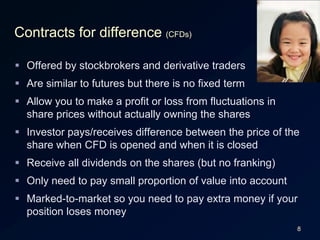

This document discusses various types of listed investments including listed property trusts, listed investment companies, derivatives, options, warrants, futures, and contracts for difference. Listed property trusts invest in commercial property portfolios and pay regular rent payments. Listed investment companies invest in a diversified portfolio of stocks on the stock exchange. Derivatives are financial instruments whose values are derived from underlying assets like shares or commodities. Options, warrants, futures, and contracts for difference are types of derivatives that allow investors to speculate on changes in asset prices.