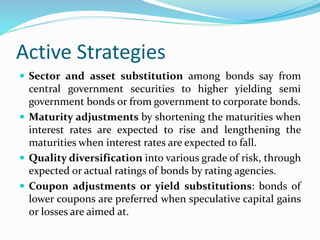

A bond is a debt security where the issuer owes the holder a debt and is obliged to repay the principal and interest at maturity. Bonds have features like nominal value, coupon rate, maturity date, and call/put options. There are various types of bonds like fixed rate, floating rate, zero coupon bonds, and municipal bonds. Bond portfolio strategies include passive buy and hold strategies, active strategies like sector substitution, and semi-active strategies like immunization and duration matching to reduce interest rate risk. Bonds are evaluated based on the issuer's financial strength and past earnings, while valuation considers the present value of future cash flows and yield measures like current yield and yield to maturity.