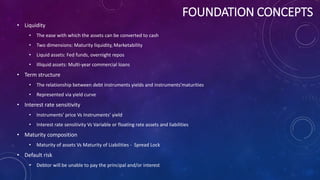

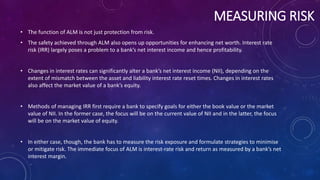

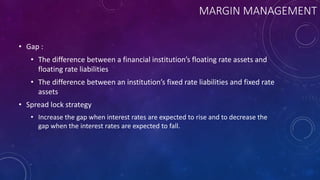

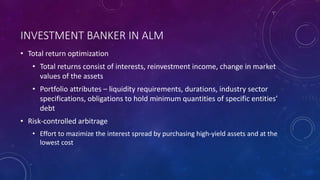

Asset liability management (ALM) addresses risks from asset-liability mismatches due to liquidity or interest rate changes. ALM systematically manages these risks through targeting metrics like net interest margin and net economic value, while maintaining balance sheet constraints. Key ALM concepts include liquidity, maturity, interest rate sensitivity, and default risk. ALM measures interest rate risk through methods like gap analysis and aims to optimize returns while controlling risk.