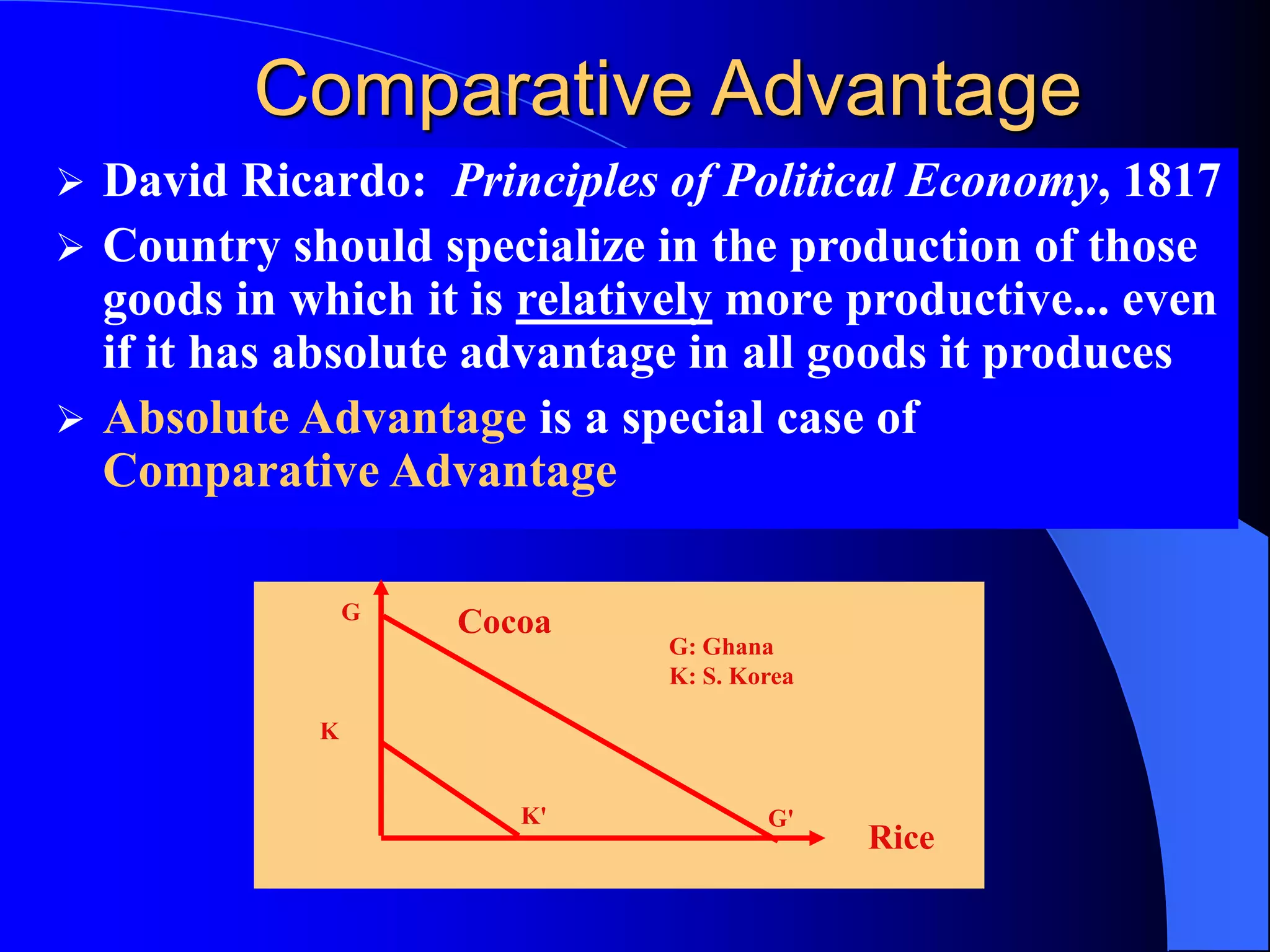

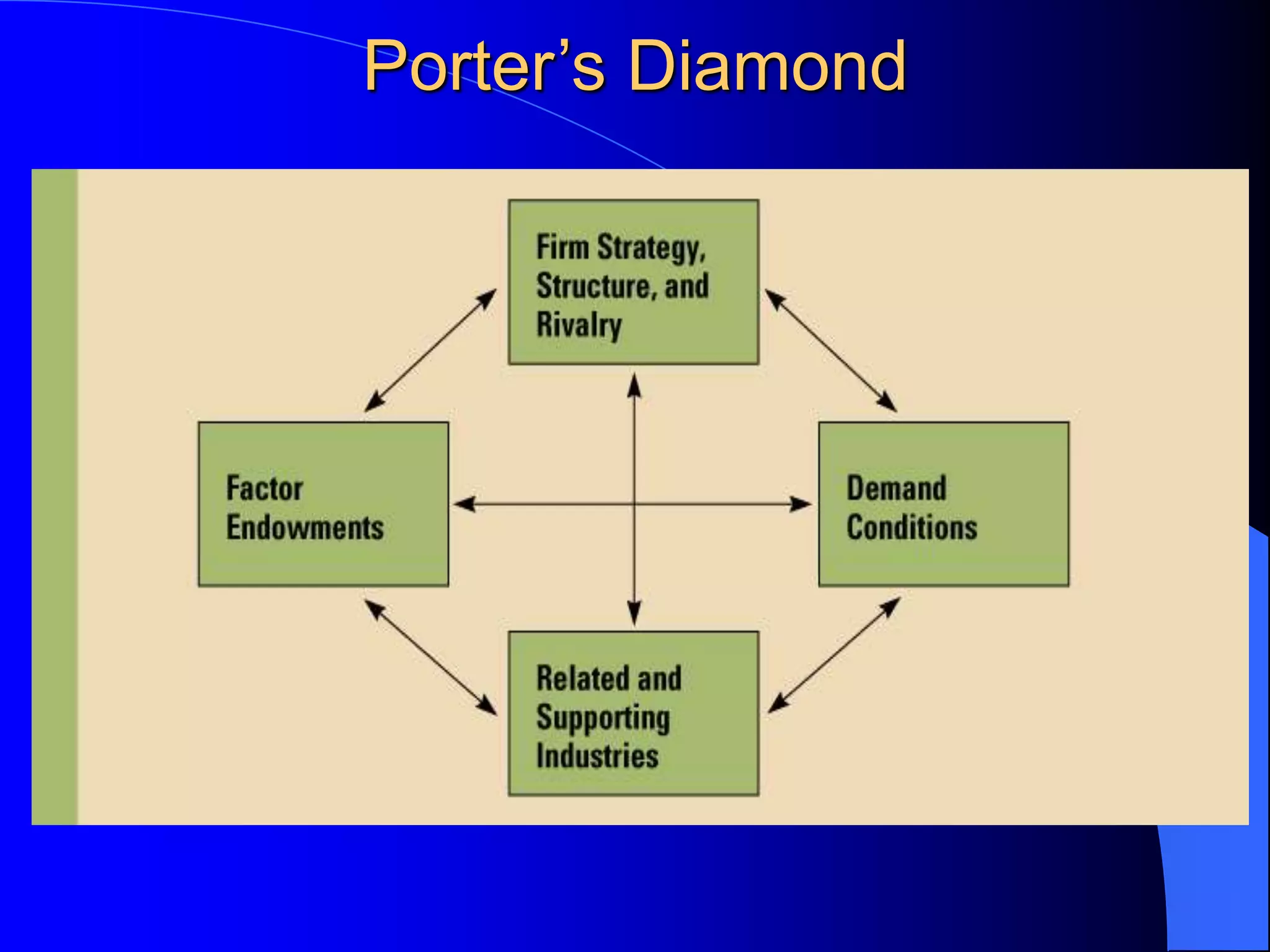

International trade theory seeks to explain why trade occurs between countries. Classical theories cite comparative advantages from differences in resources and productivity. New theories incorporate increasing returns to scale, network effects, and first-mover advantages that can create barriers to entry. A country's competitive advantages are determined not just by resource endowments but also by demand conditions, supporting industries, and the competitive environment shaped by firms and government policy.