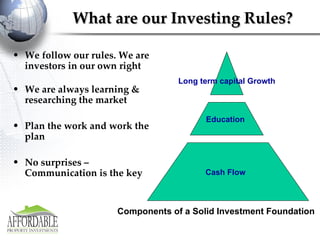

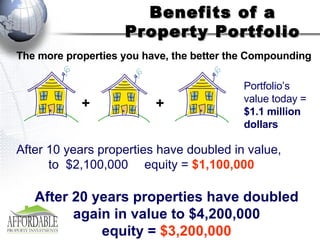

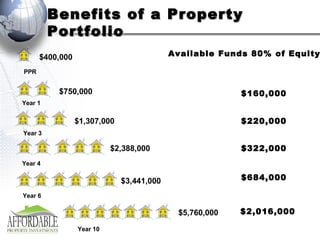

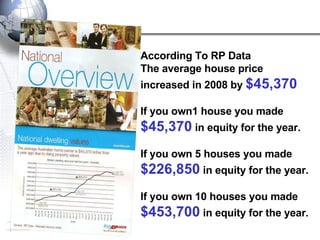

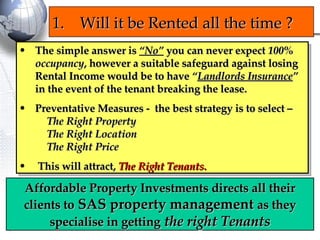

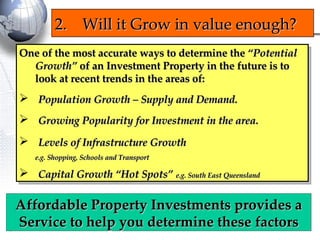

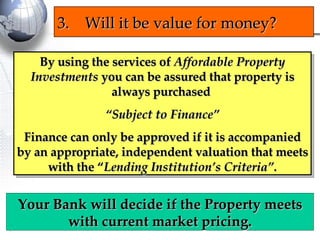

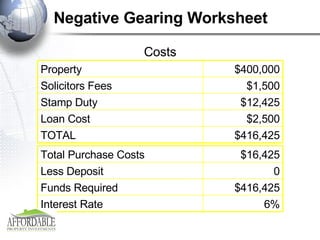

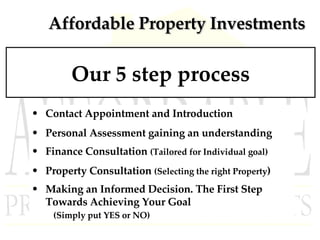

Affordable Property Investments helps people grow their wealth through property investment. It is owned by Rohan Birmingham, who has experience in property development and management. The company's goal is to create a network of experienced property investors and professionals to provide services like research, education, financing and management to help members invest successfully in properties for long-term capital growth and cash flow.