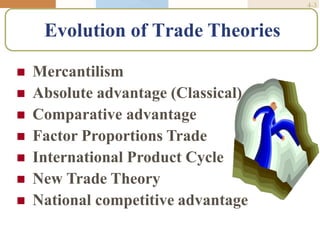

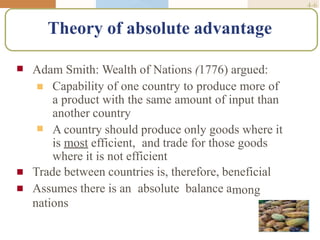

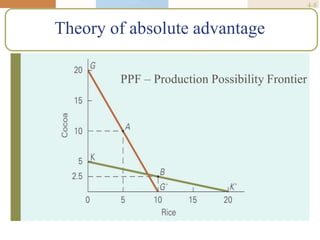

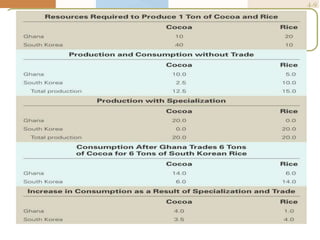

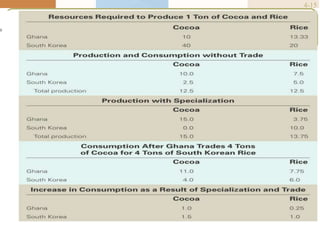

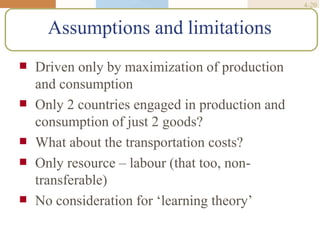

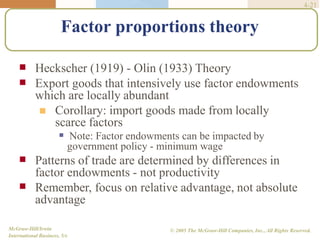

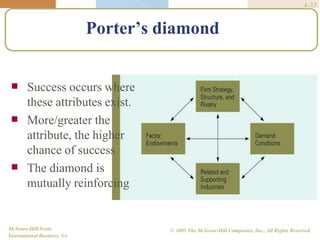

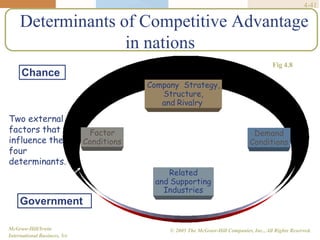

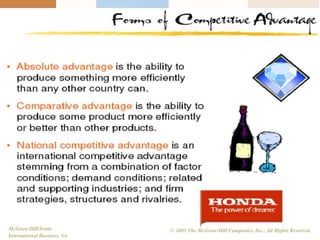

The document outlines the evolution of international trade theories from mercantilism to contemporary theories of national competitive advantage. It discusses key theories including absolute advantage, comparative advantage, factor proportions theory, product life cycle theory, new trade theory, and Porter's diamond model of national advantage. Theories are compared and criticisms addressed. Business implications are described around location decisions, first-mover advantages, and policy impacts on firms.