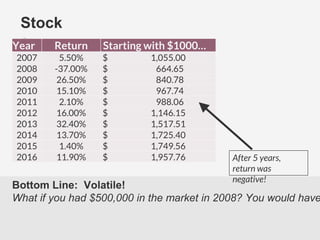

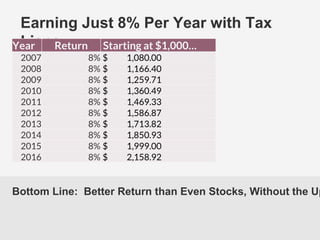

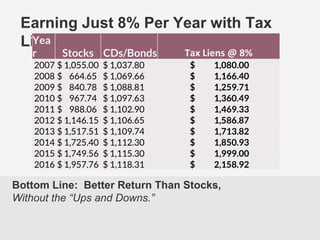

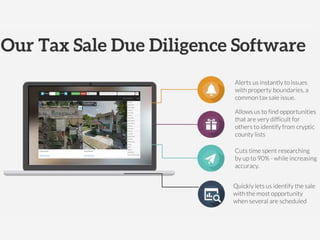

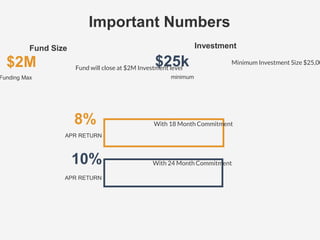

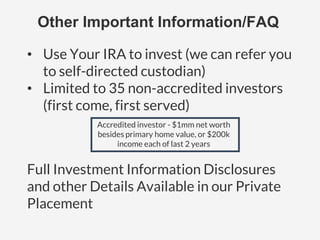

This document is a confidential investor presentation for the DeedGrabber Tax Lien Fund. The fund aims to generate above-market returns of 8-10% annually by purchasing tax liens at auctions. It has identified tax liens as an inefficient market with big opportunities. The fund has purchased over 400 tax liens in 2017 and aims to raise $2 million total. It will invest in Indiana tax liens paying 7-20% APR over 1 year. Returns are generated from lien redemptions. The fund provides diversification and removes the hassle of directly investing in tax liens.