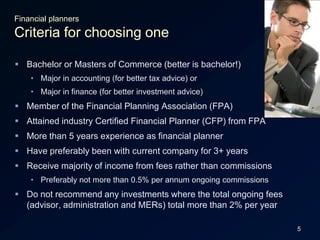

This document discusses issues with profitability in the financial planning industry and potential solutions. It notes the typical costs of running a financial planning business and that developing customized plans can take 6 hours regardless of a client's age. Most clients are unwilling to pay more than $500 for a plan or $300 annually for reviews. To address this, some planners accept commissions from fund managers of 1% of new investments plus $1,000 fees, and 0.6% annual trailing commissions plus $500 review fees. However, this approach is criticized as potentially prioritizing returns over clients' best interests. Alternative options discussed include finding a planner through referrals or the Financial Planning Association directory who charges fees rather than commissions and meets other