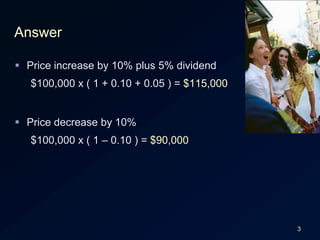

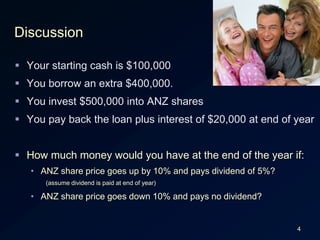

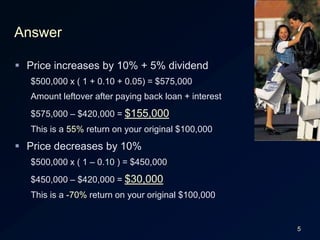

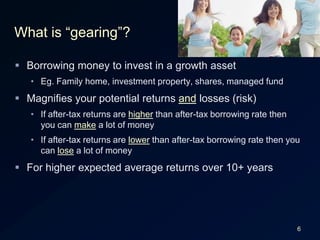

This document discusses using debt (leverage or "gearing") to invest. It provides an example showing how borrowing $400,000 to invest $500,000 in shares can magnify returns but also losses, depending on whether share prices and dividends increase or decrease. It defines gearing as borrowing to invest in growth assets. It notes that gearing is for long-term investors who can withstand short-term market fluctuations and have a high tax rate to reduce interest costs. It also defines positive and negative gearing in terms of whether investment income exceeds or is less than costs.