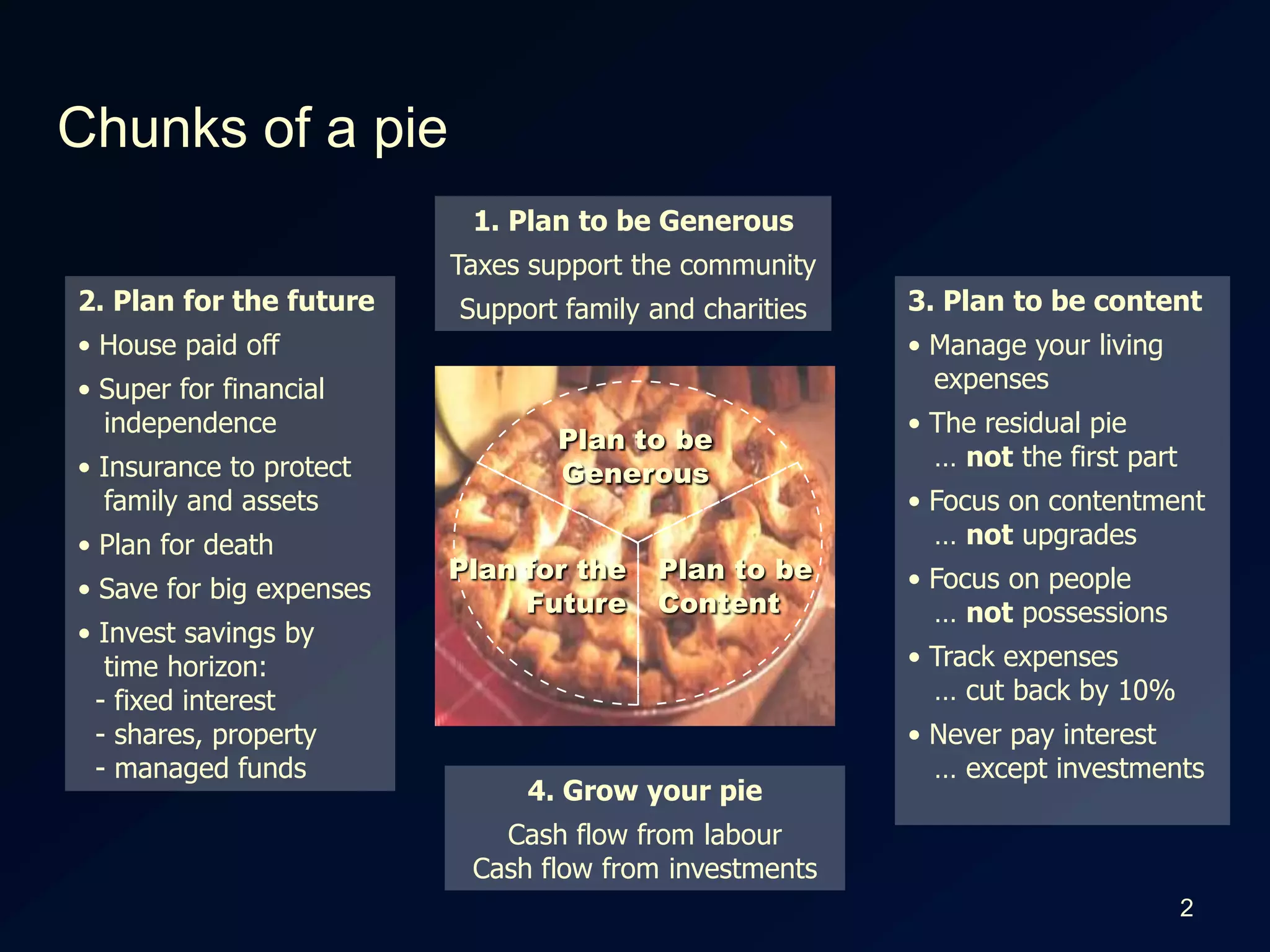

This document outlines an advanced graduate strategy for personal financial planning. The strategy involves:

1. Saving $5,000 into a savings account and $5,000 into a managed fund. Taking out a $10,000 margin loan secured by the managed fund to invest more.

2. Using the margin loan to continue investing in the managed fund up to a $100,000 portfolio over several years.

3. Buying a $300,000 property with no deposit using the First Home Owners Grant and parental guarantee. Renting a room to offset mortgage repayments.

4. Continuing to invest savings and distributions to build the portfolio to $300,000 while increasing the margin loan,