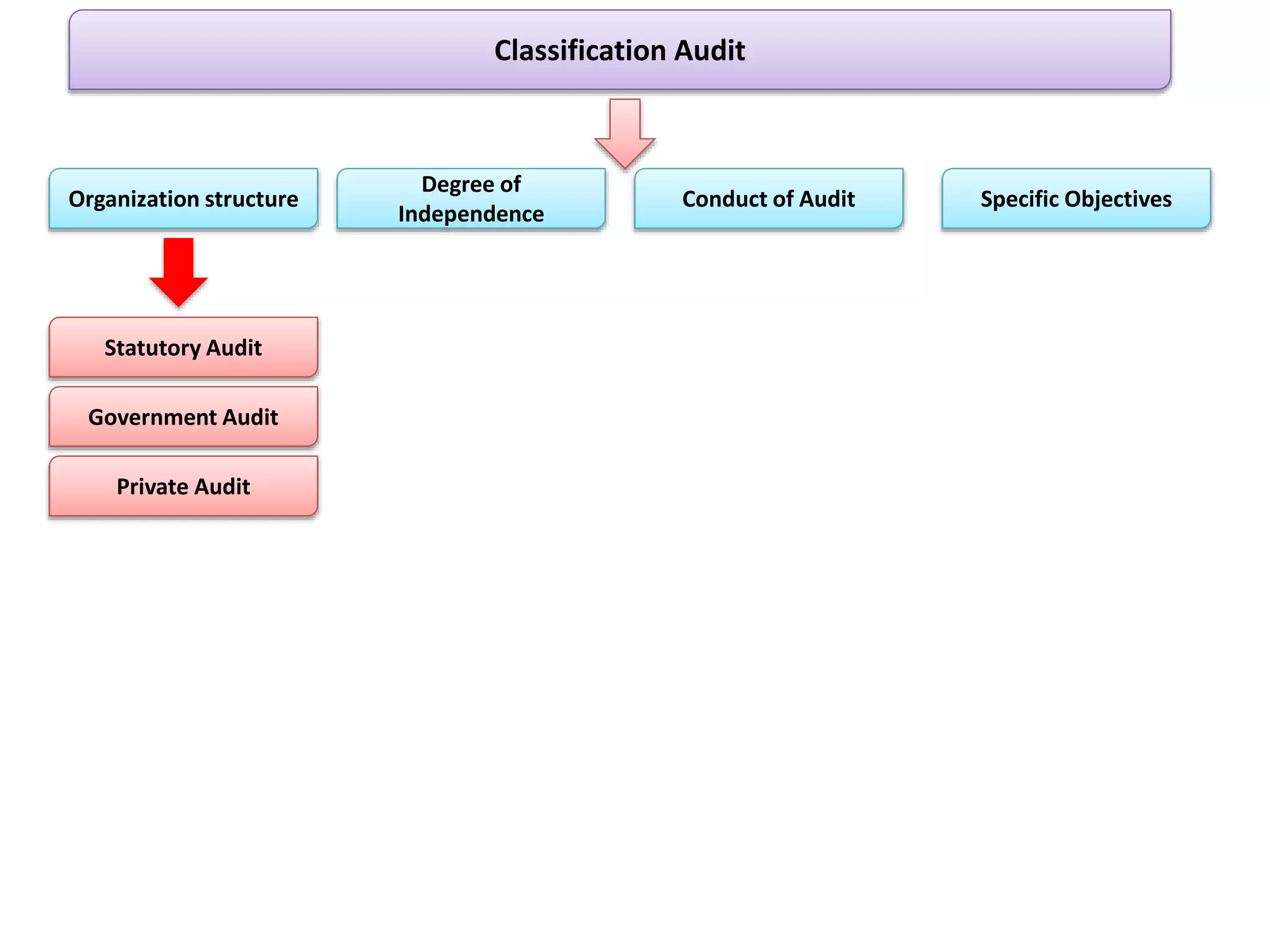

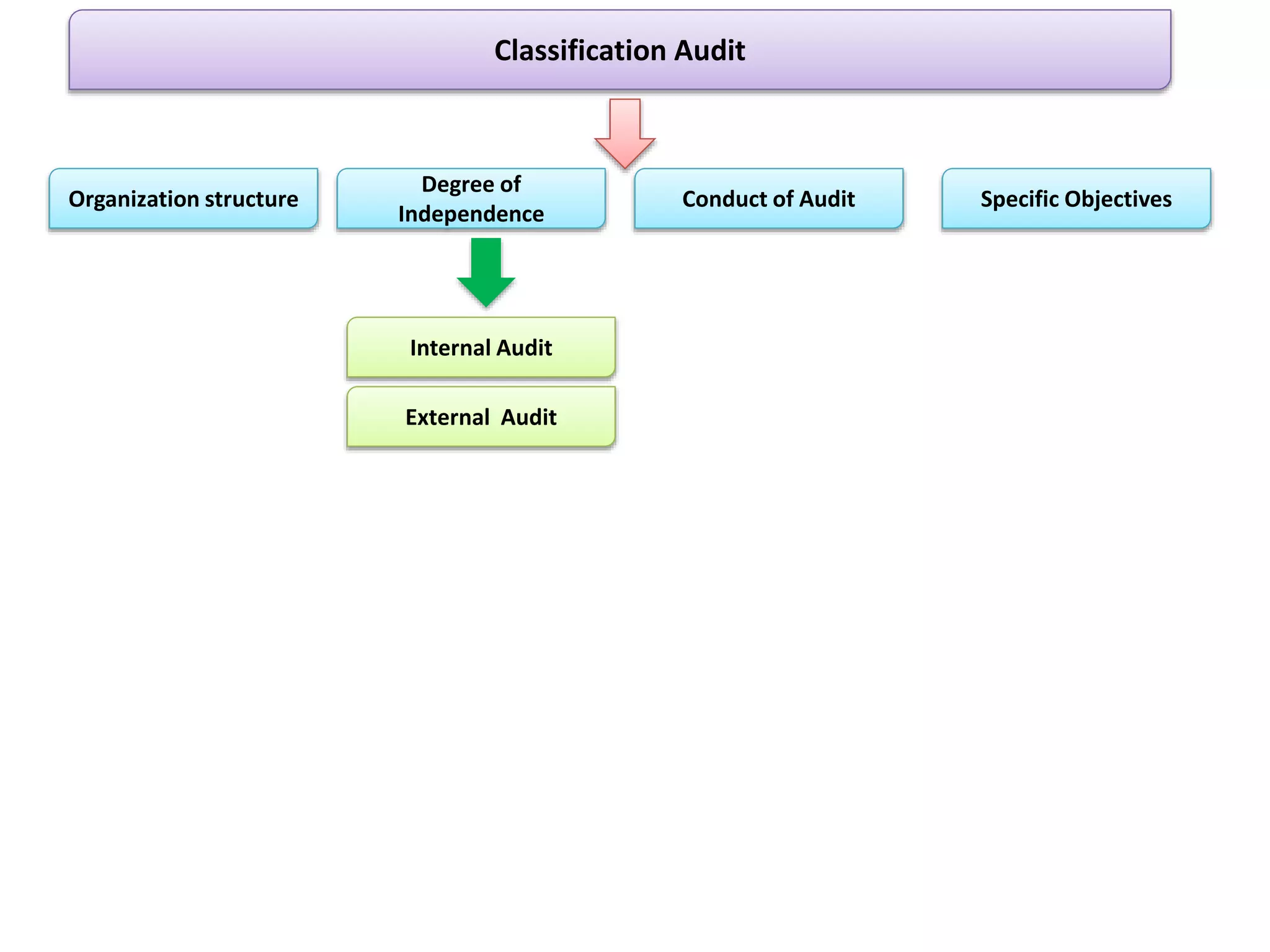

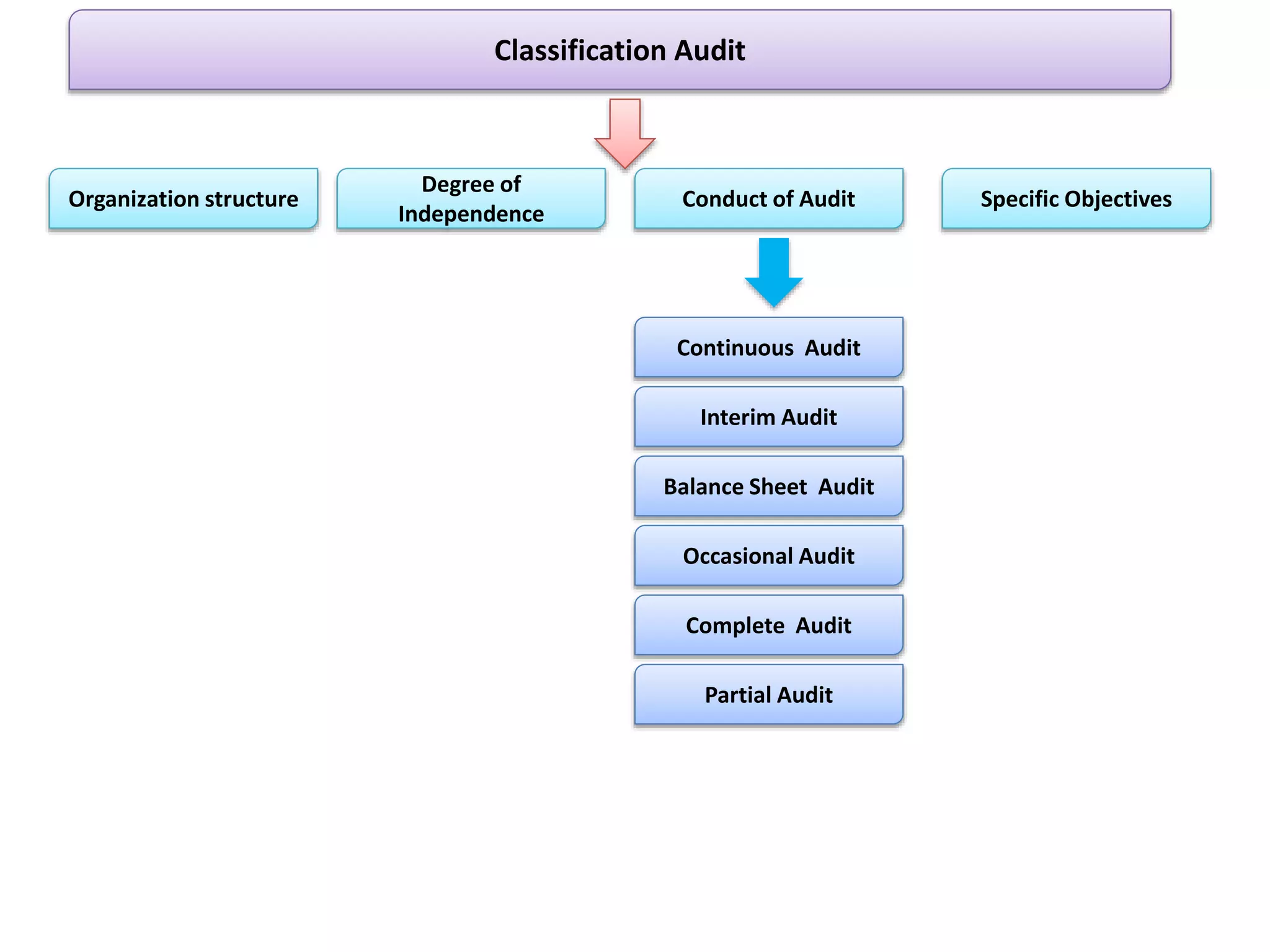

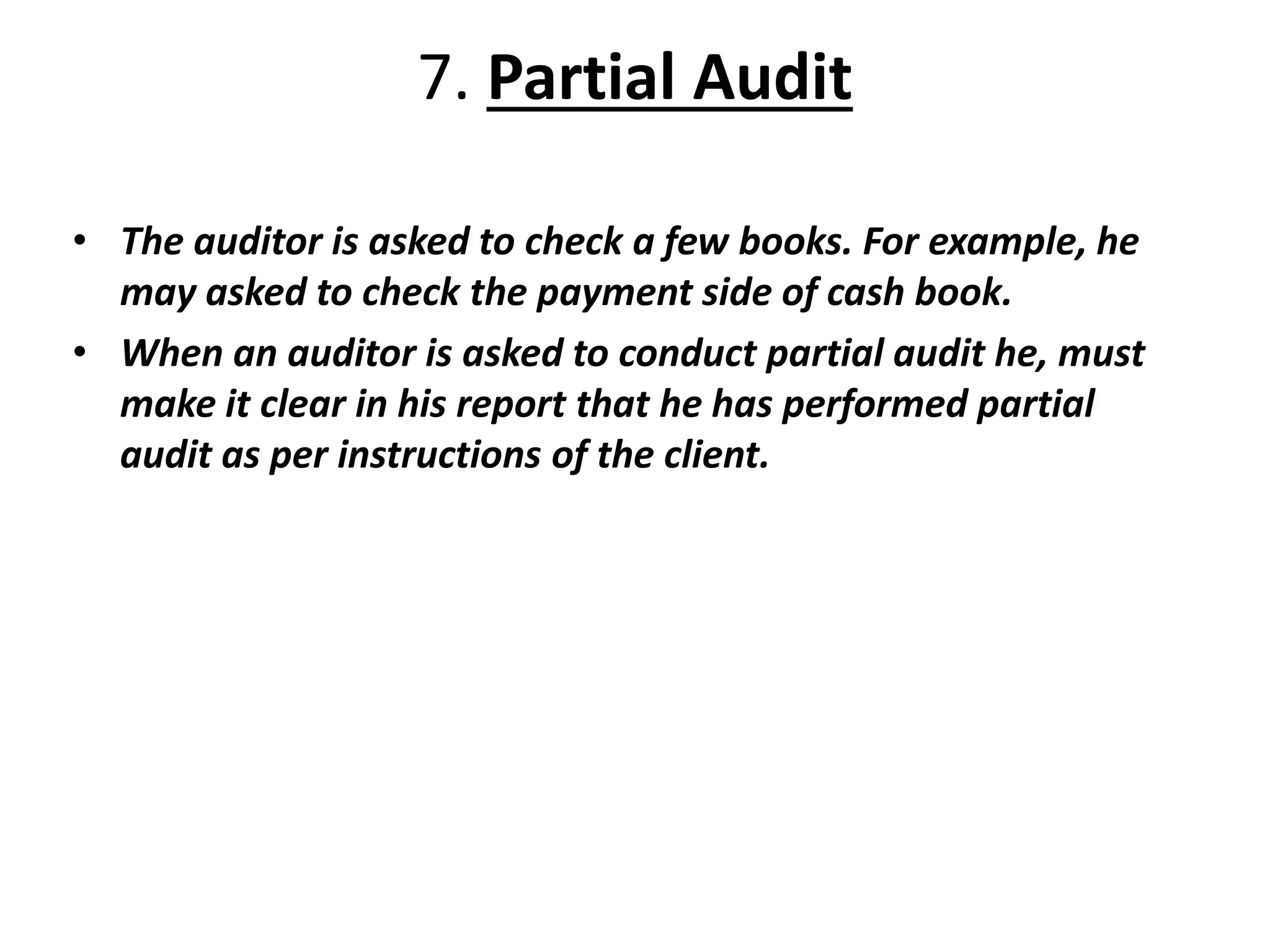

This document discusses various types of audits including statutory audit, government audit, private audit, internal audit, external audit, continuous audit, interim audit, balance sheet audit, occasional audit, complete audit, partial audit, cash audit, special audit, operational audit, proprietary audit, efficiency audit, tax audit, management audit, cost audit, social audit, classification audit, bank audit, forensic audit, and human resource audit. It provides definitions and objectives for each type of audit. Key points include that statutory audit is compulsory under law, government audit audits government entities, internal audit is conducted by organization staff, and external audit is an independent examination of financial statements.