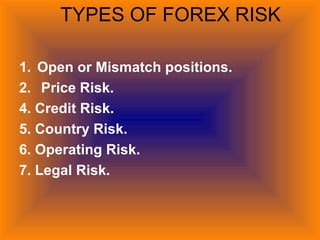

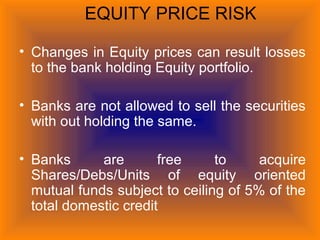

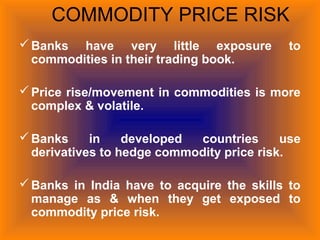

This document discusses different types of market risk that banks are exposed to, including liquidity risk, interest rate risk, foreign exchange risk, equity price risk, and commodity price risk. It provides definitions and explanations of these risks, as well as strategies that banks can employ to manage each type of market risk, such as maintaining adequate liquidity, using hedging tools and derivatives, setting prudent exposure limits, and monitoring investments. Diversification alone does not eliminate market or systematic risk for banks.