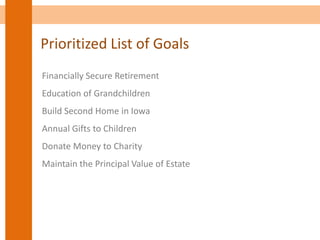

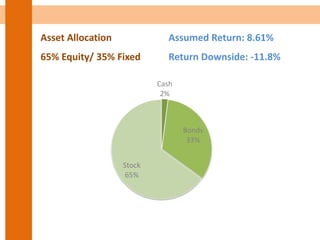

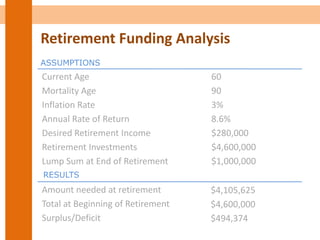

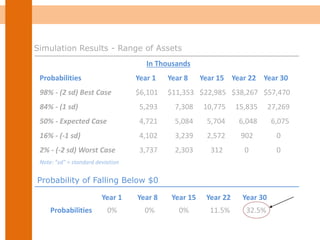

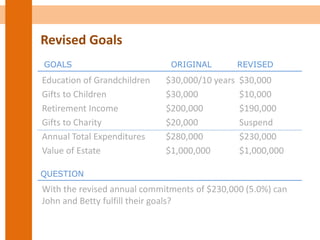

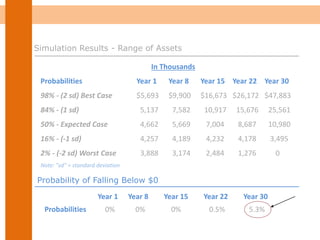

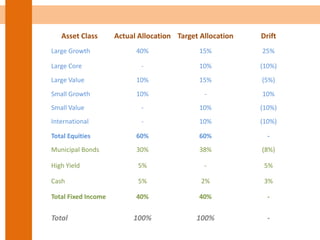

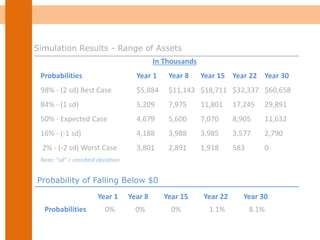

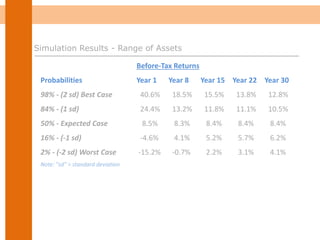

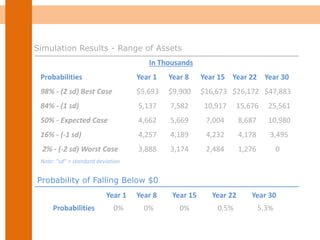

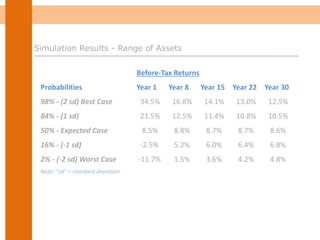

John and Betty Smith, aged 60 and 58 respectively, have 4 children and 9 grandchildren. They recently sold their business and are looking to retire. They have $6 million in total assets including $5 million in investments. Their annual expenses total $280,000. They want to ensure a financially secure retirement while funding their grandchildren's education and other goals. A proposed asset allocation of 60% stocks and 40% bonds is projected to meet their needs with an 8.3% expected annual return.